US businesses paid a record $187.2 billion in processing fees last year, with interchange fees accounting for roughly 80-90% of those costs.

While interchange fees can be complicated, modern businesses can’t afford to be uninformed on how they work. A basic understanding of how to calculate interchange fees can help your business save thousands of dollars.

Read on for a simple answer on how interchange fees work, how to calculate interchange rates, real examples, and implications for your business.

What Are Interchange Fees?

Interchange fees are transactional charges between banks for processing a credit or debit card transaction. There’s an interchange rate associated with every card transaction, and the rate itself is set by the card network (Visa, Mastercard, Amex, and Discover).

Technically, the interchange rate is paid by the acquiring bank (merchant’s bank) to the issuing bank (cardholder’s bank) to cover costs associated with maintaining the card and processing the transaction.

But interchange fees are passed through to merchants from payment processors. So businesses ultimately end up paying the interchange fee, plus an additional markup to their processor whenever they accept a credit or debit card transaction.

How to Calculate Interchange Fees

Interchange rates are calculated based on several factors, including the card type, payment method, business, and transaction amount. Here’s what needs to be accounted for to determine the interchange fee:

- Card Network — Visa, Mastercard, Discover, and American Express all set their own rates for interchange categories. Whichever brand logo is on the card is the first step to determining the interchange fee category and corresponding rate.

- Card Type — Credit cards have different interchange rates than debit cards. There are also various interchange categories for different tiers of consumer rewards cards, commercial cards, and more.

- Transaction Environment — Interchange rates vary depending on whether the card was processed in-person (card-present) vs. online, over the phone, or manually keyed (card-not-present). Recurring transactions and cards on file also have their own interchange categories.

- MCC Code — There are specific interchange categories based on the merchant category code, like retail, restaurant, small business, grocery, etc.

- Transaction Size — Depending on the business type and merchant category, some interchange rates are tiered based on transaction amount (Ex: $1,000+) or the merchant’s total annual volume with a specific card brand.

- Processing Data — Submitting Level 3 transaction data like sales tax, quantity, shipping out, etc,. can qualify for lower interchange rates on commercial credit cards. Conversely, failing to submit minimum data requirements can cause transactions to downgrade to the most expensive possible interchange rates.

On every unique transaction, the corresponding interchange matrix for the card brand is used to calculate the interchange rate.

How Much Are Interchange Fees?

In the US, the average interchange rate for credit cards is around 1.7% to 2.2% of the transaction amount. Debit card interchange rates range are lower, closer to 1.19% on average.

There are hundreds of different interchange fees published by the card networks, with rates based on factors like card type, merchant category, transaction environment, and more.

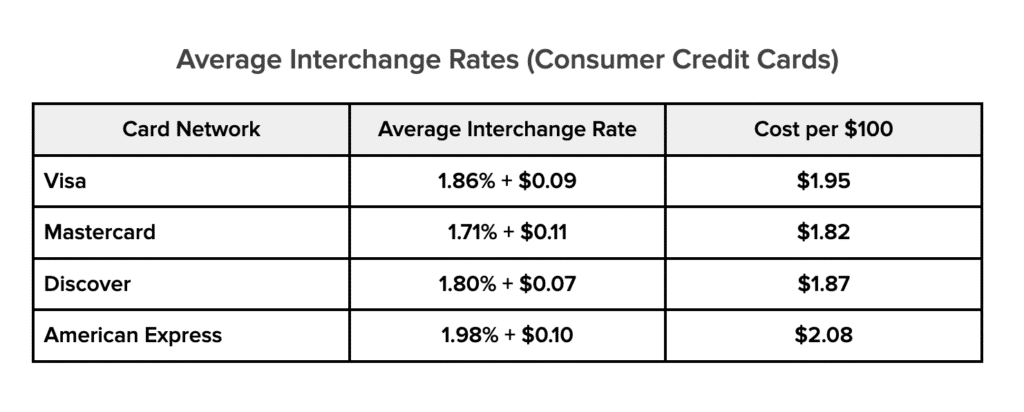

Average Interchange Rates

Between all four card networks, the average interchange rate is 1.8375% + $0.0925 on consumer credit cards.

These numbers come from analyzing 533 individual interchange rate categories across all four card networks, specifically looking at consumer credit card transactions.

The average interchange rates for unregulated debit card transactions are a bit lower.

- Visa: 1.17% + $0.18

- Mastercard: 1.04% + $0.18

- Discover: 1.35% + $0.14

American Express doesn’t issue traditional debit cards, so that’s why they’re excluded here.

Do All Businesses Pay Interchange Fees?

All businesses that accept credit cards pay interchange fees.

There’s an interchange category and corresponding rate for every single credit and debit transaction. This gets paid by the merchant acquirer to the issuing bank, but the acquirer passes their costs to the business that processed the transaction.

