This is the beginning of a new era to reveal how credit card processing companies are adding hidden fees, downgrading interchange rates, and implementing surcharges to charge businesses more than they should be.

This credit card processing rate increase series will also showcase card brand changes (Visa, MasterCard, Discover, American Express) that occur throughout the year. It’s strictly educational and comes from Merchant Cost Consulting’s auditing experiences every month of what we see happening in the credit card processing industry.

We’re always keeping an eye out for rate increases and important notices from major payment processors. Here’s a look at the latest notices, fee increases, and updates from TSYS (Global Payments):

New TSYS Annual Fee – December 2025

TSYS is charging merchants a $499 Annual Fee in 2025, that will be billed on December 2025 statements.

This is one of the highest annual fees we’ve seen from other processors, including processors owned by Global Payments.

The notice was strange in the sense that it referenced an incorrect Annual Administrative Fee notice that was sent out earlier in the year with an incorrect (likely lower) amount. TSYS told merchants to disregard that notice, and that the $499 Annual Fee (increased from last year) is the correct amount.

TSYS Rate Increase – Effective November 2025

TSYS increased its base discount by 1.25% on November 1, 2025.

Additionally:

- $0.30 increase to Transaction Network Access Fee

- 0.30% increase to Non-Qualified Surcharge Fee

- 0.40% increase to Settlement Funding Rate

This is one of the largest rate increases we’ve seen from this provider to date. And an increase of 125 basis points is too high of a markup as is. As an increase, this means merchants can be paying upwards of 200 basis points per transaction just as a markup to the processor.

TSYS Rate Increases – Effective January 2025

TSYS just notified select account of a rate increase that goes into effect as of January 1, 2025:

- Qualified Base Discount Rate – 0.90% increase

- Transaction Network Access Fee – $0.20 increase

- Settlement Funding Rate – 0.40% increase

- MC Excessive Authorization Fee – $0.20 increase

- ASSOC Kilobyte Base II Fee – $0.0007 increase

- Visa Misuse of Authorization Fee – $0.06 increase

TSYS has continued to steadily rase its rates all of last year, and this is a continuation of what seems to be its plan to get all merchants to pay more. But if we look back at the last few rate increases from TSYS, we can see that they haven’t been applied equally to all accounts.

The 0.90% qualified base discount rate for January 2025 is one of the highest jumps we’ve seen in a while. So if you’ve been impacted by this rate hike and want to know your options, contact our team here at MCC for a free audit. We can review your statements and negotiate directly with TSYS on your behalf.

TSYS Rate Increases – Effective November 2024

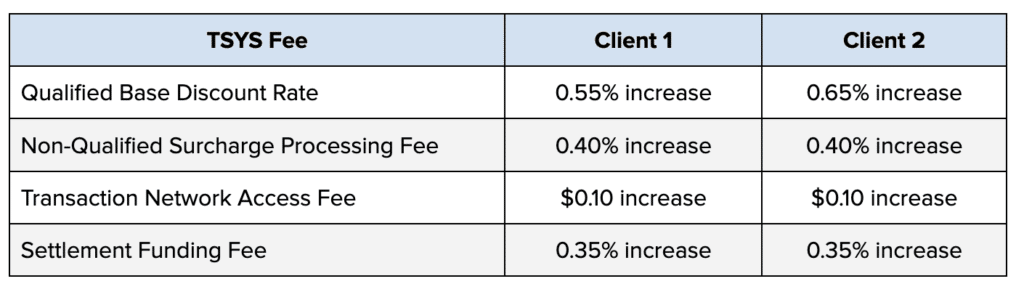

We had two clients receive notices from TSYS about rate increases that go into effect on November 1, 2024. What’s so interesting about this particular increase is that TSYS increased each account at different rates.

In addition to the rate increases, both of these notices mentioned upcoming changes for chargebacks.

Effective January 8, 2025, chargeback to debit DDA amount will happen at the time of the receipt (instead of up to 15 days later). TSYS is eliminating its chargeback notice and replacing it with a dispute advice letter.

