When it comes to shopping online, most consumers have grown accustomed to using credit cards and debit cards to complete the purchase process. PayPal and digital wallets like Google Pay or Apple Pay are popular options as well.

But some customers may want to use ACH payments for ecommerce transactions.

If you’re looking to add some variety to the payment methods on your ecommerce website, ACH payment processing could be a viable option to consider.

Is ACH payment acceptance right for your ecommerce website? Continue below to learn more.

What is an ACH Payment?

Let’s start with the basics. ACH stands for “Automated Clearing House.” This network was originally created to reduce the usage of paper checks. It connects banks across the US to facilitate electronic transfers between accounts.

In simple terms, an ACH payment is a bank-to-bank transaction.

All transactions in the ACH network are governed by NACHA, formerly known as the National Automated Clearinghouse Association.

An ACH payment needs to be authorized by the customer. To accept ACH payments online, you’ll need the following information from the buyer:

- Customer name

- Bank name

- Bank account number

- Bank routing number

- Electronic transfer amount

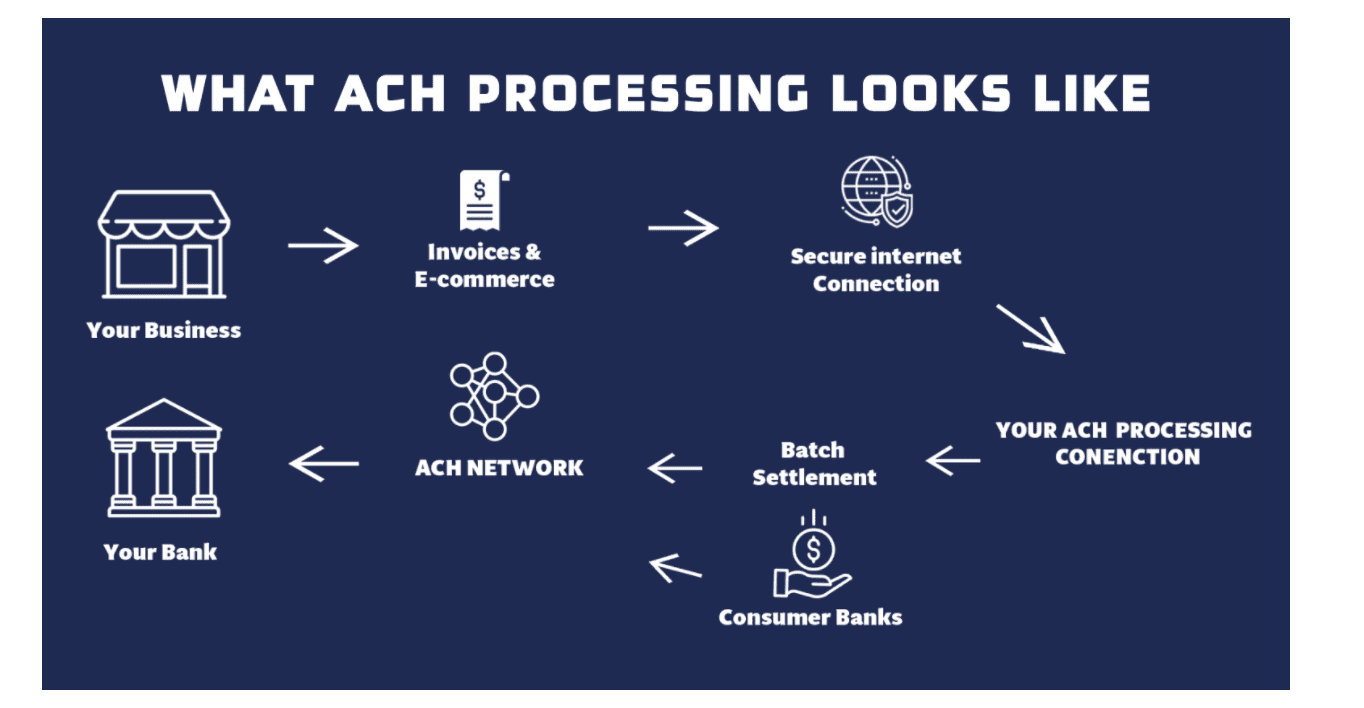

If ACH payments are collected online, the customer will need to check a box or e-sign a form with their authorization for the transaction. Here’s a visual representation that shows what ACH processing looks like for ecommerce websites:

Bank accounts associated with the ACH transaction must be verified before a purchase can be processed, which makes this payment method a safe and reliable way to handle ecommerce sales online.

