Pittsburgh-based PNC Bank has long-standing roots dating back to the 1860s. Today, it’s the sixth-largest bank in the US based on total assets and has roughly 2,500 branches across 28 states.

In addition to its traditional baking solutions for individuals and businesses, PNC Bank also provides payment processing services under the PNC Merchant Services branding.

Whether you’re a current customer or thinking of using PNC Merchant Services, this review will help you determine if you’re getting a good processing rate and if PNC Bank is right for you.

Our Quick Take on PNC Merchant Services

PNC doesn’t actually handle its payment processing in-house. They’re just a reseller of Fiserv’s products and services. While Fiserv is solid, things will almost always be more expensive when you’re going through a third party like PNC.

Most large businesses aren’t going to use PNC for payment processing. Instead, PNC targets its smaller, existing banking clients and tries to upsell them with credit card processing services.

Pros

- Decent customer service.

- Wide range of pricing options (including interchange-plus, which is our favorite).

- Open to negotiations and willing to lower rates when asked.

- They have full access to all of Fiserv’s products and gateways.

Cons

- Processing rates aren’t as competitive as other providers.

- We found instances of PNC drastically overcharging clients.

- Inconsistent pricing between merchant accounts.

- Random fees on statements and periodic rate increases over time.

Our Experience Negotiating With PNC Merchant Services For Our Clients

We have several clients using PNC Merchant Services. This gives us a unique perspective as we can compare all of those statements side-by-side while also comparing them to other payment processors.

While PNC uses Fiserv to process payments on the backend, they handle customer support in-house, which is a good thing.

We’ve had a pretty good experience with those reps whenever we’re questioning fees and negotiating rates for our clients. They’re fairly receptive to our pushback and willing to lower rates.

That said, there is one common problem that we’ve run into multiple times. After we successfully negotiate new terms for our clients, the new rate doesn’t actually go into effect when it’s supposed to.

For example, if we negotiate a new rate at a 0.75% reduction that’s supposed to start on August 1st, when the August statement arrives, everything is still charged at the old rate. We catch it and contact PNC, and they ultimately end up sorting everything out.

But it’s a pain getting the refunds, and this has honestly happened too many times now that it no longer feels like an honest mistake.

PNC Merchant Services Pricing and Credit Card Processing Rates

PNC’s pricing is all over the place in terms of contract structure and the actual price per transaction. They offer flat-rate pricing, tiered pricing, and interchange-plus pricing.

Flat-rate pricing starts at 2.60% + $0.10 per transaction for in-person payments and 3.45% + $0.15 per transaction for online and keyed transactions. These rates aren’t good, so avoid them at all costs.

PNC will try to sell you on the “simplicity” of flat-rate pricing. But interchange-plus is always going to be the cheapest route, regardless of how complicated it might sound.

That said, interchange-plus pricing isn’t consistent between accounts. In fact, we’ve seen PNC charge different rates to the exact same client who has two accounts with them.

One was a 0.20% markup over the interchange rate, and the other account was increased to 1.75% over interchange (which is highway robbery).

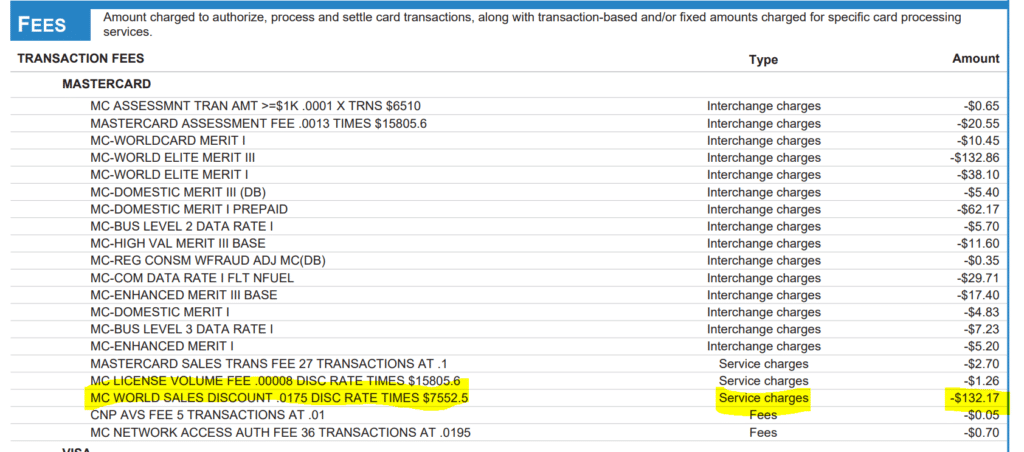

Here’s that rate highlighted on a statement:

These statements are transparent because they break down each charge so you can see the exact interchange categories from each card network. But they’re also difficult to read to the untrained eye.

Take the example above. This 1.75% markup is just one line item in a section with 20 different Mastercard fees.

We can tell that it’s a PNC markup because it’s categorized as a service fee and shown as a 0.175 discount rate—which isn’t actually a discount, it’s the rate you pay to your processor and itemized as a service fee.

But if you’re just glancing through your statements, you could easily overlook this and have no idea that you’re getting ripped off. That’s why it’s so helpful to work with a merchant consultant who can handle this stuff on your behalf.

