On April 12, 2025, Visa introduced its new Commercial Enhanced Data Program (CEDP). Here’s everything merchants need to know about the new program, fee changes, and what to expect.

What is Visa’s Commercial Enhanced Data Program?

Visa CEDP is designed for participating merchants who submit Level 3 card data with transactions on US Small Business and Commercial Credit products. It’s a data quality review program that validates requirements for merchants to qualify for lower interchange rates.

If the data submitted can be validated by VCS (Visa Commercial Solutions), merchants will get an automatic rate reduction on eligible transactions.

The program is part of Visa’s effort to crack down on merchants using their payment processor to “automatically” submit enhanced card data (that historically hasn’t been accurate). To remain eligible for these reduced rates, businesses must submit high-quality line-item data for L2 and L3 commercial card and small business transactions. Read more here about how automatic interchange optimization is ending.

CEDP Timeline: Key Dates to Know

Visa is rolling out its new Commercial Enhanced Data Program in phases:

- April 12, 2025 – CEDP officially launched and a 5 basis point assessment went into effect for eligible transactions.

- October 17, 2025 – Merchants must have a “verified” status by Visa to qualify for the reduced CEDP rates.

- April 2026 – Visa is eliminating its Level 2 interchange program entirely (except for commercial fuel transactions).

This phased approach gives merchants time to adjust their data submission process with CEDP standards. And while Visa is eliminating its L2 program, merchants submitting Level 2 card data can get L3 rates from October 2025 to April 2025.

New Visa CEDP (Commercial Enhanced Data Program) Fees

All eligible business and commercial transactions that submit Level 3 card data will be assessed a 0.05% participation fee per transaction.

That said, the new interchange fees applied to these transactions are reduced—so your overall costs will still be lower.

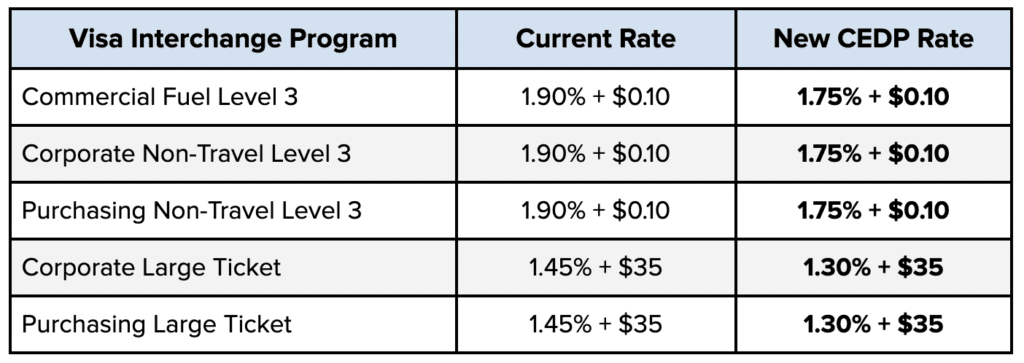

Here are the new Visa Commercial Enhanced Data Program (CEDP) rates for eligible commercial products—effective April 12, 2025:

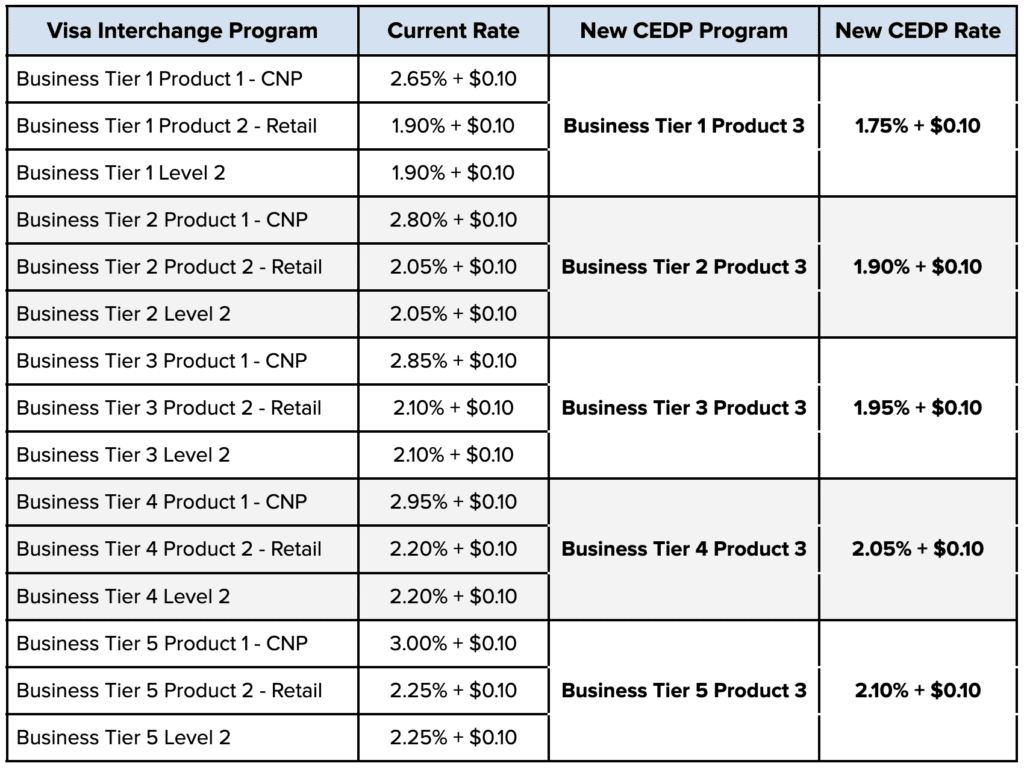

Visa’s new CEDP program will also apply to eligible business credit cards submitting accurate Level 3 card data that can be validated by VCS.

