CardConnect is a popular payment processing platform—particularly known for its payment gateway, CardPointe.

This in-depth review is based on our personal experience with CardConnect. We have several clients using CardConnect to process payments. Some are brand new, and others have been using them for years.

So we have a really good handle on what to expect if you’re using this payment processor. And we’ve even included some screenshots from real CardConnect merchant agreements to highlight certain fees and rate increases.

MCC Quick Take on CardConnect

CardConnect is a “super” ISO (independent sales organization) of Fiserv, which allows them to offer payment solutions at competitive rates.

Our experience with CardConnect has been mostly positive. But there have been a few one-off instances where we found them significantly overcharging our clients and trying to increase rates more often than they should be.

What We Like About CardConnect

- Processing rates are usually fair and on the lower end compared to competitors.

- CardPointe gateway offers automatic Level 2 and Level 3 enhanced data rates, providing B2B merchants with optimized interchange rates.

- No early termination fee or liquidated damages (on most contracts).

- A merchant surcharge program is available for businesses interested in passing transaction fees to their customers.

- Multiple contract pricing structures are offered, including interchange plus pricing (which is the best option).

- CardConnect is open to negotiations, and our team has successfully reduced rates for our clients.

- We also helped obtain refunds from CardConnect on behalf of our clients, including one recent instance where we got a $36,000 credit for a big box furniture store.

Where CardConnect Falls Short

- We’ve caught CardConnect overcharging merchants at the mid-market and enterprise levels.

- For one of our clients, CardConnect keeps trying to increase their rates by 0.10% to 0.15%, which has been ongoing for the past 18 months.

- Tiered and Bill-Back contract structures are offered, which are both terrible choices for businesses (although CardConnect doesn’t seem to force these too much).

- Lots of random monthly and miscellaneous fees.

- Inconsistent billing and charges between clients.

CardConnect Pricing, Credit Card Processing Rates, and Fees to Look Out For

CardConnect’s pricing is not consistent across the board. They offer custom rates to each merchant, depending on the business size, industry, and contract structure.

Generally speaking, you can expect your average rates to be around 2% to 3% with CardConnect, which isn’t too bad. Just make sure to keep an eye out for new fees and rate increases over time.

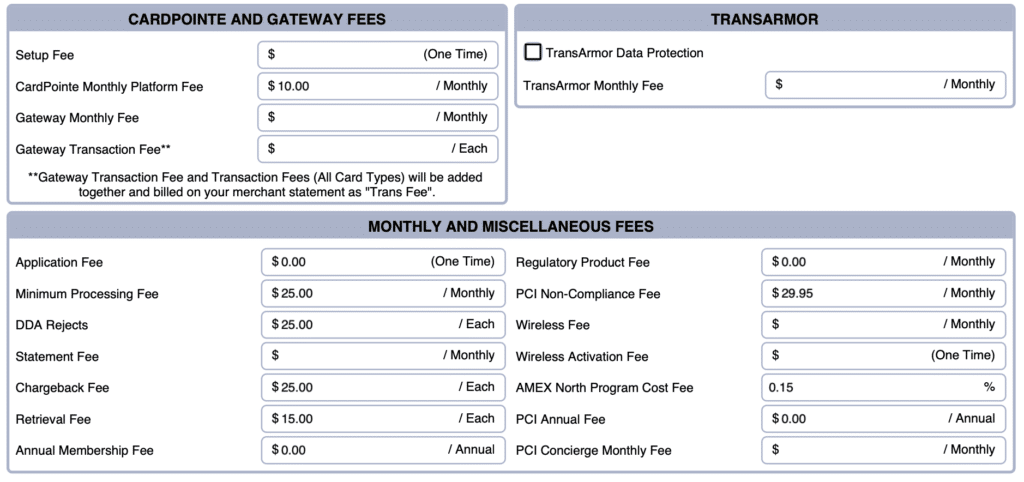

The rates below are coming directly from a brand new merchant account agreement that was offered by CardConnect in April 2024. This is a good baseline point of what you can expect if you’re just getting started with CardConnect. But as you’ll see later on, these fees aren’t set in stone and may change down the road.

