Proper data security is vital for all businesses. Customers want to know that their personal information is being protected at all times.

Credit card processing is arguably the most important data that must be safeguarded.

Consumers must feel comfortable that their personal payment information is safe during the checkout process and remains secure after the fact as well.

Without calling anyone out, I’m sure we can all think of a company or two that had a large-scale credit card breach over the years. The negative fallout from this type of event can be insurmountable. Brand images could be damaged beyond repair.

So how do credit card processors and businesses protect payment data? Tokenization is one of those ways.

What is Tokenization?

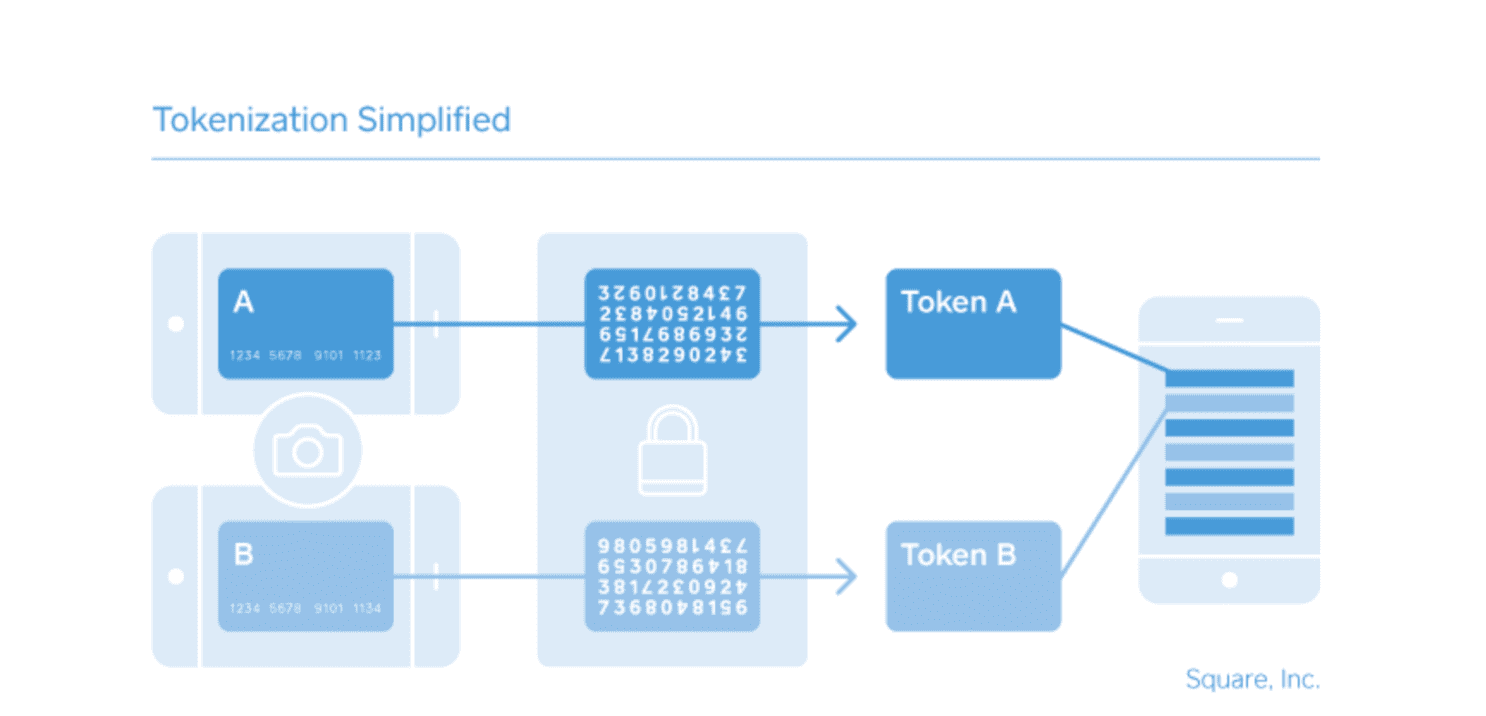

Tokenization is the process of taking sensitive data (like a credit card number) and replacing it with a “token.” Tokens are algorithmically generated sequences that typically include uppercase letters, lowercase letters, special characters, and numbers.

There is no relationship between a token and the type of data that it’s encrypting.

Tokenization adds an extra layer of security for any sensitive data transmission. If a hacker or cyber thief gained access to a token, it would be worthless since the data is encrypted.

Tokenization in Payment Processing Explained

While tokenization can be used to transmit nearly anything, it’s one of the most secure ways to process and store credit card information. Just like EMV chip cards help protect against card-present fraud, tokenization helps fight digital breaches and online payment processing.

When credit card data goes through the tokenization process, the information can be passed through the Internet or other payment processing networks without exposing the actual card information.

