If you’ve just spotted the Infrastructure Upgrade Fee on your merchant processing statement, you’re dealing with a bogus charge that’s continuing to increase every year.

This annual fee has been quietly appearing on merchant accounts, and the rate itself is seemingly arbitrarily applied across different accounts.

Here’s everything you need to know about this junk fee and how to get it removed from your account.

What is the Infrastructure Upgrade Fee?

The Infrastructure Upgrade Fee is an annual charge imposed by certain payment processors, allegedly to cover costs associated with upgrading or maintaining processing infrastructure.

But this is complete nonsense. It’s just another way for your processor to extract more money from your account.

Unlike legitimate assessment fees charged by the card networks (like Visa and Mastercard), the Infrastructure Upgrade Fee is completely made up by the processor. It goes straight into their pockets as an additional profit on top of the regular markup you’re paying them to process your transactions.

It’s most commonly found on statements written exactly as Infrastructure Upgrade Fee. But other variations can include:

- Infrastructure Fee

- Annual Infrastructure Fee

- System Upgrade Fee

- Technology Infrastructure Fee

This fee is typically charged in October of each year. But depending on your processor, it could be assessed at different times or potentially multiple times throughout the year.

How Much Does the Infrastructure Upgrade Fee Cost?

The cost of the Infrastructure Upgrade Fee varies and has been steadily increasing year over year, with processors charging whatever they can get away with.

Just in the last two years alone, we’ve seen at least four different amounts charged by multiple processors. For example:

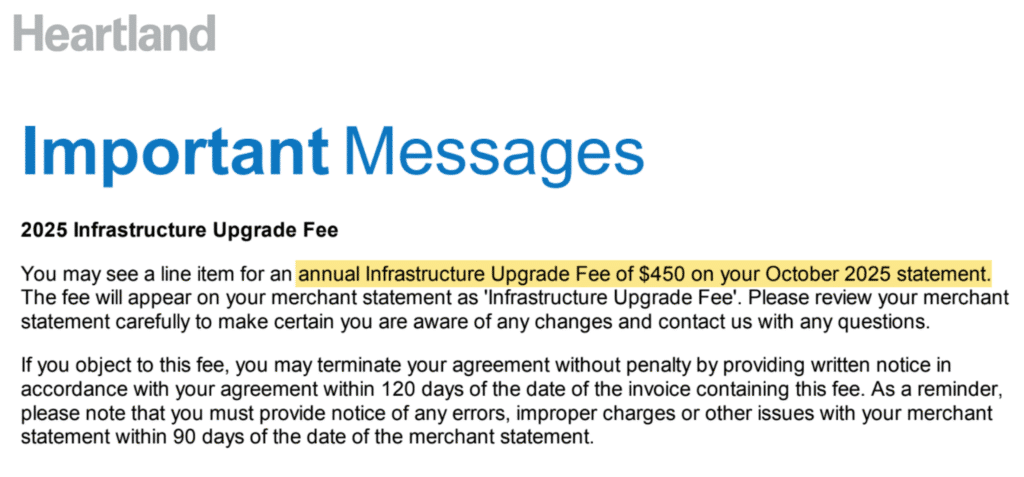

- $450 by Heartland Payments in 2025

- $254 by Heartland Payments in 2024

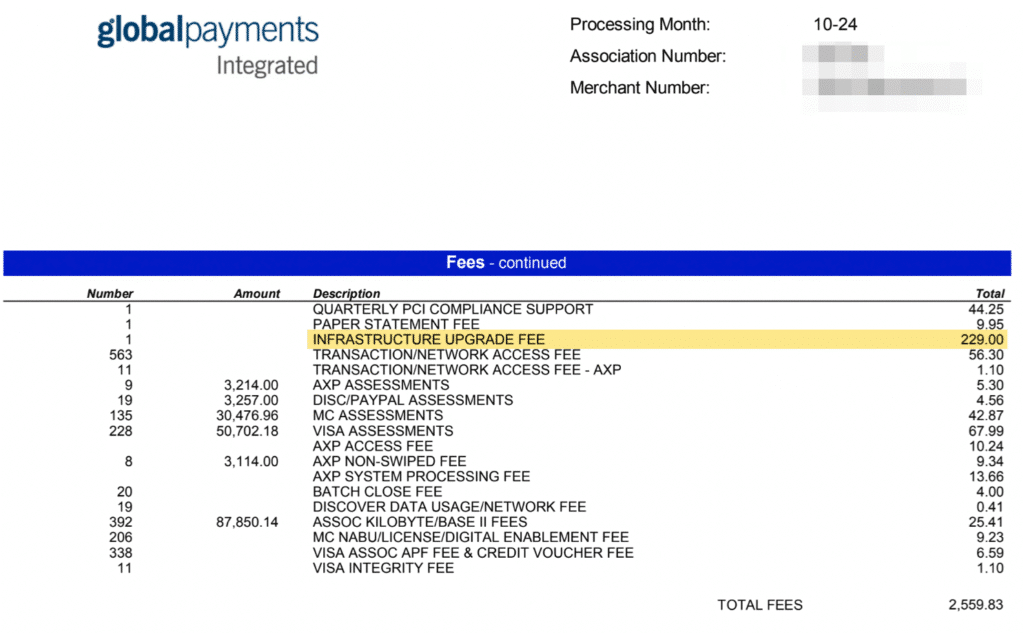

- $229 by Global Payments in 2024

- $169 by Cayan and TSYS in 2024

That’s right. Four processors, and four wildly different rates—with the highest and most recent ($450) nearly triple the amount from just one year ago.

Even if you look just at Heartland, you see a drastic increase from $254 to $450 in one year. There’s no justification for a 77% increase in “infrastructure” costs year over year. This is simply your processor testing how much they can squeeze out of you before you start pushing back.

