If you’ve spotted a “Visa Authorization Misuse Fee” or “Visa Misuse Fee” on your monthly processing statement, you’re probably wondering what it means and why you’re being charged.

This guide breaks down everything you need to know about the authorization misuse fee from Visa, including what triggers it, how much it costs, and more importantly how to avoid it.

What is the Visa Authorization Misuse Fee?

The Visa Authorization Misuse Fee is a penalty that Visa charges merchants for authorization transactions that aren’t properly settled or reversed within the required timeframes.

Visa has previously referred to these as “ghost authorizations” (transactions that are effectively in limbo). They’ve never been completed or properly canceled.

Depending on your processor, the fee can appear on merchant statements under various names, including:

- VISA AUTHORIZATION MISUSE

- VISA MISUSE AUTH FEES

- VISA MISUSE FEE

- VS AUTH MISUSE

- VS MISUSE AUTH

- VS MISUSE OF AUTHORIZATION

- VISA MISUSE OF AUTH FEE

Basically, if you see any combination or abbreviation that includes “auth” alongside “Visa” and “misuse,” then you’re being charged with Visa’s Authorization Misuse Fee.

How Much the Visa Misuse Authorization Fee Costs

On January 1, 2025, Visa increased its Authorization Misuse Fee to $0.15 per transaction. This is a substantial jump from its previous rate of $0.09 per transaction.

Here’s how the fee has changed over time:

- October 2009 — $0.045 per occurrence

- April 2018 — $0.09 per occurrence

- January 2025 — $0.15 per occurrence

Visa’s auth misuse fee has tripled since it was first introduced back in 2009. But considering the long gaps between each increase, I don’t think we’ll see this touched again before 2030 at the absolute earliest (though this is purely my speculation).

Why Visa Charges This Fee

Visa implemented its authorization misuse fee as a way to cut down on “ghost authorizations.” These are transactions that were never settled or properly reversed.

When a merchant leaves authorizations hanging without settlement or reversal, it can create problems for cardholders who have available credit tied up unnecessarily.

Here’s what happens.

Let’s say you authorize a transaction for $100. As soon as you do this, the cardholder’s available credit is immediately reduced by that amount. If you never settle (complete) the transaction or reverse (cancel) the authorization, those funds remain unavailable to the cardholder even though no actual purchase occurred.

Any approved or partially-approved Visa authorization that can’t be matched to a cleared transaction or authorization reversal is subject to the $0.15 penalty.

Understanding Estimated Authorizations and Incremental Authorizations

Not every authorization is as straightforward as tapping a card at the point of sale or entering a card number when processing an online checkout. Visa has special rules for situations where the final purchase amount isn’t known upfront or where multiple authorizations are required.

These are called estimated authorizations and incremental authorizations.

It’s important to understand how these work because that’s where lots of merchants make mistakes and ultimately get hit with the misuse of auth fee.

Estimated Authorizations

An estimated authorization occurs when a merchant places a hold for a projected amount, knowing the final bill will change later.

This is common at gas stations, hotels, bars, and car rental businesses.

If the final amount ends up being lower or higher, you need to adjust the authorization with a reversal for the unused portion or replace it with an incremental adjustment for the higher amount. Simply leaving the original estimated authorization hanging can trigger the misuse fee.

Incremental Authorizations

Incremental authorizations are additional approval requests made after the original authorization. This is usually because the transaction amount is going to be higher than expected.

If a hotel guest extends their stay or a restaurant bill increases after tips are added, an incremental authorization may be required.

Make sure you link the incremental authorization to the original authorization to ensure auth is either matched to the clearing transaction or reversed for unused funds. If the chain gets broken or the final settlement doesn’t match the approved auth, Visa counts it as a misuse.

Common Scenarios That Could Trigger a Misuse Authorization Penalty

Technical details aside, here are some actual actions by consumers and merchants that could lead to a $0.15 penalty from Visa:

- Tip adjustments that weren’t properly processed at a restaurant.

- Running a $1 “test transaction” instead of using Visa’s Account Verification Service.

- Verifying a customer’s payment during account creation but never settling a transaction

- Cart abandoned after authorization but before shipping.

- Customer changed their mind after a card was authorized for a service.

- Authorization was taken for a future service that got cancelled..

