Merchants using Shift4 have been contacting me non-stop the first week of the new year, questioning a new Regulatory Assurance Fee on their December statements (sent out in January).

If you’re in the same boat, here’s what you need to know:

- Shift4’s Regulatory Assurance Fee (RAF) is $325 per device.

- There’s a 3-device max, capping the fee at $975.

- It’s billed annually, most recently in December 2025 statements.

- The fee is “supposedly” used to cover PCI standards (more on this later).

- But in reality, this is just another annual fee from Shift4 (which they already charged, separately).

That’s the short version. But there’s quite a bit more to unpack if you really want to understand what’s happening here.

Quick Note About Shift4

Before we continue, I want to make sure you understand where my insights are coming from.

I’ve personally audited hundreds of Shift4 statements over the last nine years, and my team collectively has auited thousands. While I’ve found my fair share of mistakes and junk fees in that stretch, I actually like Shift4 and think they’re a solid processor overall.

Basically every processor looks for ways to inflate their profit margins in the form of additional fees. This isn’t unique to Shift4, and I’m not “bashing” them or anything like that.

I’m simply trying to expose the practice because I think merchants have the right to understand what they’re being charged for.

That said, I have several problems with Shift4’s Regulatory Assurance Fee:

Shift4’s RAF Fee is Transparent But Somewhat Misleading

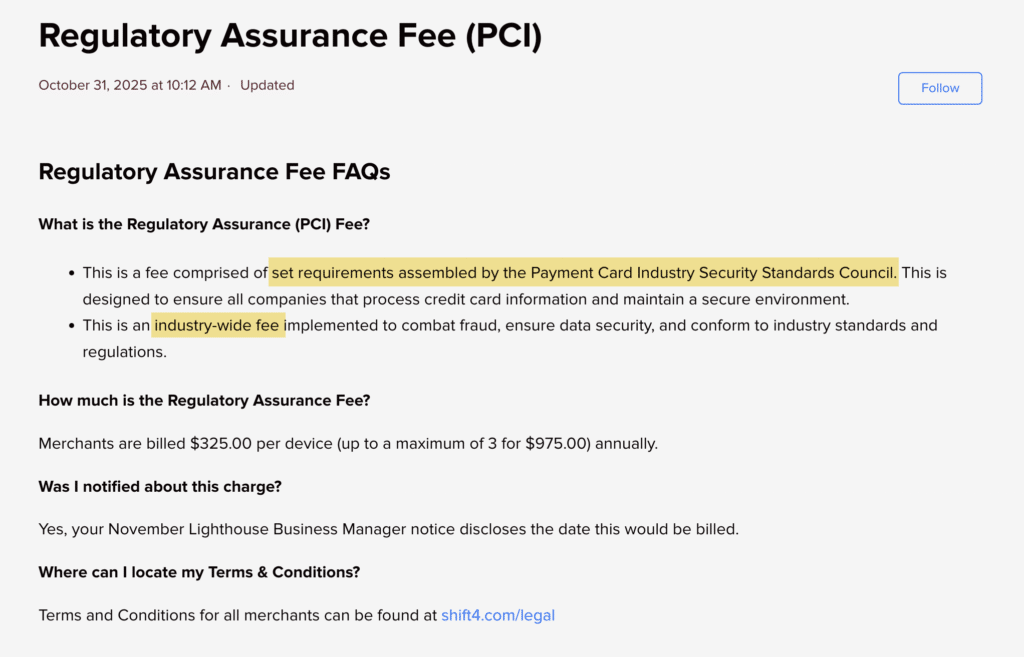

To Shift4’s credit, the annual RAF fee is completely transparent, and they’ve even published it on their helpdesk site for merchants to access. They also provided advance notice to all merchants.

Not every processor does this. I’ve seen other processors just sneak these types of charges into statements under the radar, with no publicly available information about it.

So in that sense, Shift4 is being transparent.

My problem with Shift4’s reason for charging the fee is that they’re saying it’s an “industry-wide fee” used to maintain PCI standards. I’ve highlighted those parts of the explanation here:

This is very misleading.

While PCI compliance standards are legitimate, there’s no industry-wide mandate that requires processors to charge merchants for PCI compliance. And the fee itself is definitely not an industry-wide fee either.

How do I know this? We literally audit statements from every processor on the market, every single day. That’s how my entire team here at Merchant Cost Consulting spends 90% of their workdays.

Shift4 is the only processor charging this specific Regulatory Assurance Fee. Their reasoning that “everyone else is also charging this fee” is simply not true.

The Amount is Completely Arbitrary

Let’s just pretend for a minute that the fee actually was required to be charged to every merchant industry-wide (which it’s not).

Where is that $325 amount coming from? And why is it capped at 3 devices max?

