US Bank has been around for over 160+ years, offering a wide range of traditional banking products to businesses and consumers alike.

We have tons of experience working with US Bank on behalf of our clients—auditing statements and negotiating rates. So whether you’re a current US Bank customer or thinking of using US Bank’s merchant services, you’ve come to the right place.

Below you’ll find an honest review based on our first-hand experience, including a closer look at US Bank’s merchant services fees and statements that aren’t available anywhere else on the web.

Our Quick Take on US Bank

US Bank is Elavon’s sponsoring bank for payment processing and merchant services. US Bank only works with Elavon—funneling all of their leads to Elavon and offering all of the same products.

We’ve generally had a good experience working with US Bank for our clients. If you’re a US Bank customer using their payment processing services, you’ll typically get better customer service than going directly to Elavon.

What We Like About US Bank

- Transparent pricing.

- Great customer service.

- Willing to remove fees and issue credits or refunds.

Where US Bank Falls Short

- Some unnecessary fees.

- Flat-rate pricing is too high (avoid this).

- They aren’t offering anything unique or groundbreaking (just passing you to Elavon).

US Bank Merchant Services Pricing and Credit Card Processing Rates

If you go directly to US Bank’s website and browse merchant services rates, you’ll quickly find flat-rate pricing that’s simple and transparent:

- 2.60% + $0.10 per transaction for in-person swipes, dips, and taps

- 2.90% + $0.30 per transaction for online payments

- 3.50% + $0.15 per transaction for manually entered payments

AVOID THESE AT ALL COSTS!

While transparent and easy to understand, flat-rate pricing is terrible and will result in you paying tens of thousands of dollars more than you need to.

US Bank offers interchange-plus pricing, and that’s what you should be asking for. With this model, you simply pay the wholesale rate charged by the card networks plus a small markup to US Bank.

However, US Bank’s interchange-plus rates aren’t published online. These are customized for each business and typically align with whatever Elavon is charging.

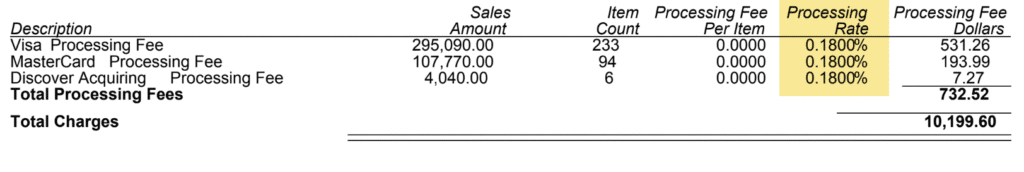

Here’s a screenshot from one of our clients using US Bank:

US Bank is charging 0.18% per transaction on top of the interchange rate here, which tends to be about the average rate we see when auditing statements—give or take ~5 basis points.

The exact rate is going to depend on your MCC code, volume, and any specific features or services you might need. For context, the merchant in this example processes about $550,000 per month.

But one thing is for sure—this rate is so much better than the flat-rate prices listed above.

Other US Bank Fees to Look Out For

We don’t generally find lots of unnecessary fees on US Bank statements, which is great.

Sometimes we’ll see a random $35 monthly fee charged to merchants. But this is marginal and nothing to really lose sleep over (although it can be removed).

However, one fee to keep a close eye on US Bank’s ITNL Card Handling Fee, which is typically charged for an additional 60 basis points per transaction.

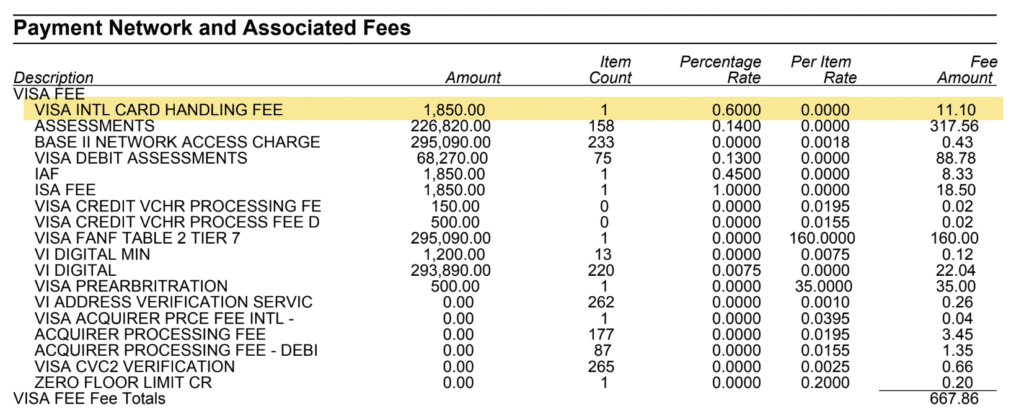

Here’s an example of it on a statement:

Despite being listed alongside Visa’s assessments and network fees, this is NOT coming from Visa—it’s a markup from US Bank/Elavon.

In this instance, it’s only one transaction costing the merchant $11.10, which isn’t a huge concern. But we’ve seen this charge cost other businesses tens of thousands annually.

A Closer Look at US Bank’s Merchant Services Statements

It’s really important that you learn how to read your monthly processing statements. Understanding how these statements work will keep you informed and you’ll be able to identify hidden fees and determine if your processor is ripping you off.

Fortunately, US Bank’s statements are extremely transparent and very easy to read.

