Text payments have been gaining traction for quite some time now. But the trend has skyrocketed in the past few years.

Businesses across all industries have recognized the importance of touchless payments for credit card processing.

According to Mastercard, 79% of cardholders worldwide are using some form of contactless payments. Another study found that 51% of Americans have adopted contactless payment methods.

These trends make Text2Pay an appealing payment acceptance method for merchants. From payment reminders on late or missed payments to confirming receipt of payment and using text messages to process secure payments—there are several ways for businesses and consumers alike to benefit from text to pay.

Read on if you’re interested in using pay by text payment functionality to enhance your business and improve customer satisfaction.

What is Text to Pay?

Text to Pay—also known as Text2Pay—allows merchants to accept payments via text message. By leveraging SMS payments, businesses can quickly and efficiently charge a customer’s credit or debit card to collect outstanding balances remotely.

Text to pay is a great option for merchants with recurring billing business models. But with that said, the method can be used to process one-time payments as well.

We’ve seen text to pay used across a wide range of business types and industries, including subscription-based services, hair salons and barbershops, restaurants, retailers, and more.

How Does Text2Pay Work?

Text to Pay works by sending payment links to customers via text message. Customers can simply click the bill payment link, and enter their payment method into the SMS payment gateway.

Have you ever sent or received an invoice through email? Text2Pay uses those same principles for accepting payments, except the invoice is delivered via SMS.

The exact message and collection method will vary slightly based on the SMS payment acceptance provider that you’re using.

There are two main ways that text to pay can work. The first simply leverages SMS messaging to remind customers about upcoming payments and amounts due. The second method establishes a digital wallet for payment processing.

Why Businesses Should Use Texting to Accept Payments

According to Campaign Monitor, SMS messages have a 98% open rate, and it takes people just 90 seconds to reply. Alternatively, emails have a 20% open rate, and it takes an average of 90 minutes to reply.

Message recipients are likely to open a text immediately. If a customer has credit card information stored on their phone in a digital wallet, they can complete the payment process in just a few clicks. It’s convenient for your customers, and you’ll get paid quickly.

So if you’re comparing SMS to email as a payment option, Text2Pay is the clear winner.

