Despite being one of the largest credit card processors in the world, Global Payments has a bad reputation in the payments space.

Global Payments is known for frequent, high rate increases (sometimes several times per year). They’re notorious for adding lots of bogus fees to merchant statements, and we’ve caught them padding assessment fees on multiple accounts—an unethical practice that’s deceptive and predatory.

I’ve covered all of this stuff extensively in my Global Payments review.

But just last month, our audit team found two different businesses being taken advantage of by Global Payments. I feel obligated to share these stories because I’m sure the same thing is happening to hundreds, if not thousands, of other merchants who have no idea they’re being ripped off.

Example 1 — Global Charged a 20% Effective Rate on a $178k in Sales

To put this into perspective, the average effective rate is ~3% for most businesses—meaning Global Payments charged over 500% more than the industry average.

This is one of the craziest rates I’ve ever seen, and I’ve audited thousands of statements in my career.

Let’s take a closer look at the statements so you can see for yourself.

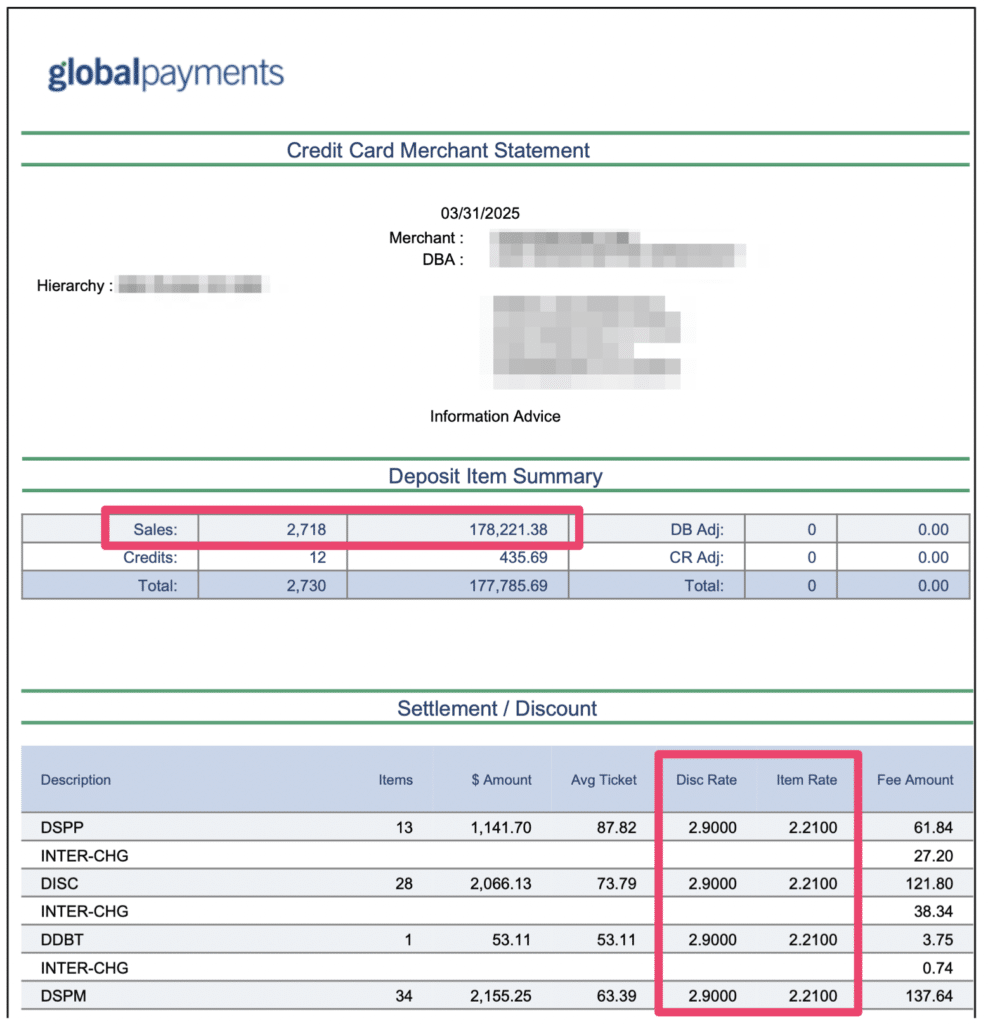

First, we can see that Global is charging 2.9% + $2.21 per transaction in addition to the interchange rate.

