When reviewing your credit card processing statements, it can be tough to figure out which fees are legitimate network charges and which ones are junk fees added by your processor. And just because the card network is the name of the fee, it doesn’t automatically mean that the charge is legit (like the Amex Support Fee that’s a pure processor markup).

Today we’re taking a closer look at Visa’s Zero Dollar Verification Fee — a legitimate assessment charged by Visa for a specific purpose.

Understanding this fee is important because it helps you recognize whether you’re paying the correct amount or if your processor is overcharging you.

There’s also a lot of incorrect information on the web about Visa’s Zero Dollar Verification Fee, including discrepancies about its price. I’ll clear all of this up for you below.

What is the Visa Zero Dollar Verification Fee?

Visa’s Zero Dollar Verification Fee is an assessment fee charged by Visa when a merchant verifies a cardholder’s information without actually authorizing a charge or processing a sale on the card. This process is known as “zero dollar verification” or simply “account verification.”

When you perform a zero-dollar verification, you’re checking details like:

- Card account number validity

- Billing address (through AVS)

- Whether the account is active and in good standing

- CVV2

This verification method is commonly used by businesses that need to validate payment information before actual charges occur.

For example, it can be used by a subscription service that offers a free trial. Hotels and car rental agencies may run a zero-dollar verification during the reservation process. And it can be used by online businesses that store cards for future purchases.

How Much the Visa Zero Dollar Verification Actually Costs

The cost of Visa’s Zero Dollar Verification Fee depends on whether you’re verifying a debit card, credit card, or international card:

- US Debit Cards: $0.030 per transaction

- US Credit Cards: $0.035 per transaction

- International Cards: $0.070 per transaction

Here’s where things get interesting.

There are several sources on the web right now claiming that Visa’s Zero Dollar Verification Fee is $0.025. This is incorrect.

The $0.025 rate was from April 2022. But Visa increased the fee in 2023, and those sources never updated their prices.

It’s important for you to understand your current rates so you can audit your statements and verify your processor isn’t padding your fees beyond what Visa actually charges. With so much misinformation online incorrectly listing this fee at $0.025 in situations where it should be $0.035, we’re seeing an increase in businesses thinking that their processor is padding their assessment rates.

And I’m always the first one to call out a processor for unethical billing practices. But in this case, the $0.035 rate is correct, and not padded or inflated.

What to Look For On Your Statement

You should only see the Zero Dollar Verification Fee on your statements if you’re actually running zero-charge verifications, typically through AVS or CVV.

The exact line item on your statement might vary slightly depending on your processor. Common examples include:

- Visa Zero Dollar Verification

- VS Zero Account Verification

- Visa Zero Acct Ver CR Fee

- Visa Zero Account Verification DB

- Visa Zero Acct Ver INTL Fee

- VI Zero AMT Fee

- VI Zero Account Verification Fee

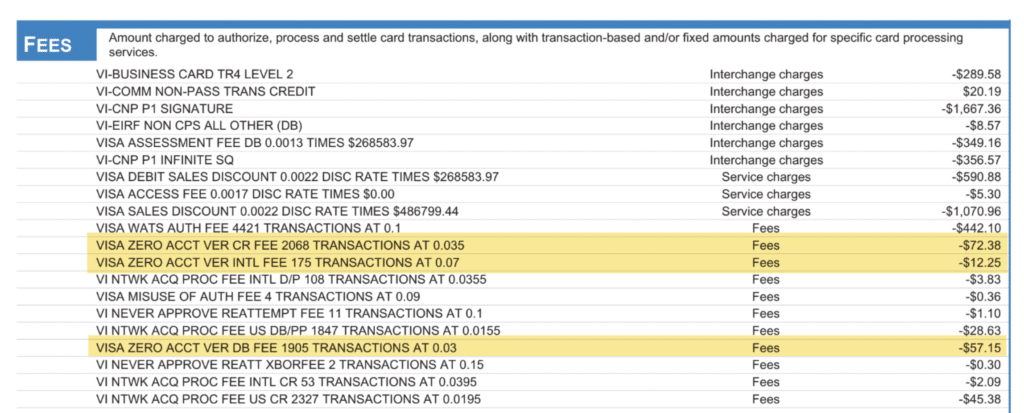

Here’s an example of from one of our client’s statements:

As you can see, they were charged all three rates — 2,068 credit transactions at $0.035 ($72.38 total), 175 international at $0.07 ($12.25 total), and 1,905 debit at $0.03 ($57.15 total).

All in, they paid $141.78 in Visa Zero Dollar Authorizations during this particular month. These charges are completely legitimate, and they’re being billed correctly by the processor.

It’s worth noting that merchants on a flat-rate plan typically won’t see this fee itemized separately on their statements. Your processor might charge you their own separate fee for this service.

