If you’re new to accepting credit cards or you’re shopping around for different processors, you might come across the term “rolling reserve” on your contract.

Unfortunately, rolling reserves are not pleasant for merchants. Account reserves can cause cash flow problems and create other issues. So if you have some doubts or questions about your contract, this guide will steer you in the right direction.

Continue below to learn more about what a rolling reserve means for your business and how to overcome the challenges associated with this contract stipulation.

What is a Rolling Reserve?

A rolling reserve withholds a percentage of a merchant’s gross credit card sales in a non-interest-bearing account. The funds are held for a predetermined amount of time before the processor releases money to the merchant’s bank account.

Depending on your contract terms, the percentage of sales is typically held for 180 days, and the reserve account usually falls around 5-10% of gross sales. But this varies by the processor, business, and contract details.

Reserve accounts are created to protect credit card processing companies from covering the costs of a chargeback. The funds in a reserve account are “rolling” because they’ll eventually be released to the merchant. A percentage of new credit card transactions get added to the reserve.

Unfortunately, reserve accounts are non-interest-bearing. So your money is just sitting in an account while you’re forced to wait for it.

How Rolling Reserves Work in Credit Card Processing

Rolling reserves work on simple yet often misunderstood timeline. Each day, your processor withholds a fixed percentage of your credit and debit card sales (usually between 5-10%), and places those funds into a separate, non-interest-bearing reserve account.

After a set period (typically 180 days), the funds begin to get released. This creates a continuous reserve cycle where 5% of the sales from the previous 180 days are always held in a reserve account, and funds start getting released on day 181.

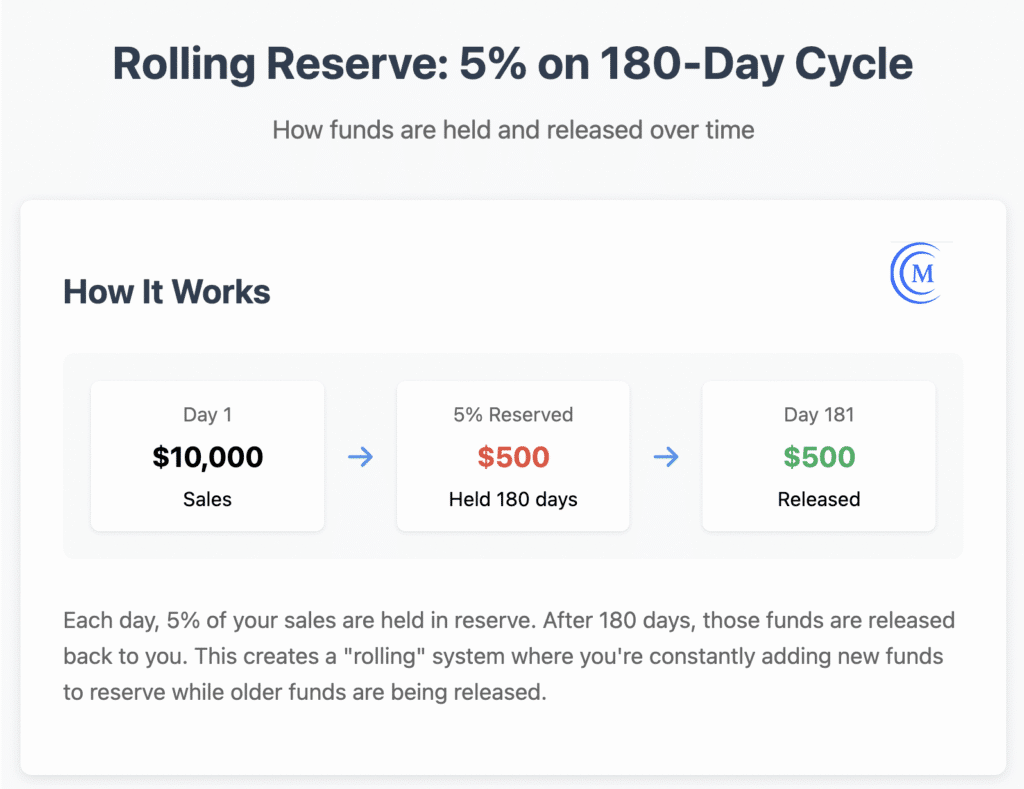

Here’s an example using a 5% rolling reserve on a 180-day cycle with daily payouts:

Let’s say the transactions on day one $10,000.

At 5%, this puts $500 into the reserve account. That $500 hold is ultimately released to the merchant on day 181 after the cycle has been completed.

