If TSYS is your payment processor and you see a Transaction Network Access Fee on your monthly statement, you’re being charged for absolutely nothing.

This fee appears right alongside legitimate card network charges and actual assessment fees, and it’s designed to look official. In fact, it looks so legit that most businesses glance past it, assuming that it’s just a normal part of credit card processing.

But it’s a junk fee that’s likely costing your business thousands of dollars per year.

Read on to learn more about this charge and how you can get rid of it.

What is the TSYS Transaction Network Access Fee?

Transaction Network Access Fees are processor markups disguised as card network assessments. As the name implies, TSYS claims that this fee is charged for giving your business access to using the card networks (Visa, Mastercard, Amex, and Discover).

If you spot this fee on your statements, you’ll notice it’s itemized right in the middle of other legitimate assessment fees from the card networks.

This placement is intentional. TSYS wants you to assume this is just one of those unavoidable network fees that every processor passes along to merchants. They’re counting on you just lumping the cost together with legitimate charges and never questioning it.

TSYS even goes as far as to separate the Amex Transaction Network Access Fee as its own line item, making it look like an even more official network requirement.

How Much is the Transaction Network Access Fee?

Transaction Network Access Fees from TSYS used to cost $0.10 per transaction. But the Transaction Network Access Fee doubled to $0.20 per transaction in January 2025.

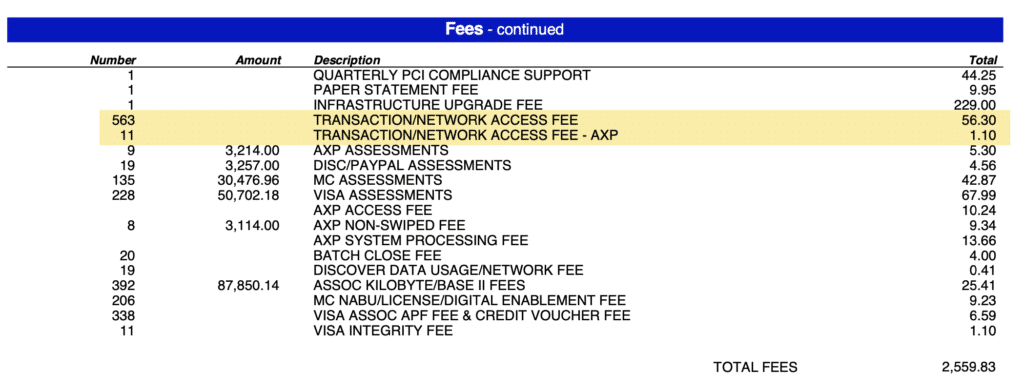

Here’s an older statement with the $0.10 rate:

563 transactions x $0.10 per transaction = $56.30

11 Amex transactions x $0.10 per transaction = $1.10

As you can see, the fee is listed alongside legitimate card network assessments, plus some other junk fees mixed in (like a $229 infrastructure upgrade fee, $9.95 for TSYS to send you a paper statement, and $44.25 for PCI support).

