NFC payments have been trending upward in the payments processing industry for the past few years. As some of you know, near field communication (NFC) is the technology behind mobile payment processing.

With contactless payment trends on the rise. Many organizations rely on contactless mobile payments and NFC to process credit card transactions.

If you’re unsure about NFC and how it works, you’ve come to the right place. Let’s dive in.

What is NFC?

NFC stands for “near field communication.”

This technology transmits data between two devices that are in close proximity to each other. Examples include smartphones, tablets, laptops, wearables, and other mobile devices. In addition to mobile payment devices, NFC payments can also be processed from a traditional payment terminal with an NFC enabled reader.

NFC is the foundation for contactless payments with mobile wallets. Tap-to-pay credit cards, like Apple Pay, Android Pay, Samsung Pay, Google Pay, and more, are all powered by NFC technology.

How NFC Mobile Payments Work?

The concept of NFC payments is similar to RFID (radio frequency identification). But unlike RFID technology, the two devices transmitting data using NFC must be within a few inches of each other.

If you’ve ever seen a mobile wallet used, the payment doesn’t process until the smartphone has been placed almost directly next to the contactless reader.

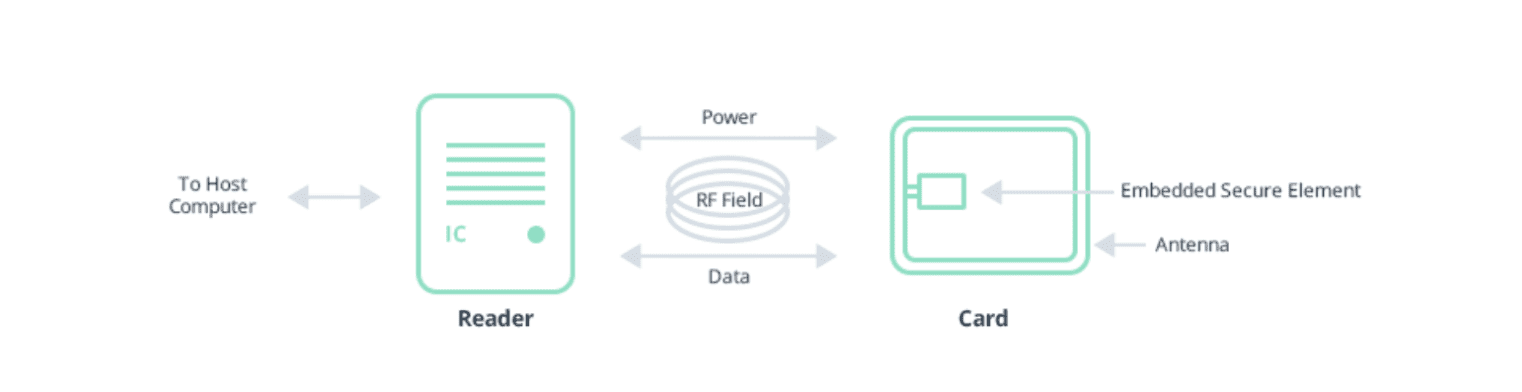

Here’s a basic visual representation of how NFC communication works, using a tap-to-pay enabled card and reader.

Broadly speaking, there are three ways that NFC technology can be used:

- Peer-to-peer NFC — Two devices share data with an established connection.

- Read and write NFC — An active NFC-enabled device gets data from a passive device (the passive device is not able to read the data).

- Card emulation NFC — Contactless payments.

The last method is obviously what we’ll be focusing on here in this guide, as it applies to merchants, mobile wallets, contactless payments, and credit card processing.

Understanding Mobile NFC Payments For Credit Card Payment Processing

Not sure what to make of NFC for payment processing just yet? Like most new technology, people tend to have reservations before jumping in. Here’s what you need to know know about NFC as it applies to payment processing and contactless payments.

Accepting NFC Mobile Payments

Remember when we made the transition to EMV chip cards? Consumers and merchants alike felt like the “dip” process actually took longer than the swiping method.

Over the years, we’ve gotten used to the few seconds it takes to process those transactions. But with NFC payments, the payment time is much quicker.

In most cases, an NFC payment via tap-to-pay cards or mobile wallets is faster than chip card transactions. Lower sale values usually won’t require a PIN or signature either.

This makes your customers happy and keeps lines moving quickly at the checkout counter.

NFC Equipment

Lots of merchants shy away from new technology because they think it’s expensive. But that’s not the case with NFC technology.

Some of you might already have the capability to accept NFC payments if you have a newer POS terminal. In fact, 88% of POS stations in North America shipped in 2017 had NFC capabilities. So if your terminal is from 2017 or later, there’s a good chance you fall into that category.

If not, upgrading won’t break the bank. Pricing for an NFC card reader usually falls in the $50-$150 range.

Mobile Payments Are Safe and Secure

Similar to EMV chip cards, NFC technology and mobile payments are more secure than magstripe credit cards.

Yes, smartphones and NFC-enabled devices are susceptible to theft. But as long as the device and payment information is locked via passcode or biometric lock activation, unauthorized users won’t be able to access those credit and debit cards.

