If you’re reading this right now, there’s a good chance you’re evaluating payment services and payment processing solutions for your business.

Understanding key terms in the credit card processing space is crucial, and “payment service provider” definitely falls into this category. PSPs are appealing to lots of different businesses, but they’re not for everyone. Make sure you read this article before signing up to accept credit cards with a payment service provider.

This guide will not only define what PSPs do, but we’ll also cover how they compare to traditional merchant accounts. By the end of this post, you’ll be equipped to make the best long-term decision for your business.

What is a Payment Service Provider?

Payment service providers give merchants the ability to accept electronic payments, including credit cards, debit cards, and digital wallets. Many PSPs support in-person transactions as well as online transactions.

Some of the most well-known payment service providers on the market today include Stripe, Square, PayPal, and Shopify. Most of you have probably heard of these names, but that doesn’t automatically mean they’re right for your business (we’ll get to that later).

How Does a Payment Service Provider Work?

Payment service providers are also known as aggregators or third-party processors. These alternative names do a better job of explaining a PSP’s role in payment processing.

Here’s how payment service providers work:

Unlike a traditional merchant account, a PSP combines all businesses using the service into an umbrella merchant account. So when you sign up for a PSP, you’re not given a merchant account number.

As a result, PSPs can make credit card processing more accessible to small businesses. This also speeds up the sign-up and approval process. In many cases, you can sign up for a PSP and start accepting credit cards right away. Here’s an example of this pitch directly on Stripe’s homepage:

For a monthly fee, you can accept payments immediately and sign up without going through a complete auditing process by traditional payment processors.

But these benefits come with a fair share of drawbacks as well, which we’ll cover in greater detail shortly.

Payment Service Providers vs. Merchant Accounts

As mentioned above, there are fundamental differences in the way PSPs set up businesses for credit card processing compared to traditional merchant accounts.

With PSPs, every business is a sub-user within a larger merchant account bucket. The PSP takes full responsibility for the merchants. The sign-up and vetting process is very straightforward, which is why merchants can essentially start taking credit cards immediately with a PSP.

When you’re evaluating a merchant account, the approval process and underwriting process are much more in-depth. That’s because you’re going straight to the processor instead of going through a third party.

Merchant accounts tend to focus specifically on payment processing, and you’ll need to set up your merchant account with an acquiring bank. On the other hand, PSPs typically offer all-in-one solutions for merchants. For example, many PSPs offer credit card terminals, processing hardware, and POS systems. They usually provide payment gateways for ecommerce, online payment integrations, and built-in PCI compliance.

