Credit card refunds can be a pain for merchants. Regardless of your business size or industry, these annoying transaction fees can be costly for many different reasons.

If you’re issuing a refund, the customer is obviously not happy or satisfied with your products or services. Maybe they are returning a product, or maybe your services just fell short of their expectations. Even though the customer might be disgruntled, you can actually use the refund process as a way to build trust with your customers and keep them coming back in the future.

With that said, if your customers paid for their initial purchase with a credit card, you’ll likely incur some additional fees for processing the return with their original payment method.

Unfortunately, refunds are just part of doing business. But most merchants don’t even realize that returns are costing more than just the costs associated with COGS, shipping, and more.

Are you paying a credit card refund fee? Do merchants get charged for credit card refunds?

This in-depth guide answers everything you need to know about credit card refunds and refund transaction fees. Read on to learn more.

How Do Credit Card Refunds Work?

Before we dive into credit card refund fees, it’s important for you to understand how the credit card refunds process works.

The entire refund process can be simplified into three quick steps:

- The merchant refunds the amount (in-full or partial) back to the credit card using a POS system or virtual terminal.

- The refund will show up on the cardholder’s statement as a credit. This process typically takes at least a few business days.

- The issuing bank reverses any promotions like points or cash back from the cardholder’s initial purchase.

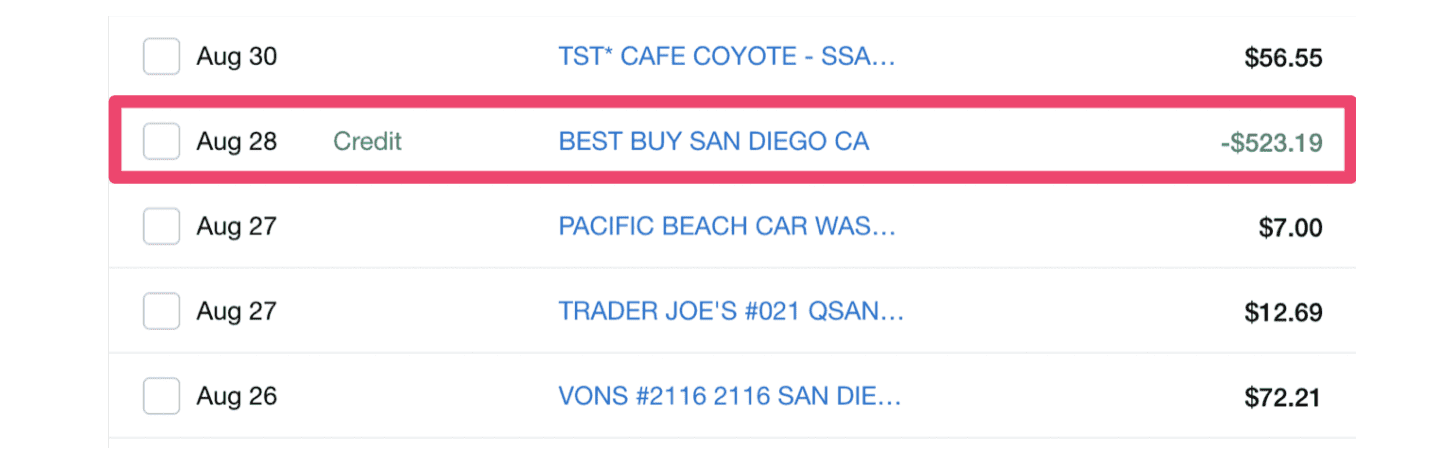

As a cardholder, we all know what this looks like on our statements. Here’s an example of credit issued by Best Buy on an online Amex statement:

That’s the simple way to explain what happens when a refund is issued. It’s essentially the “big picture” view of the process.

But from the merchant’s perspective, there are a few more things that you need to keep in mind to fully understand how credit card refunds work. The most important factor to consider is how the product or service is being sold or delivered.

For example, let’s say you’re selling online through an ecommerce marketplace. You might not have total control over the refunds process. Some marketplaces have their own rules and return policies, and merchants have less say in how returns get processed or who pays for shipping.

If you’re handling the entire refund yourself, either through an in-person POS terminal or in-house fulfillment center, things will be a bit more straightforward. However, you might incur losses that go beyond just the loss of the sale.

Credit Card Refund Fees Explained

When a credit card refund occurs, every penny gets credited back to the customer. In simple terms, if the total sale was $100, the customer will eventually receive a $100 credit back to their statement.

However, this may not be the case for you. Depending on your credit card processor, the refund could cost you some extra money.

