Here at Merchant Cost Consulting, we’re always staying up to date with the latest updates, fees, and rate increases from credit card processors.

Below you’ll find the most recent updates for Shift4 Payments.

Additional Reading: Shift4 Review – Pros, Cons, and Fees to Look Out For

Shift4 Rate Increase – March 2026

Effective March 1, 2026, Shift4 is increasing its Month End Billing Fee to 0.05% (up from 0.02%).

5 basis points may not seem like a lot, but it’s a steep increase and important to understand for several reasons:

- The rate is going up by 2.5x

- It’s applied on your total payment volume each month

- And while you can avoid this fee by switching to Daily Billing, this comes with tons of accounting and reconciliation challenges that most businesses aren’t prepared to handle

We’ve also noticed that when Shift4 merchants switch from Monthly to Daily billing, it becomes harder for them to notice new fees and increases (which is probably one of the reasons why Shift4 is encouraging you to switch).

If you received this March 2026 rate increase notice from Shift4 and want to understand your options, contact our team here at MCC for a free audit. We can help negotiate directly with Shift4 on your behalf to lower your effective rate without changing anything (even if you’re ultimately stuck with this fee).

Shift4 Updated its Merchant Processing Terms and Conditions

Shift4 just sent a notice to merchants that its MPA is being updated. Changes can be found at Shift4.com/legal.

The notice was sent out to most clients in mid-November, stating the the new conditions will take effect in 30 days (by December 14, 2025).

By continuing to use Shift4, merchants automatically agree to accept the amended terms of their agreement.

New Shift4 Annual Regulatory Fee – December 2025

Effective December 1, 2025, Shift4 is charging a new Annual Regulatory Assurance Fee (RAF) of $325 per device (with a three device maximum).

This means that Shift4 merchants with at least three devices are being hit with a $975 fee this December to “support secure card processing and maintain compliance” which is something that should be part of Shift4’s processing service to begin with. Not something you should pay extra for.

What’s crazy about this fee is that it’s being charged in addition to Shift4’s regular Annual Program Fee of $99 per device, which we already started seeing on client statements months ago.

Combined, these two charges bring Shfit4’s annual fees into the thousands, which makes them among the highest in the industry.

New Shift4 Fees and Rate Increases Effective September 2025

Shift4 is rolling out several new charges that go into effect on September 1, 2025. Here’s what you can expect:

- Rate Increase – 0.07% + $0.05 per transaction

- BMS Portal Fee – $20 per merchant per month

- Premium Monthly Support and Service Fee – $50 per MID per month

- Incoming Chargeback Fee – Increased to $35 per chargeback

- Batch Header Fee – Increased to $0.40 per batch

These are just money grabs, especially the two new monthly charges. That’s Shift4’s way of getting an additional $70 per month and $840 per year from your account.

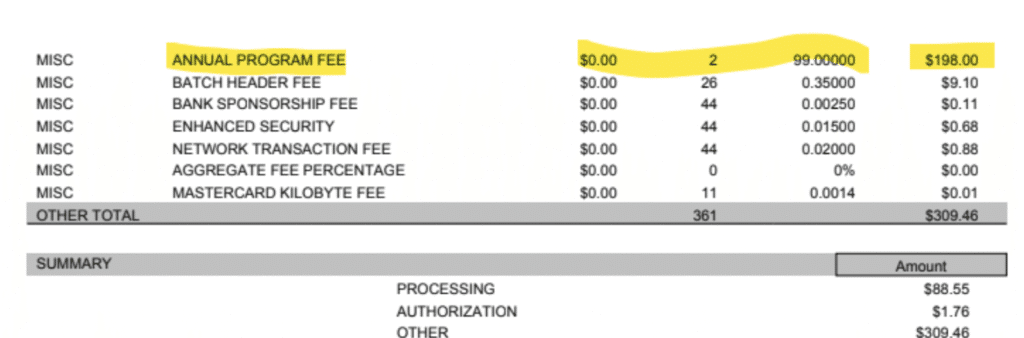

Shift4 Fee Annual Program Fee – 2025

We’re already starting to see annual fees charged on monthly statements. Typically, processors wait until Q4 for closer to the end of the year to apply these, but Shift4 is including them on accounts over the summer.