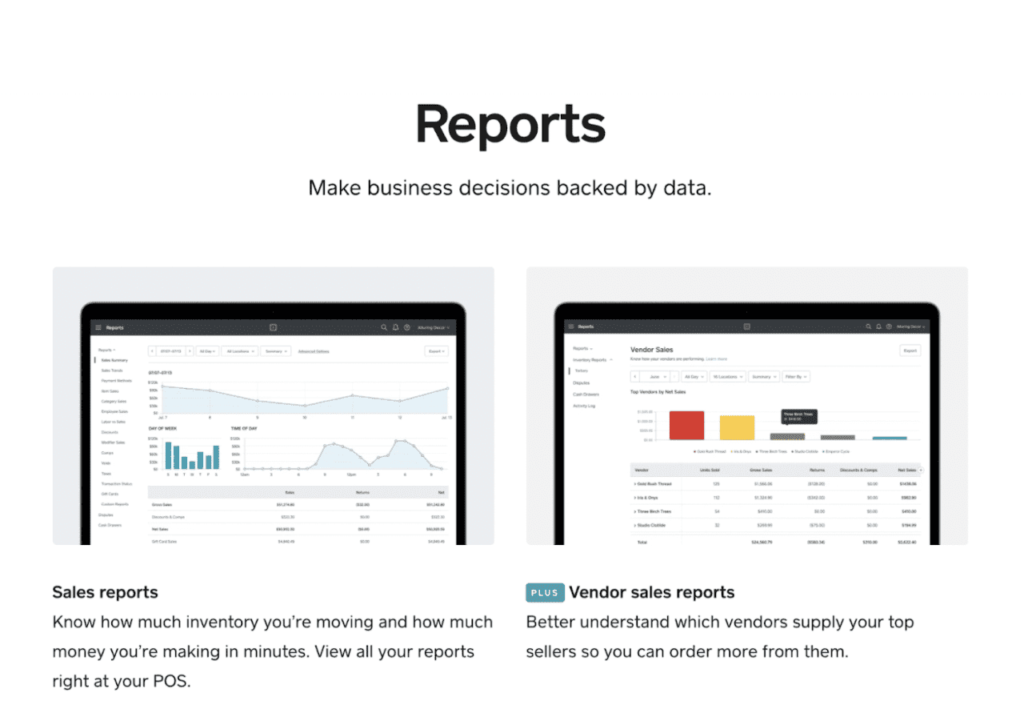

It’s common for PSPs to sweeten the deal with value-added offers like inventory tools, team management solutions, timecards, and robust reporting. Here’s an example from Square’s product page to showcase my point.

For small businesses with limited funds for extra software, these freebies and add-ons can definitely be appealing. But many businesses may find these add-ons unnecessary and not worth the overall cost of using a PSP over a traditional merchant account.

Payment Services vs. Payment Gateway

Many payment service providers also provide payment gateways. But that’s not the case for all merchant service providers

Payment gateways make it possible for businesses to process online payments and accept a wide range of online payment methods. This is necessary for any ecommerce business or any business that sells products or services online.

There are also third-party tools out there that are strictly payment gateway solutions. This means that you don’t necessarily have to get your gateway from a payment processor.

How Much Does it Cost to Use a Payment Service Provider?

Cost is arguably the most important factor to consider when you’re evaluating PSPs and comparing them to merchant accounts.

Unfortunately, there isn’t really a one-size-fits-all answer for everyone. This typically boils down to your business size, processing volume, and industry. The average size of your transactions can also play a factor here.

The vast majority of PSPs offer flat-rate pricing. This means you pay the same rate for every transaction, regardless of the card being used or the size of the ticket. 2.9% + $0.30 per transaction is a common price you’ll see with PSPs.

Many PSPs don’t have monthly subscription fees unless you’re using other services. For example, let’s say you’re starting an ecommerce store with Shopify. You’d need to pay the subscription for ecommerce services, and the Shopify payments solution would be applied to each transaction (assuming you use that for payment processing).

Some very small businesses can actually save money with a flat-rate pricing model, but most businesses will do better with a traditional merchant account.

Additional Reading: Credit Card Processing Fees Complete Guide

Advantages and Drawbacks of PSPs for Payment Processing

Now that you understand how PSPs work and the costs associated with using them, let’s take a quick glance at the pros and cons. This will make it easier for you to decide what’s right for your business.

Pros

- Easy to sign up

- Fast approval process

- Simple pricing structure (simple doesn’t mean cheaper)

- Built-in compliance

- Freebies (hardware, reporting tools, inventory tools, etc.)

- Ability to accept online payments

Cons

- Higher credit card processing rates compared to merchant accounts

- Limited support

- Can’t negotiate your rates

- Increased chances of account freezes, holds, and account termination

- Monthly fees

Final Thoughts: Is a Payment Service Provider Right For Your Business?

So should you sign up with a PSP for credit card processing?

If you’re a really small business that wants to start accepting credit cards ASAP, using a PSP is a viable option. They’re really straightforward, easy to use, and offer everything you need to get started right away. PSPs might also be a good option for high-risk merchants who can’t get approved for traditional processing.

But if you fall into any other category, you’re better off using a merchant account. While it takes longer to get approved for a merchant account, your costs will likely be much lower over time. That’s because you’re cutting the third-party provider out of the process.

Here’s something else to keep in mind. If you’re using a merchant account for traditional credit card processing, your rates are negotiable. That’s what we do here every day at Merchant Cost Consulting—negotiate credit card rates on behalf of our clients.

So if you sign up for a merchant account and feel like you’re overpaying, just contact our team, and we’ll be happy to offer you a free audit and analysis.