TSYS Rate Increase – Effective August 2024

Effective August 1, 2024, TSYS is increasing the following rates for select merchants:

- Qualified Base Discount Rate – 0.65% increase

- Transaction Network Access Fee – $0.15 increase

- Settlement Funding Rate – 0.45% increase

It’s also worth noting that the Transaction Network Access Fee applies to all authorized transactions, including returns and declines.

Similar increases went into place in May of 2024. But appears that not all merchants were affected by that initial announcement, and TSYS is continuing to apply these changes to even more accounts.

TSYS Rate Increases – Effective July 2024

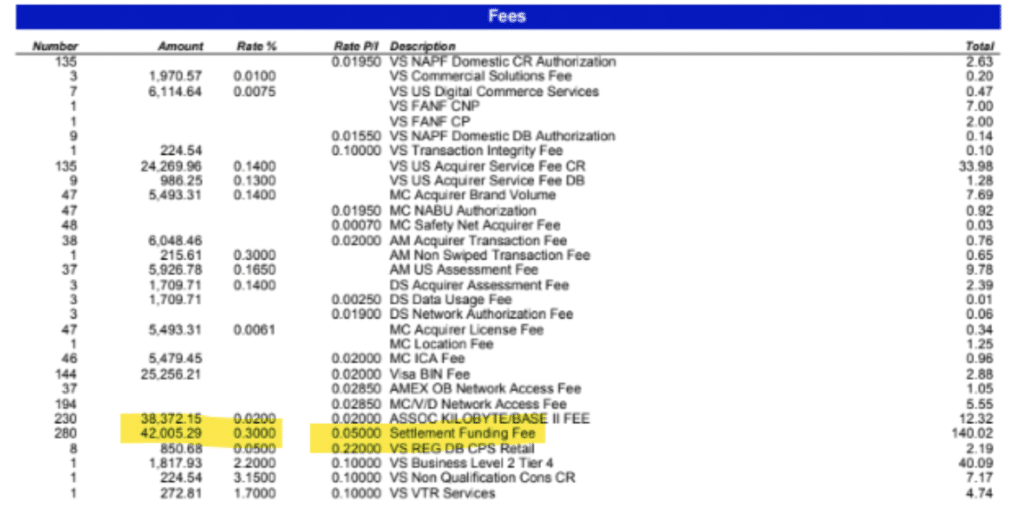

As of July 1, 2024, our team noticed TSYS adding Settlement Funding Fee to monthly statements. It’s charged at 0.30% rate based on total monthly settlement volume.

Here’s an example of this from a statement we audited:

Check out our full TSYS review for a full list of fees to look out for on your TSYS statements.

TSYS Rate Increases – Effective May 2024

As of May 1, 2024, TSYS is increasing its qualified base discount rate by 0.65% and its non-qualified surcharge processing fee by 0.75%.

The Transaction Network Access Fee is increasing by $0.20. This fee applies to all authorized transactions (including returns and declines).

TSYS is also increasing its Settlement Funding Fee by 0.45%.

New TSYS PCI Compliance Fee – Effective July 2023

Effective July 1, 2023, TSYS is increasing its PCI non-compliance fee to $94.95 per month.

This fee will be assessed monthly to all merchants who have not submitted their PCI DSS Compliance Validation, and will continue being charged until the compliance validation has been completed.

PCI DSS Validation is not required to use TSYS for payment processing. However, merchants are required to confirm their PCI DSS status.

TSYS (Global Payments) Rate Increase Effective December 1, 2022

As of 12/1/2022, TSYS (Global Payments) is increasing the processing rate for credit card and signature debit card transactions by 40 BPS (0.0040). This applies to all Visa, Mastercard, American Express, and Discover transactions.

The processing rate per authorization is also increasing by $0.20.

TSYS (Global Payments) is also increasing qualified base discount rates by 0.20%. A $0.10 transaction network access fee is being added to all authorized transactions, including returns and declines.

