The amount of money your business accepts via credit card payments can directly influence how much you pay in processing fees.

Payment processing is like any other industry where high-volume sales give you negotiating power. Think of it like this: if you bought a single t-shirt vs. 10,000 t-shirts, wouldn’t you expect to pay less for the bulk order?

This same concept translates to merchant services. A business processing $10,000 per month in credit card payments shouldn’t pay the same rate as another company processing $10 million.

And while this logic is easy to follow, I still consult with tons of clients that had sales double, triple, and even 10x over the years, but they’re still paying the same rate (or more) in credit card merchant fees.

High-Volume Merchants Can Access the Cheapest Rates

Merchant discount rates are set based on a variety of factors. But at the end of the day, your processor really only cares about one thing: how much money they can make on your account.

So consider this scenario of two businesses using the same processor, with drastically different volumes and rates.

Merchant A (Standard)

- $1 million annual volume on 150,000 transactions

- 0.10% + $0.10 per transaction in processor markups

- ($1M x 0.10% = $1k) + (150k x $0.10 = $15,000)

- $16,000 in total fees

Merchant B (High Volume)

- $25 million annual volume on 750,000 transactions

- 0.05% + $0.05 per transaction in processor markups

- ($25M x 0.05% = $12.5k) + (750k x $0.05 =$37.5k)

- $50,000 in total fees

Merchant B pays half the rate as Merchant A, but the processor generates more than 3x the revenue because of the volume.

Processors don’t typically advertise rates publicly because they’re customized to each individual business during the underwriting process. But whenever we review custom rate offers for our clients, volume is always a huge factor.

If Your Business Grows Over Time, You Need a Rate Adjustment

Think back to when your business first started accepting card payments, and how much you processed at that time. Fast forward to today. Has that number grown significantly?

Now compare your rate from back then to your rate right now. I doubt that number has gone down. But it should.

As a matter of fact, most processors increase rates automatically every year or two. So even if your processing volume jumps from $10 million to $50 million in three years, there’s a good chance your processor increased your rates over that stretch instead of lowering them.

It’s 100% on YOU to contact your processor and ask for an adjustment.

There’s a misconception out there that the only way to lower your merchant fees is by switching providers. But that’s completely false.

You know who controls that narrative? Other processors who want your business.

It’s All About Negotiating Leverage

Merchant services providers are much more willing to make concessions as your volume increases to keep your business. They don’t want to lose your account because it’s highly profitable for them.

But they are never going to be the ones reaching out to you with a lower rate offer.

Pick up the phone or send an email, and simply ask for a reduction. Cite your volume increase as a valid reason.

And if you’d like, you can get quotes from other processors (even if you have no intention of switching). This can give you even more leverage as another provider will almost always undercut your current rates.

This is one of the many reasons why it’s so helpful to have a merchant consultant on your side during this process. For example, it’s common for processors to tell you that you’re “already getting the lowest possible rate” or “there’s nothing else they can do.”

But if you’re working with me or someone else on my team here at MCC, we can easily verify that for you. We have all of the statements from other clients using the same processor as proof of their actual lowest rates. So we can bluntly tell them that we know they offered [other business] a certain rate based on their volume, and we expect the same offer to be applied here.

