Gingr is one of the most popular pet care solutions on the market today. The software has facilitated 150+ million reservations for over 9+ million users globally. It’s used by pet trainers, groomers, boarding businesses, dog parks, doggy day cares, and more.

The cool part about Gingr is that it’s an end-to-end software that covers everything from internal operations to client-facing reservations and includes integrated payment processing so businesses can accept card payments directly within the software.

This review is for anyone who’s considering Gingr, particularly Gingr Payments. But it’s also a great option for existing Gingr customers who want to make sure they’re getting the best rate on integrated processing.

And if you’re considering migrating from PetExec to Gingr (because of PetExec’s new 1% gateway fee), we’ll compare the two solutions so you can make an informed decision.

MCC Quick Take on Gingr Payments

All of our clients using Gingr are happy with the software. It works as advertised, and it’s clear that Gingr is an industry leader for good reasons.

In terms of Gingr Payments, the integrated processing solution is convenient. However, the advertised flat-rate prices are high—even for integrated processing standards (which will always be slightly higher than traditional processing).

Whether you’re a current or prospective Gingr customer, here’s what you need to know:

- Gingr Payments is powered by Stripe on the backend.

- Alternatively, Gingr users can set up integrated processing with CardConnect.

- Gingr claims that the CardConnect rates are higher (because they want you to use Gingr Payments instead).

- But in reality, Gingr doesn’t set your rates if you’re using another processor.

- PetExec users are being nudged to switch to Gingr payments to avoid a new 1% gateway fee (Gingr’s parent company acquired PetExec).

Read on for a more in-depth explanation of Gingr Payments, including its features, payment comparison options, and how to ensure you’re getting the best possible rate.

Gingr Payments Pricing and Key Features

Gingr software is charged as a monthly subscription model, with all three plans supporting integrated payments.

- Spa (for Groomers and Trainers) — $105 per month

- Play (for Daycares and Training Facilities) — $145 per month

- Stay (for Overnight Boarding) — $155 per month

There’s also an enterprise plan designed for pet care businesses managing multiple facilities.

It’s also worth noting that the Stay plan jumps to $180 per month if you choose not to use Gingr’s integrated payments solution. This is the only plan that promotes a discount rate in the advertised features (which translates to interchange-plus pricing instead of flat-rate pricing).

Regardless of how you set up integrated processing, you still have to pay for the Gingr subscription separately. Then your processing costs are charged per transaction, with other miscellaneous fees and charges along the way.

With Gingr Payments, you’re getting:

- Online and in-person payment acceptance.

- Ability to collect deposits and charge subscriptions to cards on file.

- PCI compliance built-in.

- Automatically batched payments (so you don’t need to manually reconcile).

- Ability to accept tips during checkout.

Overall, the payments solution is solid and works nicely within the software for merchants and consumers alike.

Gingr Integrated Credit Card Processing Overview

Let’s quickly clarify how payment processing works with Gingr so you fully understand your options.

- Gingr is the pet business software (no payments by itself).

- Gingr Payments is Gingr’s branded payments solution—but it’s powered by Stripe on the backend.

- CardConnect is a different third-party processor that integrates with Gingr’s pet software.

So if you want to set up integrated payments with Gingr, you essentially have two options—Gingr Payments and CardConnect.

Gingr Payments (Powered by Stripe)

Gingr isn’t actually a payment processor. So to create and facilitate Gingr Payments, they need to work with a provider who can actually handle the payment processing on the back end. So that’s where Stripe comes into play.

While Stripe handles the actual processing, Gingr sets the rates for its service and provides customer-facing support. Base rates start at:

- 2.79% + $0.05 for in-person transactions

- 2.99% + $0.40 for card-not-present transactions

That’s why the advertised rates are inflated. Gingr needs to earn enough of a markup to earn a profit even after they pay Stripe for its role in the process.

Stripe has excellent technology, and we have no major issues with them as a payment processor. But Gingr Payments is effectively just offering Stripe’s base flat-rate pricing, which is laughable when you really understand how much lower this rate could be.

If you look at our Stripe review, you’ll see we have clients paying 0.22% + $0.15 per transaction on an interchange-plus model, and as low as 0.09% + $0.08 per transaction on a blended structure for high-volume businesses.

Integrated processing does deserve a slightly higher markup because of the setup. But you shouldn’t be paying more than 50 basis points over the interchange rate. Gingr Payments is structured to potentially pay more than 100 basis points over interchange, which is just too much.

So don’t accept their standard rates. Despite the perceived simplicity, flat-rate processing eats into your margins.

CardConnect

CardConnect is a different payment processor altogether. It’s best known for its payment gateway (CardPointe), and this is just another option to consider when you’re trying to set up integrated processing with Gingr.

To be clear, CardConnect has nothing to do with Gingr Payments. It’s an alternative solution to Gingr Payments within Gingr’s pet software.

But here’s the catch. For facilitating the integration, there’s a chance CardConnect needs to pay a commission to Gingr on your transactions. I don’t have direct proof of this, but I know this is common practice in the payments industry for integrated payments within software.