Credit card data can be tokenized at a POS system when the customer dips or swipes their card. Tokenization can also occur when card details are entered into a virtual terminal.

Once authorized by the credit card network, a randomly generated token is sent back to the merchant so the card data can be stored on file. The tokenization process helps merchants avoid data breaches by providing enhanced security.

Read More: How Network Tokens Secure Payments

Payment Tokenization Examples

There are three main ways that tokenization is used for payment processing:

- Card on file payments (for subscriptions or other recurring payments)

- Ecommerce card storage for one-click checkouts

- Mobile wallets

I’ll give you some examples to explain how the tokenization process works in various scenarios.

Ecommerce Tokenization

The tokenization process protects consumers while shopping online.

Let’s say you run a global furniture business, and a customer buys a desk from your website. The customer agrees that you can store their credit card information on file for future purchases. All of the card data gets tokenized. So if a hacker breaches your system, they’ll only have access to the randomly generated sequence—not the card data.

New tokens get generated each time a customer shops. So if that same customer has their card information stored with another retailer that gets breached, you won’t have to worry about the card’s vulnerability on your own system.

Mobile Wallet Tokenization

With mobile wallets like Apple Pay and Google Pay growing in popularity, tokenization has recently become a popular industry buzzword.

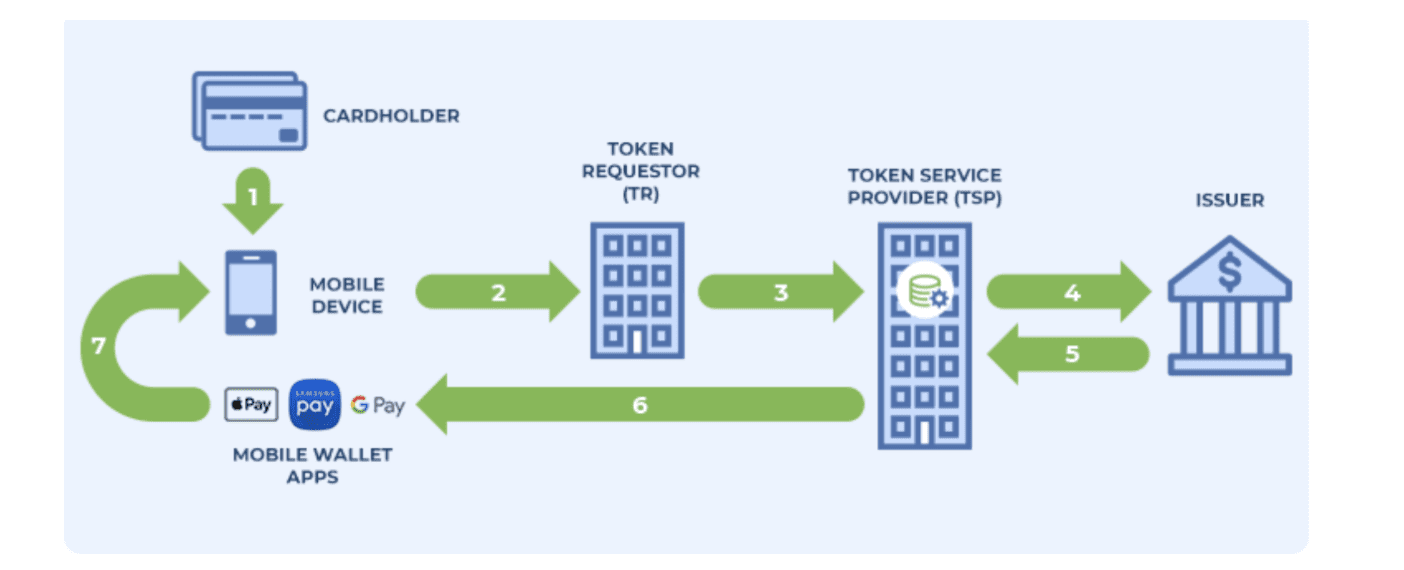

When a consumer uploads their credit card information to their device, Apple or Google sends the card details to the issuing bank. That bank replaces the card data with a token. Then Apple or Google programs the token to the user’s phone. The PAN (primary account number) is never stored on the device itself.

That’s just the process for adding the card to the device. But now here’s another diagram that shows the transactional process for when someone uses their mobile wallet to buy something.