Looking Beyond Your Discount Rate

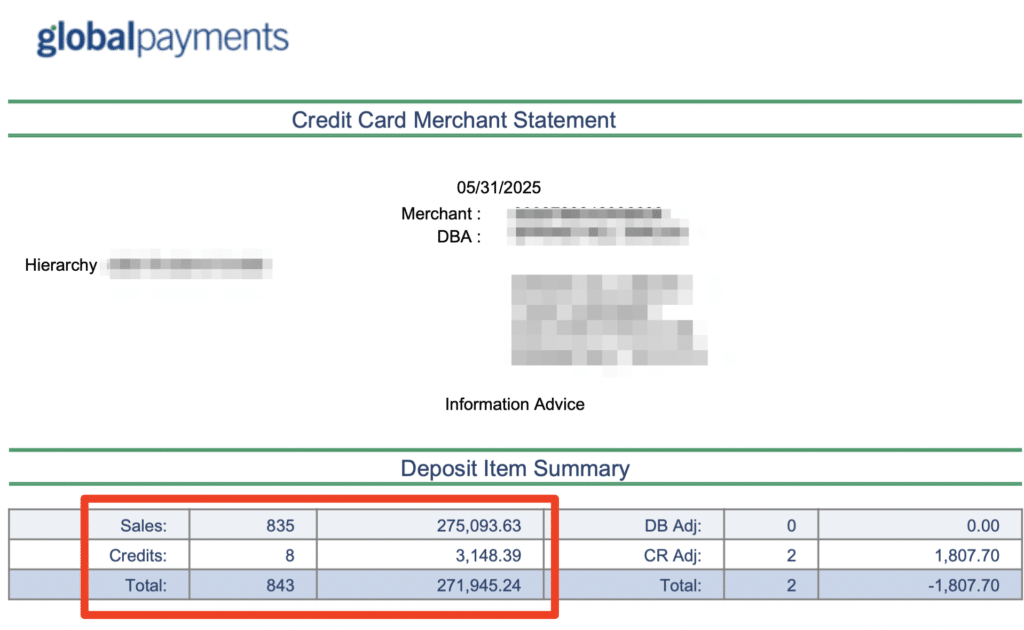

Another thing that you need to understand is that your total merchant fees can increase even if your discount rate stays the same or even decreases. How is this possible?Let’s look at an example so you can see what I mean. Here’s a merchant processing about $275,000 on 843 transactions:

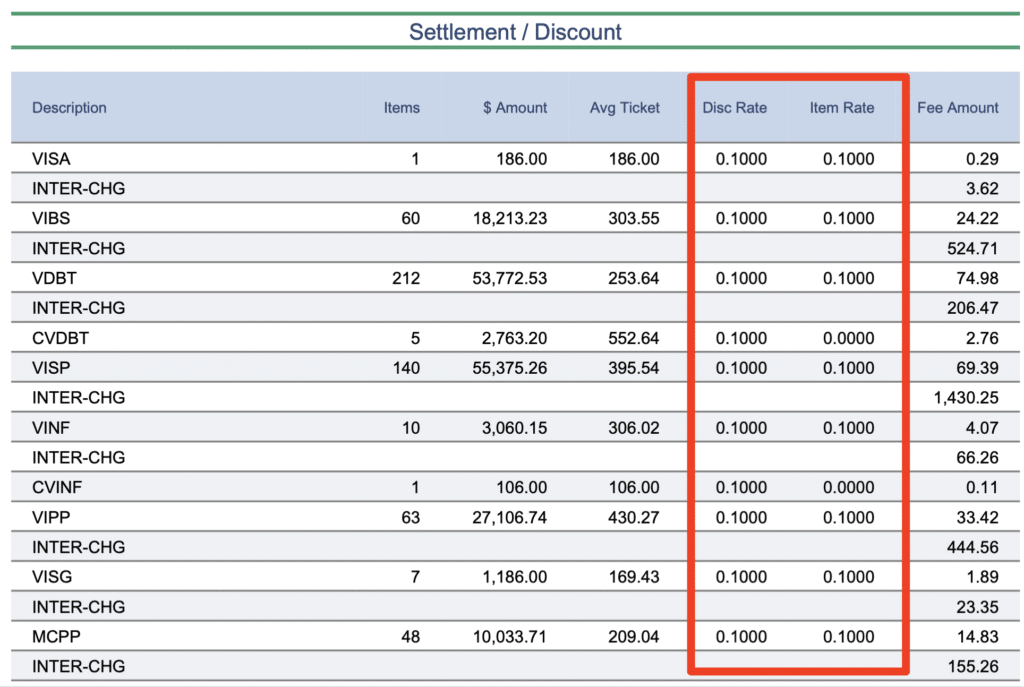

Their discount rate 0.10% + $0.10 per transaction, which we can clearly see applied correctly in the breakdown of each transaction type with the interchange fee and processor markup as separate line items:

So far so good. And honestly, 0.10% + $0.10 is a fair rate for this volume range.