Benefits of Accepting ACH Payments

There are several reasons why ecommerce businesses should consider accepting ACH payments. I’ve identified and explained those benefits in greater detail below.

Cost

ACH payments are extremely cost-effective. These transactions aren’t subject to the interchange rates and assessment fees imposed by the card networks and issuing banks.

The exact cost for an ACH transfer depends on the processor you’re using. But generally speaking, these fees will be significantly lower than credit cards. Flat-fees typically fall in the $0.20 – $1.50 range per transaction. If your processor charges by percentage, ACH transactions usually cost somewhere around 0.5% – 1.5%.

Recurring Payments

For those of you who offer products or services that require recurring billing, ACH payments are an excellent option.

You can definitely use them for one-time transactions as well. But in many cases, high-ticket recurring transactions are facilitated with ACH payments online. Some examples include utility payments, insurance premiums, and rent payments.

Flexibility

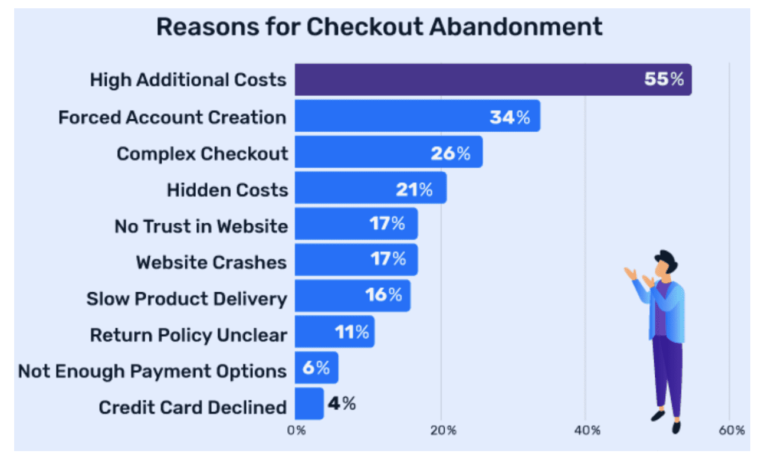

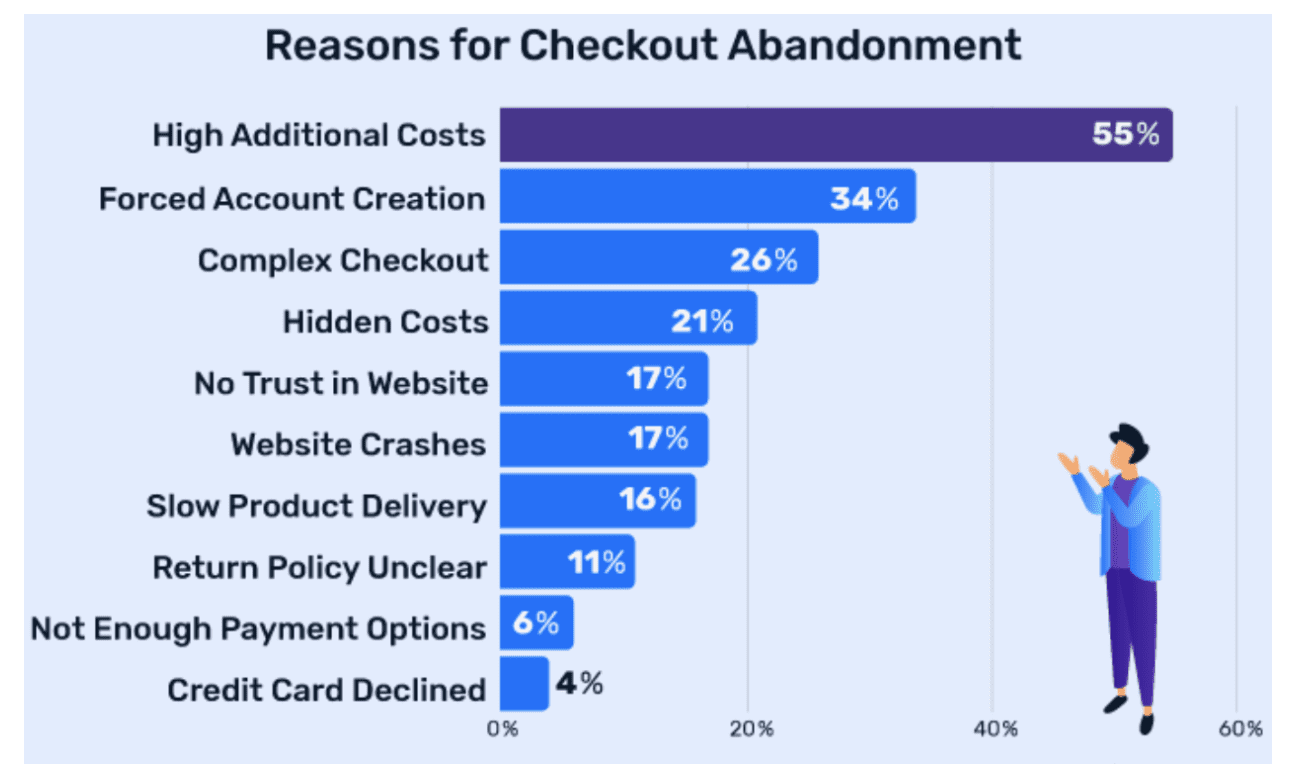

It’s always in your best interest to give your customers as many options as possible to pay for goods and services online. Lack of available payment methods is one of the top ten reasons for shopping cart abandonment online.

Imagine this scenario. A visitor lands on your website and adds something to their cart. But when it’s time to check out, they want to pay via ACH transfer. If you don’t have that option on your website, you could lose out on the sale.

29% of Americans don’t have any credit cards. You need to give those people alternative payment options.

Chargebacks

There are only three reasons where a customer can dispute an ACH transfer:

- Unauthorized transaction.

- Transaction was completed earlier than the authorization date.

- Transaction amount and authorization amount do not match.

Credit card chargebacks, on the other hand, can be disputed for basically any reason the consumer can think of. Furthermore, customers don’t have nearly as much time to file a dispute for ACH payments.

It’s worth noting that merchants can’t dispute any ACH reversals. But the probability of an ACH payment being disputed is low.

High-Risk Industries