CardConnect Processing Rates

- Credit Card Processing Rate — 2.9126% per transaction

- Credit Card Qualified Rates — 2.65% per transaction

- Debit Card Processing Rates — 1.25% per transaction

- Authorization Fees — $0.10 per authorization

Other CardConnect Fees

- ACH Batch Fee — $0.05 per batch

- Voice Authorization Fee — $0.95 each

- CardPointe Platform Fee — $10 per month

- DDA Rejects Fee — $25 each

- Chargeback Fee — $25 per chargeback

- Retrieval Fee — $15 each

- PCI Non-Compliance Fee — $29.95 per month

Some of these fees may appear slightly different on your monthly statements. For example, CardConnect sometimes combines the gateway transaction fees with the transaction fees for all card types and puts them together as a single “Trans Fee” line item.

Here’s a direct look at a new CardConnect merchant agreement from April 2024 that shows the fees listed above:

Again, your contract might look slightly different than this.

And as you’re about to see, we have other clients that are charged higher fees than what you’re seeing above.

CardConnect Rate Increases and New Fees

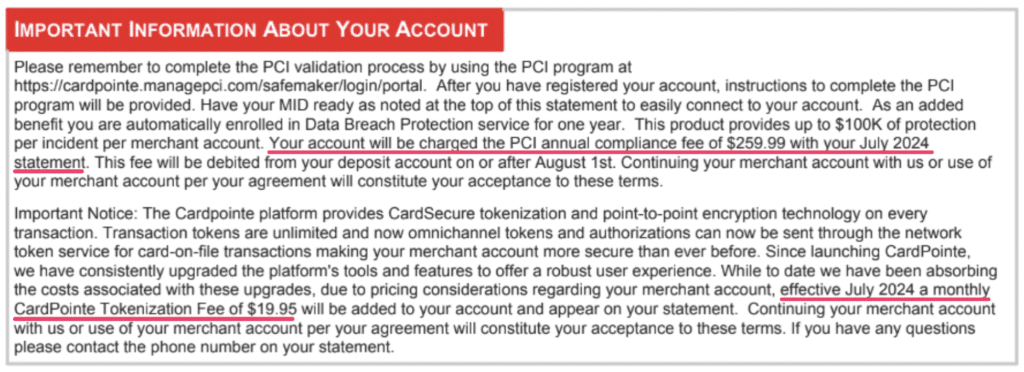

We just had a different client receive a notice from CardConnect that they’re going to be charged $259.99 per year for a PCI Annual Compliance Fee. This went into effect as of July 2024. Here’s that notice:

This notice also mentions a new CardPointe Tokenization Fee of $19.95 per month that also went into effect in July 2024. (See a full history of CardConnect rate increase here).

But if you look back at the previous screenshot, neither of these two fees are shown.

In fact, the new merchant agreement from April 2024 has the PCI Annual Compliance Fee listed as $0.

How is this possible?

It’s honestly something that’s all too common in the payment processing space. The difference between these two merchants is that the first one is new—so CardConnect doesn’t want to overwhelm them with fees.

But the second business has been using CardConnect for years. So after some time, CardConnect raises rates. They’re no longer trying to win the account, and they don’t feel like they’re in jeopardy of losing it, either.

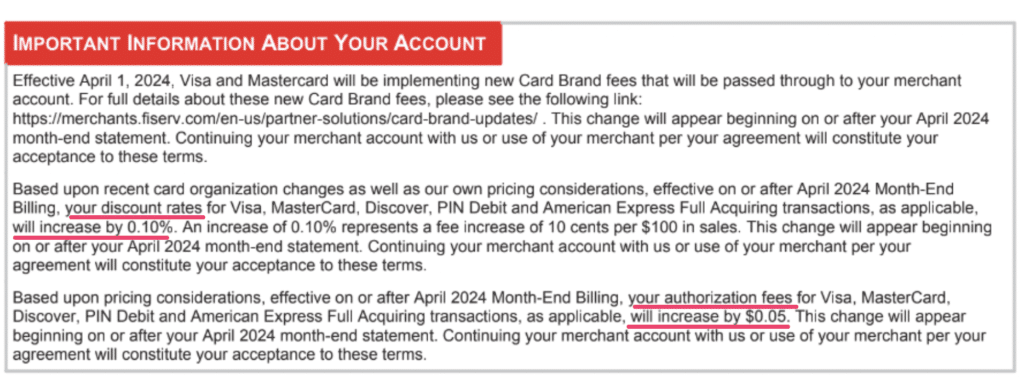

Let’s look at another example from a merchant we’ve been working with for years. For the past 18 months, CardConnect has been trying to increase their rates by about 0.10% to 0.15% every few months.

