GuestSuites is an all-in-one hotel management software that includes features to support online reservations, accounting, channel management for third-party booking sites, and more. It’s used by traditional hotels, resorts, vacation rentals, campgrounds, and even versatile enough to support country clubs and other membership organizations.

One of the most popular capabilities within GuestSuites is its integrated payment processing, which allows you to accept credit cards both in-person and online.

But the payment processing features from GuestSuites are often misunderstood. While it’s part of your software subscription cost, the actual processing is handled by a separate merchant services provider.

This may seem like a minor detail. But it’s crucial when it comes to your costs.

If you let this go unmonitored or just assume GuestSuites is getting you a good deal on processing, I can guarantee you’ll end up overpaying by thousands of dollars every single month.

GuestSuites Integrates Exclusively With Shift4 for Credit Card Processing

Shift4 is the only merchant services provider that integrates with GuestSuites (hotel-software.com). This is both good news and bad news for very different reasons. Here’s why:

Good

- Shift4 has everything you need to accept payments at your properties and online.

- Their technology is modern, easy to use, and secure.

- The integration with GuestSuites is seamless.

- It works both in the GuestSuites POS and on the backend in terms of reporting, reconciliation, and within the other PMS capabilities.

Bad

- Only having one integrated provider to choose from means you lose some leverage when it comes to negotiating competitive rates.

- Shift4 is known for adding some bogus fees to merchant statements that will increase your overall costs.

- Expect your rates to increase every year or two, even if you think you’re “locked in” to a contract.

- We’ve found some billing errors on Shift4 statements when auditing them for our clients (all of which resulted in overcharges).

Overall, it’s never ideal when you only have one payment processor to choose from in an integrated setup. And while Shift4 is far from the worst option on the market, I wouldn’t say they’re the best, either.

Integrated Payment Processing in GuestSuites is Optional

With all of that in mind, you’re not forced to use Shift4 at your hotel, resort, or whatever property you’re managing via GuestSuites.

If you’re already set up with an existing processor and considering GuestSuites to streamline your management capabilities, you can keep your existing provider and use GuestSuites hotel software independently.

The integrated setup is definitely a preferred choice for many properties. But switching processors is a hassle, and it’s very expensive (despite what your new processor claims to offer as an incentive for switching).

For a hotel with multiple properties, this headache likely isn’t worth it.

You can still use GuestSuites to manage online bookings and integrate online travel agencies (Booking.com, Expedia, Google Hotels, etc.), but the payment processing capabilities will be separate.

If you’re unsure about what to do right now, you can still sign up for GuestSuites. Just keep your current merchant services provider, and if you change your mind down the road, you can always add on the integrated processing module at any time.

SkyTab POS (from Shift4) is Available in Addition to the GuestSuites POS

Here’s another common area of confusion for businesses using or considering GuestSuites. You have two different POS systems to choose from, which can also be used jointly. These are your options:

- GuestSuites POS

- SkyTab POS (from Shift4)

- A combination of GuestSuites POS and SkyTab POS

Point-of-sale software isn’t included in the base price of your GuestSuites subscription. So when you’re customizing the add-ons, you can select GuestSuites POS and/or SkyTab.

The only reason to consider SkyTab is if you decide to use the integrated payment solution from Shift4. Otherwise, just stick with GuestSuites POS.

It’s also worth noting that, while some standard POS features will overlap, these two systems offer different capabilities.

Here are some of the key features and notable differences of each.

GuestSuites POS

- Works with existing touch screen monitors, so you may not have to purchase additional hardware

- Guest folio billing from restaurants, bars, spas, room service, etc.

- Inventory tracking and ordering capabilities

- Online credit card authorizations

- Employee time tracking and attendance

SkyTab POS

- Requires specific SkyTab hardware powered by Shift4.

- Mobile-friendly systems without being tied to a specific desk or counter.

- Ability to create customer profiles with room preferences, menu favorites, and targeted email campaigns.

- Automated customer satisfaction surveys.

- Supports EMV payments and tokenization capabilities.

There’s definitely a case for using both of these jointly.

If you decide to use the integrated setup with Shift4, it’s best to go with all SkyTab POS payment terminals. And in addition to the payment collection, you can rely on the GuestSuites POS for stuff like folio management, inventory, and employee time tracking.

Integrated Processing Will Increase Your Base GuestSuites Software Cost

Even though the integrated payment processing isn’t handled directly by GuestSuites, they still use this as an opportunity to bill you for the feature.

Pricing is customized based on your property size and specific needs, but generally speaking, here’s how your costs will change by adding payment capabilities.

