QuickBooks is best known for its bookkeeping and accounting software. But they also offer a plethora of other tools, including payment processing services for businesses—which is what we’re focusing on for this review.

Some of you might already be using another financial tool from QuickBooks and you’re thinking about using them to process payments. Maybe you’re thinking of using QuickBooks for the first time. Or you could already be using QuickBooks for payments and wondering if you’re getting a good deal.

Regardless of what brought you here, this in-depth review breaks down everything you need to know about QuickBooks payment processing services based on our first-hand experience as a QuickBooks customer and our experience dealing with QuickBooks on behalf of our clients.

Our Quick Take on QuickBooks For Payment Processing

QuickBooks is a PayFac (payment facilitator) owned by Intuit. And like most PayFacs, pricing is always going to be a bit higher when you’re going through a third party instead of going to a direct processor.

Their payment processing services are pretty straightforward, and many businesses don’t mind paying a premium for the ability to accept payments from their accounting platform.

While you could use QuickBooks to accept payments in-store as a retailer or online through your ecommerce store, there are tons of better alternatives to consider. It makes much more sense to use QuickBooks if you want to accept B2B payments through digital invoices.

So if you’re looking solely for a payment processor for consumer transactions and you’re not already using QuickBooks for accounting, I’d honestly look elsewhere. But overall, QuickBooks is solid enough. In fact, we actually use QuickBooks here at MCC to accept credit card transactions.

What We Like About QuickBooks

- QuickBooks offers interchange plus pricing (even though it’s not really advertised).

- We’ve been able to successfully negotiate lower rates for our clients.

- Simple and straightforward payment platform with built-in invoicing and accounting.

- Plenty of other financial tools are available if you want several services under one roof.

Where QuickBooks Falls Short

- They try to lure in most businesses with a flat-rate pricing structure (which is high).

- Most plans have a monthly fee in addition to the transactional costs.

- There’s no Level 2 and Level 3 card optimization, which is unfortunate because so many of their customers use QuickBooks to accept B2B payments.

- The aggregate rate shown on statements can be deceptive.

QuickBooks Pricing and Credit Card Processing Rates

There are two components to QuickBooks pricing—the monthly fee and the transactional costs. The monthly fee depends on the plan and features you want that go beyond payment processing (bookkeeping, receipts tracking, invoicing, etc.). And the transaction costs depend on how you’re accepting payments.

If you look at their website, QuickBooks really only advertises flat-rate pricing for payment acceptance. But they DO offer interchange-plus pricing at 0.15% + $0.15 per transaction.

This isn’t the lowest rate we’ve ever seen in the payments space, but it’s still so much cheaper than these flat-rate transactional costs:

- Online Credit Cards and Debit Cards — 2.99%

- Digital Wallets — 2.99%

- In-Person Card Reader Payments — 2.5%

- Manually Keyed Cards — 3.5%

- ACH Bank Payments — 1%

QuickBooks says that if you process more than $2,500 per month, you can save up to 25% on processing. However, the best way to get the cheapest rates from QuickBooks is by requesting an interchange plus structure.

Even with a 25% discount on the rates above, 0.15% + $0.15 per transaction above interchange is almost always going to be cheaper.

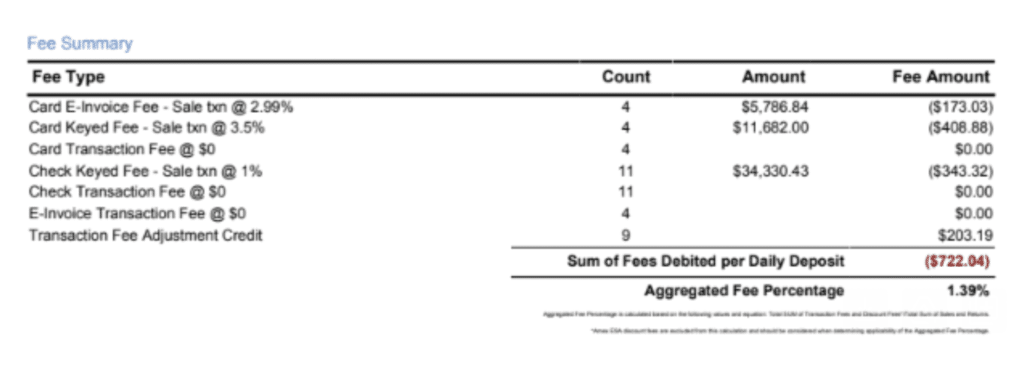

Here’s a recent statement that we obtained from a client on a flat-rate plan:

As you can see, the rates shown here are all aligned with the rates advertised on the QuickBooks pricing page.