This merchant is on pace for about $3.2 million annually, which isn’t the highest volume out there. But it’s a solid enough business to command a decent rate, and that’s exactly what they’re getting here.

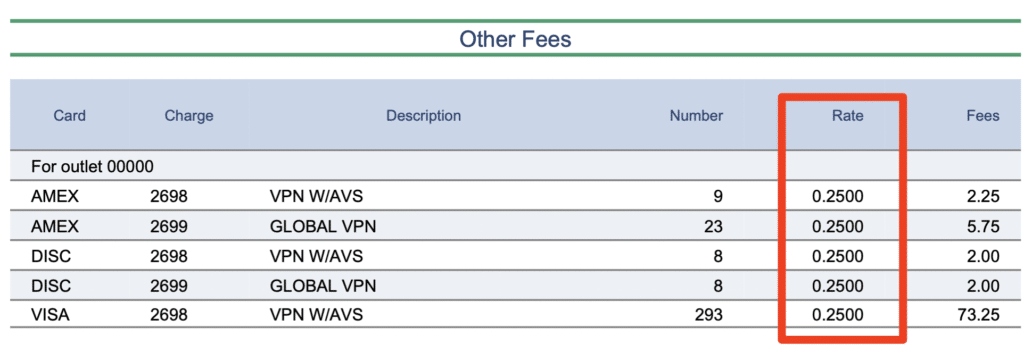

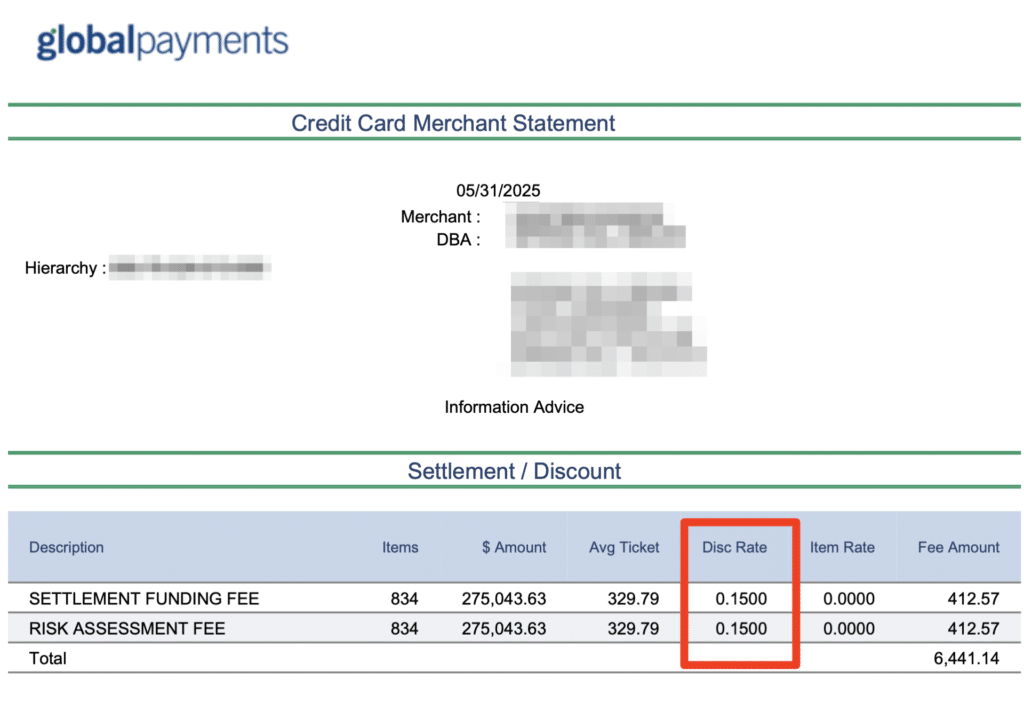

But when you start to look closer at different line items on this statement, you’ll see that their processor is adding a bunch of other fees that inflate the overall rate. Here’s an example:

There’s a $0.25 Global VPN fee charged on each transaction.