2.9% + $2.21 per transaction on its own would be on the high end of a flat-rate pricing plan. But Global Payments is still passing through the interchange costs to the merchant—which is honestly absurd for this high of a discount rate.

I highlighted the total sales here as well. This business processed $178,221.36 from 2,718 transactions in the month of March.

This number is important for two reasons. First, we’ll use it later to calculate the effective rate. Two, it translates to $2+ million in sales per year—which should be solid enough to deserve a lower rate and volume discount.

While this pricing model is outrageous in itself, it’s not even the worst part of what we found during this audit. Check this out:

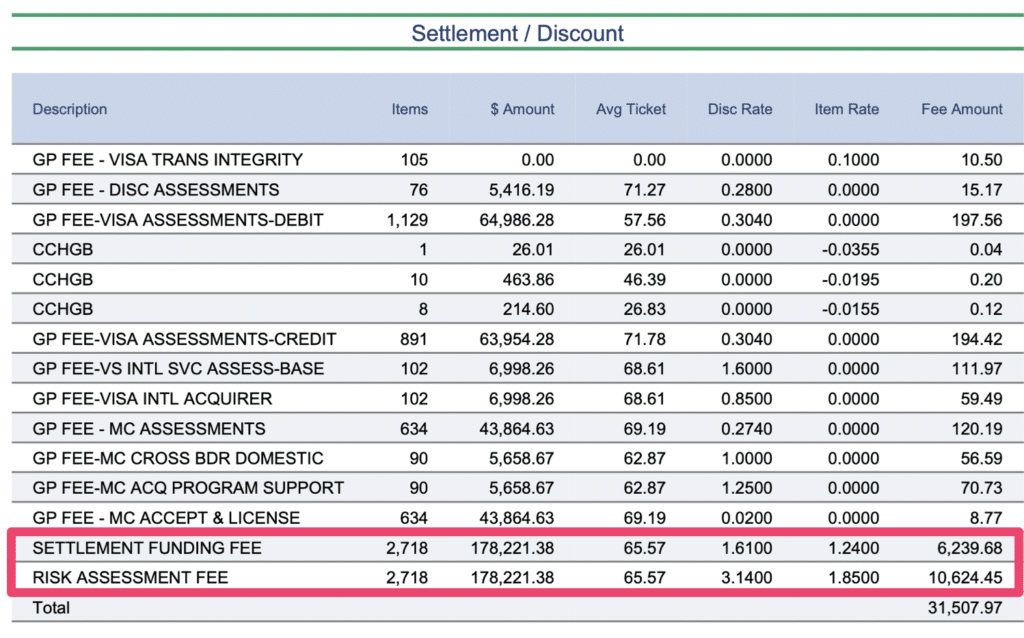

This business paid $16,863 just in Settlement Funding Fees and Risk Assessment Fees.

- Settlement Funding Fee — 1.61% + $1.24 per transaction ($6,239.68)

- Risk Assessment Fee — 3.14% + $1.85 per transaction ($10,625.45)

This is outrageous.

I’ve never seen either of these fees so high. And as you can see, both of these fees are being applied to the total sales volume ($178,221.38).

Between the discount rate and these two fees alone, this merchant is paying a minimum of 7.65% + $5.30 on every transaction.

