Visa and Mastercard, the two biggest card issues worldwide, are postponing credit card fee increases for yet another year.

The two organizations initially planned to hike up credit card processing fees for merchants back in April of 2020. But amidst a global pandemic that impacted businesses of all shapes and sizes, the changes were pushed back a year.

Now that we’re through the first quarter of 2021, there’s good news and bad news. The bad news is that COVID-19 is still playing a huge factor in our daily lives across the globe. But on a positive note, Visa and Mastercard have decided to postpone the increased processing fees until April 2022.

This gives business owners a bit more relief as they aim to recover from COVID-19’s impact.

Why Are Visa and Mastercard Interchange Fee Changes Being Delayed?

Lawmakers and businesses alike have been pressuring Visa and Mastercard to avoid the interchange fee price increase scheduled for April 2021. Businesses are struggling as it is. In a time where consumer spending is shifting to ecommerce and contactless payment, the planned increase couldn’t have come at a worse time for merchants.

According to a March press release from United States Senator Dick Durbin’s office, US Representative Peter Welch and Durbin both sent a letter to the CEOs of Visa and Mastercard. The letter urged these companies to avoid interchange fee increases amidst the pandemic.

Durbin and Welch painted a picture of businesses nationwide starting to gain hope for summer reopening’s as vaccination efforts rolled out in every state. The politicians explained that the increased fees would not only hurt merchants who are already struggling but would ultimately be passed to the consumers.

Here’s a copy of that letter in its entirety, which was sent on Mach 3, 2021:

Senator Durbin did not stop there. A week later, his office released another press release, calling for more transparency and fairness over credit card interchange fees. The Senator explains that the existing credit card fees are more than enough and higher than what would be charged in a competitive market. He explains that businesses are forced to accept Visa and Mastercard because they wouldn’t be able to survive without them. But in doing so, the credit card companies are able to charge higher prices without any negotiation.

This isn’t the first time that Richard Durbin has spoken out against credit card companies. Back in 2010, he pioneered efforts to set limits on debit card processing fees for banks with over $10 million in assets. This ultimately became known as the Durbin Amendment to the Dodd-Frank Act.

It’s unclear whether or not Durbin and Welch’s letter and outspoken efforts against the credit card companies ultimately caused the delay. But Visa and Mastercard eventually decided to push off the increases for another year.

Reaction to Interchange Fee Increase Postponement

In the weeks following the announcement, it seems clear that Visa and Mastercard made the right decision here.

According to a statement from Bloomberg’s industry analysts, they believe that Visa and Mastercard pushed the fee increase back a year to minimize their risks in terms of credit card market share. The analysts also hypothesized that an increase during a pandemic could have potentially led to legislative fee caps and merchant litigation, which has since been avoided by delaying the increases to 2022.

The Merchant Payments Coalition also backed the decision made by Visa and Mastercard. A spokesperson from the coalition said that the companies “did the right thing” by delaying the increase.