Non-qualified surcharge processing fees are increasing by 0.70%. For merchants who are not currently being assessed a non-qualified surcharge processing fee, one will be added to your statement at 0.70%.

For access to card brand services, merchants using TSYS (Global Payments) will be assed a 0.10% fee.

TSYS (Global Payments) July 2022 Updates

Mastercard is rolling out a “buy now, pay later” (BNPL) program. This allows cardholders to split the cost of a purchase into equal installments with the issuing bank.

Merchants will be paid in full according to the existing settlement agreement and funding schedule. No action is required from merchants. They will automatically be enrolled in the program.

TSYS (Global Payments) notified merchants of this update. The notice has an opt-out clause. Based on this terminology, it sounds like TSYS is going to charge a fee to merchants for the auto-enrollment.

Merchants currently using TSYS for credit card processing should keep an eye on their statements for this Mastercard BNPL fee.

Additional Reading: Mastercard Interchange Rates

Effective June 2022: TSYS (Global Payments) Updates

In a notice sent to merchants, TSYS (Global Payments) notified customers of changes to PIN debit networks that could impact costs. Merchants may see new fees or notice an increase in:

- Card network fees

- Assessment rates

- Switch fees

- Activity fees

- Settlement funding fees

- PCI non-compliance fees

- Network security fees

- Early termination fee

TSYS (Global Payments) is reminding merchants to carefully review statements to make sure they’re aware of these changes.

TSYS Rate Increases Effective April 2022

TSYS (Global Payments) notified its customers on February 2022 statements about upcoming changes. Here’s a summary of that notice:

- Visa, American Express, Mastercard, and Discover are modifying interchange structures and introducing new interchange categories effective April 2022. Details of these changes and fee updates will be addressed on March 2022 statements.

- The rate for all non-EMV assessment fees is increasing from 0.65% to 1% effective 4/1/22. This applies to all non-EMV transactions for Visa, Amex, Mastercard, and Discover.

- The new non-EMV assessment fee does not apply to fallback transactions, contactless payments, or CNP transactions.

- A $25 per month fee will continue to be assessed for merchants with more 10% non-EMV transactions in a calendar month.

TSYS Rate Increases Effective January 2022

According to a notice from TSYS (Global Payments), the following changes are going into effect in January 2022:

- Mastercard is increasing fees for the TPE (Transaction Processing Excellence) Program for MACs (Merchant Advice Codes).

- The fee applies to transactions where a merchant acquirer submits a CNP (card-not-present) transaction request to the dual message system that gets declined with MAC values of 03 or 21, where the same card received the same decline codes (03 or 21) within the past 30 days from the same merchant.

- The new fee is billed at $0.03 per occurrence.

About TSYS

TSYS is a global player in the payment processing space, providing solutions for financial institutions, retailers, and card issuers. The company has a presence in roughly 80 countries, with 200 clients and 638 million accounts.

Global Payments completed its merger with TSYS in September 2019.

Acquiring solutions offered by TSYS Global include:

- Authorization and capture

- Clearing and settlement

- Reporting and analytics

- Risk and compliance

TSYS offers issuing solutions, including:

- Consumer

- Commercial

- Payment Processor for Credit and Debit Cards

- Healthcare

- Loyalty

- Licensed payment software

See all of the latest interchange rate changes and updates by visiting our complete guide to interchange.

TSYS Merchant Solutions

What is TSYS merchant solutions?

TSYS is one of the most popular merchant account providers on the market. As a credit card processor, they offer merchant accounts to a wide range of businesses. But before you set up a TSYS merchant account, you need a firm grasp of TSYS merchant solutions and how they handle merchant accounts.

Like any payment solutions provider, the terms of your contract will impact your bank account. We’ll take a closer look at TSYS Merchant Solutions and fees associated with processing credit cards below.

TSYS and TSYS ISO Hidden Fees and Rate Increases

TSYS Omaha Platform

The first we have seen of a TSYS rate increase has come from merchants being on Tsys’s Omaha platform. In laymen’s terms, this is the back end platform a Tsys account is boarded on after getting approved by underwriting.

