Merchants using Bluefin to process payments can use this guide to stay informed on the latest rates, fees, and other relevant updates. But if you’re looking for a deeper dive, check out our Bluefin review.

New Bluefin Rate Increase Effective April 2025

In a notice to merchants, Bluefin just announced a 0.23% rate increase on all Visa, Mastercard, Discover, and American Express transactions.

This new rate goes into effect on April 1, 2025.

Bluefin Rate Increase (May 2024)

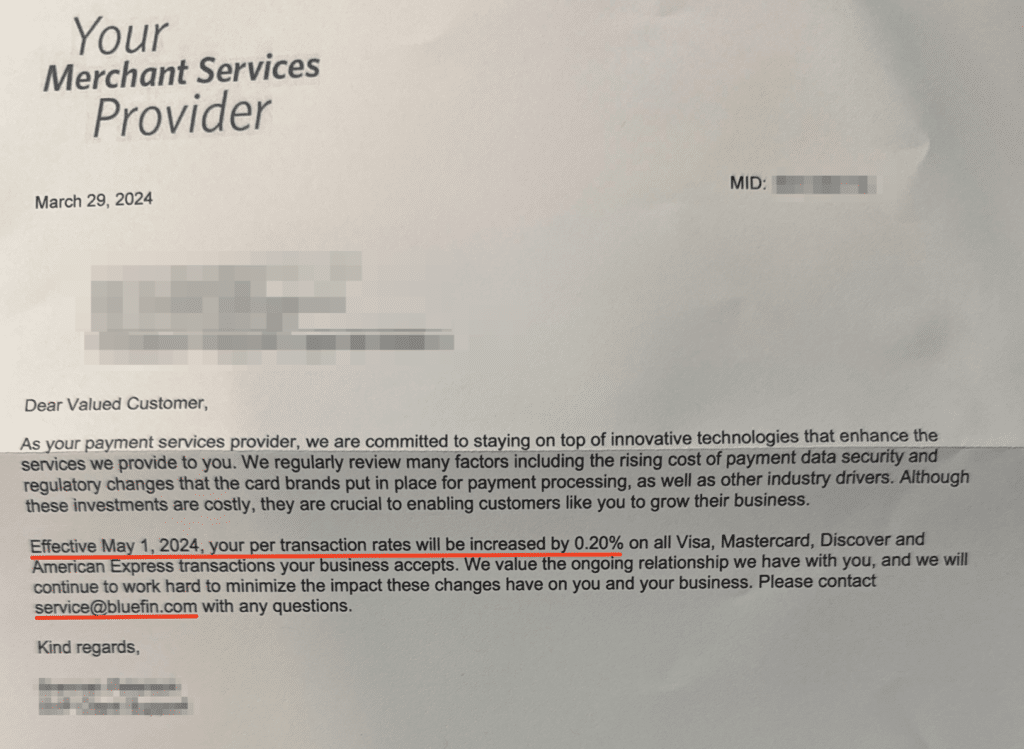

Beginning May 1, 2024, Bluefin is increasing its processing rates by 0.20% per transaction.

This announcement was not made publicly. Instead, merchants using Bluefin were sent a notice to prepare them for the impending rate increase.

Here’s a copy of the letter that we obtained:

The notice instructs merchants to contact Bluefin directly with any questions regarding the increase. But many businesses using Bluefin’s technology obtained them from a third-party partner. So your merchant services provider may intentionally tell you to contact Bluefin as a way to divert attention away from them.

What to Do If Your Business is Affected by This Rate Increase

If you received this notice from Bluefin, here are a few things you should do right away:

- Contact your merchant services provider immediately.

- Push back against the rate increase. Remember, credit card processing rates are negotiable.

- Work with a merchant consultant to negotiate Bluefin’s rates on your behalf.

Remember, only the interchange rates and assessment fees imposed at the card network level are set in stone. Everything else is 100% negotiable. Visa, Mastercard, Discover, and Amex did not all increase every interchange category by 0.20%. So this rate increase set by Bluefin is an arbitrary amount that’s just a way for them to make more money off your business.

If you need help navigating these waters, contact our team here at MCC. We can help you save money on credit card processing without switching providers or moving away from Bluefin.

Bluefin Products

- ShieldConex

- PayConex

- PayConex for Salesforce

- QuickSwipe

- Decryptx

- P2PE Manager

Industries Served by Bluefin

- Banking and Finance

- Business Services

- Construction

- Education

- Faith Based

- Food Service

- Government and Utilities

- Healthcare

- Manufacturing

- Nonprofit

- Petroleum, Drilling, and Mining

- Processor

- Real Estate

- Retail

- Software and Technology

- Theater and Ticketing

- Travel and Transportation

- Wellness

About Bluefin

Bluefin is an integrated payments solution that was founded in 2007. They provide a range of encryption and tokenization technologies to process payment data across different environments—including in-person payments, contactless payments, mobile payments, call center payments, and more.

The company works with over 300+ partners (processors, ISV’s, payment gateways, and software vendors) to serve 35,000+ businesses. More than $40+ billion in card sales get processed through Bluefin every year.