At this rate, the fee could be pushing $800 by next year and eclipsing the $1,000 mark after that.

Who Charges the Infrastructure Upgrade Fee?

The Infrastructure Upgrade Fee primarily comes from Global Payments and its various subsidiaries. Since Global has acquired numerous processors over the years, this junk appears across multiple brands, including:

- Global Payments

- Heartland Payment Systems

- TSYS

- Cayan

- OpenEdge

This pattern should look familiar if you’ve been following Global’s practices over the years.

They consistently add bogus fees across all of their brands, like the Settlement Funding Fee and Risk Assessment Fee.

Is the Infrastructure Upgrade Fee Legitimate?

Absolutely not. The Infrastructure Upgrade Fee is 100% a junk fee.

Here’s why it’s complete garbage:

Infrastructure upgrades are a normal cost of doing business for processors. Every technology company needs to maintain and upgrade its systems. That’s not something that merchants should pay extra for. These costs are already baked into your regular processing rates.

The fee provides no additional value or service to merchants. You don’t get faster processing, better customer service, new features, or anything else in exchange for the fee. You’re paying hundreds of dollars for literally nothing.

Rates are completely arbitrary. If this were a legitimate fee based on actual infrastructure costs, you’d expect to see consistent pricing across accounts. Instead, we see wildly different amounts charged to different businesses with no explanation or justification.

Real Examples of the Infrastructure Upgrade Fee

I want to show you exactly what I mean about how these rates are arbitrarily determined using real examples from merchant statements.

First, here’s one of the cheapest rates we’ve seen on Cayan and TSYS accounts:

At $169 charged annually, it may not seem like the end of the world. But as you’re about to see, this can quickly escalate.

Here’s another example from a Global Payments statement from October 2024:

At $229 it’s slightly higher. But still not the end of the world.

What’s interesting about this fee is that it comes in the same month that Heartland announced a $254 Infrastructure Upgrade Fee that was applied in October 2024.

Remember, Heartland is owned by Global Payments. So why is Global charging $229 while Heartland is charging $254? Because the fee is completely arbitrary.

Now fast forward to October 2025, and here’s the notice being sent to Heartland merchants:

How did Heartland get from $254 to $450 so quickly? And how did Global (who is ultimately setting these rates for all of their brands) get from $178 to $450?

That’s what processors do. They want to make as much money as possible on your account. If it means inventing fees and increasing the rates every year, they have no problem with it.

And if you don’t speak up, they’ll assume you don’t have a problem with it, either.

What to Do if You Find an Infrastructure Upgrade Fee on Your Statement (and How to Get it Removed)

Whether you received a notice about the upcoming charge or you found the Infrastructure Upgrade Fee while reading your monthly statement, you don’t have to just sit back and let your processor take advantage of you.

Here are some steps that you can take to get it removed.

Step 1: Contact Your Processor

Call your processor immediately and demand the removal of the fee with a full refund. Don’t accept their excuses about “infrastructure costs” or “system improvements.”

This is purely an additional markup disguised as a necessary charge.

Step 2: Reference Your Right to Object

For those of you with Heartland or another Global subsidiary, reference the termination clause in the fee notice. We do NOT recommend canceling your account over this fee (it’s not worth it).

But you can use this as a negotiation tactic and let them know that you’re prepared to terminate the agreement if the fee isn’t removed. Trust me, they won’t want to lose an account generating tens of thousands of dollars over a couple hundred dollars.

Step 3: Escalate if Necessary

If the first representative you speak with is refusing to help you, hang up and call back. Keep asking to speak with a retention specialist, account manager, or supervisor.

Be persistent. Processors often hope you’ll just accept these fees without fighting back.

Step 4: Get Professional Help

If you’re not getting anywhere on your own, consider working with a merchant consultant who has experience negotiating these types of fees with processors.

Here at MCC, we can help you remove this bogus charge and even help you negotiate a better rate on your total processing fees. Regardless of your processor and how the fee is labeled, we find savings on 96% of statements we audit.

Why the Infrastructure Upgrade Fee is a Major Red Flag

Finding an Infrastructure Upgrade Fee on your statement is typically just the beginning of your problems. While $200 or even $450 charged once a year might not seem like a huge deal, the fee is almost always accompanied by other junk fees that could be costing you thousands.

This is especially true for Global Payments, Heartland, TSYS, Cayan, and other Global subsidiaries.

If your processor is bold enough to charge you $450 for absolutely nothing, they’re definitely taking advantage of you in other ways.

Sometimes it’s just other small and bogus charges that add up to a few thousand dollars every year. Other cases are more extreme, like padded assessments or rate increases resulting in tens of thousands in charges every month.

Processors intentionally make your statements difficult to read. So it’s usually tough for the average business to spot these overages on their own.

Final Thoughts

The Infrastructure Upgrade Fee may just be a single line item that appears on your account in October. And it’s one of thousands of line items on your statement throughout the year. But this single charge represents everything that’s wrong with the payment processing industry.

It’s literally a made-up fee that provides zero value to merchants while generating pure profit for processors.

What makes this fee particularly egregious is that the infrastructure maintenance and upgrades are just standard operational costs of operating a payment processing business. It would be like a hotel charging a “new pillow fee” or “elevator maintenance fee.” Customers shouldn’t be paying extra for basic operational expenses.

So if your processor is charging you an Infrastructure Upgrade Fee, it’s a clear sign that they’re trying to take advantage of your account and they don’t think you’ll do anything to stop them.

Don’t let them get away with it. This fee should be removed from your statement along with any other junk fees they’ve quietly added over time. And if you need help, contact our team for a free consultation.