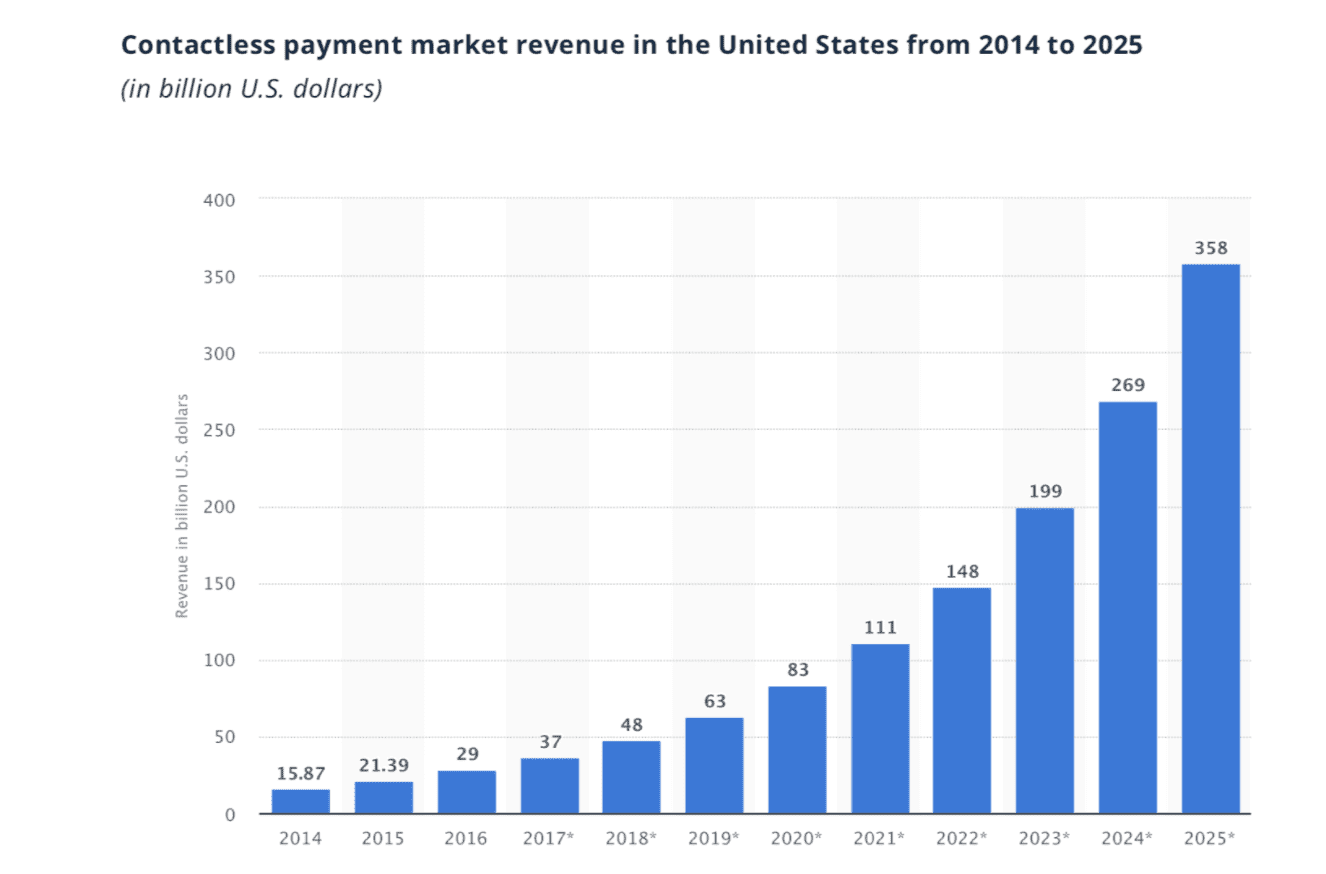

According to Statista, the contactless payment market in the United States is expected to reach $358 billion by 2025.

Between the rise of contactless payments and the consumer’s quick response to text messaging, Text2Pay is an appealing option for lots of merchants.

Mobile payment processing is on the rise. This contactless payment acceptance method helps merchants get paid quickly while simultaneously lowering average collection times and reducing costs associated with paper invoices.

Text2Pay is also safe and secure for customers.

How to Accept Text Payments

First, you need to get set up for Text2Pay with your payment processor. Reach out to your existing payment processing company to inquire about text to pay, and they’ll likely have a solution for you.

Some payment processors have an integrated pay by text product for businesses. Others will refer to a third-party text message service for accepting payments.

From there, here’s a quick look at how the process works.

- Customers need to opt-in to accept SMS messages from your business.

- You’ll send payment prompts via SMS to all customers who have opted in. This can be done manually, or with pre-defined automated rules.

- The customer can pay by entering their payment information through a secure form. At this time, they can choose to save the card information on file for future payments (which would be ideal).

- The payment gets processed, and the customer receives a confirmation text right away.

After the initial opt-in and card saved on file, the entire Text2Pay collection method can help your business get paid in seconds. It’s as simple as the customer opening the message and authorizing the payment.

With our phones seemingly glued to our hands 24/7, getting a quick reply to these messages shouldn’t be a problem.

It’s worth noting that the credit card processing fees associated with text payments will be a bit higher than in-person sales. That’s because these are classified as card not present transactions, which typically carry higher costs.

Benefits of Accepting Text2Pay

Should your business start accepting text to pay? If you’re on the fence, consider these advantages.

Speed

If you’re currently sending paper invoices or emailing bills to customers, Text2Pay is a significantly faster alternative. Remember those statistics we mentioned earlier comparing SMS to email?

90 seconds vs. 90 minutes. 98% vs. 20% open rate. Text is the clear winner.

Paper invoicing is about as slow as it gets. It’s labor-intensive, expensive, and best case scenario you’ll get paid in a week or two.

Contactless

In a time where contactless payments are being leveraged more than ever before, it makes sense to offer as many no-touch payment options to your customers.

As you’ve seen from the charts and data shown earlier, contactless payment revenue is expected to quadruple in less than five years. Text2Pay will be part of that surge.

Convenience

Text2Pay is easy for your customers. All they have to do is opt-in once and store their card information on file. Moving forward, payments can be processed in seconds with minimal clicks on their end.

They won’t have to worry about opening emails, writing checks, or filling out lengthy forms. Authorizing a payment is as simple as opening a message and following the prompt.

Payment Reminders

If you have your customer’s phone number, you can send them reminders about upcoming or past-due bill payments. But that alone still requires the customer to take an extra step to complete the payment (phone calls, writing a check, paying online, etc.).

But with Text to Pay, you can send a payment link along with the reminder. This makes it easy for customers to pay by text—and then instantly get a reply text confirming receipt of the transaction.

Final Thoughts on Using Text to Pay to Accept Payments

Is Text2Pay right for your business?

Theoretically, any business can implement text to pay. But with that said, it’s definitely a solution that’s geared toward businesses that send recurring invoices.

B2Bs and even B2Cs in the service space will benefit the most from Text2Pay.

For quick-serve industries, like coffee shops, Text2Pay probably doesn’t make a ton of sense. Do you normally send your customers invoices for a cup of coffee? I’m assuming the answer is no.

If you fall into one of those categories, you can still benefit from the contactless trend with NFC (near field communication) payments.