Field service management (FSM) is crucial for all organizations with employees operating on job sites. The importance is amplified at scale for larger organizations, like small-to-mid-sized enterprises and beyond.

While most businesses with field service technicians prioritize modern software for things like ticket support, fleet management, real-time communication, and more, many lack the right tools for payment processing.

Adopting a mobile payment solution for your field service operation can give you a tremendous edge. It makes things easier for your field service workers, customers, and billing department.

If you’re tired of mailing invoices and chasing down checks from customers, this guide will explain why you need a mobile payment solution.

What is a Mobile Payment Solution?

“Mobile payment solution” is a broad term. It encompasses everything from mobile wallets to mobile commerce apps and everything in between.

But for the purposes of field service payment collection, we’ll be discussing mobile point-of-sale (mPOS) systems. This technology lets you turn any smartphone or tablet into a POS system for credit card acceptance. Here’s a visual example of what this looks like from Square:

There are even some standalone mobile card readers that operate independently from a smartphone or tablet.

This allows your team to accept credit cards from anywhere. So whether they’re in a customer’s home, commercial job site, or operating anywhere on the go, your field service workers can collect payments on the spot.

Benefits of Mobile Payment Solutions For Field Service SMEs

Not sure if your business needs a mobile payment solution? Let’s take a closer look at the top advantages of integrating this technology with your business.

Improved Cash Flow

In theory, the business might feel like it’s booming. You’ve got a packed schedule every day, and your field service workers are constantly on the road completing services. But that’s useless if you’re not getting paid.

Take a look at your average collection times. How long is it taking you to get paid?

Many field service operations have high accounts receivables simply due to the process. In some cases, an invoice might not even be generated until several days after the work was performed. From there, the invoice must be sent to the customer, and then it turns into a waiting game. Most invoices have net-30 terms, but even that is a long time to wait.

Poor cash flow can lead to lots of other issues. You might have trouble buying new equipment, meeting payroll, expanding, or even keeping the lights on. Cash flow problems can even hurt your chances of being approved for a loan or line of credit from the bank.

According to a recent survey, look at how FSM technology positively impacted real businesses:

83% of businesses surveyed benefited from faster customer payments.

Expect your average collection time and receivables balance to drop significantly after switching to a mobile payment system. You can get paid instantly, on the same day jobs are done.

Safer Payment Collection

Without a mobile payment solution, the alternative methods of collecting payments on-site aren’t very safe. It usually involves customers paying with a check or sometimes cash.

Even if you trust your workers, handling cash for field service payments is never a good idea. It can make your customers feel uncomfortable and creates a liability for your business.

While checks might seem a bit safer, what happens if a check is lost or misplaced? Then you need to ask the customer to pay again, which makes your business seem very unprofessional.

Mobile payment solutions immediately make this process safer. It’s just like the customer would pay for something at a retail storefront or a restaurant. They can pay using a credit card and feel safe about the transaction. This also reduces the liability burden of your field service workers.

Cost Savings and High ROI

I know what some of you are thinking—how can a mobile payment solution save me money?

In many cases adding this type of solution is another expense. You’ll incur costs associated with credit card processing fees, equipment, and maybe even a subscription.

But those costs quickly pay for themselves when you factor in the time and labor associated with improving your process.

A ten-second on-site transaction could save hours in labor costs when you factor in the alternative. Generating invoices, printing them, addressing and licking envelopes, stamps, trips to the mailbox—and that’s only to generate the invoice. Once the check comes back, that’s another process that involves manual labor. Now factor in the phone calls or additional collection notices—your outdated payment collection process is expensive.

Between its simplicity and fast payment, using a mobile solution is a no-brainer.

Better Customer Service

Aside from getting paid and doing things the right way, you also want to keep your customers happy. Otherwise, you’ll struggle to get repeat business, and a bad reputation can make it more challenging to acquire new customers.

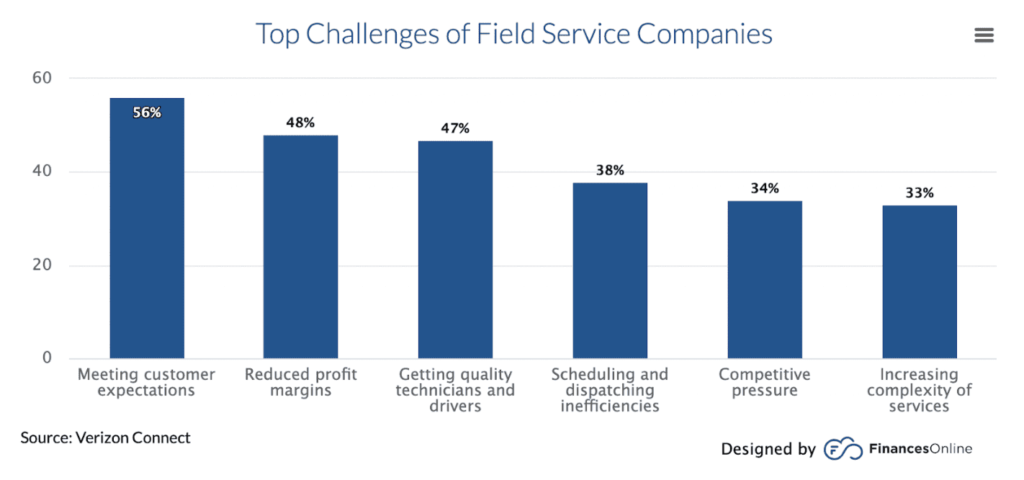

A recent study found that meeting customer expectations was the biggest challenge for field service companies.

Convenience is a huge part of this. Asking people to write and mail checks isn’t convenient for anyone. Neither is going to the bank to initiate a wire or calling to pay over the phone.

Mobile payment solutions immediately address one of the biggest problems in the field service industry. This convenient payment system will keep your customers happy while simultaneously making your process more efficient.

Improved Compliance

Payment information is sensitive data. Without a mobile payment solution, some businesses resort to unsafe tactics that can land them in hot water with certain industry standards.

Outdated systems typically require lots of paperwork. If anything is lost or misplaced, you could face some compliance problems. But mobile payment collections digitize your process, ensuring that all of your recordkeeping is in order.

You also won’t have to worry about manually writing down credit card numbers and entering them into a terminal at a later time. Not only is this unsafe, but it’s actually more expensive to process transactions that way.

Final Thoughts

Forward-thinking organizations understand the importance of modern technology in the field service industry. You’re likely using other tools and software to improve your process, so why not use mobile payment solutions too?

If you’re worried about costs, contact our team here at Merchant Cost Consulting.

We can help you save money on credit card processing without switching providers. So you can future-proof your payment collection process while reducing your credit card fees at the same time.