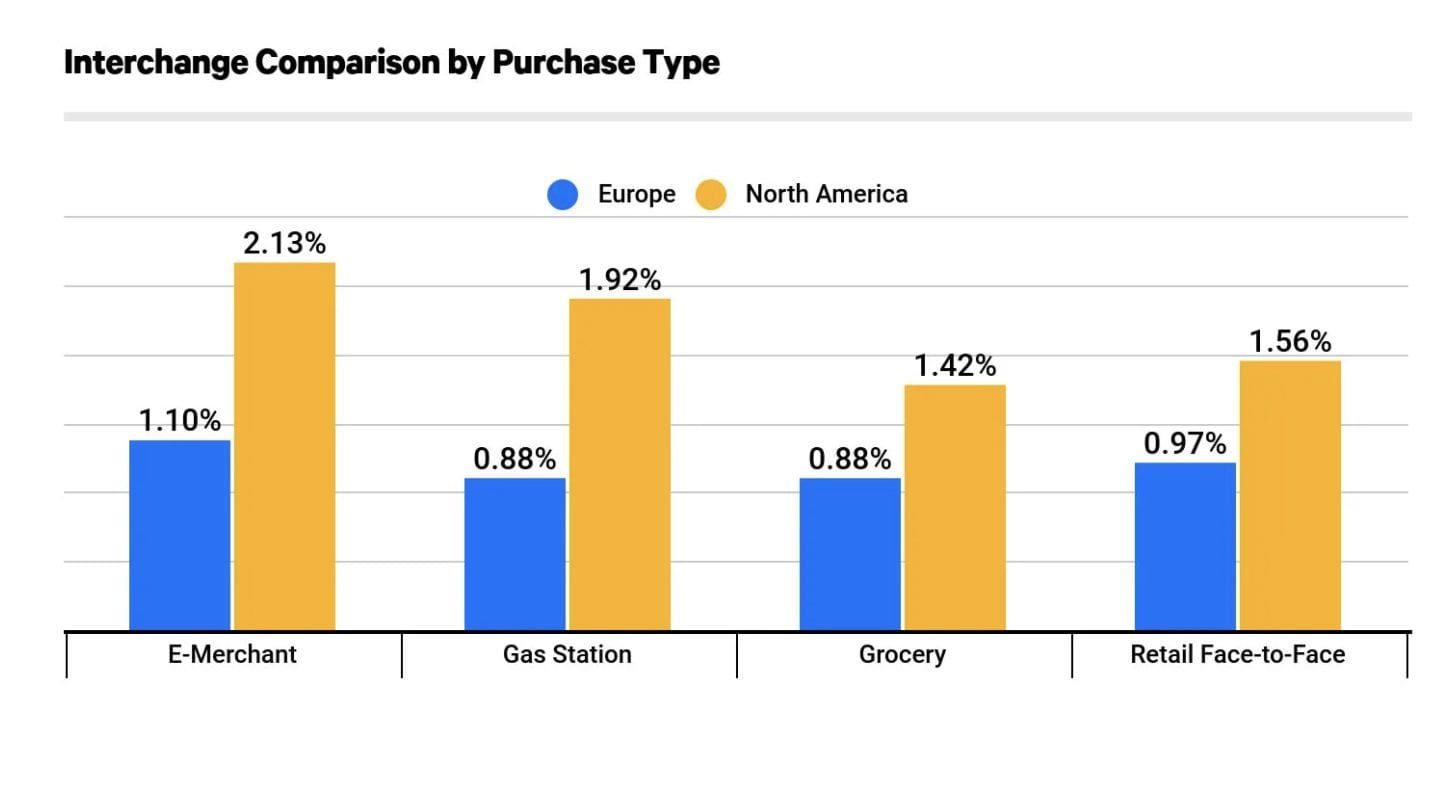

With that said, credit card processing fees are still high as they remain today. According to Value Penguin, Canada and the United States pay the highest credit card interchange fees in the world, averaging 1.78% and 1.73%, respectively. Here’s another interesting graphic that compares the average interchange by purchase type between North America and Europe:

As you can see, North America is significantly higher in every category. This is largely due to the fact that government regulations are stricter in other countries compared to the US.

Without stricter regulations, the proposed interchange fee increases from Visa and Mastercard are still inevitable. As of now, nothing is stopping the increase from happening in April 2022. But today, businesses can operate knowing that the fees will remain the same for at least another year.

Planned Interchange Fee Changes

Technically, the interchange fees are just changing, not necessarily increasing. For some transactions, the credit card transaction fees for merchants will actually be less, but the vast majority of these changes will be more expensive to merchants.

One of the biggest planned changes relates to card-not-present (CNP) transactions. The credit card companies are planning to increase interchange fees for online transactions and transactions made over the phone.

This is coming at a time where ecommerce is at an all-time high. Consumers are buying online more today than ever before. According to a recent study, ecommerce in the US grew by 44% in 2020. Check out this graph that illustrates the ecommerce market share compared to total retail sales, year-over-year.

It’s tough to say whether or not this would have happened without COVID-19. While ecommerce would have likely grown either way in 2020, it’s unlikely that the spike would have been so high under normal circumstances.

With that said, consumers have grown accustomed to shopping online. Even people who prefer in-person shopping over ecommerce have learned to adapt in the past year. Moving forward, it’s likely that people will continue choosing ecommerce and digital purchasing over in-person sales.

Businesses have adjusted as well, shifting more operations to accommodate online sales. So if the planned increase happens as scheduled in April 2022, a large percentage of businesses will be impacted by these changes.

Final Thoughts

As of right now, it’s nice to know that there aren’t any immediate interchange fee increases planned for the remainder of 2021.

But the changes are still scheduled for April 2022. In terms of fighting those changes, there’s not much your business can do. Fortunately, there are other ways to save money on credit card processing. Contact our team here at Merchant Cost Consulting to find out how much money you can save without switching credit card processors.