For B2B organizations, collecting payments from clients is a crucial part of operating.

Historically, B2B (business to business) companies accepted payments from other businesses by mailing a paper invoice and getting a check mailed back in return. But this system is fundamentally flawed.

According to the US Bureau of the Fiscal Service, businesses are 125 times more likely to have problems with a paper check compared to electronic payments,

So if you’re still using outdated methods for B2B payment collection, it’s time to update your system.

This guide will explain everything you need to know about payment processing for B2Bs, with a primary focus on B2B credit card processing. If you currently accept credit card payments, you might qualify for lower credit card processing rates.

What’s the Difference Between B2C and B2B Payment Processing?

B2B payments are made between two businesses. As a result, there are a wide range of factors and challenges that make this transaction very different from a direct-to-consumer sale.

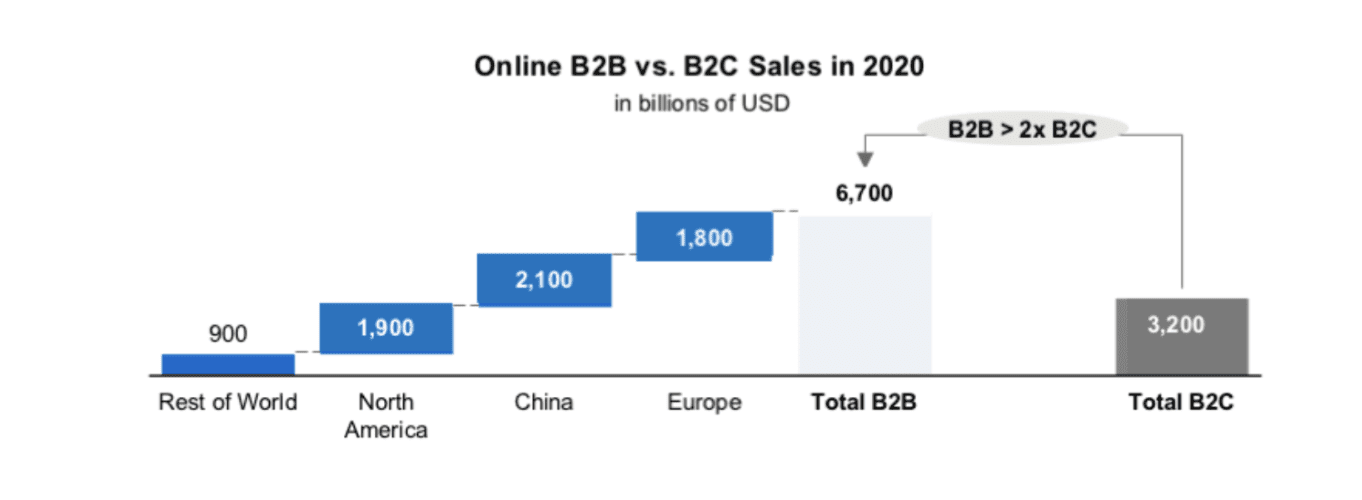

For starters, there is a significant difference in volume between B2B vs. B2C payments. Let’s take a look at the total B2B online sales vs. the total B2C online sales in 2020.

The B2B sales are more than double the B2C sales.

Lots of B2B payments are made on a recurring basis. Even if it’s a one-off purchase, the B2B transaction is going to be significantly more than a one-off purchase made by a consumer.

With so much money at stake, B2B organizations need to collect payments in a timely fashion. Payment delays can create major problems with overhead and operations. B2C transactions are usually settled at the time of the sale, and for far less money.

B2B Payment Methods

We’ve already established the fact that paper checks are not the best way to collect payments for your B2B. There are thee other common methods to collect payments in the B2B space.

If you’re using billing and invoicing software to bill your customers, you can potentially let them pay using any of these methods.

Credit Cards and Debit Cards

There are lots of different ways to collect credit cards as a B2B. You might find that this actually the preferred payment method of your clients.

Credit cards work in person (think of companies like Costco and other wholesale companies with physical stores), on your website through a payment gateway, or over the phone via a virtual terminal. Payment gateways and virtual terminals allow you to set up recurring payments, in addition to one-off sales.