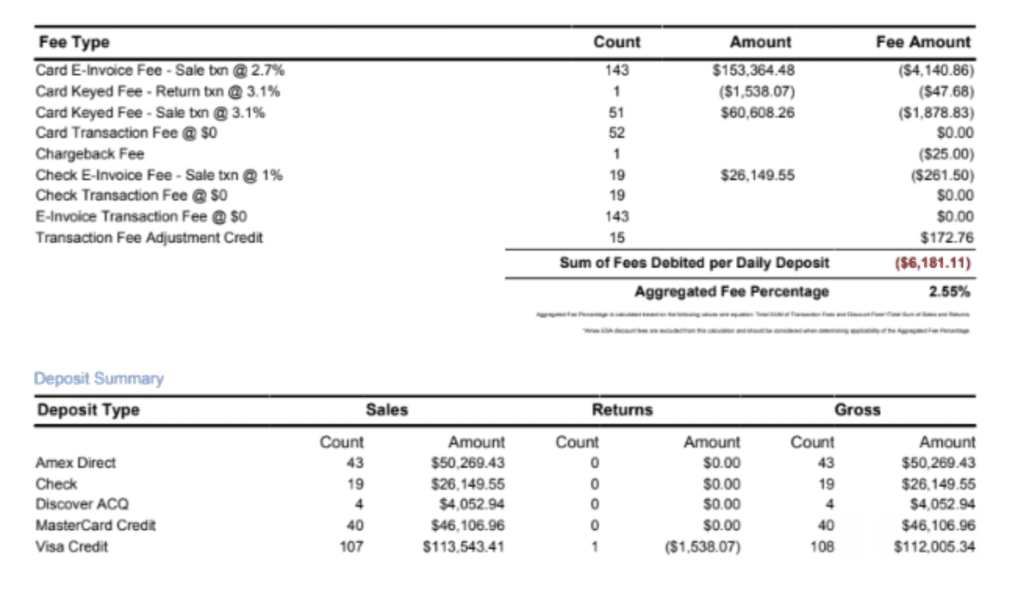

Here’s another one with slightly lower rates—although still on a flat-rate plan:

The second statement has a much higher volume than the first. So the card fee here is 2.7% compared to 2.99% and the keyed in fee is 3.1% instead of 3.5%.

