Nothing stays the same price forever. And credit card processing fees are no exception.

So when your processor sends you a notice about an annual rate hike, you may not think much of it.

Most businesses just assume that annual fee increases are a normal part of credit card processing that they need to accept. While the first part is true (it’s normal for providers to raise rates), it shouldn’t happen every year, and you definitely have a say in this.

While fractions of a percentage may seem small, annual rate hikes can cause serious damage to your bottom line. The math speaks for itself, and I’ll show you some real examples that explain just how significant this can be for your business.

The Troubling Trend of Annual Rate Increases in Merchant Services

It used to be that processors would be pretty good about keeping your rates steady for at least 3-4 years. Sometimes even longer. Those days are over.

Once certain processors started raising rates every 12-18 months, others quickly followed suit.

But over the past few years, it seems like every major processor is applying some form of an increase at least once per year. If not every year, it’s every other year.

Our clients get these rate increase notifications more often than ever before. And to make matters even worse, the amount of each rate hike is also spiking with the frequency. This is creating a compound effect that’s translating to merchant discount rates doubling in some years, and growing to be anywhere from 5-10x more expensive over 3-5 years.

It’s unsustainable, and I think that misinformation amongst merchants is a leading cause of this problem (behind processor greed, of course).

5 Myths About Annual Rate Increase in Credit Card Processing

When merchant services providers send out annual rate increase notices, the language is very misleading. This causes many businesses to believe things that simply aren’t true.

As a result, they accept the increase without pushback. And then their processor continues to apply this same tactic year after year.

Here are the most common myths and misconceptions about rate increases that I want to clear up:

Myth #1 – Rate Increases Are Mandatory

False. There is no governing body or industry-wide compliance mandate that requires processors to raise rates.

If your processor tells you this, they are lying.

This is particularly the case when increases are applied to monthly or annual PCI compliance fees. Whether you’re PCI compliant or not, processors are always looking for ways to jack up these fees and use some type of “mandate” or “compliance” language to make you think it’s something they’re forced to do.

Myth #2 – Rate Increases Come From the Card Networks

This is partially true, but dangerously misleading when worded a certain way.

While the card networks adjust interchange rates once or twice per year (which can result in an increase), this has absolutely nothing to do with what your processor charges you as a markup for their services.

Here’s an example of this type of language that processors use to justify increases:

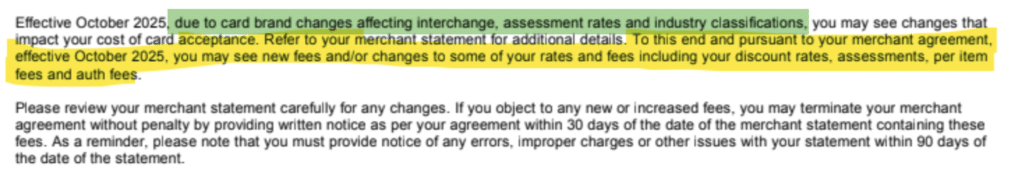

Pay close attention to what I highlighted in green:

“Due to card brand changes affecting interchange, assessment rates, and industry classifications…”

This is completely independent of what’s highlighted in yellow, where Global is saying that discount rates, per item fees, and authorization fees are going up. Two totally separate things are happening here at the exact same time:

- Card networks adjusted interchange fees

- Global is increasing its rates

Global timed this rate hike to align with the October 2025 interchange adjustments. And then they worded this notification in a way that sounds like the card network changes are somehow a justification for Global’s rate increase.

Now merchants notice higher rates after October and assume it’s because of Visa and Mastercard. But in reality, it’s just an annual increase from their processor.

Myth #3 – Your Rates Can’t Increase While You’re Under Contract

Lots of our clients think that their rate increase was a mistake. They assume that a 3-year contract locks their pricing terms (and this is a reasonable assumption).

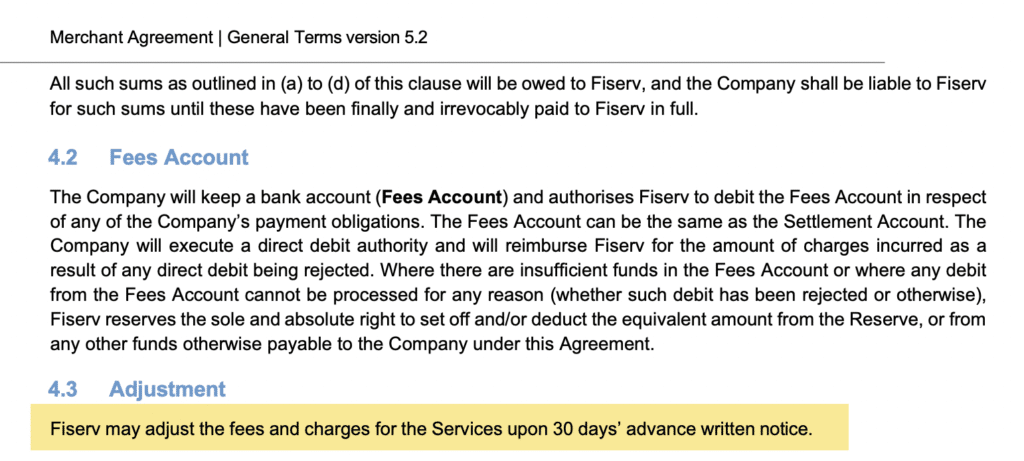

But virtually every single merchant agreement contains some type of language that allows your processor to increase your rates at any time during the contract, as long as they provide you with notice.