Other Fees to Look Out For

Keep a close on your PNC Merchant Services statement for any one-off or miscellaneous fees that just don’t look right. These aren’t always consistent between accounts, but some examples of what we see include:

- Annual fees

- Rate increases

- Acquirer POS transaction fees

- PCI compliance fees

- Batch fees

- Inactivity fees

- Clover fees and/or Clover security fees

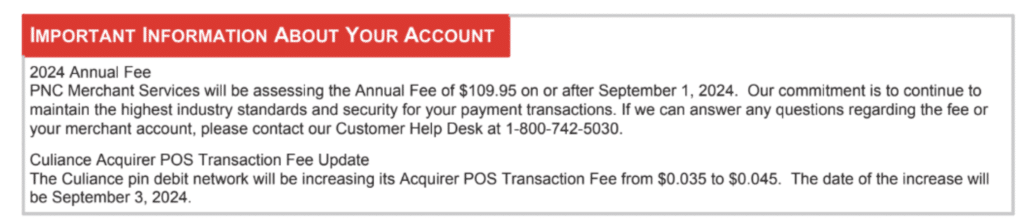

Here’s a recent notice one of our clients received about an annual fee of $109.95 that’s being charged to their account, plus a small rate increase on a particular transaction fee:

Not all of these fees will always apply to your specific account.

For example, the Clover fees will obviously only apply if you’re getting Clover POS systems from PNC.

What’s interesting is that PNC has access to all of Fiserv’s products and gateways, but they tend to mainly focus on selling the Clover devices. I imagine this is more profitable for PNC, and those Clover products are geared toward small businesses (which is who PNC targets).

We keep an updated list of PNC Merchant Services fees here that you can reference for any rate changes.

It’s probably a good idea for you to read our Fiserv review, as there’s tons of overlap between these two providers (since Fiserv is actually handling the backend processing for PNC).

Latest PNC Merchant Services Rate Increases, Updates, and Noteworthy News

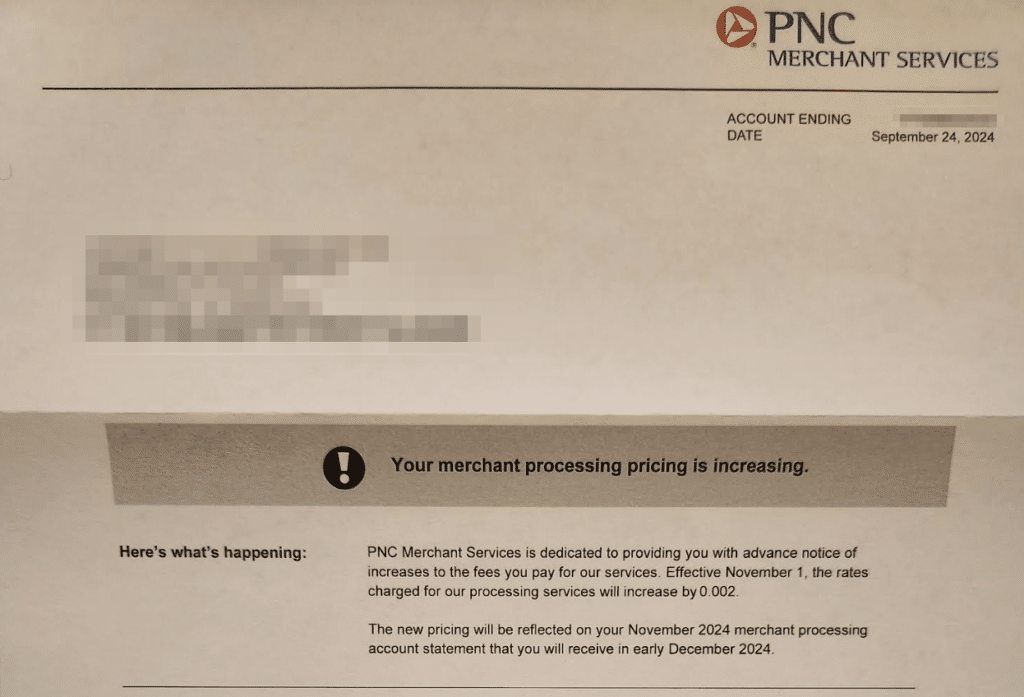

On November 1, 2024, PNC Merchant Services increased its processing rates by 0.20% per transaction. Here’s that notice so you can see for yourself:

They also notified merchants of an annual fee that’s being charged in September 2024 and an increased Culiance Acquirer POS Fee (to $0.045 up from $0.035) for September 2024 as well.

Earlier this year, PNC announced a pretty major expansion plan.

They’re investing $1 billion to open 100 new branches and renovate existing locations. This is expected to be completed by 2028.

Should You Switch to PNC Merchant Services?

I wouldn’t.

While we’ve always had a good relationship with PNC when negotiating for our clients, they really don’t do anything special or powerful. PNC is just a Fiserv reseller with no unique value other than the ability to get your business banking and payment processing services from the same provider.

This may sound convenient, but you can get better rates elsewhere—saving thousands and potentially tens of thousands per year.

I think these savings are well worth the small hassle of having to work with another provider.

Our Final Thoughts on PNC Merchant Services

Even though I don’t necessarily recommend PNC Merchant Services, that doesn’t mean you should cancel your contract if you’re a current customer.

Despite PNC’s flaws, it’s rarely in your best interest to switch.

It’s common for Fiserv to have liquidated damages clauses in the merchant agreements, so there’s a chance your PNC agreement could have the same. This would make it really expensive to cancel (and honestly unrealistic).

Even if you don’t have an early termination fee in your contract, you’re better off trying to negotiate directly with PNC. You have some leverage here as they don’t want to lose your account, and we know from experience that this is something they’re willing to do.

Let us know if you need help with any of this, and we’ll be happy to audit your statements for hidden fees and handle those negotiations with PNC on your behalf.