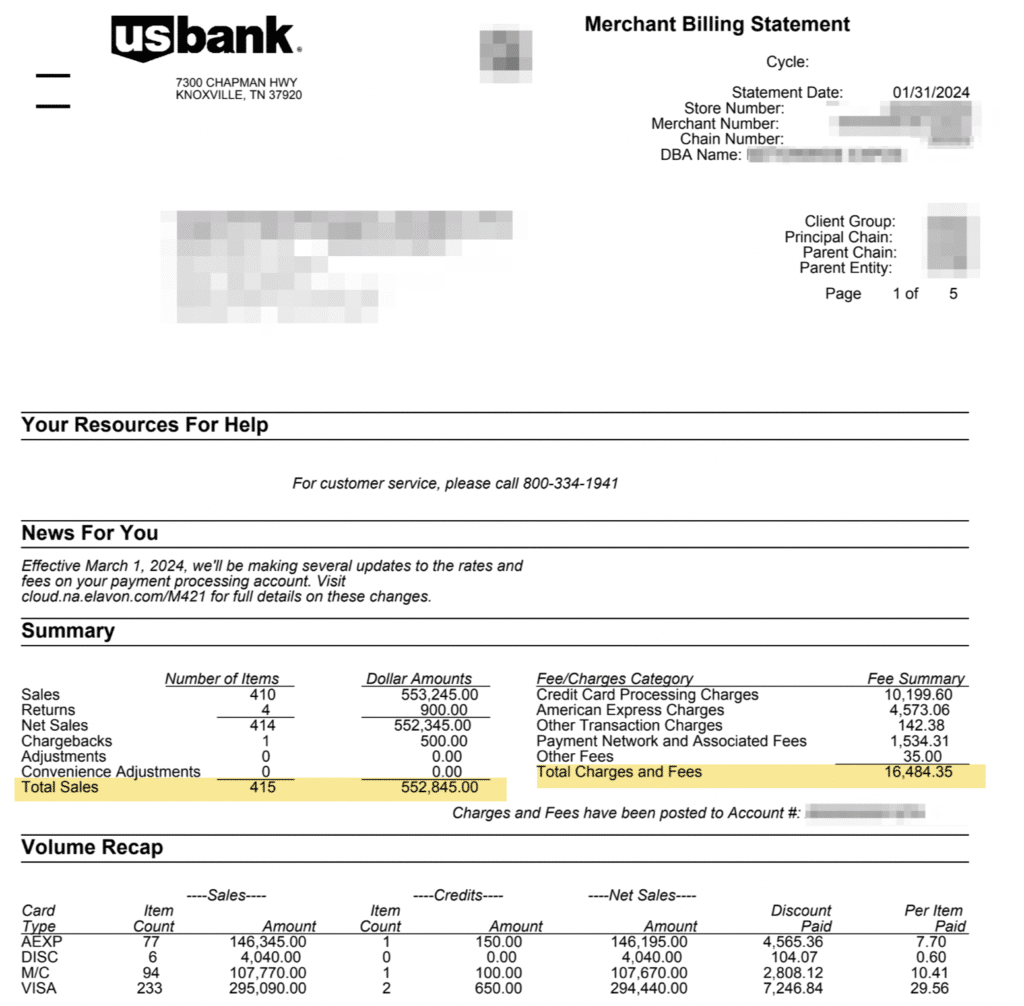

Here’s an example of what the first page looks like, including a monthly summary:

I love this statement because it gives you all of the most important pieces of information in one place. While you’d think this would be standard across the industry, you’d be surprised how many other processors make you search through dozens of pages and hundreds of line items to find these.

I highlighted the two most important numbers above.

Now can use the Total Sales ($552,845) line and Total Charges and Fees ($16,484.35) line to quickly calculate the effective rate.

Just divide the fees by sales, and we see that this merchant paid a 2.98% effective rate this month—which is solid and right where it should be.

The effective rate accounts for all interchange fees, assessments, processor markups, and other miscellaneous fees. So it’s the true cost of acceptance.

Should You Switch to US Bank?

If you’re currently using another payment processor, I probably wouldn’t switch to US Bank. Even if your processor is charging you more, it’s almost always better to stay with your current provider and negotiate a better deal (switching is more expensive than most businesses realize).

That said, if you’re a new business or an established business that’s looking to accept credit cards for the first time, US Bank is a solid choice—especially if US Bank is already handling your other banking needs (they may even offer you an incentive).

It’s better to go directly to US Bank as opposed to Elavon, even though Elavon will ultimately end up handling your processing. You’ll just get better service by going through US Bank.

Just remember to avoid the flat-rate pricing options. Only use US Bank if they offer you interchange-plus pricing (less than 20 basis points is a reasonable offer).

Our US Bank Review Methodology and Why You Should Trust MCC

We have a unique position in the payment processing industry, making our reviews among the most trustworthy on the web.

As a merchant consultant, we work on behalf of our clients and always keep their best interests in mind. We don’t offer payment processing services. Instead, we audit statements and negotiate better rates for our clients.

This model gives us access to thousands of statements from every provider on the market. So we know exactly what US Bank is charging other businesses and how those fees stack up against the competition.

So you get the facts blending with our industry expertise to give you all of the information you need to form your own opinions.

Our Final Thoughts on US Bank Merchant Services

US Bank is a pretty decent payment processor. While they technically outsource the actual processing to Elavon, they still offer in-house support and are willing to negotiate fees.

They provide solid customer service and don’t typically inflate rates or add bogus fees to your statements.

Just be careful with that international card handling fee. That’s the one charge that we see merchants paying for that’s costly and unnecessary, especially if you have lots of transactions that fall into this category.

If you need help negotiating with US Bank, contact our team here at Merchant Cost Consulting. We’d be happy to audit your statements for free and identify any savings opportunities.