California has some of the most unique credit card surcharge rules in the country. Home to roughly 40 million residents, the Golden State has gone through three significant changes governing how merchants can impose surcharge fees on credit card transactions.

While the history of these laws is interesting (which we’ll cover later), the most important thing to understand is whether it’s legal to charge a surcharge fee on credit cards in California today.

California Senate Bill 478, part of the Consumer Legal Remedies Act, bans all “junk fees” on purchases across California. This includes credit card surcharges in most situations.

It’s also worth noting that California’s new laws extend beyond credit card surcharges. So businesses can’t disguise a surcharge as a “service fee” and even hotels are barred from adding mandatory “resort fees” that aren’t properly disclosed.

Read on for a more in-depth breakdown of these new rules and how they impact your business. It’s also crucial for consumers to understand California surcharge laws to ensure they’re not overpaying when making purchases in California.

Disclaimer: This information is for reference only, and it does not constitute legal advice. Consult with an attorney with any legal-specific questions.

Is it Legal to Surcharge Credit Card Transactions in California?

As of July 1, 2024, it’s illegal to surcharge credit card transactions in California.

According to Senate Bill 478, California businesses are required to disclose the total price for goods and services upfront to maintain transparency and protect consumers from being surprised by additional fees when it’s time to pay.

Other states have similar surcharge laws, but what makes CA SB 478 unique is the fact that a simple disclosure statement is no longer allowed when it comes to credit card surcharging.

For example, adding a statement on a sign, menu, website, or POS terminal stating that a “3% convenience fee will be added to all checks” is no longer sufficient. California’s new law states that the listed price of goods and services must include the full amount that a customer will pay. Taxes are the only exception to this rule.

Beyond Credit Card Surcharging: Breaking Down California Senate Bill 478

Credit card surcharging is just one aspect of California’s new law. SB 478 applies to other “junk fees” and “hidden fees” that most of us are used to seeing.

Here’s a closer look at the key points you need to know:

- All fees must be included in the total price displayed to the customer.

- Disclosing additional fees before a customer finalizes a transaction is NOT allowed.

- Businesses cannot advertise a price that is lower than a customer will actually pay (even if they’re disclosing that additional fees will be added).

- Non-compliance can result in a $1,000 fine per violation.

When you dive deep into the specifics of this bill, it actually makes a lot of sense. The law isn’t preventing businesses from charging what they want to provide goods or services—it’s simply preventing California customers from falling victim to false advertising practices.

Businesses that have previously been adding surcharges to bills are left with some tough choices. So I expect to see those businesses raise prices to account for the difference.

To soften the blow to consumers, businesses can legally add a statement saying that the total listed fee includes service charges.

Let’s look at an example from Ticketmaster.

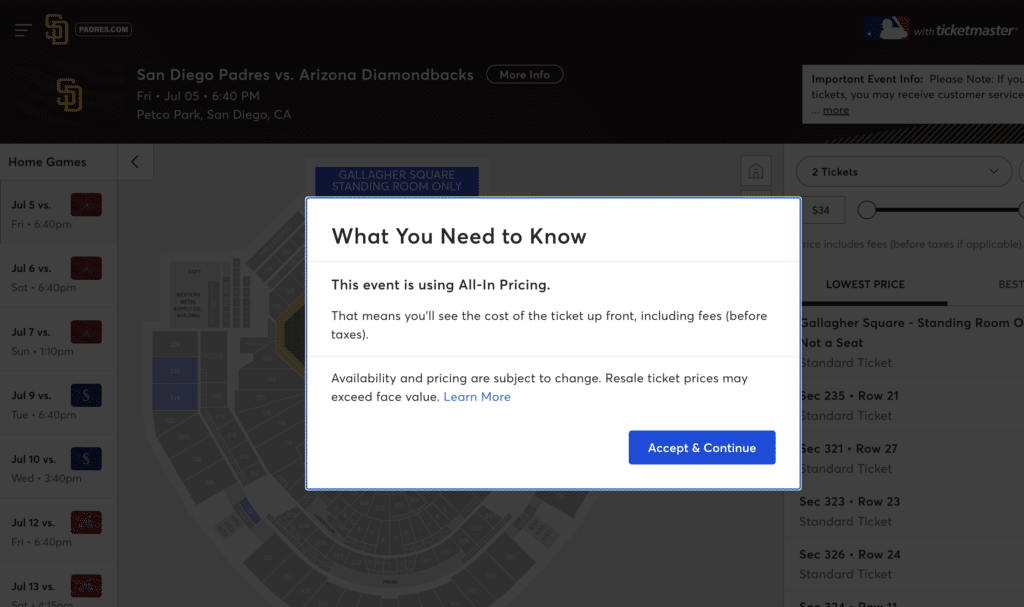

If I go online to purchase tickets to a San Diego Padres game in California, Ticketmaster instantly presents a popup that references “all-in pricing.”

The wording here is compliant with the new surcharging law. Ticketmaster is still charging fees, but those fees are included in the price displayed.