Here are the interchange categories that will be affected and eligible for reduced rates:

Under the new CEDP program, the interchange rates have been reduced by roughly 7-10% depending on the interchange category—with large ticket purchases seeing the most significant rate reduction.

So the 0.05% program participation fee per transaction is marginal, and you’re still coming out on top for eligible transactions.

How Visa Determines Merchant Verification Status

Under CEDP, Visa assigns merchants one of two verification statuses based on their historical transaction data:

- Verified Merchants: Consistently submit enhanced data that meets CEDP standards for participating transactions. These merchants qualify for lower interchange rates.

- Non-Verified Merchants: Do not submit enhanced data that meets program standards.

Effective October 17, 2025, only verified merchants are eligible for Visa’s reduced CEDP rates.

Merchant’s won’t lose their verified status for occasional data errors. Visa allows for a small percentage of “bad” data without effecting a merchant’s verification status (although specific thresholds haven’t been published). It’s all about consistency.

If a verified merchant sends bad data, Visa will notify the processor and the merchant will have a chance to correct those errors before their status gets changed to non-verified.

Visa sends processors a list of verified merchants every month. Merchants not on this list will not get CEDP rates until they’ve been verified.

CEDP Data Requirements for Level 2 vs. Level 3

Visa’s CEDP validation requirements depend on the card type and MCC code.

Level 2 Data Requirements

- Business and Corporate Cards: Sales tax indicator and sales tax amount.

- Purchasing Cards (Non-Fuel MCCs): Sales tax indicator and sales tax amount.

- Purchasing Card (Fuel MCCs): Customer code.

Level 3 Data Requirements

All card types and remaining MCC codes require the following 12 data fields for Level 3 qualification:

- Discount amount

- Freight/shipping amount

- Duty amount

- Item commodity code

- Item descriptor

- Product code

- Quantity

- Unit of measure

- Unit cost

- Discount per line item

- Line-item total

- Line-item detail indicator

Merchants in states without sales tax can still achieve Level 3 data rates starting in October 2025. Refer to your processor’s guidelines for how to format and submit this data.

You cannot use “filler” data (like spaces and all zeros) to qualify. This is part of Visa’s crackdown and requires merchants to truly submit accurate data to get reduced rates on eligible transactions.

Are Visa CEDP Fees Negotiable?

Visa’s new Commercial Enhanced Data Program fees are non-negotiable. These are interchange rates set at the card network level by Visa.

Interchange rates and assessment fees are the only two non-negotiable components of credit card processing.

That said, you can negotiate discount rates and markups paid directly to your processor—and there’s often lots of room for savings to be found there.

Identifying Visa CEDP Fees on Your Merchant Statement

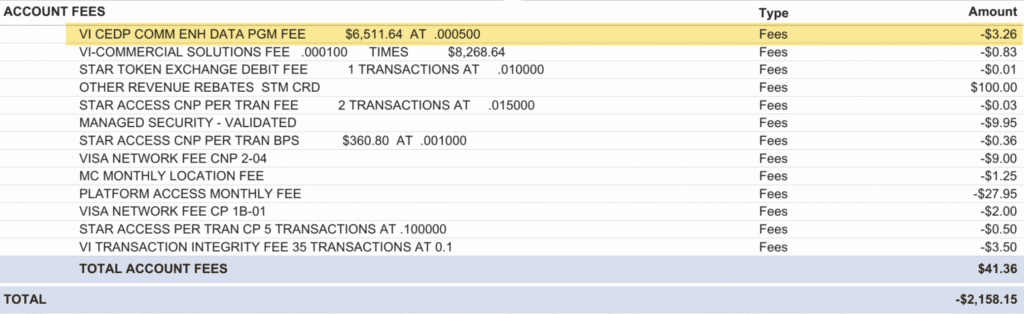

Here’s an example of Visa’s Commercial Enhanced Data Program Fee from a recent statement we’ve audited:

As you can see, the 0.05% rate is being assessed on $6,511.64 of qualifying Visa transactions. The total cost is marginal here, resulting in just $3.26 in fees on that volume.

Math on this one is correct.

But any merchant processing business or commercial card transactions while capturing Level 3 data should still keep a close eye on their statements to ensure the rate reductions are being applied properly.

If not, there’s a chance your processor could still be charging you the old rates and pocketing the difference as an extra profit for themselves. It wouldn’t be the first time we’ve caught a processor applying interchange padding tactics.

We have a detailed guide on how to audit your merchant statement that will help you find the CEDP fees along with other interchange rates, assessments, and important fees that can otherwise be difficult to spot.

Final Thoughts on Visa’s New CEDP Rates

Visa’s CEDP represents a major shift in how commercial credit card processing works industry-wide. For years, merchants and processors were getting away with submitting bogus or incomplete Level 2 and Level 3 data, and Visa is now preventing this from happening automatically.

It’s also worth noting that Mastercard hasn’t announced any changes to their Level 2 and Level 3 programs. So CEDP only affects Visa commercial transactions, which may create some added complexity for merchants accepting both brands.

But it’s still likely in your best interest to submit as much accurate data as possible, regardless of the card type. So if Mastercard decides to roll out something like this in the coming years, you’ll be prepared.

I strongly recommend talking to your processor as well to ensure their system has been validated to meet CEDP requirements. You can also ask them to provide reporting from Visa on your current verification status. And if you’re submitting errors, they should be able to identify those as well.