It’s $99 Annual Program Fee per device, and here’s an example from one of our clients:

This is another one of those processor charges that are just used to inflate profits. And you shouldn’t be charged an annual fee just for the privilege of using their services (they already get plenty from your processing volume).

Shift4 Acquired Global Blue

On July 3, 2025, Shift4 officially announced that its acquisition of Global Blue is complete.

This is the largest acquisition in Shift4’s history, and instantly gives them access to hundreds of thousands of retailers and travel businesses across Europe, Asia, and South America relying on Global Blue’s tax-free refund and currency conversion technology.

These solutions will be added to Shift4’s global payments platform, and an all-in-one solution to combine payment processing with these services is on the horizon.

During Shift4’s 2Q25 earnings results, they adjusted EBITDA outlook to reflect an additional $125 million from Global Blue. Leadership also said that integrating Global Blue and international expansion is a top priority for the year.

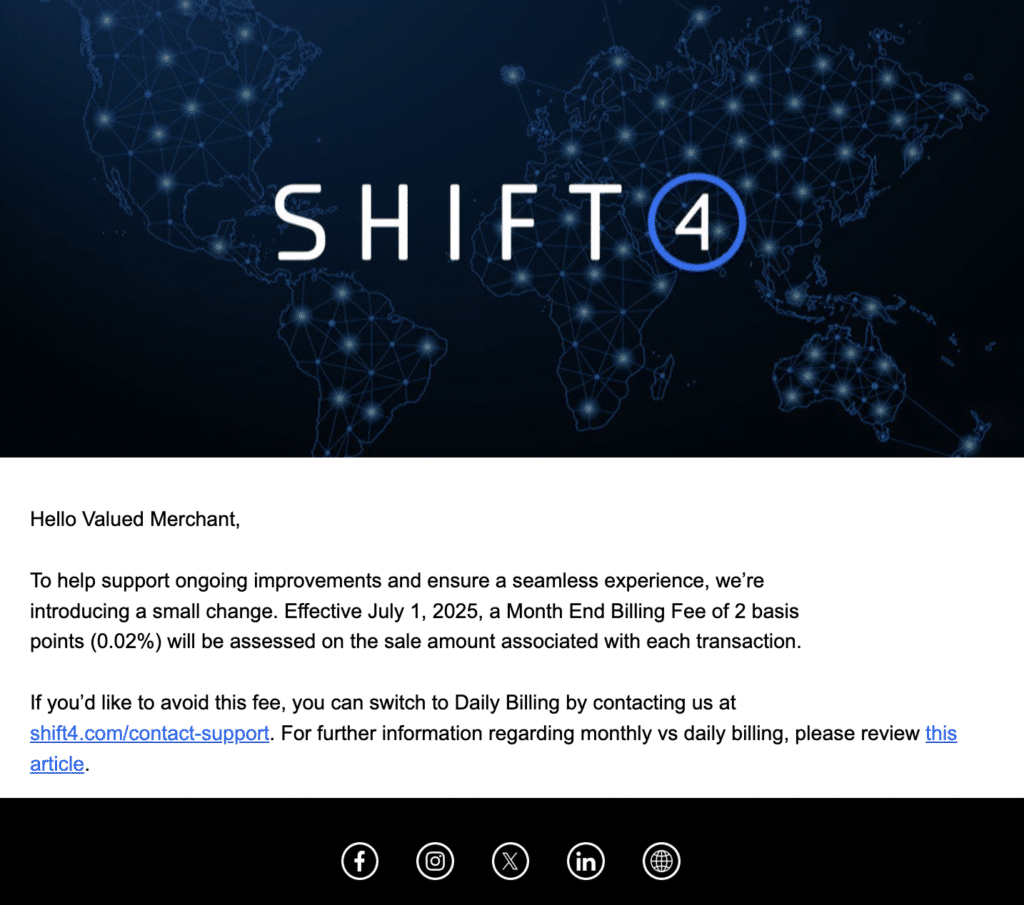

New Shift4 Fee Effective July 2025

Effective July 1, 2025, Shift4 is adding a new Month End Billing Fee of 0.02% (2 basis points) charged on the total sales volume for each transaction.