These are just a handful of examples.

But basically, if you authorize a card but never actually complete the transaction or reverse the authorization, you’ll be hit with the penalty.

Every Visa authorization must be matched to a settled transaction or authorization reversal.

Spotting the Visa Authorization Misuse Fee on Your Merchant Statement

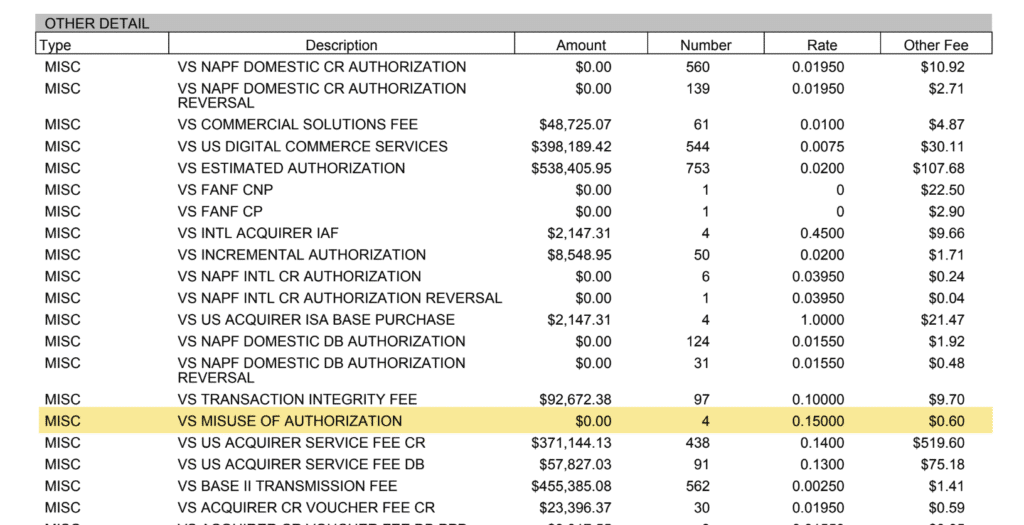

If your processor is itemizing your assessments and card network fees (which they should be), then the Visa Authorization Misuse fee should be with the rest of those. You’ll need to go line-by-line to identify the fee.

Here’s a recent example from one of our clients:

As you can see, this penalty was applied to four transactions at $0.15 per violation—for a grand total of $0.60.

Obviously $0.60 isn’t the end of the world. But it’s still important to verify that you’re being charged correctly. Some processors will pad assessment fees, which artificially inflates the rate you pay and make it appear as though the charges are coming from the card network.

For example, if you’re being charged $0.30 per misused authorization on Visa cards, it means your processor is doubling the rate and pocketing the difference.

Again, $0.15 probably isn’t worth losing sleep over. But it’s a red flag that your processor is likely applying other unethical practices to your account.

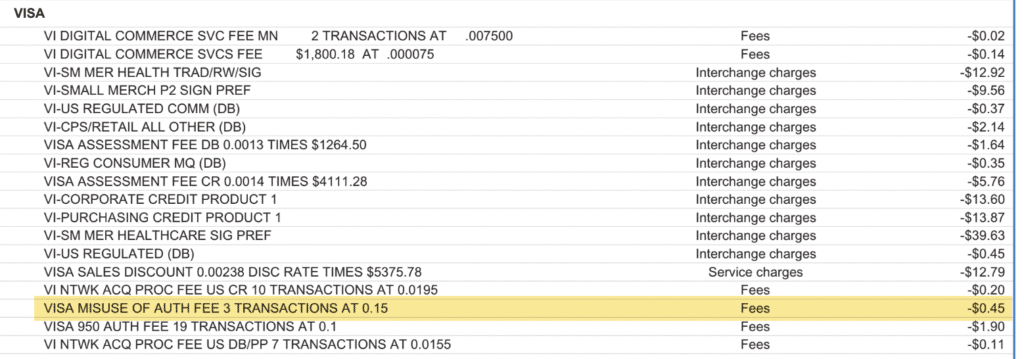

Here’s a second example from another processor, so you can see how this fee can appear slightly differently based on the provider:

The math checks out just fine on this one, too. So no cause for concern.