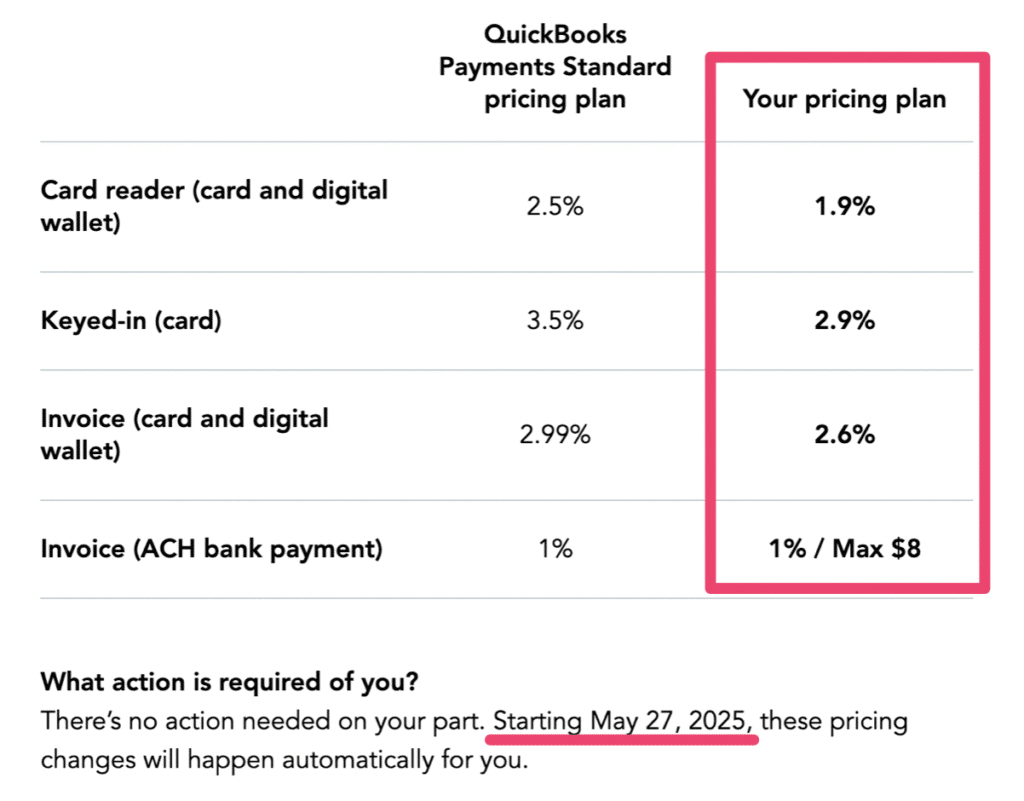

Here’s a third example showing QuickBooks custom pricing for one of our clients with new rates effective May 27, 2025:

Don’t get me wrong. These rates are still high.

I’m using this to simply illustrate the fact that the pricing advertised by QuickBooks is not set in stone and it’s definitely up for negotiation.

But remember, most of you will still be paying a monthly fee on top of all this—which ranges anywhere from $35 to $235 per month.

There is a free plan that allows you to accept payments and just pay transaction fees based on usage, but this doesn’t include in-person payments. That said, I really don’t recommend QuickBooks for in-person payments, so you can get basic invoicing and accounting capabilities while still being able accept payments without the monthly fee.

Insider Tips and Insights For QuickBooks Payment Processing

We’re in a really unique position when it comes to QuickBooks. That’s because we use QuickBooks to accept card payments online, and we have clients using QuickBooks.

We also work with dozens of other payment processors and have access to thousands of statements from those providers. So it’s really easy for us to spot a good deal when we see it and be able to tell if someone is overpaying.

If you’re using QuickBooks now or plan to use them to process payments, just make sure you keep the following information in mind:

Try Hard to Get an Interchange Plus Pricing Plan With QuickBooks

This is by far the best way to get the lowest rates on payment processing with QuickBooks. While a flat-rate plan might seem simple to understand, it’s not the most cost-effective.

QuickBooks says things like they’ll never downgrade your transactions, and they have a pricing chart that compares their rates to other providers like Square and Stripe. This is all in an attempt to make their rates look cheaper. But trust me, 2.99% per transaction is not cheap.

Negotiate them down to an interchange plus structure at 0.15% + $0.15 per transaction.

The Aggregate Fee Percentage on Your QuickBooks Statement is NOT Your Effective Rate

This is a big one that I want everyone to understand. I don’t think QuickBooks is intentionally trying to be deceptive here, but their statements can definitely be misleading.

