Credit card processing statements are incredibly confusing, especially to the untrained eye. They contain hundreds of line items across several pages written in small print using industry jargon you’re likely not familiar with.

That’s why so many businesses just give them a quick glance, spending maybe 15 seconds max when they should be spending at least 15 minutes reviewing the details.

Fortunately for you, I’ve reviewed thousands of statements from hundreds of different processors. So I can easily show you the most important parts of your statements and what you should be paying attention to.

Why It’s So Important to Read Your Merchant Processing Statements Every Month

Here’s the reality—credit card processors make these monthly statements difficult to read on purpose. Some processors even use deceptive billing tactics to fool merchants so they can bury hidden fees and get away with charging higher rates.

By reading your statements every month, you can:

- Figure out how much you’re actually paying to accept credit cards.

- Identify hidden fees and rate increases.

- See if your fees are changing from month to month.

- Find out if your processor is doing anything deceptive or unethical.

- Look for cost-saving opportunities.

- Ensure the fees you’re paying align with your merchant agreement.

It’s also worth mentioning that by the time you receive your merchant statement, your processor has already deducted the fees from your account.

So if there are any discrepancies or inaccuracies, they already have your money. It’s on you to spot these errors and recover the funds.

First, Calculate Your Effective Rate—This is the Most Important Part of Your Statement

Your effective rate is the all-in percentage that you pay to accept credit cards—including all interchange fees, assessments, processor markups, and other fees. This is your true cost of accepting card payments, and it’s by far the most important piece of information on your statement.

But you’ll likely need to do some quick math to determine your effective rate, as processors rarely include this information on your statement.

To calculate your effective rate, you need to find your total fees for the month and divide that number by the total volume of card payments you accept.

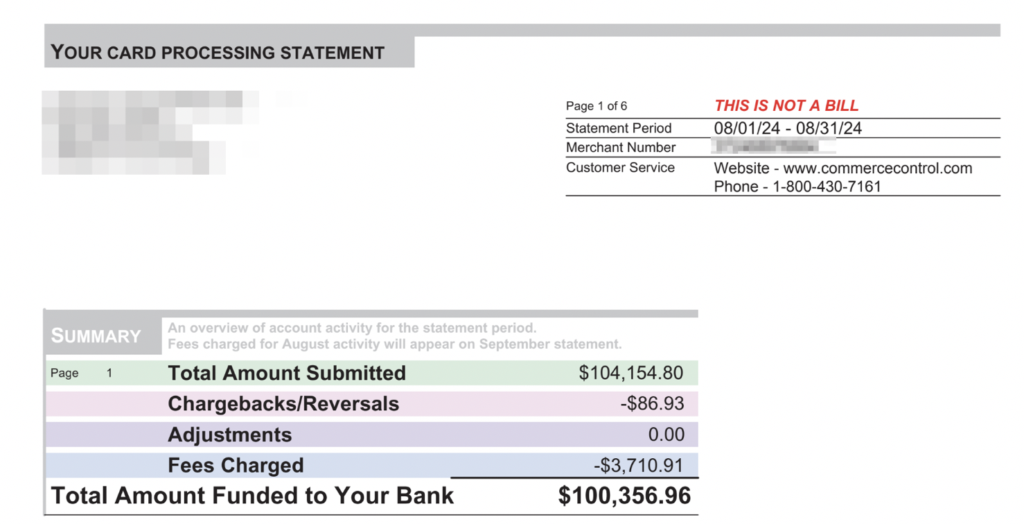

Some processors include a summary that looks like they’re showing you the effective rate, but that’s not actually the figure you need. Here’s an example from Bank of America Merchant Services to show you what I mean:

At first glance, this looks pretty straightforward—$3,710 in fees on $104,154 submitted would result in a 3.6% effective rate, right? Wrong.

If you look at the note above the fees, it says that the fees charged for August’s activity will appear on the September statement—even though this is an August statement. So the fees charged here ($3,710) are actually from July.