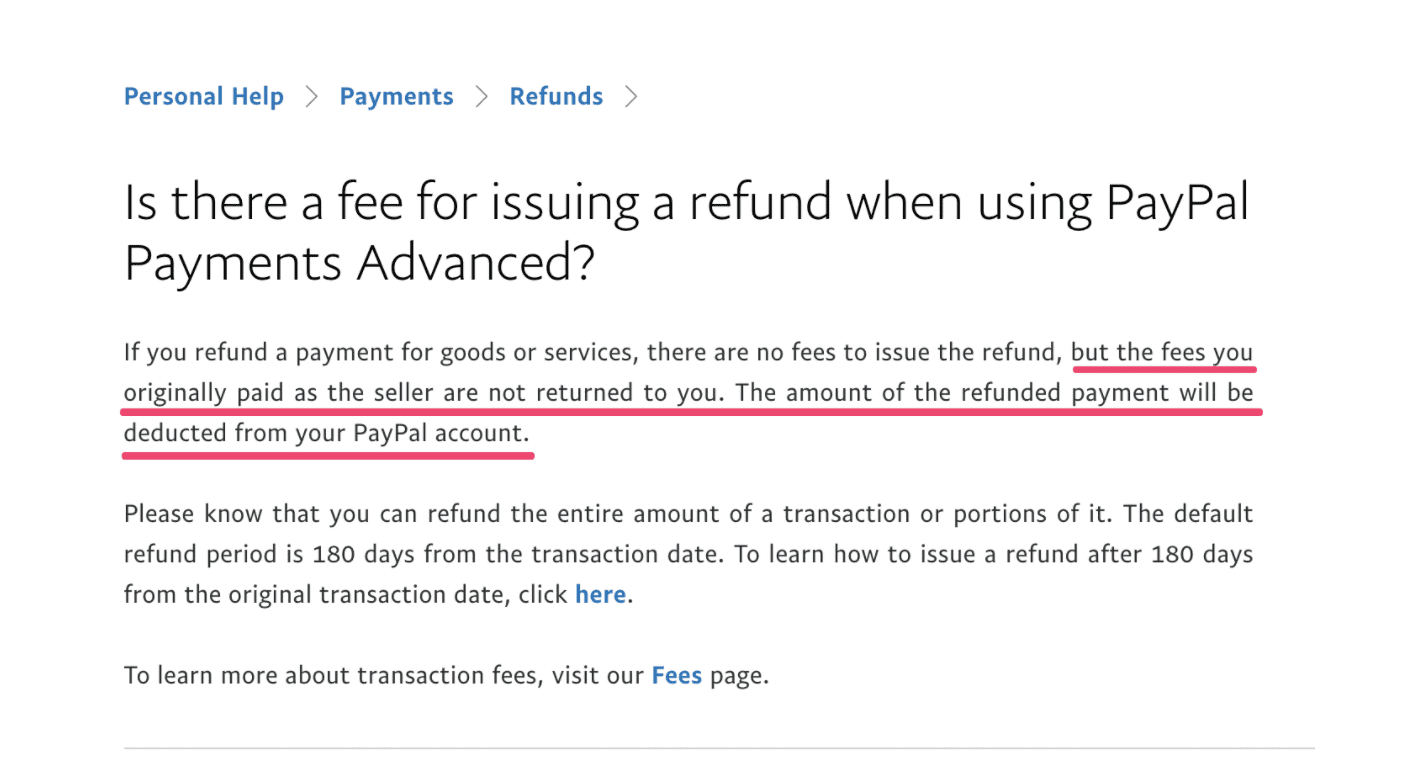

For example, let’s say you’re using Stripe or PayPal to process transactions. Neither of these companies refunds you the original transaction fees when you issue a return.

So is there a refund fee? Technically no. But it’s still going to cost you money as a merchant.

Let’s continue using the $100 example. The standard processing rate for both of these platforms is 2.9% + $0.30 per transaction. So while the customer gets the $100 back in-full, these processors would both keep $3.20 from your end when the refund occurs.

Again, this all depends on the processor you’re using. In some instances, it could also depend on the credit card that was used in the transaction as well.

Here’s another example. Payment Depot is a popular credit card processing company. To keep businesses happy, Payment Depot does not keep the processing fees associated with a transaction that was ultimately refunded. But there is one exception—American Express. Amex doesn’t refund the interchange fees from a transaction that was refunded, so neither does Payment Depot in this scenario.

Some credit card processors will refund the processing fees, but charge you a flat-rate fee for returns. This could be as little as $0.05 or $0.10.

These fees might not necessarily appear on your transaction as a “credit card refund fee.” But you may not be getting your processing fees back.

While this is frustrating, it’s important to understand why this is happening. The financial institutions still want to be compensated for their role in moving money around. For a refund, they had to move money around twice, and feel as though they should still be paid.

How to Handle Refunded Transactions

Regardless of your business type or industry, a refunded transaction is bound to happen eventually. This is especially true for certain industries, like ecommerce merchants.

When it comes to refunded payments, you need to consider the fees paid as just a cost of doing business. These can come in many forms, either as a percentage fee of what was originally paid, a flat fee for refunds, or potentially a combination of the two. You’ll even pay interchange fees for partial refunds. Many merchants think that a partial refund is somehow a loophole to avoid the fees, but that’s simply not the case.

Make sure you have a fair and repeatable process to issue funds back to the customer’s account. Provide your staff with more information about your process to ensure the steps are followed correctly each time. You’ll also need to make your bookkeeper aware of refunded transactions so they can update your records and reconcile the bank statements appropriately.

How to Avoid Credit Card Refund Fees and Refund Transaction Fees

The easiest way to avoid the credit card refund fee is by limiting your returns and providing exceptional customer service. If possible, try to issue store credit instead of returning money back to the credit card. Just make sure all of this is clearly outlined in your returns policy and refund policy.

With that said, you need to tread carefully when it comes to returns. If you’re not willing to refund the cardholder, they can just go over your head and contact their credit card company directly. The only exception is if a customer is clearly trying to exploit your policy. But still, card networks (Visa, Mastercard, Amex, etc.) tend to side with the buyer as opposed to the seller.

If the cardholder disputes the charge and files a chargeback, it will cost you even more money than if you just accepted the return.

You also need to consider restocking fees, shipping fees, and other costs associated with a return.

Final Thoughts on Credit Card Processing Fees For Refunds

Another way to avoid the credit card refund fee is by negotiating with your processor. Here at Merchant Cost Consulting, we can do that on your behalf.

While we’re at it, we’ll also discuss your current processing rates with your processor. Our team will help lower your credit card processing fees without forcing you to switch processors.

So even if you get charged for refunds, your new low processing rates could ultimately offset those costs.