Here’s a notice they got back in April of a 0.10% + $0.05 per transaction rate hike:

This is another prime example of a processor that’s always going to look for ways to squeeze more profits from businesses over time.

Had this company not been working with a merchant consultant like MCC, then they’d likely be stuck with these increases. But fortunately for them, our team has been able to work directly with CardConnect to lower their rates and get those fees back down to what was agreed upon when the contract was initially signed.

A Closer Look at CardPointe: CardConnect’s Payment Gateway

While CardConnect is an ISO of Fiserv, they do have their own payment gateway that they’ve created—CardPointe.

CardPointe is CardConnect’s shining star. It’s a fully integrated cloud-based platform that can be used to accept payments in-person, online, and on the go.

But as a merchant consultant, I’m not easily impressed when it comes to payment gateways, POS systems, and virtual terminals. There are dozens of providers out there that essentially all do the same thing, and the technology itself is basically just a matter of personal preference.

What I care about the most is the fees charged to the merchant—and this is one area where CardPointe edges out alternatives, especially merchants in the B2B space.

That’s because CardPointe automatically optimizes B2B transactions that capture Level 2 and Level 3 data. So if you’re accepting a commercial or corporate card from another business via CardPointe, CardConnect will give you a better rate.

It’s also worth noting that CardConnect offers Clover POS systems. Remember, CardConnect is a super ISO of Fiserv, and Fiserv acquired Clover back in 2019.

Should You Switch to CardConnect?

If you’re a new business that’s looking to accept card payments for the first time, CardConnect is a solid option to consider. They offer fair rates, and we’ve had a good experience working with them over the years.

However, if you’re currently using another payment processor, switching to CardConnect probably won’t make too much sense.

Even though we like CardConnect, switching processors rarely works in your favor. That’s because the new processor will always beat your current rate, but then ultimately go up in price over time. Plus logistics behind switching can be a nightmare. You may have to deal with system outages and potentially missed sales—not to mention changing all of your operations.

Instead, we recommend negotiating directly with your current processor instead of switching to CardConnect. If you need assistance with this, our team here at Merchant Cost Consulting can handle this on your behalf.

Should You Cancel Your CardConnect Account?

In our experience, CardConnect offers merchant-friendly contracts. We don’t usually see any early termination fees or liquidated damages, making it easy for you to opt out of your contract without having to pay penalties.

Obviously, you need to check your current merchant agreement to verify your specific cancellation clauses, but here’s an example of a recent CardConnect contract we obtained that has a $0 early termination fee.

That said, there’s really no reason to cancel your CardConnect account.

Their prices are fair, and even if they raise your rates, you can always negotiate with them. We’ve been successful in negotiating with CardConnect for all of our clients.

In one instance, we worked with a big box furniture store that was using CardConnect to process payments. During our audit, we found that they had been getting overcharged for months because the rates didn’t match the initial contract.

While this may seem like a reason to cancel your account, it’s actually the opposite. Instead, we negotiated a $36,000 credit for the merchant and got their rates lowered. Had this merchant tried to terminate their agreement, they wouldn’t have received their $36,000 back.

Our Final Thoughts on CardConnect

Overall, we like CardConnect.

While there are some exceptions, they generally offer fair pricing and they’re receptive to negotiations. We also like that they automatically optimize Level 2 and Level 3 rates for B2B transactions.

CardConnect has some massive accounts, and the fact that they’re powered by Fiserv’s backend for payment processing allows them to offer really competitive rates in this space.

Just know that size matters. We’ve noticed that CardConnect tends to overcharge larger businesses (both mid-market and enterprise).

You’ll need to monitor your statements and push back against rate increases and new fees, but you can definitely get good rates with CardConnect.