But flat-rate accounts don’t typically have pass-through fees from the card networks on their statements.

This is just one of the many reasons why you should avoid flat-rate processing. Your rates are already inflated so high that they cover these additional costs, and still leave plenty of margin for your processor to earn a profit.

Why Zero Dollar Verification Fees Are Better Than the Alternative

Before Visa introduced its Zero Dollar Verification service, it was common for businesses to run “ghost authorizations” in which they charged a $1 to verify card information with no intentions of actually settling the charge.

This practice caused several problems, and all of the card networks put new rules in place to effectively eliminate it.

By introducing a Zero Dollar Verification service (with $0 authorized instead of $1), nothing appears on the customer’s statement. So it eliminates confusion, reduces disputes, and simplifies things internally for Visa.

Now Visa charges a Misuse of Authorization Fee if you’re incorrectly authorizing cards to verify them (like running ghost auths).

The $0.03 or $0.035 fee is marginal for the service you’re getting, and it’s definitely better than getting hit with a $0.15 penalty for authorization misuse.

Looking back at the example from above where the merchant paid $141.78 in Zero Dollar Authorization Fees, they would have paid $622.20 in penalties on those 4,148 transactions if those cards were authorized for $1 instead of $0. That’s a huge difference.

And it will save them roughly $6,000 every year if their volume is consistent.

Visa Zero Dollar Verification Fee vs. Visa Zero Floor Limit Fee

Make sure you don’t confuse the Zero Dollar Verification Fee with Visa’s Zero Floor Limit Fee. While these fees look and sound very similar, they’re two completely different charges.

The Zero Floor Limit Fee costs $0.20 per transaction, and it applies when you settle a transaction WITHOUT getting proper authorization first.

Visa’s Zero Floor Limit Fee is essentially a penalty for improper transaction handling, whereas the Zero Dollar Verification Fee is a usage charge for Visa’s account verification service.

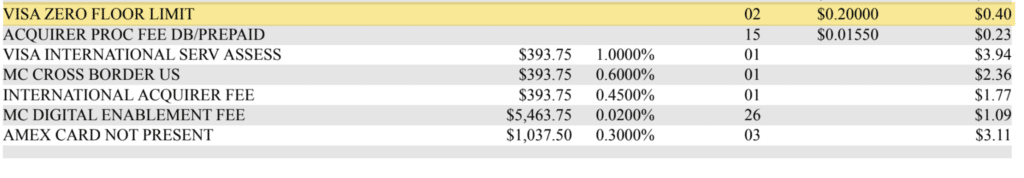

That’s why the Zero Floor Limit Fee is much higher ($0.20 vs. $0.03 or $0.035). This penalty is even higher than the authorization misuse fee. Here’s an example:

You’ll only see Zero Floor Limit Fees on your statement if a sale gets processed that can’t be matched to a previously approved authorization. And if you see these fees regularly, it means there’s a problem with your authorization and settlement process that needs to be corrected.

Is Your Processor Overcharging You?

Even though the Visa Zero Dollar Verification Fee is 100% legitimate, you still need to make sure your processor isn’t overcharging.

And while we haven’t seen a ton of widespread evidence of processors marking up this specific charge, we’ve caught multiple processors padding assessment fees in the past. So it’s totally possible that this could be happening to you, and it’s worth checking your statements against the correct rates:

- $0.03 for debit cards

- $0.035 for credit cards

- $0.07 for international cards

If you’re being charged more than this, then your processor is doing something sketchy and you shouldn’t ignore it.

Some merchants think that it’s not a big deal if their processor is charging an extra few cents on a card brand fee. But this is almost always the sign of a much larger problem. If your processor is willing to rip you off on a few cents buried in your assessments (something that’s completely intentional, deceptive, and unethical), they’re likely overcharging you by thousands elsewhere.

You can always get a professional audit by our team here at MCC to verify that your rates are all correct.

This is just one of dozens of other assessment fees on your statements, and the average business doesn’t have time to verify everything on their own and check what they’re being charged against the correct rates (especially when there’s so much wrong information on the web about what the rates are supposed to be)

Final Thoughts

Understanding the Visa Zero Dollar Verification Fee is important for two main reasons.

First, it helps you recognize legitimate network charges so you can distinguish them from junk fees. Just because a line item has “Visa” in the name, doesn’t automatically mean it’s actually coming from Visa (processors can be tricky with this).

Second, even legitimate fees need to be charged at the correct rate. And when otherwise reputable sources on the web publish wrong information about these rates online, it confuses merchants and makes things even more complicated.

So if you’re unsure whether you’re being charged correctly for this fee or any other processing fee on your statement, our team can help you out. Contact us today for a free audit and assessment.