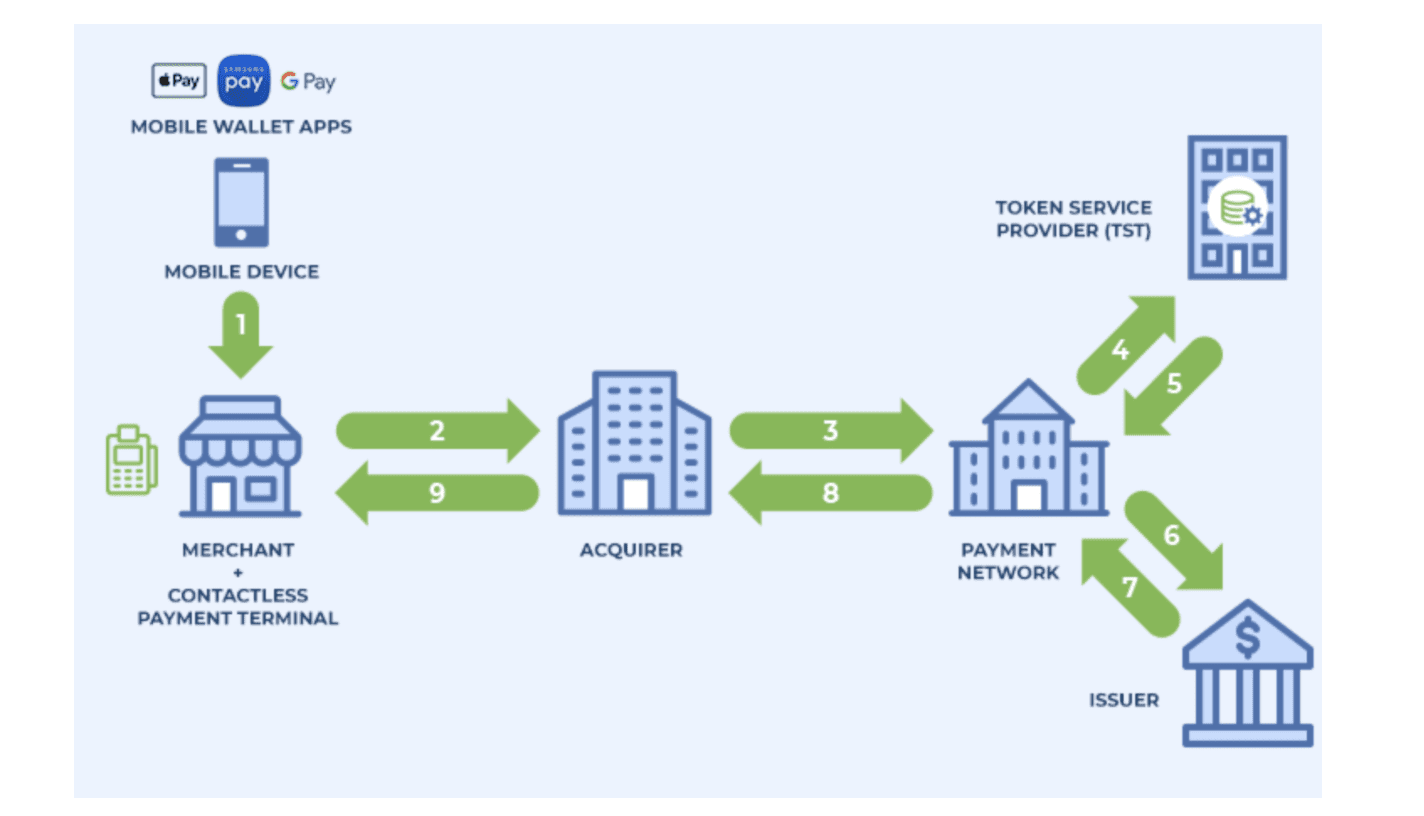

The cardholder presents the token from their digital wallet. This token gets sent to the acquirer from the merchant’s terminal. The acquiring bank routes the transaction to the payment network, just like a normal transaction.

When the payment network realizes that they’ve been sent a token instead of a bank identification number (BIN), the transaction is routed to the token service provider.

From here, the token is validated, de-tokenized, and sent back to the payment network. The payment network sends the request to the issuing bank and everything else proceeds as normal, all the way back to the approval on the merchant’s terminal.

The merchant and acquiring bank never have access to the card data, which is another reason why the risk of fraud is reduced.

In-App Tokenization

Consumers store credit card information within mobile apps for a simple checkout process. Instead of having to enter their card number every time they want to buy something, they just check out with the card on file.

With tokenization, the apps won’t have access to the actual card details. Instead, the app simply stores a token.

Benefits of Tokenization in Credit Card Processing

Tokenization protects merchants and consumers alike. Consumers shopping online, signing up for subscriptions, or using mobile wallets can feel comfortable knowing that their card information is safe.

Merchants benefit because they have the ability to access secure card data without having to store that information themselves. Instead, they simply store the token.

You can use tokenization to set up recurring transactions, customer loyalty programs, and one-click checkouts for customers online or through your mobile app without running the risk of compromising their data in the event of a breach.

Final Thoughts on Tokenization in Payment Processing

In simple terms, the process of tokenization is all about adding an extra layer of security to credit card processing.

Merchants store a randomly generated code (the token), instead of consumer card data.

This system takes the burden off the merchant. While tokenization might seem like a complicated process behind the scenes, there’s not much that will change for you in terms of accepting credit card payments.