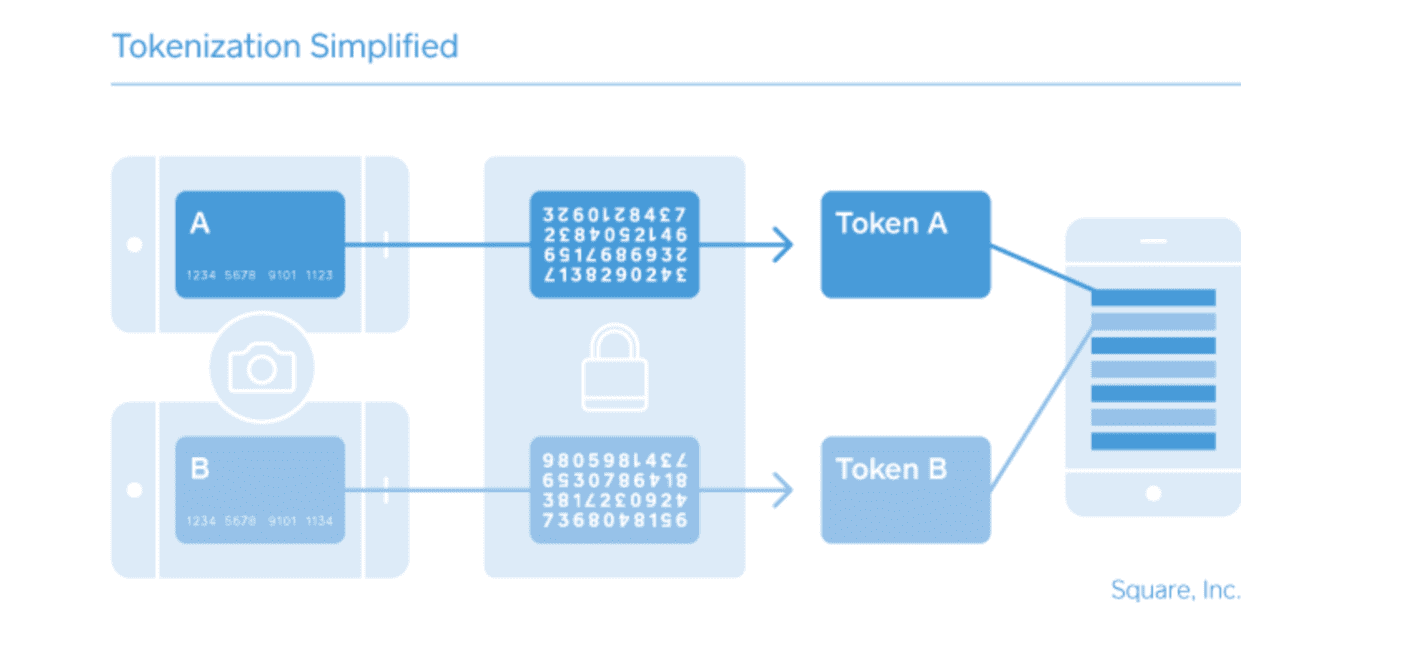

As far as the data being transmitted, there are two layers of protection in an NFC transaction. The first layer is the payment device itself, and the second is data encryption. Card numbers are never exposed during the payment process. Instead, NFC payments use tokenization, which is only used once for each transaction. Here’s an example of what that looks like.

Check out our guide on the process of tokenization to learn more about this technology.

Mobile Payments Drive Consumer Engagement

Customers and merchants both want the transaction process to be safe, secure, and quick. Aside from the simplicity and enhanced security associated with NFC transactions, mobile payments help strengthen relationships between businesses and consumers.

With NFC technology, merchants can integrate loyalty programs into the payment process. For example, a customer can use coupons by tapping their phone during a transaction.

Customer loyalty programs using NFC can provide business owners with valuable analytics about consumer buying behavior as well.

Smartphone Payments Are the New Normal

We’re living in an era where everyone is seemingly using their smartphones for everything. If someone isn’t holding their smartphone, the device is within an arm’s reach at all times.

Consumers expect merchants to accommodate their needs and be up to date with the latest and greatest technology. NFC payments definitely fall into this category.

Prepare For an “Honor All Wallets” Rule

Most merchants are familiar with the “honor all cards” rule imposed by the card networks. This basically says that if merchants accept one type of card brand, they must accept the rest.

While no official policies have been imposed for digital wallets, it wouldn’t be out of the question to see this in the near future. It’s better to be early to the party than late. So it’s in your best interest to start accepting NFC payments accepting mobile payments from virtual wallets sooner rather than later.

NFC Payment is the Future (and the Future is Now)

We’re already living in a time when cash is becoming more obsolete by the year. Consumers are quickly discovering the benefits of using their smartphones and other devices for digital wallets.

Before you know it, physical credit cards could be following the path of cash into obsoletion, and NFC mobile payment technology is the driving force behind it.

Final Thoughts on NFC and Contactless Payments

NFC (near field communication) technology has a wide range of use cases. In terms of accepting credit cards and processing payments, NFC is changing trends in payment methods.

Thanks to the way NFC payments work, customers can use their mobile device to pay for goods or services on any NFC enabled payment device.

Between tap-to-pay cards and mobile wallets, we’re definitely going to see a rise in the usage of NFC technology moving forward.

As a merchant, you need to adapt. Make sure that you have the hardware and technology to accept NFC payments at your brick-and-mortar locations.