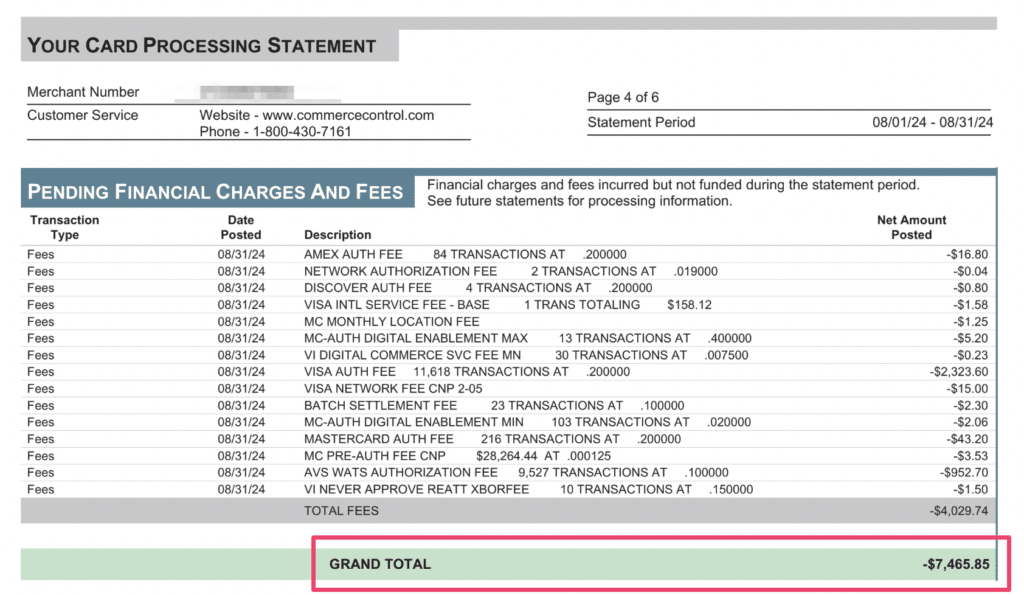

Instead you need to scroll through the pages until you find the grand total of fees charged for your current statement period, which in this case, is $7,465.

Now we can calculate the effective rate by dividing $7,465 by $104,154 to get 7.16%.

This is double the rate that you’d get if you simply used the numbers in the summary, which is why it’s so important to read your statements thoroughly and identify your true costs.

And BOA isn’t the only processor that does this. QuickBooks statements include an “aggregate rate” in the summary that’s also incredibly inaccurate because the rate includes ACH transactions (which are much cheaper to process than credit cards).

I highlighted this in our QuickBooks Payment Processing Review, which shows an example of a statement that has a 1.39% aggregate rate but a 3.33% effective rate when you crunch the numbers.

In short, don’t just rely on the percentages shown in your summary or even the numbers in your summary for that matter. Did through your statement to find your total fees and divide that number by your total processing volume. That’s the only way to accurately calculate your effective rate.

Check Your Discount Rate

Your discount rate is essentially your processor’s markup. This is how much they’re charging you on top of the interchange rate.

Discount rates are typically displayed as a percentage or as basis points.

