Patient care is obviously a top priority for everyone in the healthcare industry—that goes without saying.

But if you run your own practice, you know first hand that there’s a business side to healthcare. At the end of the day, someone needs to pay for the services you’re offering. From yearly checkups to routine blood work, surgeries, teeth cleaning, eye exams, x-rays, and more, there’s always a bill associated with an appointment or procedure.

Studies show that 22% of Americans stay away from medical visits because of the cost. Another 15% of those polled said that a family member in their household decided to skip medical care because the cost was too expensive.

That’s not all. An alarming 29% of US adults did not take their prescribed medications because of the price. Some even cut their pills in half or skipped doses to avoid refilling the prescription.

This is becoming a problem nationwide. But cost aside, one way to curb this issue can be handled in the office—it all starts with payment transparency.

What is payment transparency? How can you establish a transparent payment policy in your healthcare practice? You’ve come to the right place—this guide will teach you how.

A Quick History on Healthcare Payments

Years ago, it was common practice for patients to pay a copay at the time of a medical service, regardless of what that service entailed. Patients expected this payment, and they weren’t caught off guard by anything. Any services that would count towards a patient’s deductible would be billed at a later time.

So let’s say a patient has a $40 copay for office visits. They’d be expected to pay $40 upon arrival.

But if someone had a $2,500 deductible and they were going in for outpatient surgery, they weren’t expected to pay anything on the day of the surgery. A bill would come from the hospital within a few weeks. First, the claim had to get sent to the insurance provider. After the rates were negotiated and the insurance company paid their part of the bill, the remaining fees counting towards the deductible would be sent to the patient.

Things have changed in recent years. Today, studies suggest that about 75% of hospital systems in the United States ask patients to prepay certain out-of-pocket fees.

This can be a bit off-putting, especially if the patient isn’t aware of your policy until the time of the appointment.

Should You Ask For Payment Upfront?

So should you be asking your patients to pay before a procedure? There’s really no right or wrong answer here. I’m not going to tell you how to run your practice—that’s 100% your decision.

Asking for payment upfront is ok, as long as you’re transparent about this from the beginning.

Patients don’t want to find out the day of or a night before a procedure that they need to shell out a $3,500 deductible payment. That’s something that should be discussed well in advance.

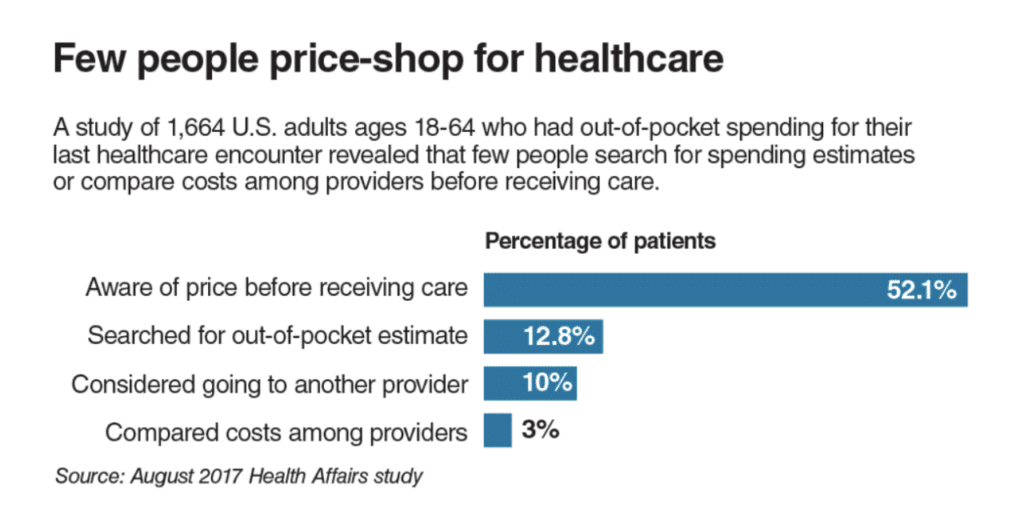

Generally speaking, US adults don’t shop around for healthcare estimates.

There are obviously other factors to consider here as well. Some healthcare facilities don’t want to provide an inaccurate estimate. A patient can go in for one procedure and end up having a hospital stay that lasts for weeks instead of days.

Payment Plans

It’s common for healthcare practices to establish relationships with banks to offer payment plans to those who need to pay in installments. Unlike payment plans for other purchases, medical payment plans are typically offered at no interest and available to anyone—regardless of credit history.