Merchants have the opportunity to avoid this fee by switching to Daily Billing.

Here’s the official notice of this increase that we obtained from our clients using Shift4:

While 2 basis points may not seem like a lot, there’s no reason to pay this fee. Either switch to daily billing to avoid this, or contact our team here at MCC to negotiate with Shift4 on your behalf.

Shift4 Rate Increase Effective March 2025

On March 1, 2025, Shift4 increased its rates by 0.05% + $0.03 per transaction.

Select merchants also received notice that they’re being transitioned to Shift4’s “Simplechange” pricing structure. This model is confusing and not a true interchange plus structure (it’s more of bundled interchange plan).

If you’ve been impacted by either of these changes, contact our team here at MCC for help. We typically find that merchants can save roughly 25 basis points with Shift4’s interchange plus plan instead of the Simplechange model. Our team can negotiate this on your behalf.

Shift4 Rolls Out “Pay With Crypto” Feature

In October 2024, Shift4 announced its ability for merchants to accept multiple cryptocurrencies, including:

- Bitcoin (BTC)

- Ethereum (ETH)

- Solana (SOL)

- US Dollar Coin (USDC)

This feature applies to both online and in-person transactions. All crypto accepted will be automatically be converted to US dollars when it’s settled to the merchant.

Shift4 is the first major processor to offer this capability on a global scale.

Shift4 SkyTab Restaurant POS Update

In a July 27, 2023 press release, Shift4 announced that it will pay $1 to restaurants for every order received within the first three months of using the SkyTab POS service.

Shift4 is also offering a $5,000 signing bonus to offset costs for restaurants switching from another POS system.

SkyTab starts at $29.99 per month.

Shift4 Updates

Shift4 announced the following changes effective 4/1/2022:

- The latest card brand changes will be passed through to Shift4 customers for transactions beginning in April 2022.

- Merchants using Shift4 can see these new rate increases in changes by logging into their merchant portal.

- Shift4 customers agree to these changes by continuing to use Shift4’s services after 30 days.

Shift4 Updates for ACH Descriptors and Billing Statements

In a notice sent to customers in December 2021, Shift4 outlined the following changes going into effect for 2/1/2022:

- Shift4’s ACH (Automated Clearing House) descriptors POSitouch, Future POS, and Restaurant Manager are all changing to Shift4.

- Shift4 is simplifying client billing statements. Effective 2/1/2022, Shift4 customers will see consolidated statements. This change is designed to make it easier for customers to see what they’re being charged each month.

- The consolidated billing statements will also include pricing variances.

Shift4 Updates to Terms and Conditions

In a notice sent to Shift4 customers in December 2021, the processor outlined the following changes going into effect for 1/1/2022:

- Shift4’s Merchant Applications Terms and Conditions have been revised.

- Shift4 customers agree to these terms by continuing to use Shift4’s services for 30 days.

- Visit https://www.shift4.com/legal to see the latest version.

If you’re an existing Shift4 customer, you can find this notice from your online account. Click “Display Statements” and navigate to “Statement Messages.”

About Shift4

Shift4 is a publicly traded payment processing company based in the United States. Founded in 1999, Shift4 currently processes $200+ billion in transactions per year. More than 200,000+ businesses rely on Shift4 for processing needs.

Shift4 Industries Served

Shift4 offers payment solutions to businesses in the following categories:

- Retail

- Ecommerce

- Food and Beverage

- Travel and Hospitality

- Casinos and Gaming

- Specialty Businesses

Shift4 Features

Features include:

- Business intelligence

- Gift cards

- QR code solutions

- SkyTab mobile solutions

- SkyTab online ordering

- Unified commerce

- POS solutions

Check out our complete guide to interchange fees and rates to learn more about how interchange works and how to save money on credit card processing.