This merchant paid a $0.45 penalty for three misused Visa authorizations.

How to Avoid the Visa Authorization Misuse Fee

While the $0.15 penalty is marginal, you should still be taking steps to avoid the fee. And fortunately, this is actually one of the easiest Visa assessments to control.

Unlike other Visa assessments that are unavoidable and passed-through on your total transaction volume, the authorization misuse fee is completely preventable if you follow Visa’s rules.

Here’s what you need to know:

Follow Visa’s Processing Timelines After Every Authorization

Every authorization has an expiration date, and Visa requires you to act before it lapses. This means that you either need to settle the transaction (if it was completed) or reverse it (if it never went through).

Merchants who ignore these time windows are the ones who are most often paying a $0.15 penalty for each occurrence.

These are Visa’s official requirements:

- If a transaction isn’t completed, the full authorization must be reversed within 24 hours.

- If the final cleared amount is less than the sum of the estimated and incremental authorizations, the unused balance must be reversed within 24 hours of the completed transaction.

- Card-present transactions must be cleared within 5 days of the original authorization.

- Card-not-present transactions must be completed within 10 days.

- Rental MCC codes must complete authorized transactions within 10 days.

- Lodging, vehicle rental, and cruise line merchants can take up to 30 days, but still need to promptly reverse unused funds.

It’s also worth noting that incremental authorizations don’t extend the original timeline. If you need more time, you need to reverse the original auth and request a new authorization.

Use Visa’s Account Verification Service

Years ago, it was common practice for merchants to run a small “test” transaction to either confirm that a card works or that their system is operating properly.

So they’d authorize a card for $1. But if those authorizations aren’t reversed, they fall into misuse territory.

Visa wants to cut back on this practice altogether. So they offer an Account Verification Service (AVS) and Zero-Dollar Verification as alternatives.

These tools confirm a card’s validity without placing an open authorization on the cardholder’s account.

Train Your Staff on When and How to Run Authorization Reversals

Human error is another leading cause of misuse of auth fees. Whether it’s a server forgetting to enter a tip adjustment or a hotel clerk leaving holds open after a guest checks out, ensuring your staff is properly trained can help you avoid misuse penalties.

Helping them understand when an authorization reversal is necessary depends on your business.

But most payment gateways and virtual terminals make it easy for you to run a reversal as a transaction. So once your staff recognizes the need to reverse something, they should be able to do it fairly quickly.

If they don’t know how to access it, contact your processor or gateway provider for training guidance (as exact steps vary based on the system you’re using).

Is Visa’s Authorization Misuse Fee Legit?

Yes, Visa’s authorization misuse fee is 100% legitimate. This is an assessment fee (in the form of a penalty) coming directly from Visa—not your processor.

However, you should always verify that you’re being charged the correct amount. You should never be charged more than $0.15 per instance. So if you’re being charged more, it’s likely a sign that your processor is unethically marking up the fee and pocketing the difference.

This is a red flag that usually means they’re applying similar markups to other assessments, and it should be investigated further.

Can You Negotiate or Remove the Auth Misuse Fee?

No, you can’t negotiate or remove Visa’s misuse auth fee from your statement. Any assessment, fee, or penalty set by Visa at the card network level is non-negotiable, and the auth misuse fee falls into this category.

However, you can avoid the penalty by applying the tips mentioned earlier.

If you follow proper authorization and settlement procedures as set forth by Visa, you won’t have to pay this non-compliance penalty.

Final Thoughts on the Visa Authorization Misuse Fee

The Visa Authorization Misuse Fee might seem like an afterthought at a mere $0.15 per occurrence. But it could actually be a sign of some bigger problems with your payment processing procedures.

If you’re seeing this fee regularly, it means that you’re not following Visa’s authorization guidelines.

This could be costing you more money than you realize, as poor authorization handling could ultimately lead to higher interchange rates, more chargebacks, and other penalties.

The good news is that this fee is completely avoidable. So some slight operational and training changes should be enough for you to put in place.

For those of you who only get hit with this fee a few times every so often, I wouldn’t worry about it too much.

But if you’re unsure about your current authorization procedures or you need help optimizing your processing fees, contact our team here at MCC for a free statement audit. We can help you save money on payment processing without switching providers.