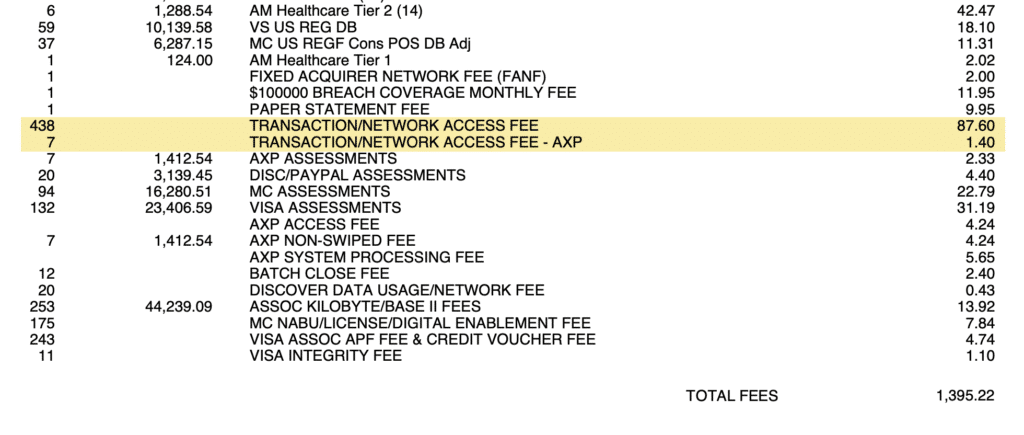

And here’s a more recent statement with the Transaction Network Access Fee charged at $0.20 per transaction:

438 transactions x $0.20 = $87.60

7 Amex transactions x $0.20 = $1.40

Again, same story here. The fee is buried amongst legitimate charges, including FANF Fees, NABU Fees, Digital Enablement Fees, and more.

So to the untrained eye, it’s easy to overlook this bogus charge from TSYS.

Why the Transaction Network Access Fee is Junk

The Transaction Network Access Fee is a made-up processor markup from TSYS.

How do I know this? There are several reasons:

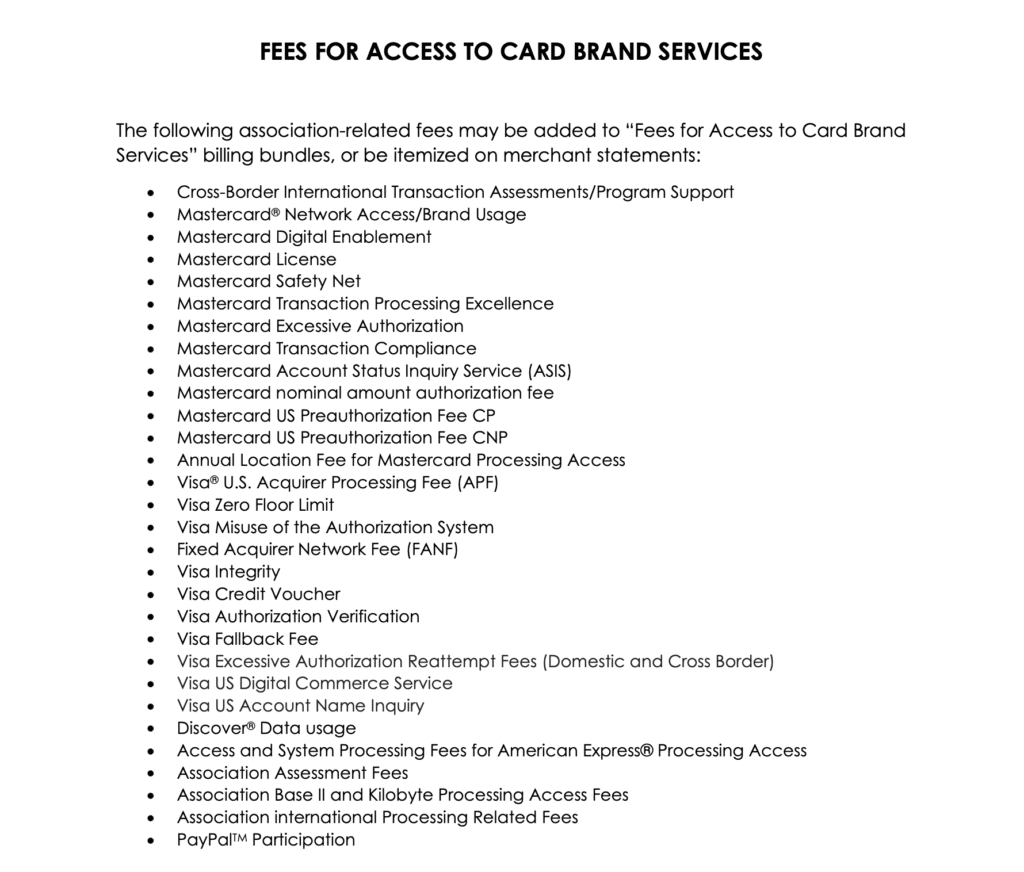

First, TSYS publishes official documentation of their legitimate network access fees, and this charge isn’t on the list.You can go directly to the TSYS Merchant Documents page to see for yourself. Then scroll down to the PDF called Fees for Access to Card Brand Services. Here’s a screenshot of that document:

Notice what’s NOT on this list? The Transaction Network Access Fee.

That’s because it’s not a real network fee. It’s not charged by Visa, Mastercard, Discover, or American Express. It’s not an assessment fee or a pass-through cost.

The other reason why I know this fee is garbage is because we audit statements from dozens of different processors every month. The Transaction Network Access Fee only shows up on TSYS accounts.

If it were a legitimate network requirement, every processor would be charging it. And they don’t.

Plus, we’ve been successful in getting TSYS to remove this fee for clients. That would be impossible to do with legitimate network fees.

The Real Cost of Transaction Network Access Fees is More Than You Think

At first glance, $0.10 or $0.20 might not seem like much. But let’s do the math.

If you process 1,000 transactions per month at $0.20 each, that’s $2,400 per year going straight to TSYS for nothing. If you process 5,000 transactions monthly, that’s $12,000 per year.

And for high-volume merchants processing 20,000+ transactions per month? You’re paying $48,000+ annually for literally nothing.

That’s money being charged on top of the legitimate interchange fees, legitimate card network assessments, and your TSYS processor markup.

Junk fees are a way for processors to pad their margins without directly increasing your rates.

Maybe you currently pay TSYS a markup of 0.50% per transaction. It’s high, but you can live with it.

But once you start factoring in the Transaction Network Access Fee and other random processor fees on your statement, like:

- Infrastructure Upgrade Fees

- Settlement Funding Fees

- Global VPN Fees

- Analytics Reputation Management Fees

Don’t forget about the paper statement fees. Now your true processor markup might be closer to 1% or more per transaction.

Processors like TSYS have become so good at disguising junk fees as legitimate charges that you’ve likely seen these on your statements every month and have no idea that you’re being overcharged.

What to do About Transaction Network Access Fees on Your TSYS Statements

If TSYS is your credit card processor, then pull your most recent statements and find the fee.

Calculate how much you’re actually paying. Multiply your average monthly transaction count by $0.20 (or $0.10 if they haven’t hit you with the increase yet), then multiply by 12 months.

Once you see the real cost, you have options:

- Contact TSYS directly.

- Ask them what this service fee actually covers, and why it’s not listed in their official network fee documentation.

- Tell them to remove the fee and refund you for the charges (they probably won’t, but it’s worth documenting you tried).

- Call back and try again. Keep sending emails, and keep escalating the situation.

- Beyond this fee, you should also be asking them to remove other bogus charges from your account and get a reduced rate per transaction while you’re at it.

If you’re not sure how much you’re overpaying or whether TSYS is hitting you with other junk fees like this one, we can help.

Our team at MCC can audit your statements for free, identify overcharges, and negotiate directly with TSYS on your behalf.

Final Thoughts

Despite the name, the TSYS Transaction Network Access Fee is not a network fee at all. It’s not an assessment or pass-through fee, either. It’s just a junk fee that TSYS created to squeeze more money from businesses while disguising it as something official.

TSYS is part of Global Payments, and this is the type of aggressive billing tactics that we see from all Global subsidiaries.

At $0.10 or $0.20 per transaction, it adds up fast. And there’s a good chance that if TSYS is charging you this fee, they’re overcharging you elsewhere on your statement, too.

It’s time for you to do something about it. Call TSYS out on their BS, and demand that they give you a reasonable rate without all of these extra charges.

Learn More: TSYS Payment Processing Review