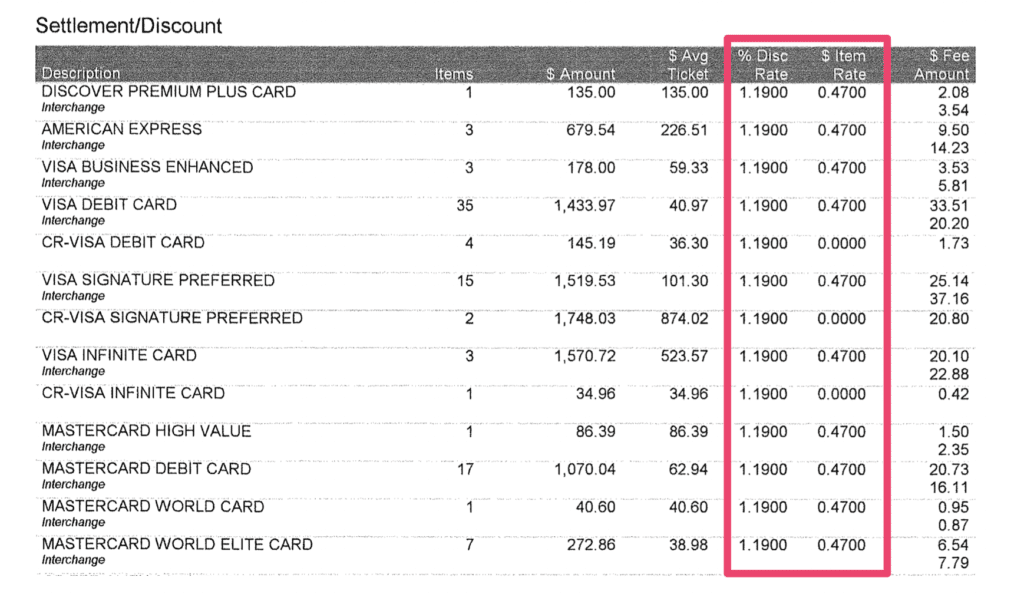

Here’s an example of a discount rate shown on an OpenEdge statement:

This merchant’s discount rate is 1.19% + $0.47 per transaction—which is incredibly high. That’s the rate that goes directly to OpenEdge for every single transaction they take.

But I like this example because if you look at the far right column, OpenEdge shows the dollar amount of the discount rate (top number) and the interchange rate (bottom number) imposed by the card neworks.

This may seem like a lot to take in, but we love this level of detail because it shows transparency.

For example, if we look at the very top line item we can see this merchant took a single transaction for $135 from a Discover Premium Plus credit card. The $2.08 fee reflects the discount rate (1.19% + $0.47) paid to the processor and $3.54 is the interchange rate paid directly to Discover.

If we total those two fees we can see that the merchant paid 4.16% on this transaction—but only 2.62% of that amount is the non-negotiable rate imposed by the card network.

There’s tons of room to negotiate the processor’s markup here, which is why it’s so important to identify your discount rate.

This OpenEdge example above is from a merchant on an interchange-plus pricing plan where, as the name implies, the merchant pays the interchange rate plus the processor’s markup.