This spills into the next page, and if you total the number, it’s actually more than the number of transactions that processed this period (likely for authorizations that weren’t approved). But for simplicity, we’ll say it’s on the 843 approved transactions.

That’s another $210.75.

Let’s keep digging:

They were also charged 0.15% in Settlement Funding Fees and 0.15% in Risk Assessment Fees on total transaction volume.

Let’s stop and assess what we’ve uncovered:

- Discount rate = 0.10% + $0.10 per transaction

- Global VPN fee = $0.25 per transaction

- Settlement Funding Fee = 0.15% per transaction

- Risk Assessment Fee = 0.15% per transaction

This merchant is really paying 0.40% + $0.35 per transaction.

And it’s actually quite a bit more than this when you look at the other miscellaneous fees being charged.

It’s a sneaky and somewhat deceptive tactic that we see used by almost every processor on the market. They tell you that you’re getting a cheap discount rate based on your volume (and they aren’t technically lying to you).

But that rate alone doesn’t tell the full story of what you’re paying in merchant fees. And all of this needs to be on the negotiating table when you’re asking for a rate reduction.

Monthly vs. Annual Volume

The distinction between monthly and annual processing volume can sometimes be a factor depending on how your processor sets up your pricing structure.

Some processors use a tiered system where the rate decreases as you hit certain volume thresholds. For example:

- 0.15% + $0.15 up to $500k per month

- 0.10% + $0.10 on $500k to $3M per month

- 0.08% + $0.08 on $3M to $10M per month

- 0.06% + $0.06 on $10M+ per month

One of the lowest processing rates we’ve ever seen comes from this type of structure.

Braintree offered one of our clients a discount rate of0.03% + $0.03 if they process over $250 million annually.

The base rate of the offer was 0.06% + $0.06 on up to $100 million, with two additional tiers for $100-$150M, and $150-250M.

I personally think annual volume is better to use than monthly. And using your trailing 12 months works best instead of calendar years.

So it’s a negotiating lever that you can potentially pull if your processor won’t budge on its current rate. You just have to make sure you actually hit your numbers to get the lowest possible fees.

Your Risk Level Matters, Too

Volume isn’t the only thing that your processor uses to set your rates. Risk is actually the primary factor, and that’s typically based on:

- Industry

- Transaction environment

- Chargeback history

Some industries are automatically flagged as high risk and no matter what, won’t have access to the cheapest rates on the market (though this doesn’t mean you’re forced to overpay).

In-person transactions carry less risk than online transactions. And obviously, the more chargebacks you have the more it’s going to hurt you.

But for low-risk merchants with minimal chargebacks accepting payments in person, you can typically get the best rates at a high volume in card sales.

What’s Considered High Volume?

You typically need to process at least $1+ million per month or $10+ million annually for a processor to think of you as a merchant that deserves a volume discount.

But you likely won’t get the absolute lowest possible rates offered by your processor unless you’re processing $100+ million or $250+ million over 12 months. This type of volume commands the lowest rates.

It’s also worth noting that there is no minimum “high-volume” threshold per processor or even industry-wide. These are judgement calls during the initial underwriting and ongoing negotiations.

And even if you’re nowhere near these benchmarks, you can still get lower rates from your payment processor as your volume increases.

For example, maybe you started out on a flat-rate plan of 2.9% + $0.30 per transaction when you first signed up and were processing $10,000 per month. Now five years later you’re processing $250,000 per month.

You’ve made enough of a jump to at least request interchange-plus pricing and negotiate a better deal.

Final Thoughts

High-volume merchants should get access to lower rates. And even smaller businesses can get a better deal as their volume goes up.

But neither of these is guaranteed.

I’ve seen some crazy scenarios where high-volume merchants were paying a 10% effective rate on millions in monthly processing, simply because their accounts lacked oversight and the processors took advantage.

Here’s the bottom line: your processor is never going to lower your rates automatically. They’re going to do everything in their power to increase your rates over time, regardless of your volume.

So if you want to lower your credit card processing fees, you need to be the one initiating the negotiation. And volume is just one of several different ways for you to position your case.