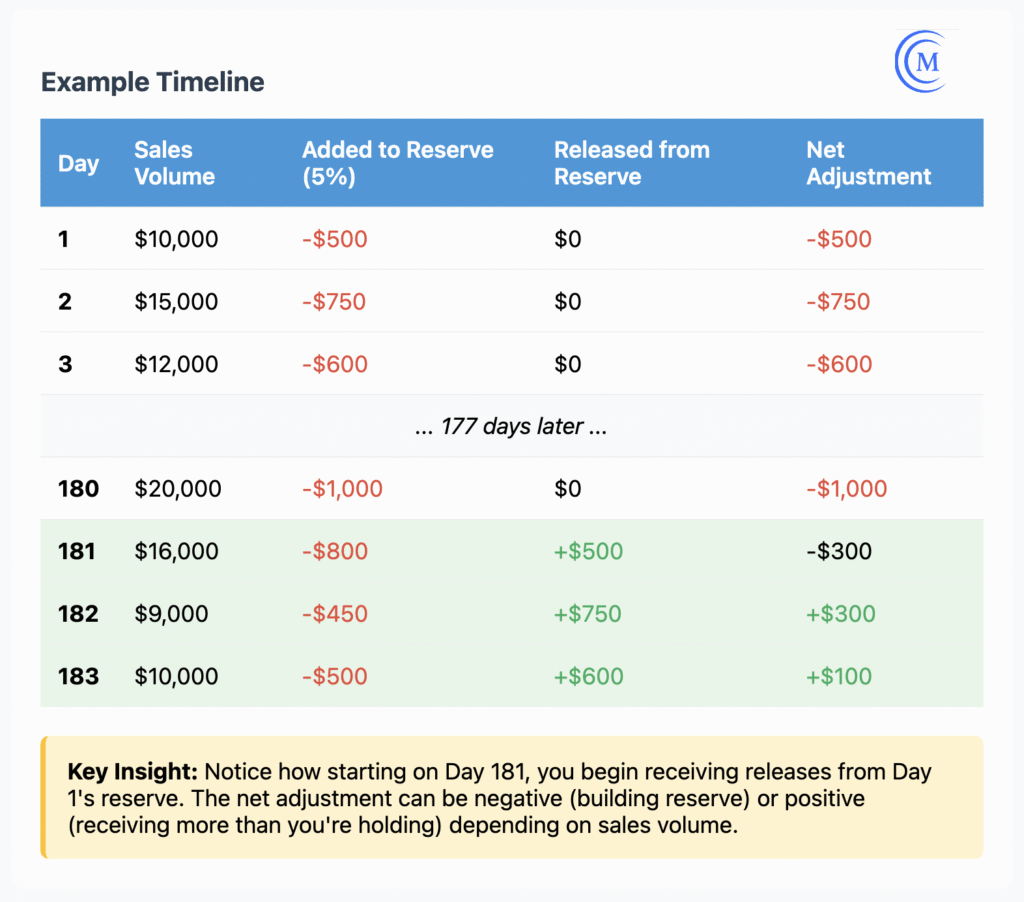

Now let’s look at what this looks like over a complete 180-day cycle:

The initial $500 deposit from day 1 into the reserve fund isn’t released until day 181. And $750 hold from transactions on day 2 get released on day 182, and so on.

Reasons for Rolling Reserves in Payment Processing

Rolling reserves are all about managing risk for the acquiring bank.

Whenever cardholders swipe, dip, tap, or enter their credit card information online to complete a transaction, they don’t actually pay for the amount immediately. The issuing bank expects the consumer to pay their balance by a certain date, but the cardholder also has the option to pay the balance over time while incurring interest.

Credit card processors operate the same way. There’s some risk involved funds are released to the merchant.

While the merchant is ultimately responsible for potential chargeback costs, credit card processors refund the cardholder immediately instead of waiting to get the money back from the merchant.

The refund obviously requires cash, so some credit card processors impose rolling reserves to limit exposure and cover costs associated with chargebacks.

We commonly see rolling reserves applied in the following scenarios:

- High-risk merchant accounts

- Industries with a higher risk of chargebacks

- Brand new merchant accounts

- Merchants on the TMF/MATCH list

- Businesses selling products or services that are unregulated (CBD, supplements, etc.)

Another common reason why a processor might impose a rolling reserve is if the business owner has bad credit. When this happens, you can eventually eliminate the reserve account if you increase your personal credit score over time.

Are Rolling Reserves Required For Merchant Accounts?