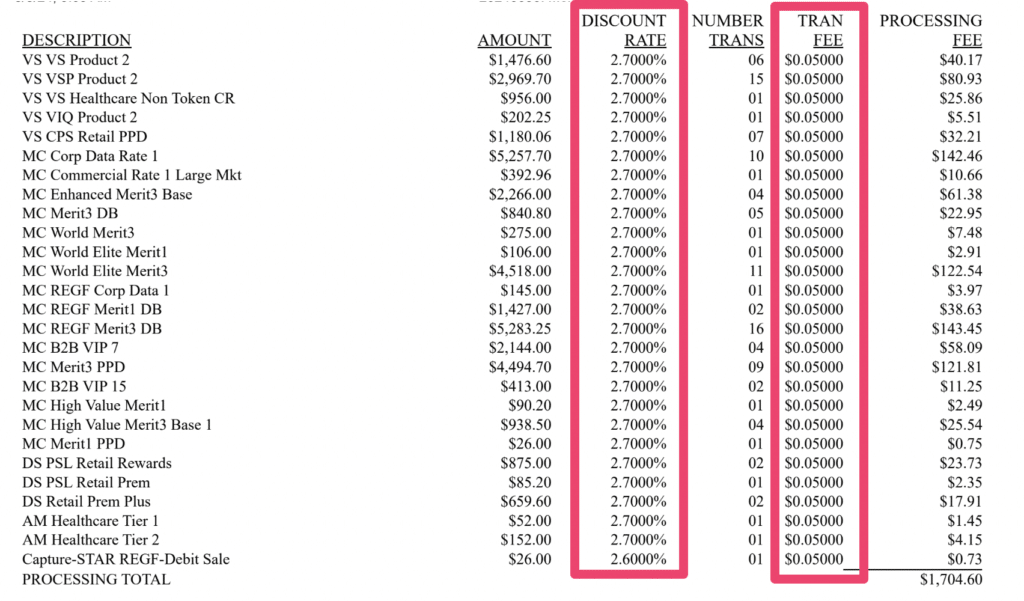

However, the discount fees on flat-rate plans will look a little different. Here’s a statement from Payjunction where the merchant is paying 2.70% + $0.05 on every transaction.

As you can see here, we don’t have a separate line item that shows the interchange rate imposed by the card network.

Instead of charging a markup on top of the interchange rate, the processor imposes a flat rate on every transaction (which ends up being much more expensive for the merchant).

If the discount rate on your statement looks like this, you need to try and switch to an interchange-plus plan because you’re definitely overpaying.

Review Your Assessment Fees

Assessment fees are another non-negotiable rate imposed by the card network. Visa, American Express, Mastercard, and Discover charge assessments to payment processors, and then payment processors pass those fees through to the merchants.

If you don’t see any assessments on your statement, then you’re likely on a flat-rate, tiered, or qualified plan, and your processor is happy to pay those for you because your rate is already inflated enough to cover those costs plus a hefty profit.

Even though assessment fees are non-negotiable, you still need to check them to ensure your processor isn’t artificially inflating these rates and pocketing the difference.

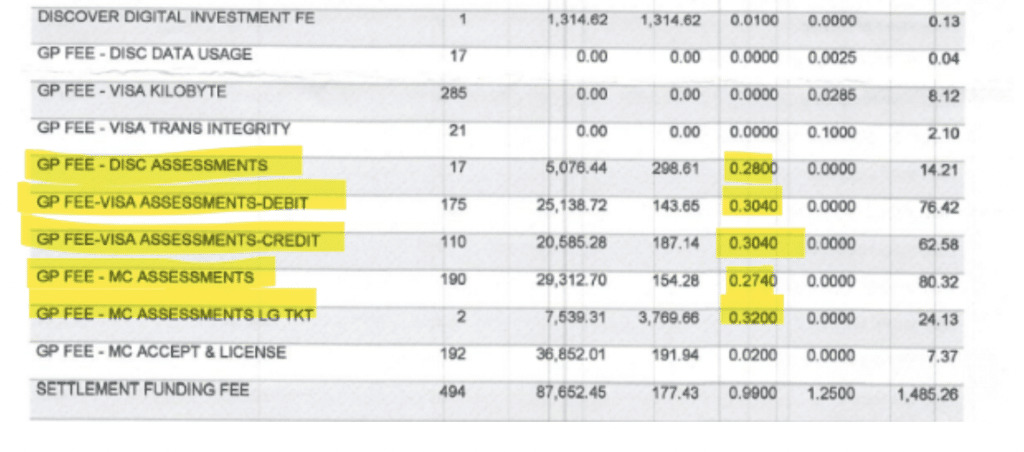

This is known as assessment padding, which is incredibly deceptive and unethical. Let’s go through a quick example using a Global Payments statement:

Every line item on this statement screenshot is an assessment fee. But I want to draw your attention to the highlighted portion.

The highlighted rates are more than double the actual assessments imposed by the card networks.

The 0.28% Discover assessment is actually supposed to be 0.13%. Visa’s credit assessment is supposed to be 0.14%, yet Global charged 0.304%.

The only way for you to catch this is by knowing what those fees are supposed to be, which is why it’s helpful to have a merchant consultant audit these statements on your behalf.

