Surcharging vs. Cash Discounts in Credit Card Processing

Credit card processing can be expensive for merchants, especially small business owners. If you’re on a tight budget, the fees imposed by credit card processing companies can significantly cut into your profit margins.

With that said, you still need to accept credit cards.

According to a recent study, just 14% of consumers prefer to pay with cash. The rest named credit and debit cards as their preferred payment method.

Merchants are always looking for ways to save money on credit card processing, which is why they implement surcharging and cash discount programs. But with that said, there’s lots of confusion about what these terms actually mean.

Is surcharging illegal? What’s the difference between a surcharge and cash discount? Does my merchant agreement permit surcharging?

This guide will explain everything you need to know about cash discounts and surcharges.

What is Surcharging?

In simple terms, a surcharge essentially charges the customer for the convenience of using their credit card.

Surcharging occurs when a merchant adds a small fee to the transaction to cover the costs associated with credit card processing. It’s illegal to surcharge debit card transactions.

Every card association and credit card processing company has different guidelines for applying surcharges. Surcharging is also banned in four states (Colorado, Connecticut, Kansas, and Massachusetts).

Again, rules vary by location, payment processor, and card association. But in general, you’ll need to do the following if you want to implement a surcharge properly:

- Set limits — Surcharges cannot exceed 4% of the transaction

- Full disclosure — You must have a sign posted at the point of sale. Surcharges should not be deceptive or come as a surprise to the customer.

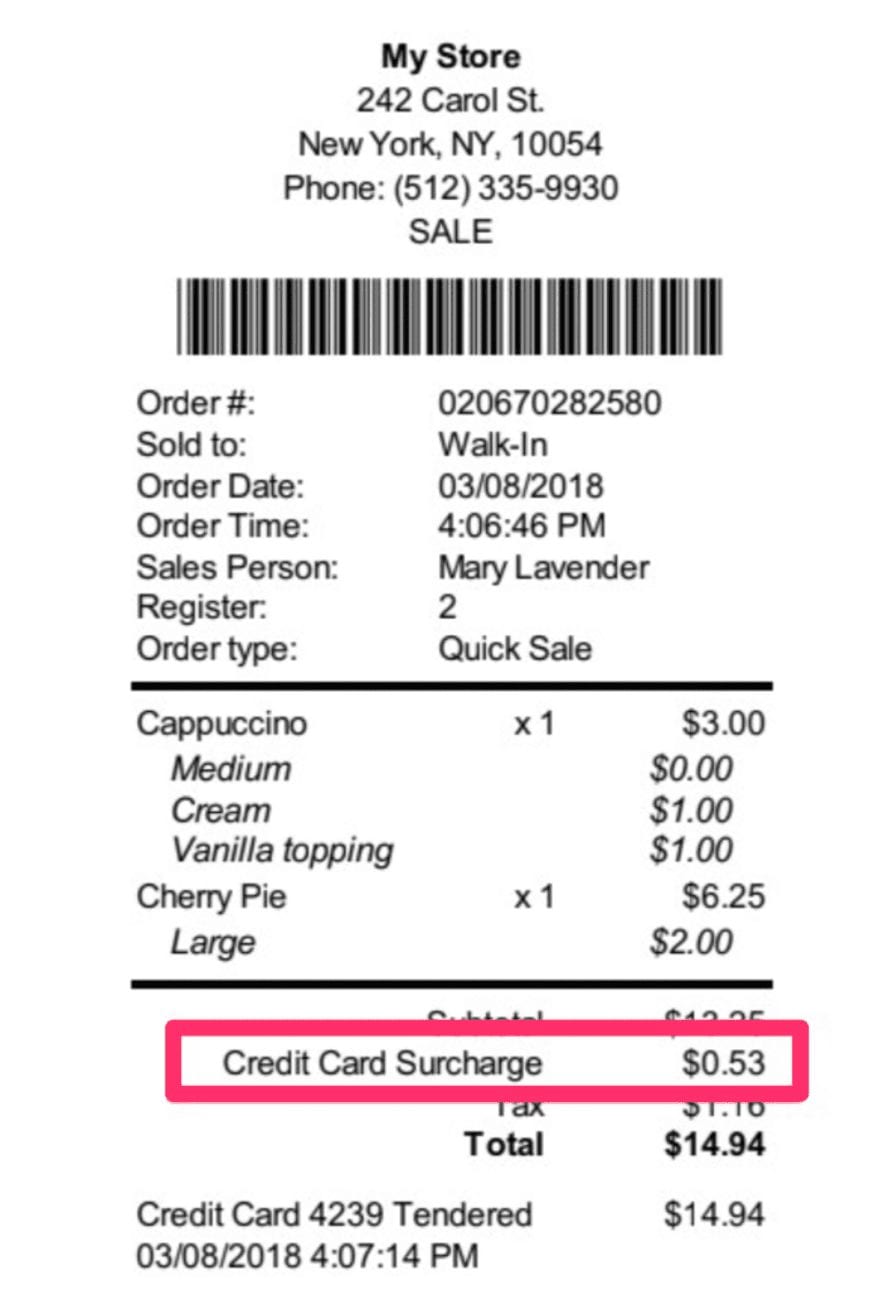

- Accurate records — The surcharge should be listed as a separate line item on the receipt.