No law requires certain types of businesses to have rolling reserves for credit card processing. This decision is solely up to the merchant services provider. Traditional merchant account providers and PSPs (payment service providers) alike may ultimately decide to impose a rolling reserve on certain accounts.

The conditions of your rolling reserve should be clearly outlined in your contract. This will explain what type of balance must be maintained in the reserve account and for how long.

Truthfully, most businesses do not need a rolling reserve. So if a payment processor is trying to impose this on you, you should question the reason for the reserve. It might be in your best interest to shop around for another processor to see if they offer the same terms.

How Much Are Rolling Reserves?

On average, rolling reserves are 5% to 10% of a merchant’s monthly gross credit card volume.

Some rolling reserves are variable, meaning the amount will change based on how much you process each month. Other rolling reserves are fixed, meaning the reserve amount stays the same even if you’re processing a higher or lower amount from month-to-month.

In some extreme scenarios, merchants may be required to have a rolling reserve that reflects up to 100% of their monthly card processing amount. This could happen if you’re a high-risk merchant that’s been placed on the TMF/Match List and can’t get approved for a merchant account anywhere else.

How Long Do Rolling Reserves Last?

Many rolling reserves are designed to be permanent, lasting for the lifetime of your merchant account (particularly in high-risk categories).

Other rolling reserves might just be temporary, lasting for a year or two, or until you can establish a good history of low chargebacks. If the rolling reserve was imposed due to poor credit, a boost in your credit score could lift the reserve as well.

It’s ultimately the discretion of your processor if and when the rolling reserve is lifted.

How Are Rolling Reserves Calculated?

Rolling reserves are part of the underwriting process, which means the exact calculation varies for each business. The reserve amount is based on a merchant’s monthly processing volume, but it includes other factors like the industry and how long the merchant has been in business.

If you’re comparing merchant account providers and obtaining quotes from different processors, you’ll likely see the reserve amounts fluctuate considerably between each quote.

Pros and Cons of Rolling Reserves

Generally speaking, rolling reservers are not good for merchants, and it’s better to avoid them whenever possible. But in some cases, a rolling reserve can be a positive.

Benefits of Rolling Reserves:

- Ability to accept credit and debit cards

- Secure payment processing if you’re a high-risk business

- You’re forced to save money in an account that will eventually be returned to you

Drawbacks of a Reserve Account:

- Restricts cash flow for businesses

- Processors have the right to hold funds for up to 180 days for chargeback liabilities

- Some merchant account providers won’t approve your application without a rolling reserve contingency

Other Types of Reserve Funds in Credit Card Processing

Reserve merchant accounts typically fall into two main categories—capped and up-front. Here’s a brief explanation of each:

Capped Reserves

As the name implies, a capped reserve restricts the amount of money that can be placed in your reserve account. Caps are usually based on a percentage of monthly processing and fall between 50% and 100%, depending on your volume.

Here’s an example. Let’s say your business processes $10,000 per month, and your processor imposes a capped reserve at 50% of your monthly volume. Once that 50% threshold is met ($5,000), no other funds will be held in reserve.

Unfortunately, most capped reserves aren’t released back to the merchant over time. The processor withholds these funds until the account has been closed.

Up-Front Reserves

Also known as minimum reserves, this type of account requires the merchant to fund the reserve before they’re able to start processing credit card transactions.

This can be done by obtaining a letter of credit from your bank or transferring the funds directly from a checking account. If you don’t have the cash or credit to fund an up-front reserve, some merchant account providers might withhold 100% of all transactions until the minimum reserve balance has been met.

Agreeing to a reserve can help ensure that your merchant account application won’t get denied.

How to Overcome Rolling Reserves in Payment Processing

I’m not going to sugar-coat it—rolling reserves, or any reserve accounts for that matter, are less than ideal for merchants. That’s because it can create cash flow problems and cut into your profit margins.

If your business is subject to a rolling reserve account, you should find out if it’s something that’s temporary or permanent. Over time, you might be able to get the reserve lifted, and get a basic merchant account without any strings attached.

Like most aspects of credit card processing, rolling reserves are negotiable. With the right assistance, you might be able to talk down the reserve amount or percentage. Over time, the reserve could be lifted altogether.

During these negotiations, it’s in your best interest to seek help from a professional. Here at Merchant Cost Consulting, we negotiate with credit card processors on behalf of our clients every day.

So if you need some assistance and want to save money on high-risk credit card processing or have questions about high risk merchant accounts, reach out to our team today.