Here’s an example from Fiserv’s merchant agreement that’s clear as day:

This is just a single line on a 28-page contract, so it’s easy to overlook.

And many contracts from other providers use language that’s even more complex to understand at first glance.

Myth #4 – Rate Increases Apply to Everyone

Another common misconception is that all merchants are hit with the same increases. Also false.

We have the privilege of working with dozens (sometimes hundreds) of merchants using the exact same processor. So when rate hikes are applied, we can see how some accounts are hit with higher increases than others, while other accounts remain completely unchanged.

So if you complain to your processor and they tell you that “everyone” is being impacted, know that they’re lying through their teeth.

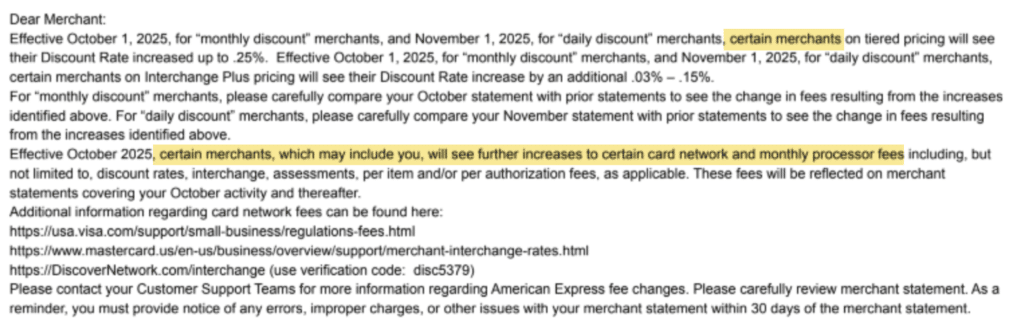

Sometimes the notifications will even be so vague to say that only “certain merchants” are being hit with rate changes. Here’s a recent example from North:

“Certain merchants, which may include you.”

I always think these types of notices are ridiculous because it takes no effort to just blindly send the exact same notice to every merchant account.

The second portion I highlighted also uses that type of deceptive language that I mentioned back in Myth #2. North is saying that the merchant will see increases to “card network and monthly processor fees.” Two things that are independent of each other and don’t need to change at the same time.

Myth #5 – You Have to Accept Rate Increases From Your Processor

Every rate increase notice gives merchants to opt out by canceling their merchant account within 30 days. Even if you’re under contract, you can get out of it by terminating your agreement when your rates go up.

Most merchants don’t do this (and we agree that switching providers is not the answer). So they assume rate hikes are final, and nothing can be done to change it.

Wrong.

You can 100% push back against your rate hikes as soon as you’re notified. Pick up the phone and call your processor. Negotiate hard. Speak to whoever you can who’s willing to listen to you.

If that doesn’t work, hang up, and call again. Send emails. Keep bugging them and demand that you’re kept at your current terms. Or at worse, try to meet them somewhere in the middle.

Our team here at MCC has successfully negotiated rate increases on behalf of our clients. So we know that it’s possible, and most processors are open to negotiations.

The Math Behind Annual Rate Increases: How Much it’s Really Costing You Over Time

When you sit down and crunch the numbers, you can quickly see that these “small” increases are not small at all. They amount to real money, sometimes tens of thousands or upwards of hundreds of thousands annually, depending on your volume.

Let’s look at some real examples so you can see what I mean.

Example 1: Elavon Annual Rate Increases

Elavon is actually a pretty decent processor and not particularly known for deceptive fees. But we are seeing more and more annual rate increases, even from the “good” processors.