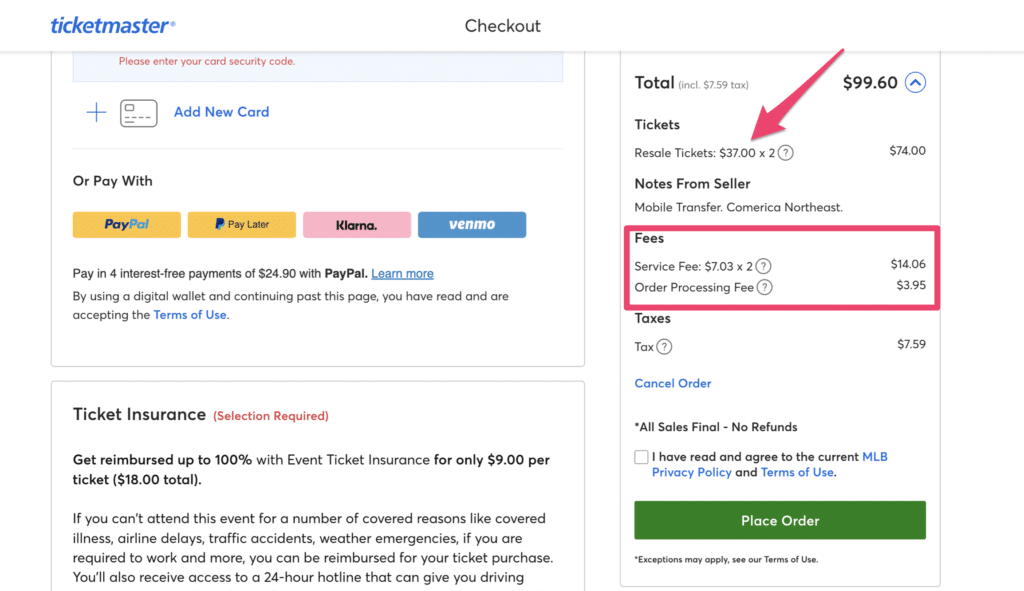

But that’s not the case when I attempt to purchase seats to a Padres game in another state. For example, when browse for tickets to watch the Padres play the Rangers in Texas, the fee listed was not the fee I saw at checkout.

The fees aren’t illegal. But what makes this illegal in California now is the fact that the price of $37 was listed as the ticket price.

Then when the customer gets to the checkout page they discover a “service fee” and an “order processing fee.”

But for the game in California, the price was fully transparent and didn’t have any surprise fees. The customer knows exactly how much each item costs (excluding taxes).

It’s also worth noting that nothing is stopping businesses from simply raising their prices beyond what the surcharge previously covered. CA SB 478 does not limit price hikes—it just requires complete transparency for all listed prices.

Major Industries Affected by California’s New Surcharge Laws

Since the initial signing of SB 478 in California, its impact on different industries has dominated the news.

Here are some industry-specific examples and changes that need to be made in order to comply with SB 478:

- Hotels must include any mandatory resort fees in the advertised price to provide customers with a more transparent picture of the total cost.

- Hotel parking fees must be included in the nightly rate or clearly displayed during the booking process.

- Hotels need to clearly disclose minibar prices or charge a flat fee to use the minibar upfront with the booking.

- Airlines must clearly disclose all baggage fees when the initial fare is displayed (instead of later in the checkout).

- Concert, sport, and event ticketing must include all fees in the upfront price of the ticket displayed to the customer.

- Gyms must clearly disclose all membership fees, initiation fees, monthly closets, cancellation fees, and other charges.

Simply put, California is really cracking down on any surcharge that’s not included in the listed price of an item or service.

Restaurants Are Exempt From SB 478

In a stunning decision, Governor Gavin Newsom signed SB 1524, just two days before SB 478 went into effect. This separate bill essentially exempts restaurants from California’s new surcharge law.

Restaurants will still be allowed to charge service fees, credit card connivence fees, and mandatory gratuities to customers. However, the fee must be clearly disclosed on the restaurant’s menu alongside the other prices of food and drinks.

So a customer cannot be surprised when the bill comes that contains additional fees.

How California’s New Surcharge Laws Are Impacting Other States

Within a month of California Governor Gavin Newsom signing SB 478, the FTC proposed a separate rule with some overlapping themes. The “Rules on Unfair or Deceptive Fees” could potentially regulate surcharges and hidden fees on a national level.

While the proposal itself hasn’t been signed into law just yet, the FTC document would prohibit businesses from omitting mandatory fees from advertised prices (which is exactly what California is doing).

If it goes into law, the FTC proposal could also prevent hotels from adding things like “resort fees” or “cleaning fees” to stays.

We’ll keep you updated on any progress here, and you can always refer to our State-by-State Guide to Credit Card Surcharging for more information.

History of California Surcharge Laws

California has gone through three major changes to its surcharging laws within the past 40 years. Here’s a summary of that timeline.

1985

California Civil Code Section 1748.1 was passed in 1985—prohibiting businesses from imposing a surcharge fee to customers paying with a credit card in lieu of cash.

The law allows merchants to offer cash discounts, debit card discounts, and check discounts, as long as there wasn’t an additional fee added to customers paying with a credit card.

2018

Federal ruling overturned California’s 1985 surcharging law, which made it legal to surcharge credit card transactions. This ruling did stipulate that surcharing was legal as long as lower prices weren’t falsely advertised in an attempt to mislead the customer.

2024

Effective July 1, 2024, surcharging is once again illegal in California. CA Senate Bill 478 was signed by Governor Gavin Newsom on October 7, 2023 to amend the Consumer Legal Remedies Act (CLRA), essentially banning all junk fees and drip pricing. Surcharging is included in this bill.

On June 29, 2024, Newsom signed SB 1524 which exempts restaurants from SB 478.

Final Thoughts on California’s New Surcharge Rules

I’ve spent over 60 hours analyzing the different credit card surcharge laws in each state. California’s law is by far the most interesting but also the most complex.

There is one key takeaway from all of this that I think a lot of people are overlooking. California’s new surcharge rule is not a price control law; it’s a transparency and consumer protections law. Businesses are still in total control over their pricing.

But the price listed needs to be the price charged—without adding extra fees.

I think other states will start to follow California’s lead in an effort to make pricing more transparent and protect consumers from surprise charges at checkout.