If you fall into a high-risk merchant category, you might have trouble getting approved for processing credit cards. But you can use ACH payments as an alternative method of getting paid online.

Down the road, you can use your ACH payment history as a way to qualify for credit card acceptance.

Payment Failure

Credit cards and debit cards typically expire every three years. This can cause payment failures for recurring billing and card-on-file transactions.

But checking accounts don’t have expiration numbers. So you won’t have to worry about this happening with an ACH transfer.

ACH Payment Processing Time

ACH payments typically take longer to receive than a credit card or debit card payment. In terms of cash flow, this is definitely something that must be taken into consideration.

The slower processing time helps ensure that you’re only receiving payments from verified and authorized bank accounts.

Any ACH debit (taken from the customer’s account) must be settled the following business day. ACH credits (deposited to the merchant’s bank account) typically take up to two business days.

For the most part, you can expect it to take 3-5 business days for an ACH transaction to appear in your bank account.

How to Accept ACH Payments For Ecommerce

The first step to accepting ACH payments is locating an ACH payment provider. You’ll also need a payment gateway and a processing account that’s connected to that gateway.

These are the most common ways that merchants can start accepting ACH payments:

- Merchant Services Providers (MSPs)

- Payment Service Providers (PSPs)

- Standalone ACH Processors (such as business bank accounts)

- Software Providers (such as accounting or invoicing software)

Inquiring with your existing processor is the most logical place to start. But that won’t always be your best option. So shop around and compare rates, fees, features, and the general user-experience of other ACH payment providers.

Final Thoughts

Should your ecommerce business accept ACH payments?

This payment acceptance method is common for B2B ecommerce sites, high-risk merchants, subscription services, and membership sites. ACH payments are great for any company using a recurring billing business model.

If you’re just selling t-shirts or small-ticket products direct to consumers, ACH payments might not be necessary. But it’s still nice to give your customers the option to buy with as many different payment methods as possible.

Plus, ACH payments can help lower your overall processing rates.