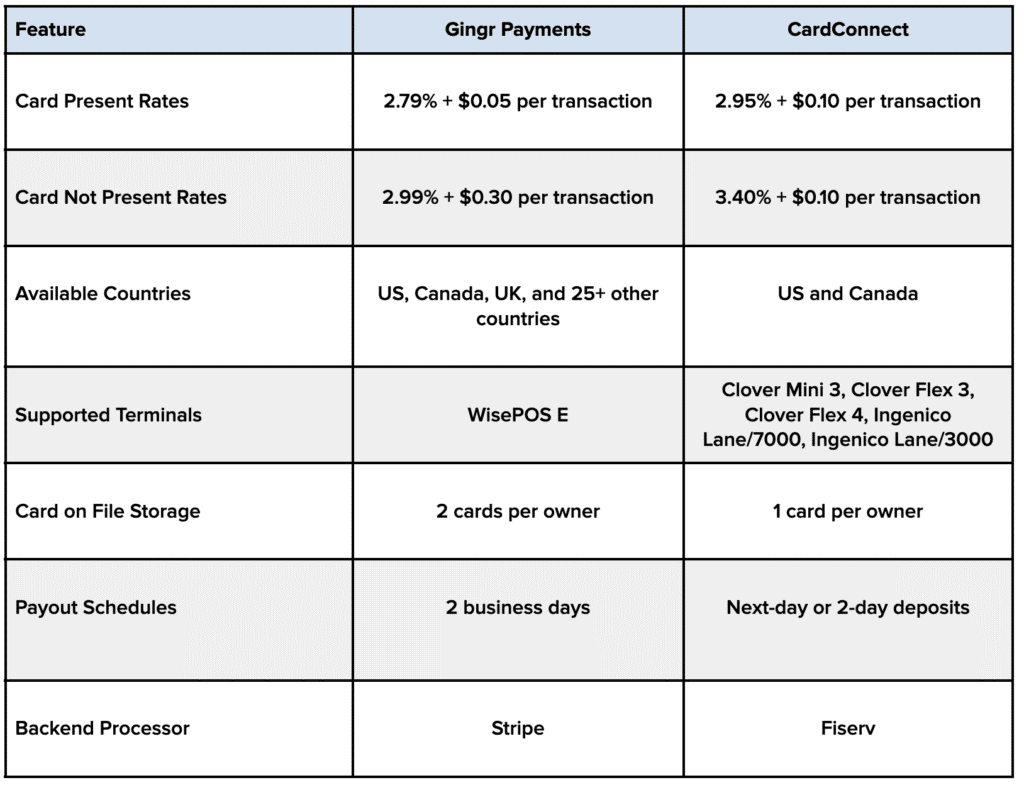

Technically, Gingr Payments and CardConnect are competitors when it comes to setting up an integration within Gingr. That’s why on Gingr’s website, CardConnect’s standard rates are higher than Gingr Payments, starting at:

- 2.95% + $0.10 for in-person transactions

- 3.40% + $0.10 for card-not-present transactions

These rates are outrageously high.

And when listed side-by-side with Gingr Payments, they seem even more expensive (because Gingr wants you to use Gingr Payments instead of CardConnect).

But I know for a fact that you can contact CardConnect directly to get a lower rate on interchange-plus processing. Gingr does not set your rates here.

That’s because CardConnect is a super ISO of Fiserv. So they have access to lower rates.One drawback of CardConnect is that they do have lots of other miscellaneous fees, including monthly minimums, gateway fees, and they also try to increase rates on a regular basis. You can check out our CardConnect review to read more about this in greater detail.

Gingr Payments vs. CardConnect

Gingr Payments vs. PetExec

Since Gingr acquired PetExec, the company has been nudging PetExec users to switch to Gingr Payments. They added a new 1% gateway fee to PetExec, and they’re telling PetExec customers that they can avoid this fee by switching to Gingr Payments.

While it’s true that staying with PetExec right now is likely going to be more expensive, migrating to Gingr Payments isn’t a slam-dunk decision.

Sure, it’s the same parent company that’s offering fully integrated payments with no gateway fee.

But as you can see from everything in this review, Gingr Payments has its own drawbacks—especially when it comes to pricing. The flat-rate structure is high, and it’s just designed to earn more profits for Gingr (not give you the lowest possible rate).

Gingr is clearly leveraging its control over PetExec to push users toward its own processing solution. But you can use that same leverage to negotiate better terms.

Gingr doesn’t want to lose PetExec customers because all that revenue goes to the same parent company. So before you feel pressured into switching, contact our team at MCC for a full statement audit to assess your options.

We’ll help you save money without switching providers. And if switching is the only option, we’ll make sure you get the best possible deal (whether it be with Gingr Payments, CardConnect, or something else).

Final Thoughts on Gingr Payments

Gingr’s software is as solid as it gets. But Gingr Payments is far from perfect.

It’s expensive if you don’t know what you’re doing and just blindly accept the rates offered to you by a sales rep. But you can actually get much lower rates if you know how to negotiate.

This holds true for both Gingr Payments and CardConnect.

Neither processor has your best interest in mind. They just want to charge you as much as possible so they can earn a high profit. And with integrated processing, they want to charge you even more because of the extra setup steps and commissions they need to pay on the back end.

Navigating this stuff alone can be tough, but with a merchant consultant on your side, all the leverage shifts to your corner. Contact MCC today to discuss your options, and we’ll help you get the best possible rate on integrated payment processing with Gingr.