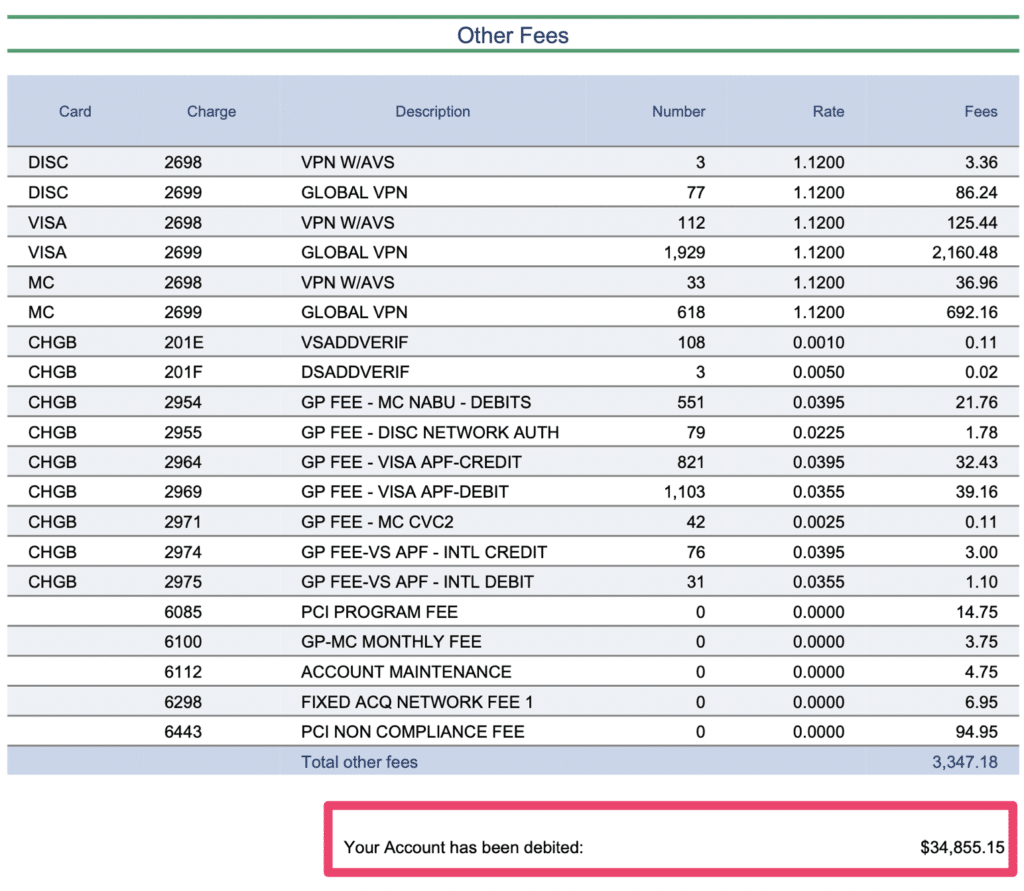

Once you factor in the interchange fees, assessments, and Global’s laundry list of other random fees, we can see that this merchant paid a grand total of $34,855.15 in fees for the month.

$34,855 divided by $178,221 results in a 19.56% effective rate.

This is highway robbery.

Example 2 — Global Nearly Tripled a Merchant’s Rates Overnight

It’s common for processors to raise rates. What’s not common—nearly tripling rates from one month to the next.