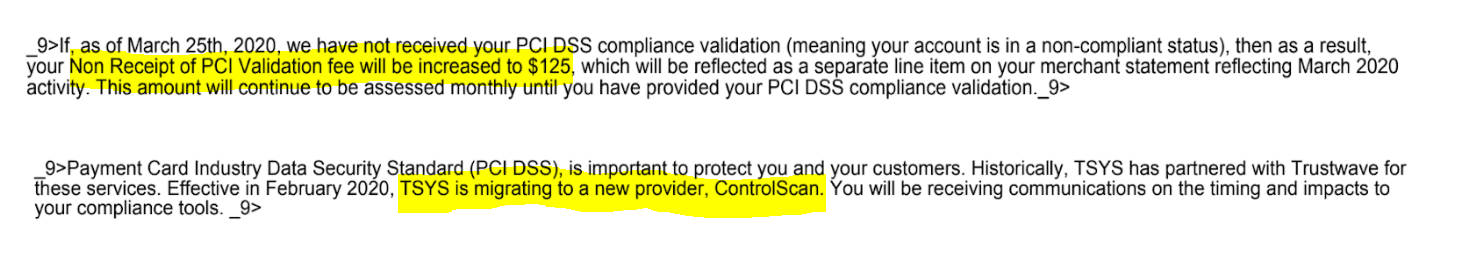

The credit card processing fee was put into effect as of March 25th, 2020 and impacts your PCI DSS Compliance.

IF you fail to take your PCI survey and become PCI compliant, Tsys is charging you $125. This is outrageous for a Non PCI fee, however we have been seeing this fee increase substantially throughout the industry.

Our assumption is that Tsys is migrating from its old partner, Trustwave, who previously help merchants become compliant, and is now shifting over to ControlScan for this support.

TSYS Cayan

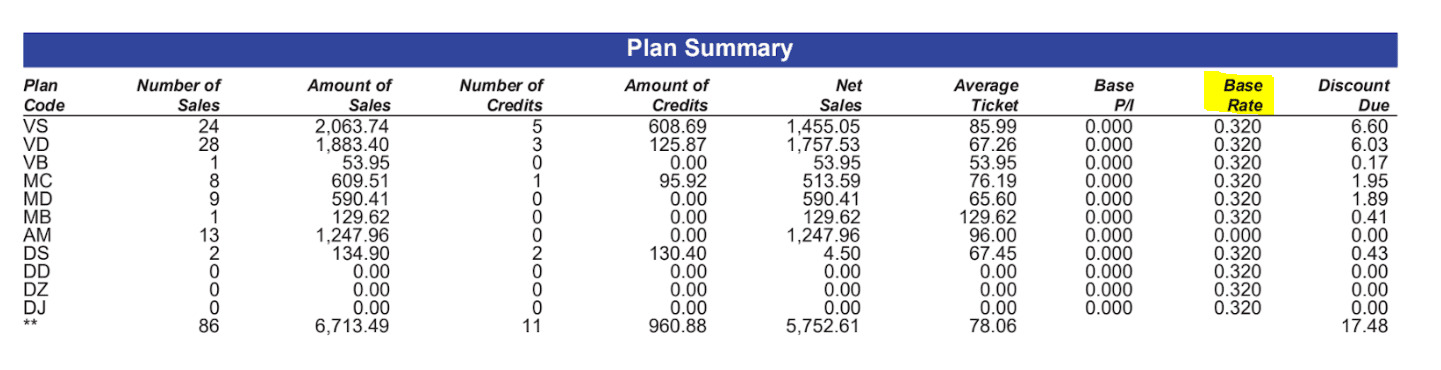

For merchants who are/were with Cayan, who was acquired by Tsys, we have seen credit card processing rate increases in their “base rate.”

In this specific example below, the merchant was previously on a base rate of 0.05% but shortly after had this fee increased to the 0.32% you see below.