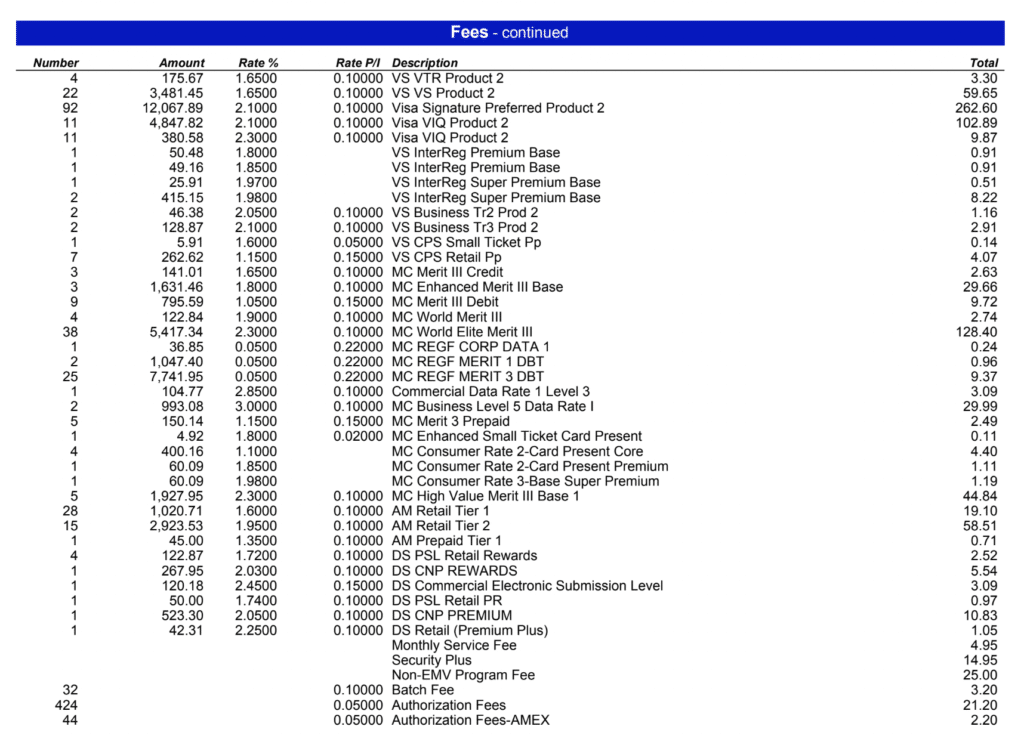

Identify Any Other Miscellaneous or One-Off Fees

Beyond your processing rates and assessments, you might find a slew of other fees and miscellaneous charges on your statement.

These are often in the same section as your assessments, and might include:

- PCI Compliance Fees

- Monthly Statement Fees

- Batch Fees

- AVS Fees

- Gateway Fees

- Annual Fees

The list is seemingly never-ending, and there are literally hundreds of different fees that might be included.

However, not all of these fees are legitimate—and you might find out that most can be removed from your statement altogether.

Some of these are legitimate assessments, but others should be scrutinized—like the monthly services fee, security plus fee, non-EMV program, and anything that isn’t an obvious assessment starting with VS, MC, DS, AM (abbreviations for Visa, Mastercard, Discover, and Amex).