So if your business accepts card payments, you’re paying interchange fees.

Identifying Interchange Rates (With Real Examples)

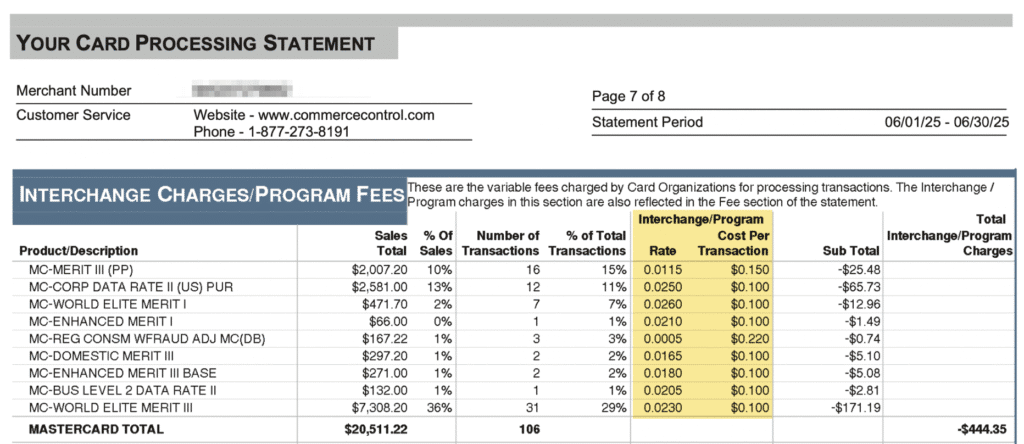

Your processor should be breaking down all of the interchange rates on your monthly processing statement. Here’s a sample from a recent statement from one of our clients, showing all of their Mastercard interchange rates from June 2025:

As you can see, there are 9 different interchange categories, just for this merchant’s Mastercard transactions.

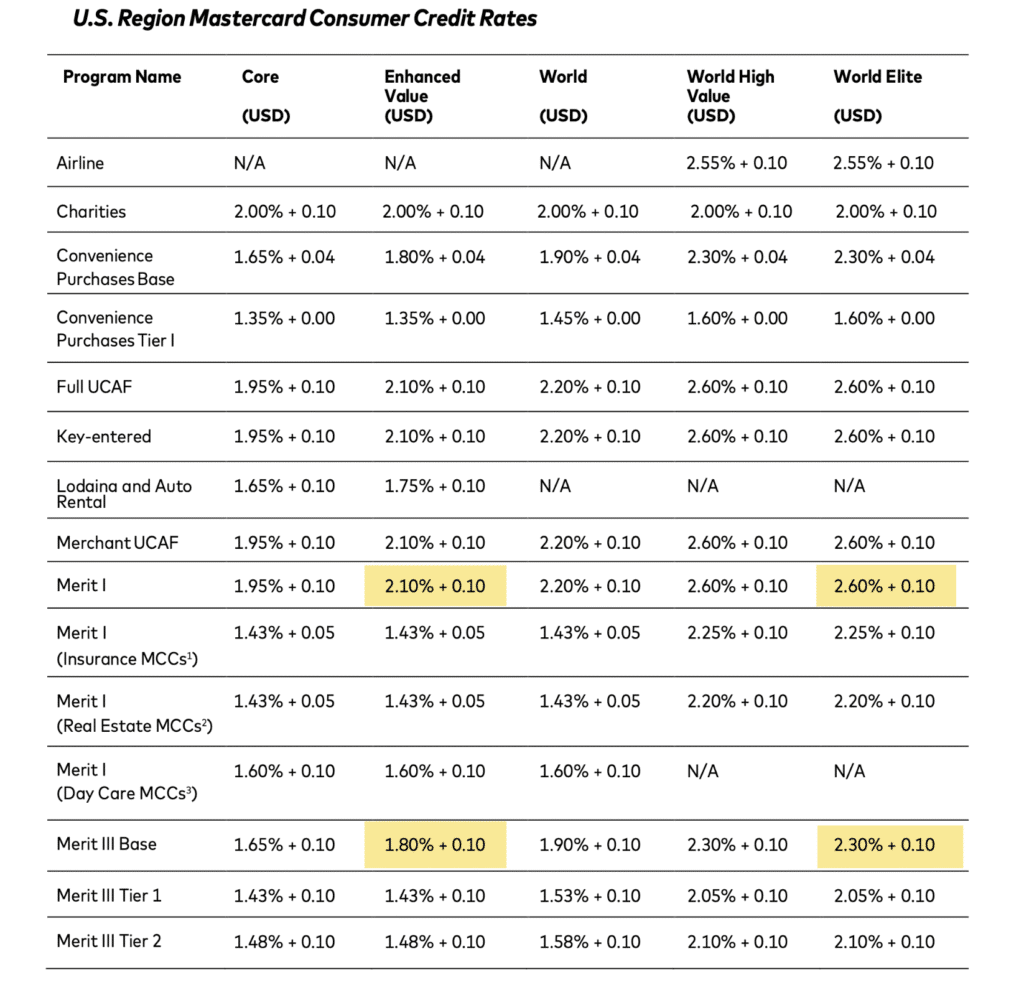

If you compare this Mastercard’s interchange matrix sheet, we can find these categories and verify the rates:

Four of the nine interchange categories paid by the merchant can be found on this page:

- MC World Elite Merit I – 2.60% + $0.10

- MC Enhanced Merit I – 2.10% + $0.10

- MC Enhanced Merit III – 1.80% + $0.10

- MC World Elite Merit III – 2.30% + $0.10

If we compare these to the statement, you can verify the rates are accurate.

Again, this is a very small snippet. We’re just looking at Mastercard transactions that happen to all fall on this page. This business paid dozens of other interchange categories for Visa, Amex, and Discover as well.

That’s why it’s so important to learn how to read your merchant statements so you actually know what you’re looking at every month, and you can determine how your interchange rates are being calculated.

Interchange vs. Interchange Plus

The term interchange refers to the category rate imposed by the card networks, while interchange-plus is a specific type of pricing model offered by payment processors.

With interchange-plus pricing, businesses pay the wholesale interchange rate that’s paid to the issuing banks, plus a markup to the processor who facilitates the transaction (hence the name, interchange plus).

For example, let’s say your processor charges you a 0.10% + $0.10 markup. You’d still pay the interchange fee for every sale, but you’d add 0.10% + $0.10 to the interchange rate to get your true processing cost for each particular transaction. So if the interchange rate was 1.65% + $0.10, you’d actually pay 1.75% + $0.20.

Interchange vs. Flat-Rate Pricing

Interchange fees are still paid by merchants on a flat-rate pricing plan, but the way it happens is a bit different. Remember, it’s the processor’s responsibility to pay the interchange fee to the issuing bank. Then they get reimbursed by the merchant in the form of a pass-through fee.

But with flat-rate pricing, the merchant is passing through the wholesale interchange rate at cost. Instead, they’re charging a flat fee for every transaction (like 2.9% + $0.30), and paying the interchange rate themselves.

This is extremely profitable for processors and terrible for merchants because the flat rate is typically so much more expensive than the actual interchange rate.

Refer back to the average interchange rates we discussed earlier. Between the four card networks, the average rate is roughly 1.84% + $0.09 per transaction. If your processor is charging you a flat rate around 3%, it means they’re pocketing the difference of 1.15% on every sale.

While it sounds simple, flat-rate processing destroys profit margins. It’s much more cost-effective to pay the wholesale interchange rate plus a small markup to your processor.

Are Interchange Fees Regulated?

Only debit card interchange fees are regulated in the United States. As part of the Durbin Amendment to the Dodd-Frank Act of 2010, regulated debit card transactions can be charged a maximum interchange rate 0.05% + $0.21 per transaction.

But this only applies to issuing banks with $10 billion or more in assets.

The Fed has proposed lower caps to further regulate debit card interchange fees (discussed in an October 2023 board meeting). But this has yet to be officially established.

Some states have proposed their own rules to regulate interchange fees. For example, Illinois passed a new law to prohibit interchange fees on sales tax and tips. But the vast majority of interchange fees, including all non-debit card transactions are not regulated at the federal or state levels.

Are Interchange Fees Negotiable?

No, interchange fees are one of the only components of payment card processing fees that are non-negotiable. All interchange fees and assessments charged by the card networks are set in stone and paid on every transaction.

However, any fees imposed by your processor can be negotiated. This includes interchange-plus markups, flat fees, random monthly fees, and anything else they’re charging you as part of their service.

So if you feel like your payment processing costs are getting expensive, that’s where you can save money.

Final Thoughts

Paying interchange fees is an unavoidable operating expense for businesses that accept credit and debit cards. But understanding how interchange rates are calculated can help save you money.

For example, businesses accepting commercial cards can qualify for reduced interchange rates with Visa’s new CEDP program. Even if that doesn’t apply to your business, you might look for ways to avoid the most expensive interchange categories by encouraging certain types of payments (like having customers pay in person for store pickups instead of collecting their payment over the phone).

If your processor tells you that you can “avoid interchange fees” by signing up for a flat-rate plan, then you’re definitely overpaying.

Contact our team here at MCC for help optimizing your interchange rates. We’ll help lower your credit card processing fees without switching providers or changing any operations.