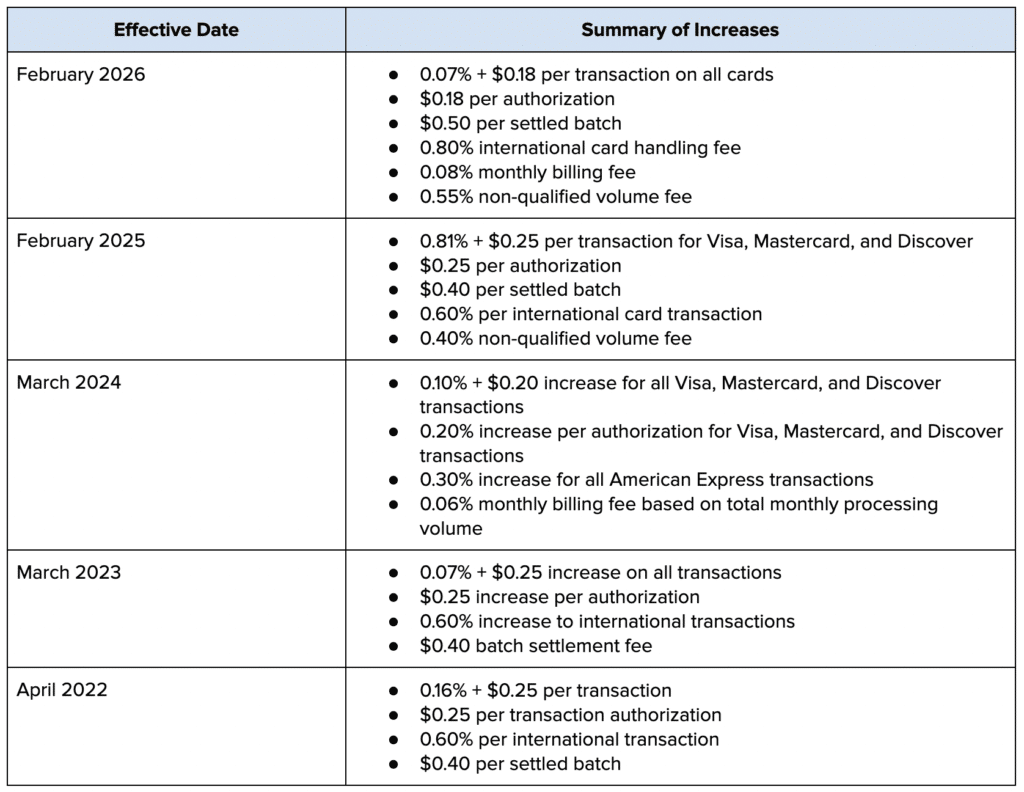

Here’s a quick summary of annual Elavon’s fee changes over the last five years:

There’s a lot to take in here. So we’ll just focus on the per-transaction rates.

Let’s assume you were getting an awesome deal from Elavon, and were paying 0.05% + $0.05 per transaction prior to April 2022.

After all of these increases, you’d be paying 1.26% + $1.18 transaction after February 2026.

That’s a 2,420% increase in five years. So for every $1 million in volume, that means you went from paying $500 in discount fees to $12,600 over that same stretch. And that doesn’t even account for the per-transaction component (could easily be another $10k+).

I’ll even do you a favor and eliminate the two highest rate increases from this example (February 2025 and April 2022). We’ll say you got lucky and Elavon skipped your account those years.

If your discount rate started at 0.05%, you’d end up paying 0.29% on just three (of the smallest) increases over five years. That’s still 6x higher, which translates to $2,400 more per million processed (and more than double when you factor in the per-transaction rates).

And it’s even more when you account for increases to the settled batch, and other miscellaneous fees that went up.

Example 2: Shift4’s Annual Rate Increases

Shift4’s annual increases follow a different approach that’s commonly used by processors industry-wide.

Instead of mainly adjusting your rate per transaction, they also add new fees and adjust miscellaneous markups that ultimately increase your effective rate.

Just look at Shift4’s timeline of changes over the past year alone:

- December 2025 — $325 per device Regulatory Assurance Fee

- September 2025 — 0.07% + $0.05 per transaction rate increase

- August 2025 — $99 per device Annual Program Fee

- July 2025 — New 0.02% Month End Billing Fee

- March 2025 — 0.05% + $0.03 per transaction rate increase

Again, let’s say you had a great deal of 0.05% + $0.05 per transaction (most merchants pay more).

Assuming you’re hit with each of these increases, you’d end up paying 0.19% + $0.13 per transaction. That’s just in one year.

Even if you were only hit with one of the major hikes (March instead of September), your rates are still doubling.

And on top of that, Shift4 is taking another $424 per device per year, just because they want to.

Final Thoughts

This is the definition of rate creep. It doesn’t happen all at once, and it doesn’t always feel like a big deal at each interval because the hikes seem relatively small (fractions of a percentage).

But the math doesn’t lie.

5 basis points here. Another 7 basis points there. Before you know it, your rates have quadrupled and they’re on pace to double again next year.

As you can see from the examples I used throughout this guide, every processor is doing this, which makes it even more frustrating.

While annual rate hikes have become the new norm in payment processing, taking it on the chin doesn’t have to be.

Fight back against your processor when they try to raise your fees. You can usually negotiate with some pushback to keep your rates somewhat reasonably priced. It takes time and effort, but it’s worth the thousands of dollars in savings.