Cloud Version of GuestSuites Pricing

- +$50 per month for credit card processing

- +$50 per month for SkyTab POS

- +$100 per month for GuestSuites POS

Desktop Deployment of GuestSuites Pricing

- +$450 per installation for credit card processing

- +$500 per installation for SkyTab POS

- +$950 per installation for GuestSuites POS

It’s important to understand that these payments go directly to GuestSuites, not Shift4. All this does is unlock the capability for these features within the GuestSuites software.

And while added costs obviously aren’t ideal, this actually isn’t the end of the world.

Normally, it’s common for payment processors to pay commissions to software providers for supporting their integration. It’s nearly impossible to confirm or detect when this happens. But in this case, GuestSuites may not need to get a kickback from Shift4 because they’re collecting extra fees directly from you.

So Shift4 won’t need to egregiously inflate your rates to cover the commission (since it may not exist).

But the Actual Payment Processing Costs Are Billed Separately From Shift4

Beyond the monthly or one-time installation fee you’re paying to GuestSuites, all of your merchant services fees are going to be billed by Shift4.

This includes:

- SkyTab POS fees

- Interchange fees

- Assessment and card brand fees

- Discount rates

- Per-transaction markups

- Authorization fees

Anything that has to do with processing credit card transactions is going to come from Shift4.

And to get started with them, you’ll need to go through the full underwriting process to open a new merchant account. This is completely outside the scope of GuestSuites, and that’s how your rates are based.

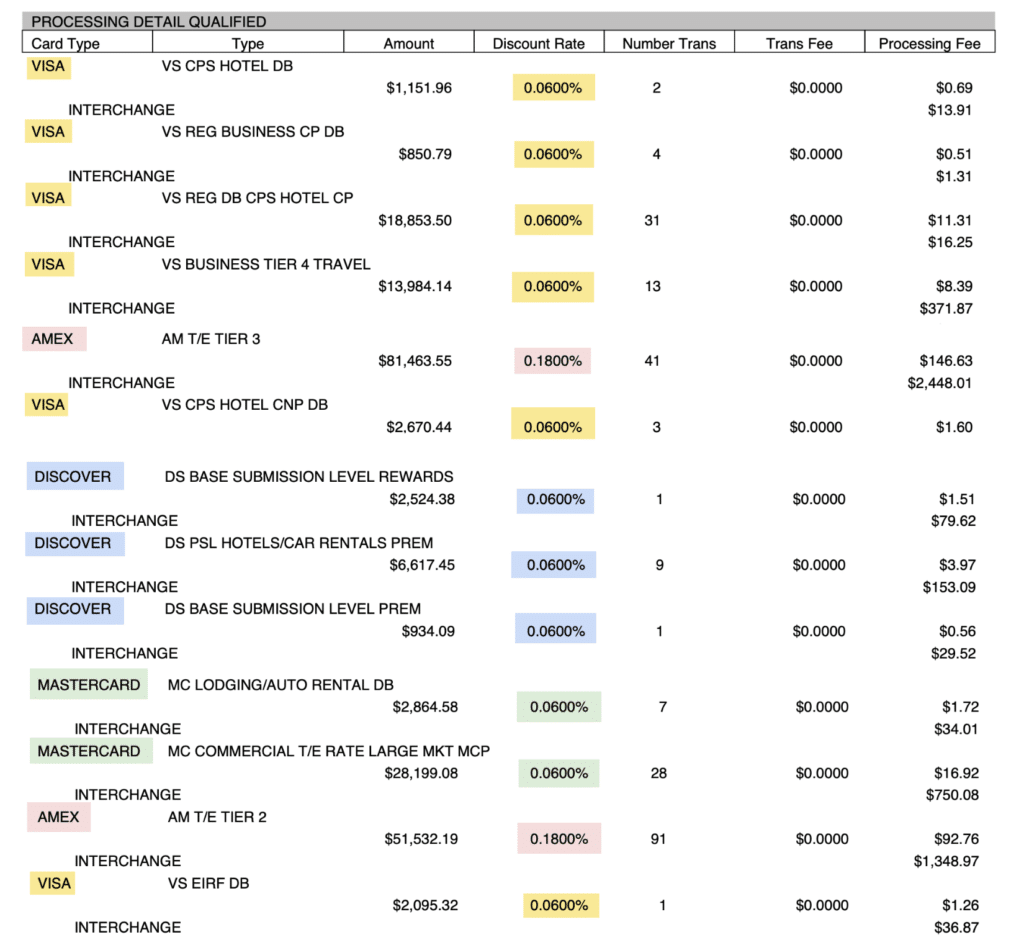

Rates are based on your volume, property type, and specific needs. But to give you a general sense of what we’ve seen, here’s a decent rate from a hotel client of ours that’s using Shift4:

I highlighted Visa, Amex, Discover, and Mastercard in different colors so you can see how the discount rate varies for each.