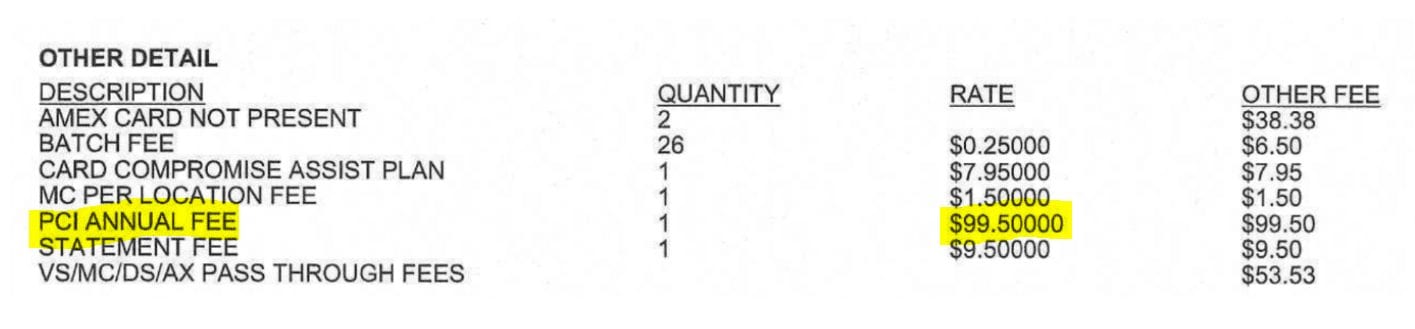

We also see that in this month that TSYS/Cayan has charged their merchants the infamous PCI Fee of $99.50:

Updating your credit card machine is one of many ways to avoid this charge.