For B2B mobile payments, you can accept payments on the go using a mobile card reader. For example, maybe you have a technician that’s performing services on-site at other businesses. If your field service workers have a mobile card reader on them, the payment can be processed that day, instead of having to wait days or weeks to send an invoice.

ACH Payments

ACH stands for “automated clearing house.”

This is an electronic bank transfer. It’s a safe and reliable way to process payments Clients can pay you directly from their bank account, which is an easy way to set up recurring transactions. ACH payments are commonly offered in tandem with credit card payments.

Wire Transfers

It’s a common misconception, but wire transfers and ACH transfers are not the same things.

A wire transfer is one of the fastest ways to move money between two bank accounts, but it’s not always a convenient choice for the client. The majority of wire transfers have to take place in person, which requires your client to physically visit their bank in order to pay you. Digital payments are much easier for B2B payments.

Credit Card Processing For B2B Payments

In order to start accepting credit cards for your B2B organization, you need to choose a processor. Some merchant service providers specialize in B2Bs. So it’s in your best interest to lean towards those ones as you’re researching different options.

How can you find the best B2B processor for your company? There are certain factors that you should keep an eye on as you’re going through the evaluation process:

- Products and services — What exactly is the provider offering you? Does your processor double as an acquiring bank? Do they provide you with hardware and software?

- Processing fees — You’re going to pay fees for each transaction processed via credit card; this is unavoidable. But those fees aren’t the same from processor to processor. The interchange fees imposed by the credit card companies are non-negotiable. But some processors mark up those fees more than others.

- Contract structure — Always review your contract, including the fine print, before you agree to anything. The contract should clearly define your pricing structure, terms, and other transaction fees, like early termination fees. Don’t fall for the sales pitch; the contract is what matters the most.

- Service and support — If you need assistance, you want to make sure that you choose a processor that will be there for you. Whether it’s for technical support, a common question, adding a payment method, or a potential billing dispute. Check out third-party reviews to see what other B2Bs are saying about the processor in question.

You can check out our full list of credit card processors for more information about this.

How to Reduce Transaction Fees on B2B Credit Card Payments

You can qualify for lower interchange rates if your company has a MCC (merchant category code) that identifies you as a B2B.

Your merchant services provider or processor should be able to assist you with this process and set you up for B2B rates. To properly accept business credit cards, you’ll need special software to help you process the sale based on credit card data (level 1, level 2, level 3).

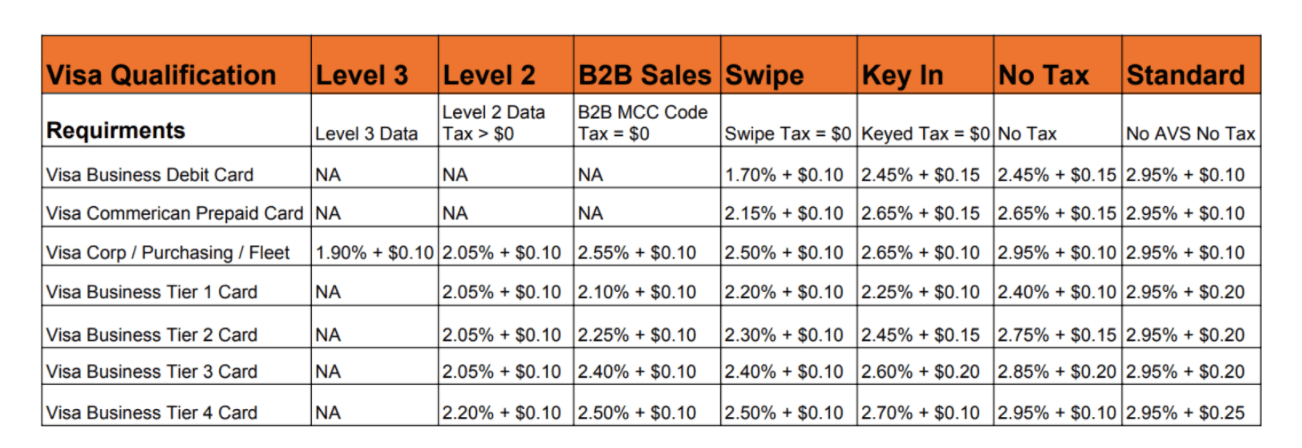

Each credit card association (Visa, Mastercard, Amex, Discover) has its own way of classifying these data rates or data levels. B2C companies only need level 1 data to process general consumer transactions. But B2Bs can process level 2 and level 3 data for business cards, and benefit from lower interchange rates.