If Shift4 truly had to recoup costs for PCI compliance on their devices, it would apply to every piece of Shift4 hardware.

Say a business has 20 different Shift4 terminals. Trust me, Shift4 isn’t just going to eat the costs on 17 of those terminals if there was any additional work or costs involved with keeping those devices PCI compliant.

That hardware is secure out of the box, and keeping your transactional data secure is simply part of your processor’s job. That’s what you’re paying them for. They shouldn’t be charging you up to $975 extra each year for doing it.

Shift4 Already Charges Merchants For Payment Security Separately From The RAF Fee

Again, let’s try to give Shift4 the benefit of the doubt here just for a second. Maybe they are going to some extreme lengths to keep their devices extra secure and they’re going the extra mile for you to maintain PCI standards.

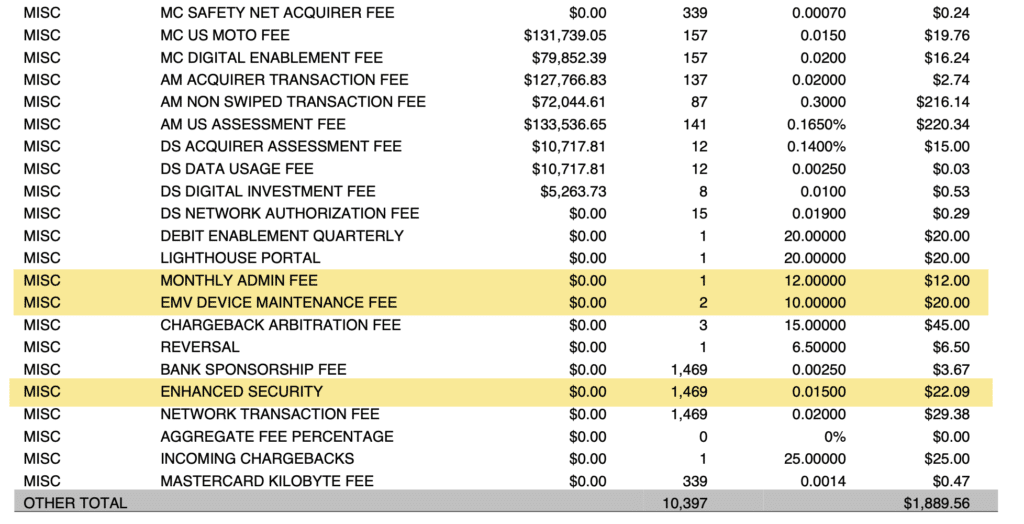

Take a look at your previous Shift4 statements (without the Regulatory Assurance Fee). Here’s an example from one of our clients using Shift4:

In the “Other Detail” section of the monthly charges, we can see a bunch of legitimate card network assessments (no issues there).

But check out these three fees I highlighted above.

- Monthly Admin Fee — $12 per month

- EMV Device Maintenance Fee — $10 per device per month

- Enhanced Security Fee — $0.015 per transaction

Ok, maybe the monthly admin isn’t specifically tied to payment security (and maybe generating an invoice for you is worth $12).

But EMV Device Maintenance is directly tied to payment security. And while it’s only a component of PCI standards (not fully encompassing), you’re still paying $10 per month for each device here.

And what is this mysterious “Enhanced Security” charge? Your guess is as good as mine.

But between these three charges alone, this merchant with just two devices and ~1,500 monthly transactions is being charged an extra $55 per month in these fees. That’s roughly $660 annually before they’re hit again with Regulatory Assurance Fees to close out the year.

Shift4 Nearly Doubled the Fee Amount Compared to Their Merchant Agreement

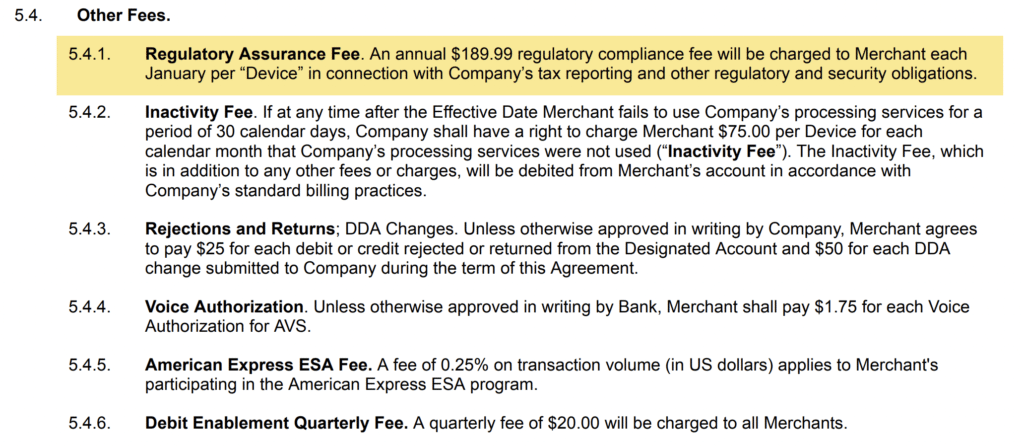

I pulled a recent copy of Shift4’s Merchant Terms of Conditions, dated from 2025.