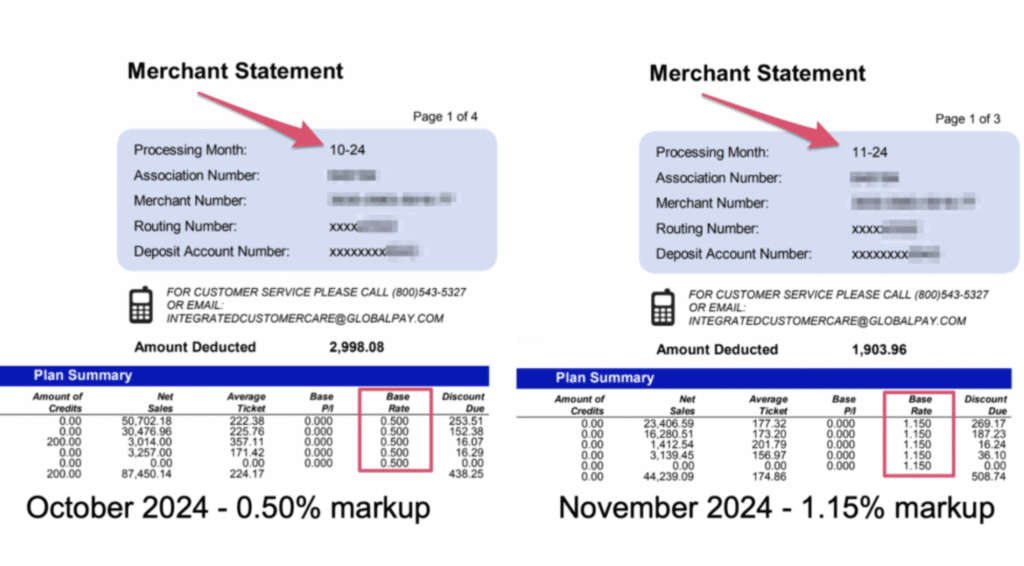

Compare Your Current Statement Against the Last Two Months

You should always have statements from the last two months with you when you’re reviewing a new statement. This makes it much easier to spot any differences or high fees that just seem out of place.

If you’re unsure about something, you can quickly check it against another statement to see if the fee is new or if you’ve been getting charged the same fee in the past.

Here’s an example of something you might find, which I covered in my TSYS review:

TSYS more than doubled this merchant’s discount rate in just one month.

Had they not been reviewing their statements every month or had the other statement close by for comparison purposes, this could easily have gone overlooked.

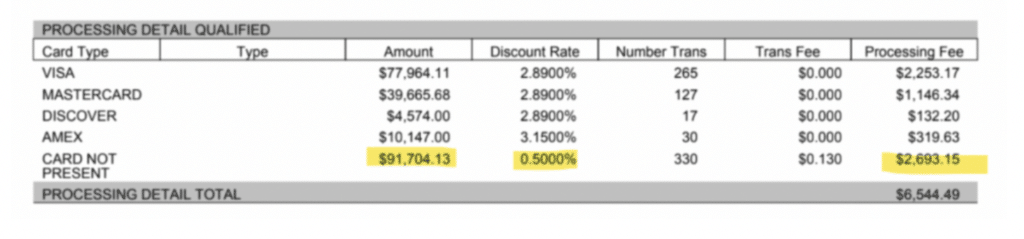

Spot Check Some Calculations

I don’t expect you to use your calculator on every line item to verify the math is correct. But I do recommend that you spot check some of the larger numbers or anything that just doesn’t look correct.

You should be going through line-by-line, and in doing so, certain things might jump off the page—and that’s what you can spot check.

Here’s an example from a Shift4 statement where the math is incorrect:

This merchant is supposed to pay an extra 0.50% for card-not-present transactions. But 0.50% of $91,704 is $458—NOT $2,693 (what Shift4 charged them).

Again, this is really easy to overlook because everything on the page looks right—except for that total fee.

If you’re reviewing your statements every month, then some of this stuff will start becoming second nature, and you’ll realize that over $2,600 in fees for CNP transactions doesn’t make sense based on your normal volume.

It’s also another reason why it’s so helpful to have your last couple of statements nearby so you can quickly compare rates and fees.

Read the Fine Print and Notices

We often see merchants burying information about future rate increases in small, fine print at the bottom of statements.

This doesn’t always happen, but you should still double-check these and read them carefully to prepare for any changes.