Everything is 0.06% (6 basis points) per transaction, except for American Express, which is 0.18% (18 basis points) per transaction.

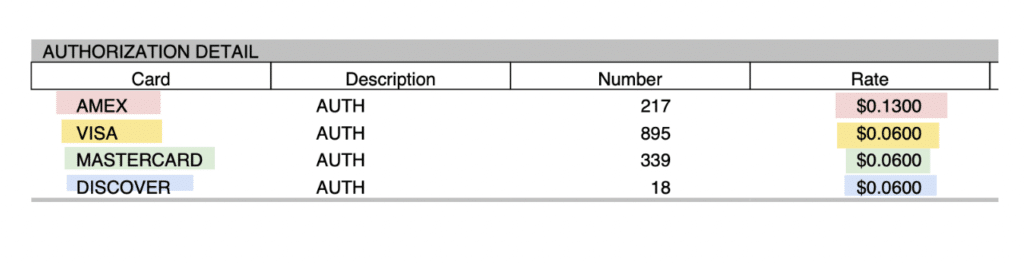

Here’s a look at the authorization rates Shift4 is charging this particular hotel:

When combined we get:

- Visa – 0.06% + $0.06 per transaction

- Mastercard – 0.06% + $0.06 per transaction

- American Express – 0.18% + $0.13 per transaction

- Discover – 0.06% + $0.06 per transaction

The Amex rate is definitely a bit high.

But overall, 0.06% + $0.06 isn’t bad. Feel free to use this as leverage when you’re negotiating your own rates with Shift4. It’s proof that they’re willing to go this low, and you can clearly see the hotel interchange categories in the first screenshot I showed you.

(VS CPS Hotel, AM T/E, DS PSL Hotels, MC Lodging, etc.).

GuestSuites Does Not Set or Control Your Merchant Services Rates

I mentioned this already but it’s worth stating again to emphasize clarity.

GuestSuites is only your hotel management software (and potentially your POS provider).

In terms of the merchant services being provided, all they do is support the direct integration from Shift4, and that’s where their role ends.

We’ve consulted with lots of hotel properties that were confused by this arrangement because the initial onboarding (including the integrated processing from Shift4) all began on the GuestSuites website (hotel-software.com).

So when they have billing questions or issues with their processing rates, they naturally contact the support team at GuestSuites.

But that’s the wrong place for merchant services support.

When it comes to your discount rate, interchange, assessments, and other processing fees associated with merchant services, you need to contact Shift4 directly. They handle your merchant account.

You Need to Pay Close Attention to Shift4’s Rate Increases, Fees, and Known Billing Tactics Applied to Hotels

In addition to the rate you pay per transaction (0.06% + $0.06, or whatever you’re able to negotiate), Shift4 is likely going to charge you a range of other markups to increase their margins.

Every processor does this.

But they all do it in their own unique way, which can sometimes make it harder to determine which fees are legitimately tied to a service or purely profit centers for the provider.

Here’s what you need to know about Shift4:

- Make sure you’re on a true interchange-plus plan (NOT “simple change” pricing).

- Shift4 charges a $325 Regulatory Assurance Fee annually per device.

- They also charge a $99 Annual Program Fee per device.

- (Yes, that’s 2 different annual fees).

- You’ll pay an extra 0.02% on your total volume for monthly billing instead of daily billing.

- Shift4 increased rates twice last year (once in March and again in September).

- Most merchants were hit with one of these increases.

- Amex support fees are notably high, in addition to the already higher-than-normal Amex discount rates.

It’s also worth noting that we’ve found billing errors on Shift4 statements.

Look, everybody makes mistakes. And I can’t sit here and say that these errors are intentional. But I can say that I’ve never once found an error that resulted in a Shift4 merchant paying less than they were supposed to. Every instance involved an overcharge.

In one particular case, Shift4 overcharged a client of ours by $2,100+ in a single month.

The craziest part about this is that it would be so easy to overlook because everything was correct, except for the final amount billed. If we weren’t auditing these statements every month as part of our service, there’s a high probability this error would have continued and eventually cost this business $25k+ per year.

Final Thoughts

GuestSuites is a solid and legitimate solution for hotels, resorts, and properties of all sizes.

But GuestSuites is NOT a payment processor. If you want to accept payments within the software interface and have everything connected, you’ll need to go through Shift4.

Otherwise, just keep your current provider and use GuestSuites as a standalone system.

Shift4 is fine, but they’re far from perfect and definitely not worth switching processors for.