If we look through these 16 pages of terms, we can see the Regulatory Assurance Fee is clearly listed under the Other Fees section. Again, Shift4 is being totally transparent about this charge. It’s literally in the contract.

But look at the amount: it’s $189.99 per device (not $325).

This fee amount jumped by over 70% in the same year.

Merchants who agreed to these terms earlier in 2025 were still subject to the same $325 fee, even though their contract explicitly states the fee is $189.99.

Well, if we look even closer at the terms, Shift4 has the full legal authority to amend these fees as long as they provide you with 30 days’ written notice (which they did).

Shift4 Charges Other Annual Fees, Too

Some merchants can live with the fact that their processor charges them an annual fee. And while I don’t think it’s right, I can understand the sentiment here.

Shift4 is providing you a service. Part of that service might include an extra fee on your statement once per year.

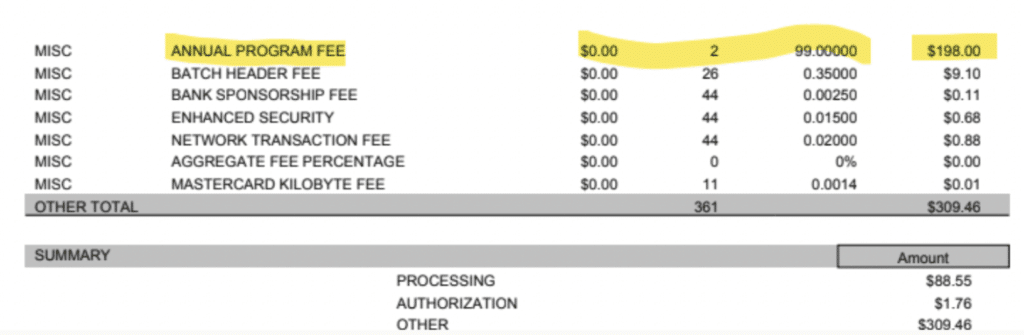

But Shift4 is doing this multiple times per year. We started seeing Annual Program Fees from Shift4 charged at $99 per device (uncapped) as early as August of last year:

So it’s really not just a one-time fee for “regulatory assurance.”

It’s layers of annual fees paired with other monthly charges that slowly but surely cut into your profit margins and increase your effective rate.

Annual Fees Are Just a Profit Center for Processors

This isn’t just a Shift4 problem. Everyone is doing it.

Your processor can call it whatever they want to. But at the end of the day, Shift4’s Regulatory Compliance Fee is just another annual fee disguised as something related to “industry-wide standards.”

Let me put something into perspective for you. We’ll say that every merchant using Shift4 has at least one terminal. That’s $424 billed annually ($99 annual program fee + $325 RAF).

Shift4 has over 200,000 merchant accounts. So between these two fees alone, they just generated $84.8+ million in additional revenue without doing anything.

And that number is likely much larger. Because as we’ve seen from the examples, Shift4 has plenty of merchants with multiple devices.

I think we can safely assume that the revenue generated from those fees is closer to double than that conservative $85 million. Shift4 investors will be pleased to hear about this on their next earnings call (which can give you other insights about your merchant fees).

Why You Shouldn’t Ignore This

It’s easy for businesses to just brush these charges off as a few hundred dollars and part of their overall processing costs.

If you’re processing millions of dollars in payments throughout the year, who cares if your Shift4 pockets an extra $325?

The problem is that it’s not just $325. Every processor has their own fee schemes that they use to pad margins, and Shift4 is no exception to this.

Shift’s Amex Support Fee is another perfect example of this. They try to charge merchants around 0.25% on total Amex volume, while making it sound like a legitimate processor assessment (it’s not).

That’s not all.

In my Shift4 review, I gave an example of a “mistake” I found when auditing a statement from one of our clients. This billing error overcharged the merchant by nearly $2,700 in a single month because payment types were misclassified (read the review for the full statement breakdown).

The point I’m trying to make is that it’s likely not just a few hundred dollars. Some merchants could be overpaying by tens of thousands annually. That’s real money, and not something you should just shrug off.

So if you’ve been hit with Shift4’s annual Regulatory Assurance Fee, I strongly suggest that you sit down and scrutinize every other line item on your statements over the past few months. There’s a good chance you’ll find other hidden charges buried in there.