Auth.net is one of the most popular payment gateways and virtual terminals in the payments space. This is largely due to the fact that it’s owned by Visa, and virtually every processor offers Auth.net as a gateway (unless you’re among the Stripes of the world).

Whether you’re currently using Authorize.net or you’re considering using it to accept payments, this review has everything you need to know about this provider.

You can use it to identify fees, see if you’re overpaying, and ultimately figure out if Auth.net is a good fit for your business.

Our Insider Take on Authorize.net

Despite its popularity, Auth.net is not robust payment gateway. Visa recently rolled out Auth.net 2.0 at ETA TRANSACT in April 2025, so there’s a chance I’ll change my opinion as this gains popularity.

But overall, Auth.net just falls a bit short compared to other gateways in terms of its capabilities, what it can do, and what it can integrate with.

It’s fine if you’re looking for a simple checkout and shopping cart experience. But I’ve noticed that as more ecommerce businesses launch, fewer are relying on Auth.net as their payment gateway compared to years ago. It seems that the industry as a whole has realized that there are more robust systems on the market, and that’s probably why Visa just did a major overhaul on the product itself.

Auth.net Pros

- Good for online stores looking for a simple payment gateway.

- Easy way to accept payments over the phone (manually entered into a virtual terminal).

- The new 2.0 version should address pitfalls from the past.

- Pricing is fairly competitive.

Auth.net Cons

- Not as robust as other payment gateways.

- Limited features and capabilities

- Limited integrations.

- Monthly gateway fees.

Authorize.net Pricing and Credit Card Processing Rates

Auth.net has a variety of pricing options to choose from depending on what types of services you need.

Rates start at 2.9% + $0.30 per transaction with Auth.net’s standard all-in-one pricing. This plan is designed for businesses that don’t already have a merchant account (which is why it’s so expensive).

You can access cheaper rates from Auth.net if you obtain a merchant account directly from your merchant services provider.

- Credit Cards — $0.10 per transaction

- Gateway Processing — $0.10 per transaction

- Daily Batch fee — $0.10

- eChecks — 0.75% per transaction

- Monthly Gateway Fee — $25

These are the standard prices that Auth.net offers to any business prior to any negotiations or volume discounts. But they offer customized interchange-plus pricing to non-profits and merchants processing over $500k per year.

We have clients paying a $0.05 per transaction gateway fee (as opposed to the advertised $0.10 rate). We’ve also seen the monthly gateway fee as low as $10 per month (instead of $25).

Auth.net charges other monthly fees and per-use fees for additional services, including:

- Digital invoicing

- Recurring payments with cards on file

- Advanced fraud detection tools

- Customer information management

You’ll need to obtain a quote for these, as they can vary by business. For more context, we have some clients paying as little as $5 per month for Auth.net’s Advanced Fraud Detection Suite. But we know of other businesses paying double.