Here’s a look at a level 2 and level 3 interchange rates for Visa:

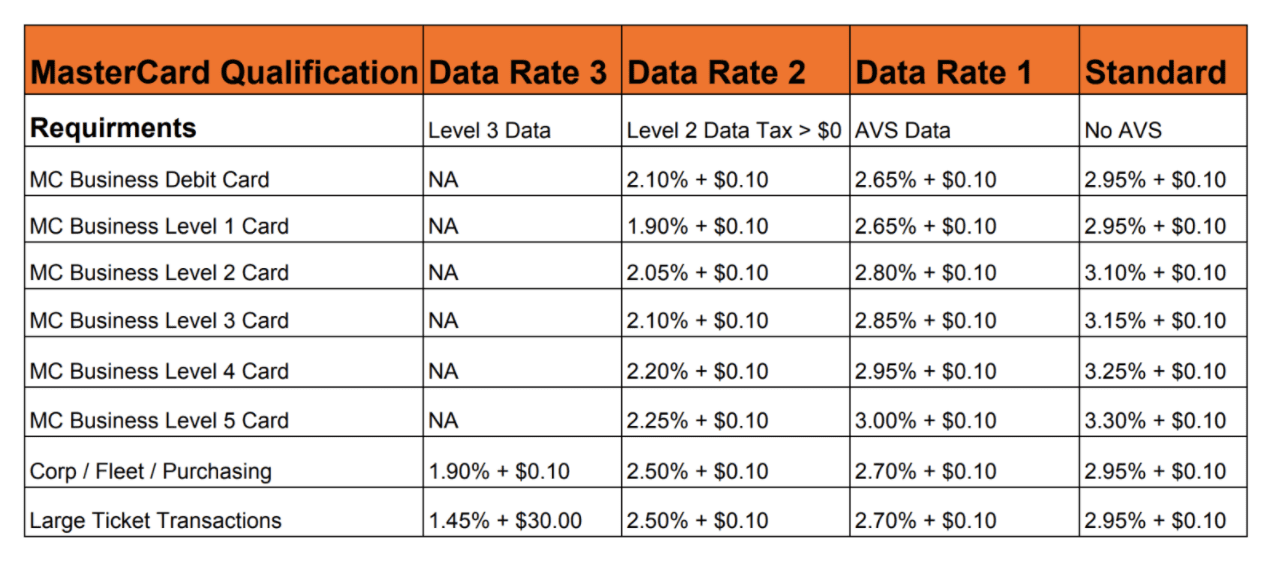

Mastercard calls these “data rates” instead of levels. Here’s what those fees look like based on Mastercard’s categories for B2Bs:

As you can see from both of these charts, the higher the level, the lower the rates.

B2Bs can also be eligible for large-ticket discounts. If you’re processing large ticket sales, you could benefit from even lower processing rates. This is clearly shown on the bottom row of the Mastercard qualification table.

Final Thoughts on Business-to-Business (B2B) Payments

The days of mailing paper invoices and waiting weeks or months to receive a paper check in return are long behind us.

Today, B2Bs need to give their clients a faster and more convenient way to pay. It’s a win-win scenario for both parties. Your customers can pay online or set up recurring payments with a credit card, and you’ll get paid much faster. This will help increase your cash flow, simplify accounts payable for your customers.

B2Bs are eligible for discounted credit card processing. To find out if you’re getting the lowest possible rates, contact us today for a free audit and consultation. We’ll let you know how much money you can save on B2B credit card processing.