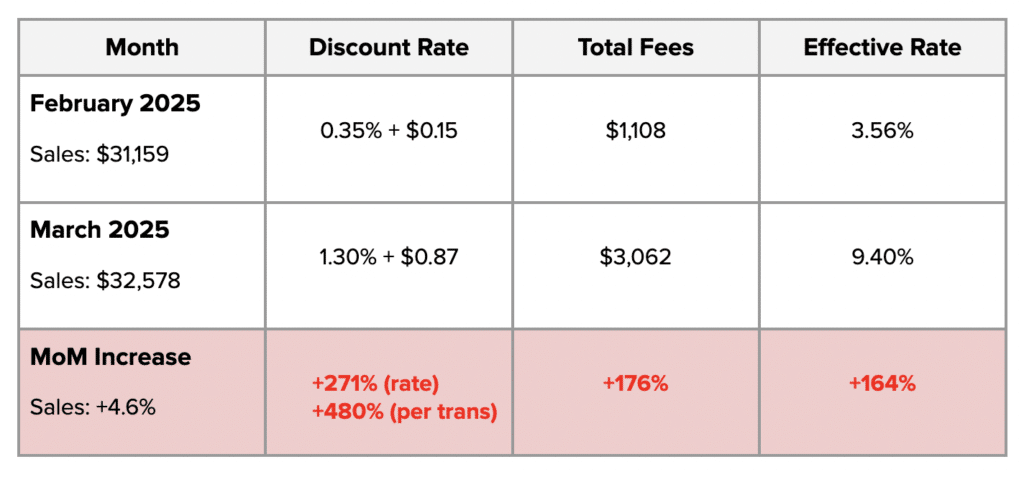

Before we dive into the specifics, here’s a quick comparison table of the key numbers:

This is a low-volume merchant doing roughly $30k in sales per month (but Global is still giving them a much better rate than the merchant doing $178k per month in the first example).

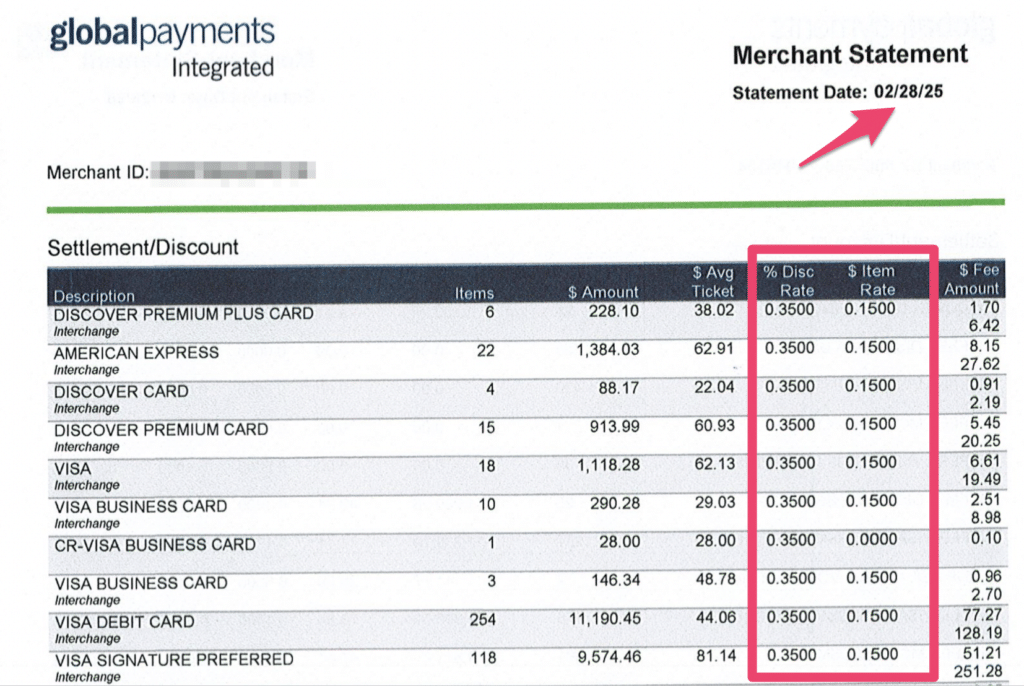

The old rate of 0.35% + $0.15 per month isn’t an amazing deal. But it’s not terrible at this volume and fairly average. The 3.56% effective rate from February is normal, and nothing egregious.