TSYS Merchant Solutions Health Services

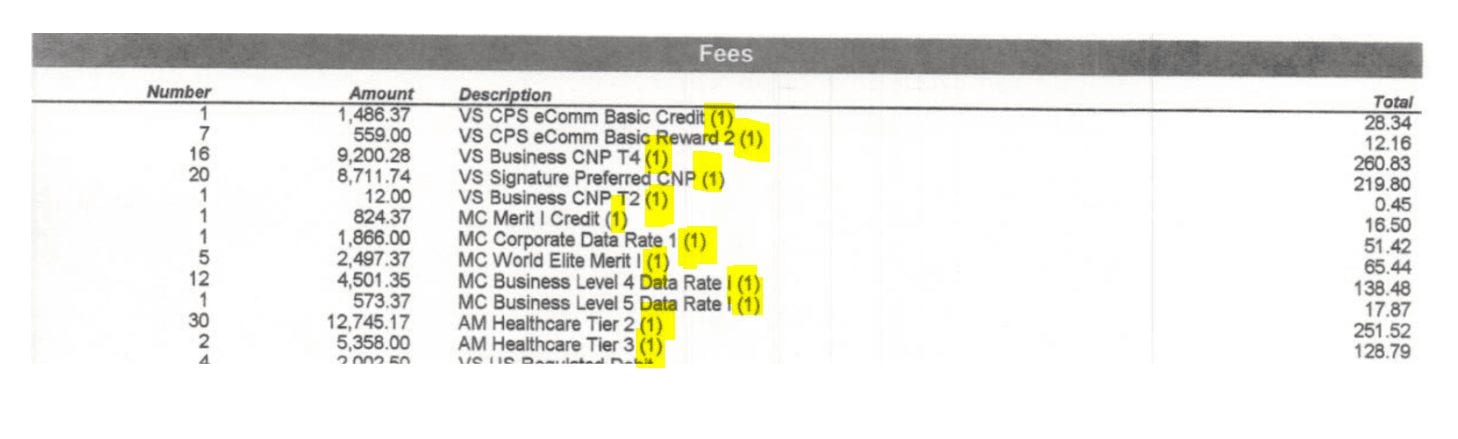

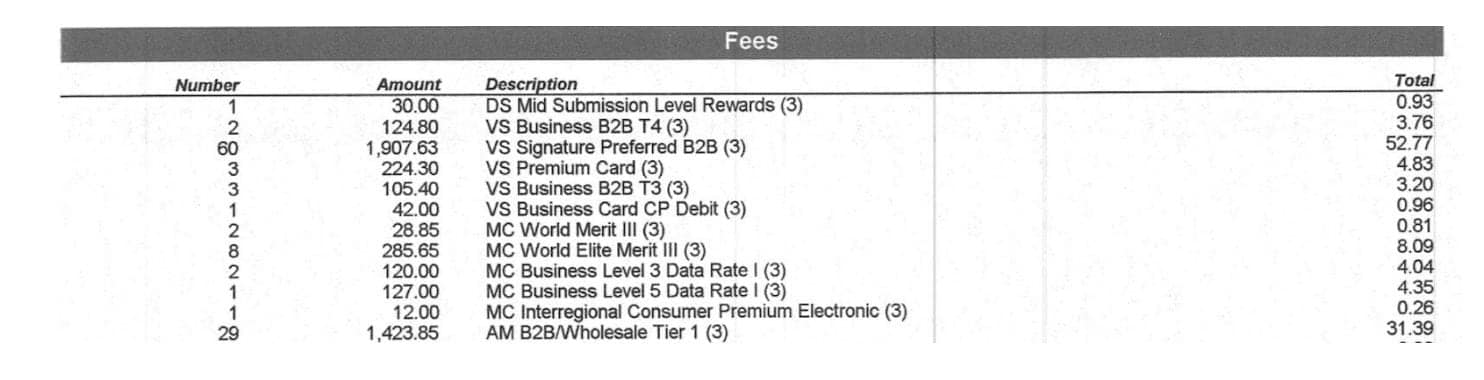

Below we have seen merchants within the health care sector, supported by Tsys Health Services, obtain a “surcharge” on their credit card processing statements.

These surcharges can vary greatly, as we have seen up to a 1.50% additional surcharge and as low as 0.10% like you see below. It is very important to note this as what you may be thinking is your credit card processing rate, may actually be something else as these surcharges can drastically affect a merchant’s bottom line.

How it works: Tsys charges you a base rate, which is subjective to what the sales representative of Tsys can offer. After, they include an additional surcharge fee that is on top of the original base rate that was offered.

Be aware of these things when reviewing merchant statements as this should be a task done monthly to ensure your pricing is where it should be.

Below is another example of TSYS Health adding surcharges to the interchange pass through fees:

TSYS Merchant Solutions Acquired by Global Payments

If you are using TSYS Merchant Solutions, you will soon be using Global Payments (one of the largest credit card processors in the world). Watch out for hidden fees, downgrades, surcharging, and early termination fees due to the merger of these two credit card processing services!

The financial-technology merger frenzy continued on Tuesday, as Global Payments Inc. officially announced a $21.5 billion all-stock deal for Total System Services Inc.

The deal is the third such combination to be announced in the payments industry this year that is focused on creating a two-party platform that can serve both financial institutions and merchants. Fiserv Inc. announced plans to acquire First Data Corp. in January, while Fidelity National Information Services Inc. said it planned to combine with Worldpay Inc. in March.

Final Thoughts on TSYS

Regardless of the payment process a merchant uses to accept credit cards, there are always credit card merchant fees that can be alleviated, reduced, or refunded. TSYS Merchant Solutions is no exception to this.

Always examine your merchant account agreement before you start accepting credit card payments. You might find things in there like an early termination fee or other hidden charges that will impact your bank account.

But overall, TSYS merchant accounts are solid. Its credit card processing department for merchant accounts get the job done. You can always discuss TSYS Merchant Solutions and acquiring solutions with their customer service reps too.

You can learn more about payment processing, merchant services, and how credit card processing rates and fee work leveraging our Credit Card Processing Complete Guide.

Take the time to understand your statements, your pricing, and the credit card processing company you are dealing with to get a true understanding of what to look out for.