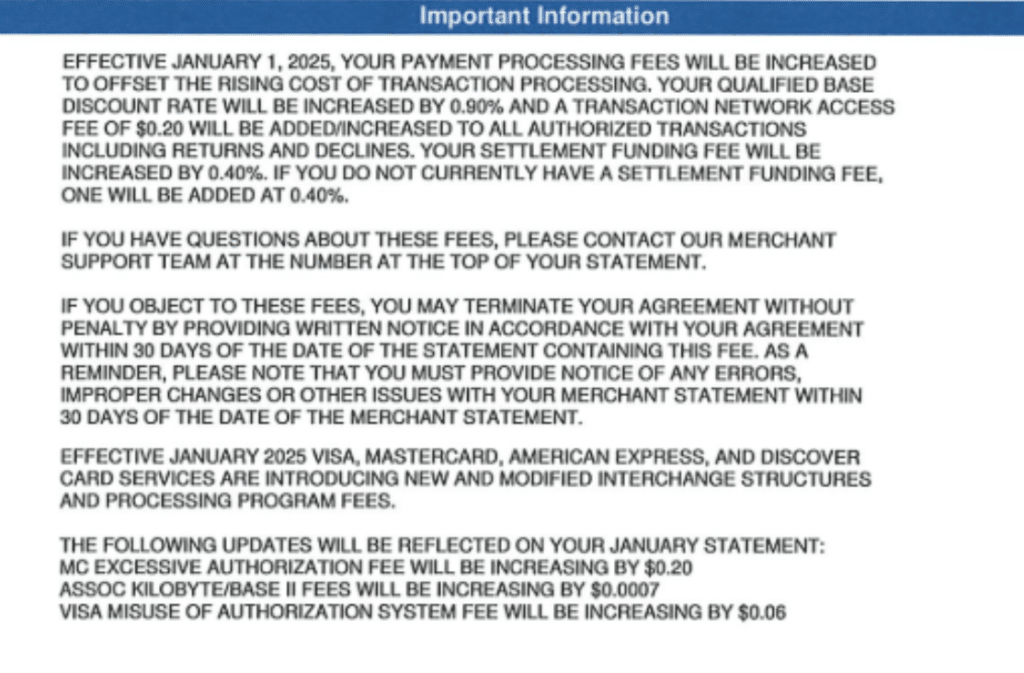

If you have TSYS or any processor using Global Payments on the backend, then your notice will look like this:

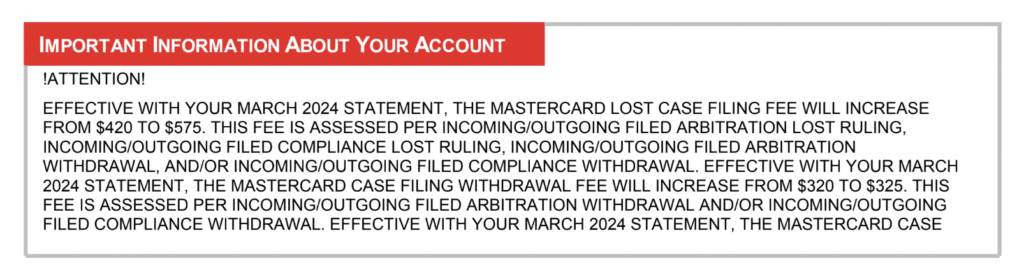

Alternatively, Fiserv and ISOs of Fiserv print notices on statements that look like this:

Staying on top of these notices is really important because you can proactively stop a rate increase instead of trying to retroactively roll back something after it’s been implemented.

While you can still negotiate your rates after a rate increase goes into effect, it can be harder to recover those funds.

Final Thoughts

Believe it or not, this is just the basics associated with reading your merchant statement. There’s actually a lot more involved when it comes to identifying overages and looking for savings opportunities.

If you don’t have time to do this on your own every month, our team here at MCC is happy to read and audit statements on your behalf.

We’ll let you know about any bogus fees, inflated rates, and overages that you might be paying—and we’ll work directly with your processor to rectify them.

Just submit your statements for a free audit to find out how much you can save.