Auth.net Statement Example

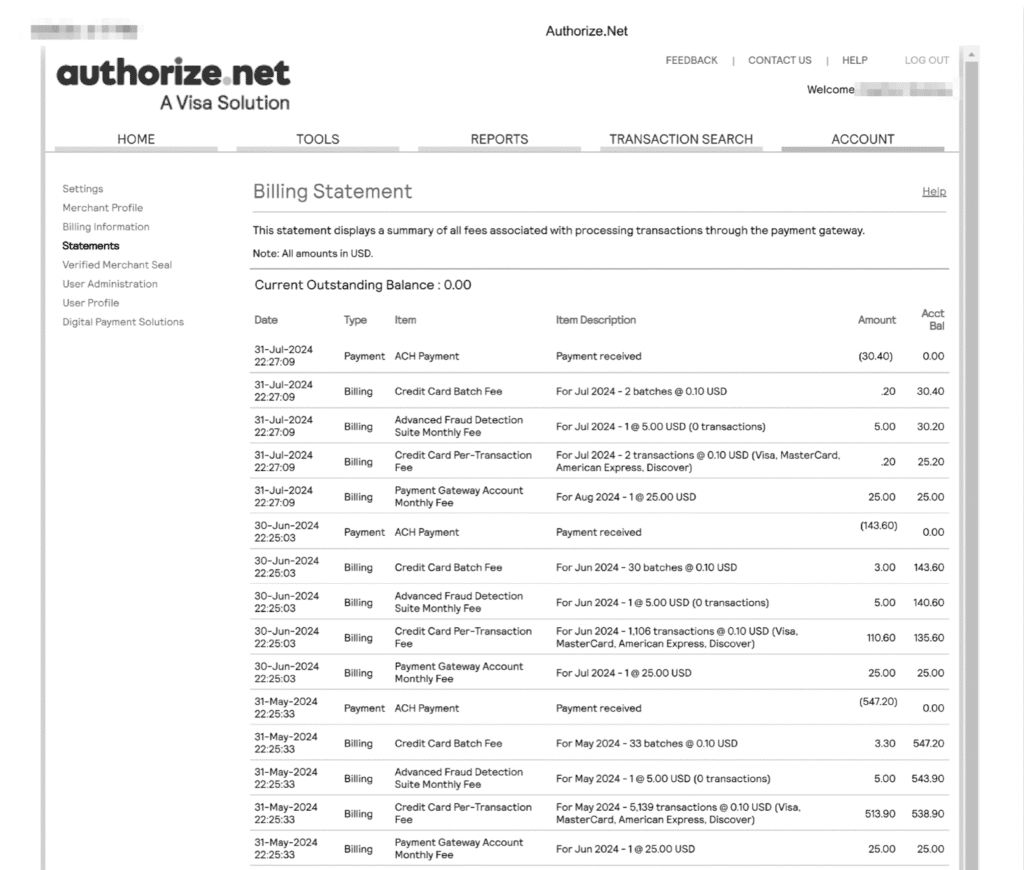

Here’s a closer look at a typical Auth.net statement that you can access online:

It’s fairly straightforward in terms of what you’re paying. But it’s not nearly as in-depth as the types of statements you’ll see directly from other payment processors.

I suggest that you take the time to learn how to read your merchant statements to ensure your processor isn’t overcharging you or double-billing you for what you’re already paying to Auth.net.

What to Expect From Authorize.net 2.0

Auth.net 2.0 began rolling out in phases on April 16, 2025. Since this is still in its infancy stages, it’s too early to tell exactly how good this upgrade actually is.

But here are some highlights based on how Visa has promoted it:

- Better user experience.

- New AI tools to automate tasks and optimize payments.

- Ability to issue invoices by speaking to the Auth.net platform.

- An updated, modern interface for Auth.net partners

- Enhanced security features

Visa is also rolling out a new unified checkout experience and a new ARIC Risk Hub.

Authorize.net Alternatives

If you want to compare Auth.net to other popular payment gateways and virtual terminals, these four alternatives are a good starting point:

Auth.net vs. Stripe

Unlike Auth.net’s limited capabilities, Stripe offers a more complete payment ecosystem with powerful developer tools and customizable options—making it significantly more robust for merchants that have complex integration requirements.

That said, Auth.net is still better if you want a simpler approach. Stripe requires more technical knowledge and resources to implement.

It’s also worth noting that Stripe’s technical superiority comes at a steeper price point. Unless you’re processing a high volume of payments, it’s tougher to negotiate a better rate with Stripe.

Read our full Stripe review to learn more.

Auth.net vs. PayPal

If you like Auth.net’s simple approach, PayPal is equally easy to use and it’s more well-recognized amongst consumers. While Auth.net is extremely popular, PayPal wins this popularity contest (as it’s the most popular payment gateway in the world).

But PayPal’s virtual terminal is considerably more expensive than Auth.net. So if you’re looking for a more economical approach, you can lean towards Authorize.net to save some money.

For new businesses that don’t have a merchant account, you can’t get one from PayPal. Instead, you’ll get a PayPal merchant ID—which isn’t the same thing as a merchant account number. Auth.net has a similar option, but you’ll have access to cheaper rates if you get a merchant account elsewhere and then just rely on Auth.net for your gateway needs.

Check out our PayPal review for more insights.

Auth.net vs. Braintree

Braintree shines above Auth.net in virtually every category. They have some of the best technology in the payments industry, and they offer interchange-plus pricing at competitive rates.

Some merchants may still prefer Auth.net’s simplicity for basic phone payments over the phone through a virtual terminal. But in the vast majority of cases, it’s tough to find a reason to use Auth.net over Braintree.

We break down all of Braintree’s prices, pros, cons, and capabilities in our Braintree review.

Auth.net vs. Adyen

One unique difference between Adeyn compared to Auth.net is that Adeyn is equally strong for in-person payment acceptance. This makes Adyen a better option to consider if you want a single provider to unify your payment systems across multiple channels.

I love Adyen’s interchange++ pricing structure and unprecedented transparency. This is definitely a bit more complicated for the average person (compared to Auth.net’s simple statements). But overall, it’s a net positive in terms of what you’re paying and truly understanding your rates.

Explore our in-depth review of Adyen to see if its advanced features are a better option for your business.

Our Final Thoughts on Auth.net

Overall, Auth.net is a fairly basic payment gateway and virtual terminal. While it’s one of the most popular options in this category, there are other solutions on the market offering superior technology and better rates.

It’s fine if you need a simple option for your online store or accepting payments over the phone.

But Auth.net definitely fell behind the competition over the years in terms of its features, integrations, and capabilities.

The jury is still out on Auth.net 2.0. But I’d be surprised if these new and improved changes bring Authorize.net ahead of its competitors.