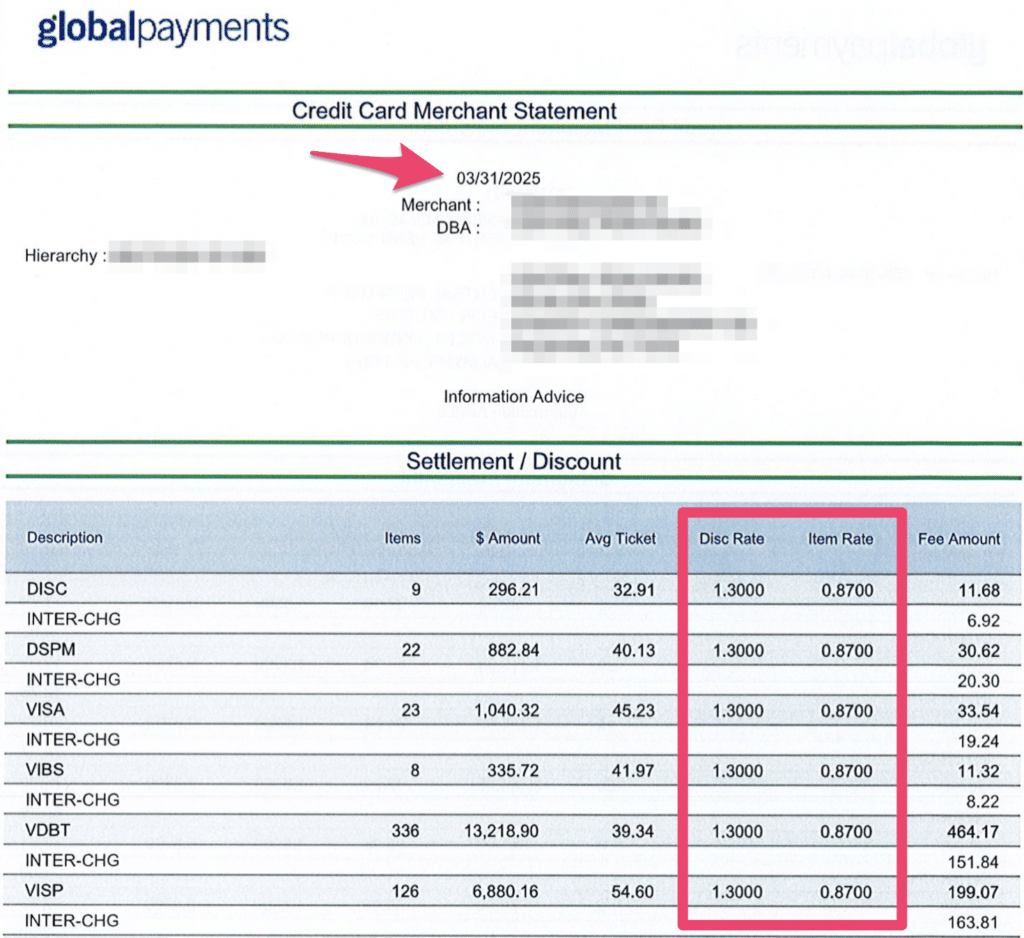

However, Global Payments decided to increase this merchant’s discount rate by 0.95% + $0.72 per transaction from February to March.

Here’s a snippet of the February statement:

And here’s March:

This is one of the highest month-over-month increases that you’ll ever see.

In my Global Payments review, I called them out for increasing a discount rate from 0.18% to 0.48%, which I thought was way too excessive.

But this example above blows that one out of the water. The percentage portion of the discount rate nearly quadrupled, and the fixed-dollar fee is nearly six times higher.