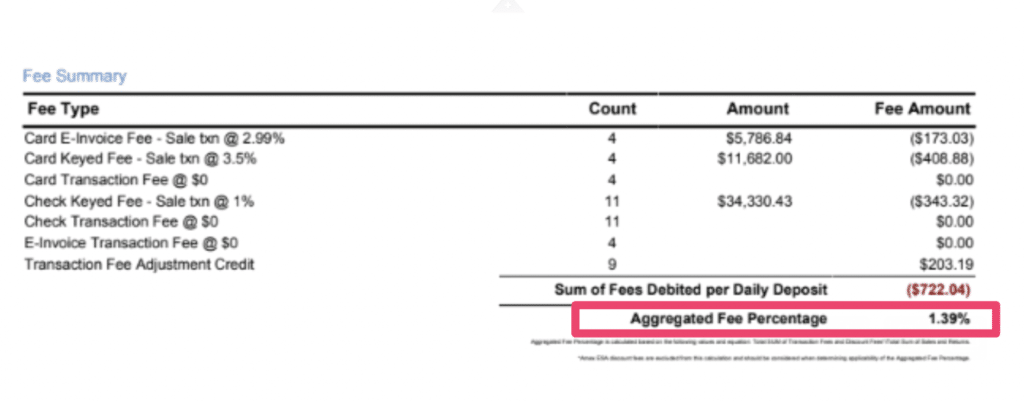

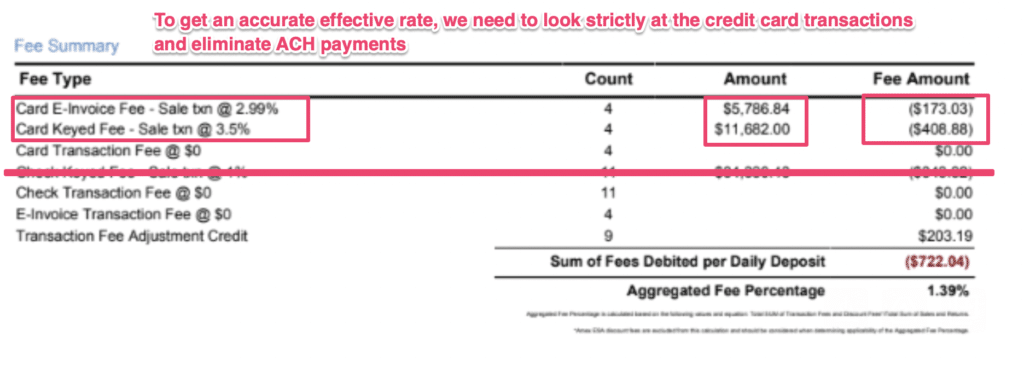

Every statement has an aggregate fee percentage section, like this:

In the statement shown above, the aggregate fee percentage is 1.39%. So at a quick glance, you might look at this and think you’re getting a really good rate.

But the aggregate fee percentage is NOT the same thing as an effective rate.

That’s because the aggregate rate includes ACH payments.

To find out how much it’s costing you to accept card payments, you need to eliminate the ACH payments and look strictly at the credit cards.

If we take the sum of the first two line items in the Amount column, we get $17,468.84 in total credit card payments accepted. Then we’ll also total the sum of the Fee Amount column of the first two lines, which is $581.91 in credit card transaction fees.

Now if we divide $581.91 by $17,468.84, we find that the effective rate is actually 3.33%.

This is nearly two full percentage points higher than the aggregate fee shown on the statement.

For more information on all of this, we have a complete guide that explains how to calculate processing rates and goes deeper into the importance of knowing your effective rate.

QuickBooks Does Not Offer Level 2 and Level 3 Optimization For B2B Transactions, Which is Unfortunate

Unfortunately, QuickBooks doesn’t do anything to help you capture Level 2 and Level 3 card data for optimized rates.

This is really a bummer, considering how much it would help their clients accept B2B transactions and commercial cards.

Level 2 and Level 3 data rates can typically lower fees by 25% to 40%. So it’s not like we’re leaving pocket change on the table here—particularly with large-ticket invoices.

We Like That QuickBooks Doesn’t Charge Tons of Other Bogus Fees

Unlike other payment processors on the market, it’s refreshing to see QuickBooks statements without pages and pages of extra fees.

You pay your monthly fee, your transaction costs, and a handful of one-off fees (like a chargeback fee). That’s really it.

I think it’s because QuickBooks is already charging such a high markup, particularly on its flat-rate plans that they don’t need to get even greedier by sneaking in other hidden charges that we commonly see from other providers.

Latest Rate Increases and Updates For QuickBooks

QuickBooks notified select accounts about another ACH rate cap increase that goes into effect on May 27, 2025. The new rate cap will be $8 on those accounts.

On December 2, 2024, QuickBooks increased its ACH rate cap to $10 (up from $5) on select accounts.

The ACH processing rate is still 1% for all transactions under $1,000. But transactions over $1,000 will be capped at $10.

This only applies to select accounts. If you’re on a standard QuickBooks pricing plan, you’ll still pay 1% for ACH payments, even if they exceed $1,000. Fees aren’t capped on a standard plan.

Should You Switch to QuickBooks For Payment Processing?

Probably not.

While we like QuickBooks and use them ourselves, it’s rare that switching away from your current provider will get you a better deal.

QuickBooks isn’t cheap and they’ll try to get you on a fixed-rate pricing plan. Even if you can negotiate an interchange-plus deal, those rates are still about three times higher than the lowest we see offered from other providers.

If you want to save money, you’re better off negotiating a better deal with your existing processor. They have more incentive to lower your rates to keep your business, and this is something that our team here at MCC can handle on your behalf.

Our Final Thoughts on QuickBooks Payments

QuickBooks is fine if you’re already using their accounting software and want to provide a payment option when you’re sending digital invoices to clients. But for the vast majority of consumer-based businesses, you can get better payment processing elsewhere.

I really wish they offered optimized rates for B2B transitions. I’d be much more willing to recommend them if this capability was offered and handled automatically.

If you decide to use QuickBooks to accept payments, just know from the start that their rates aren’t as competitive as other processors.