- Notice — Notify your credit card processor as well as the card associations, in writing, if you’re planning to surcharge transactions moving forward.

- Equal treatment — You can’t pick and choose when to implement a surcharge based on the customer or card brand. It’s either all or nothing.

Here’s an example of what a surcharge looks like on a customer receipt.

To me, disclosure is the most important part of implementing surcharges. Some merchants try to be deceptive and label the surcharge as a “service fee” or “convenience fee.” I’ve even seen merchants call it a “non-cash adjustment.”

If you’re charging extra for credit card transactions, it’s a surcharge.

What is a Cash Discount?

A cash discount is exactly what it sounds like. Your listed prices are for credit card transactions, and you offer a discount for customers paying with cash.

Basically, you’re giving customers an incentive to save some money by paying with cash.

In doing so, you’re taking the credit card processor out of the transaction, and eliminating credit card merchant fees. However, most cash discounts are offered at a higher percentage than what the credit card would be. The majority of cash discount programs start at 5% and even go as high as 10%.

So are you saving money with a cash discount program? Yes and no. You’re saving money on credit card processing, but the cost of the sale will be less. However, you’ll have the money immediately and won’t have to worry about payment processing funds on hold.

Note: Is your credit card funding delayed? Check out our guide on how to get your funds fast from payment processors for some helpful tips and best practices.

What’s the Difference Between Surcharging and Cash Discounts?

The difference between surcharges and cash discounts is that a surcharge adds a fee, and a cash discount does not. With surcharging, you’re adding a fee to the transaction. With a cash discount, the merchant discounts the advertised sales price for cash payments.

Surcharging is much more regulated by credit card companies, state law, and federal restrictions as well. Setting up a cash discount program is a bit easier since you won’t need to worry about any prior authorization.

A dual pricing disclosure is required in some jurisdictions.

Always check with your state Attorney General or a lawyer if you’re unsure about the regulations in your area. But it’s generally in your best interest to err on the side of caution.

Are Cash Discounts Legal?

Yes, cash discounts are legal. According to the Durbin Amendment (part of the Dodd-Frank Wall Street Reform and Protection Act of 2010), cash discounts are legal in all 50 states.

These discounts are permitted as an incentive for customers to pay in cash.

How To Implement a Legal Cash Discount Program Correctly

A merchant or business is required by law to provide some type of notification that states there is a credit card merchant fee service charge on every transaction.

There is a “cash discount” given to those consumers who choose to pay with cash or check instead.

The requirements suggest multiple notifications prior to the point of sale, such as at the door, at the register, and throughout the establishment.

In addition to notifying customers prior to the sale, it should be made verbally known to the customer at the point of sale as well about the credit card merchant fee that will be applied unless cash is used for purchase.

The biggest misconception with the cash discount program to customers, is that if they do not pay with cash that they cannot obtain or purchase the products or goods.

This is not the case. If a customer opts to still pay with a credit card, they will just incur the credit card merchant fee.

Should You Implement Surcharges and Cash Discounts?

For starters, if you live in a state where surcharging is banned, no—you should not implement surcharges. Furthermore, I don’t recommend surcharging unless you have a full understanding of the legal requirements in your state, as well as the provisions in your payment processing agreement.

Failure to comply could terminate your merchant account, and potentially damage your relationship with card associations.

Imagine not being able to accept Visa cards because you tried to save 3% of a transaction? To me, it’s not worth the risk.

Cash discounts are easier in terms of regulations, but they can leave a bad taste in the mouths of your customers. In a recent study of 2,000 Americans, 50% of people say they carry cash less than half of the time they go out. Of those carrying cash, 76% say they have less than $50 on hand.

A customer who prefers to pay with their card may not be happy that others can save money with cash, especially if they don’t have enough cash on hand to cover the transaction.

Final Thoughts on Cash Discounts vs. Surcharging

Most merchants view them the cash discounts and surcharges the same way, as methods to avoid paying credit card processing fees. However, that’s about the only thing that cash discounts and surcharges have in common.

Many businesses are tempted to implement a cash discount program or start surcharging transactions to save money on credit card processing. But overall, it’s a messy solution, and not really worth it in my opinion. If you’re thinking about doing either, check with your processor, card associations, and state laws before you do anything.

Federal law DOES allow merchants to offer a cash discount program, however, there are still four states that DO NOT allow surcharging.

Before moving forward with this program, do your homework.

Make sure your credit card processing company complies with all the rules and regulations of the cash discount program and that they are not masking this as a surcharge.

There’s a much easier way to save money on credit card processing fees. You can lower your processing rates without having to worry about a surcharge or cash discount.

Contact us here at Merchant Cost Consulting to find out how much money your business can save on credit card processing without having to switch merchant service providers.

0 Comments