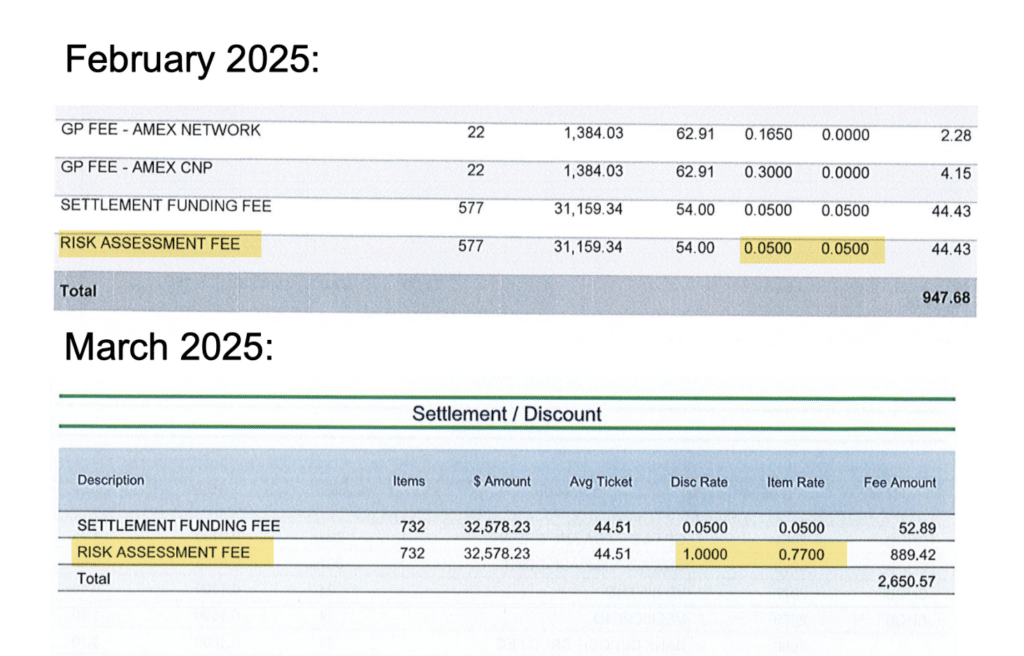

If we do some more digging, we can see that Global increased other fees between February and March as well—including the Risk Assessment Fee:

Global’s Risk Assessment Fee went from 0.05% + $0.05 in February to 1.00% + $0.77 in March.

This is nearly 20 times higher month-over-month—representing a 1,900% increase.

Outrageous is an understatement.

I’m honestly not even sure what’s crazier—this rate hike alone or the fact that the result of this massive increase is still roughly 70% lower than the 3.14% + $0.85 Risk Assessment Fee I called out in the first example of this post.

In both instances, the merchant is clearly being ripped off.

How Does Global Payments Get Away With This?

Believe it or not, Global isn’t doing anything illegal here.

It’s completely unethical and could potentially be in violation of the merchant agreement (I haven’t dug that deep into the contract yet). But not illegal.

They get away with this because they’re preying on your ignorance.

They’re hoping that merchants aren’t exactly sure what any of these fees mean and that you assume they’re mandatory.

These statements are incredibly difficult to read, especially to the untrained eye. There are hundreds of line items, plus abbreviated industry terms throughout, making it really hard to tell which fees are legitimate and which ones are bogus.

If you say nothing, they’ll just keep charging you as much as they want.

How to Make Sure You’re Not Being Ripped Off by Global Payments

If Global Payments is your credit card processor, the first thing you need to do is learn how to read your monthly statements.

Then you can calculate your effective rate, and if it’s higher than 3% or 4%, then there’s a good chance you’re overpaying. If it’s 5% or higher, then you’re definitely getting ripped off.

Even if your Global rate is low today, it could skyrocket in the future. So you need to continue monitoring your statements every month and compare them to previous statements to identify any new fees, increases, or inconsistencies.

The easiest way to make sure you’re not getting ripped off by Global Payments is by working with a merchant consultant.

Here at MCC, we can audit your statements for free and let you know if Global is giving you a fair rate. If we identify any overages or cost savings opportunities, we can negotiate directly with Global on your behalf to lower your rate and obtain any refunds you’re owed.

Plus, we’ll continue monitoring your statements every month to ensure Global upholds their end of the agreement and doesn’t try to sneak in any other hidden fees.