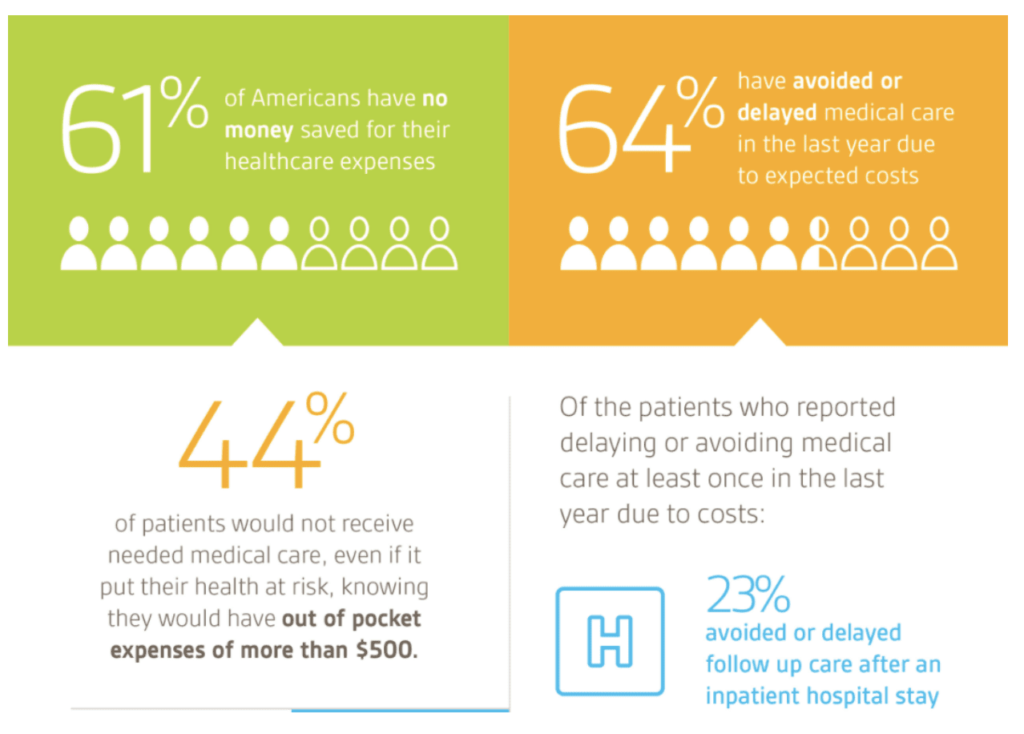

Allowing your patients to pay over time is better than not getting paid at all. You don’t want patients to turn down care due to the price.

This is increasingly important as deductibles are rising nationwide. It’s estimated that the upper caps in 2022 for an individual plan will be $9,100 and $18,200 for a family.

The median bank account balance for an American household is $5,300. This includes checking accounts, savings accounts, and money market accounts combined. Most people don’t have $18,000 laying around for medical expenses.

But 77% of adults say they would pay medical bills in installments through a payment plan if they were given the option.

How to Achieve Price Transparency and Why It’s So Important

Regardless of the medical practice you’re running, you need to be transparent about your payment policy. Not only will this make your patients feel more comfortable, but it also ensures that you’ll get paid for the services you’re offering.

If you expect the average patient to pay several thousand dollars without any notice, then some of them are going to walk away. But if you give them plenty of time to prepare and offer flexible payment options, then it’s a win-win scenario for everyone involved.

I’m not a medical professional, and I can’t give you any advice related to patient care. But I am an expert in the payment processing industry.

Whether you’re a doctor, surgeon, chiropractor, dentist, or any medical professional, you can set up recurring billing for patients who want to pay their balance in installments.

Once you have the credit card on file, the installment will automatically get charged each month until the balance is paid. This is so much easier than mailing out collection letters and forcing your patients to write a check each month. With recurring payment processing, there’s just the initial setup, and everything else is on autopilot.

Final Thoughts

Many medical professionals prefer checks over credit cards because plastic tends to have higher fees. But when you factor in the administrative labor required for checks, you’re really not saving that much money.

If you think your credit card transaction fees are too high, contact my team here at Merchant Cost Consulting. We’ll help lower your rate without needing to change your processor.

Then you can offer transparent payment policies and make it easier for your patients to pay.