Understanding how credit card processing fees truly work and what goes into them some consider to be the 8th wonder of the world.

Our 2019 complete credit card processing fee guide showcases everything you need to understand and evaluate to lower your credit card processing fees.

- Credit Card Processing Ecosystem

- Types of Credit Card Processing Fees

- Different Credit Card Processing Pricing Structures

- How To Lower Credit Card Processing Fees

- How To Lower Credit Card Processing Fees (American Express)

Payment Industry Ecosystem

There is a lot that goes behind the scenes when a business accepts a credit card from it’s customers.

All within a split second, a customer’s credit card information and data is processed through multiple different operating channels and it’s important to understand how all of them work.

What is a Credit Card Merchant Account?

A credit card merchant account is essentially a line of credit that allows a business to accept credit cards from its customers as form of payment. Pretty straight forward.

The reason a credit card merchant account is considered a line of credit is because a business gets paid before any money is truly collected from the business’s customer, similar to a short term loan.

Similar to how a checking account works, a credit card merchant account allows a business to accept a payment, except instead of check or direct deposit, and they allow credit card transactions.

However, a credit card merchant account does not hold the money but instead has a customer’s payment pass through the credit card merchant account and deposited into the business owner’s bank account.

What a lot people do not understand about the credit card merchant industry is that the big players (Visa, MasterCard, Discover) do not provide credit card merchant accounts what so ever.

Instead, they rely on credit card merchant processors, ISO’s (Independent Sales Organizations), banks, and independent credit card merchant agents, to sell, market, and service businesses.

American Express, which we all know and love (wink wink), operationally has a different set up than the other 3 card networks.

Amex has its own merchant accounts and a business would need to set up directly through them if they wanted to accept their cards.

Here is the catch however: If you process less than $1M / year in American Express, a business can sign up for their OptBlue Program.

This allows re-sellers to set businesses up with American Express instead of going through them directly.

See the difference between American Express OpBlue and American Express direct Here!

Ecosystem Continued

Card Issuer: The issuing bank, or card issuer, is the entity that creates the piece of plastic to be processed by merchants.

These are your Bank of America debit or credit cards, Chase “Sapphire” credit cards, Capital One, and the list goes on.

Go into your wallet and take out your credit or debit card. The name of the bank or entity on the card is what we call the Card Issuer.

Card Network: There are only so many networks but the 4 main credit card processing networks most would recognize are VISA, MasterCard, Discover, and American Express.

Others include UnionPay, JCB, Maestro, Interlink, STAR, SHAZAM, NYCE, Accel, Plus, Interact (Canadian), Visa ReadyLink, and Pulse.

Picture these as imaginary telephone wires that transfer your credit and debit card data around the ecosystem.

Merchant: The business itself is considered a merchant. Whether the business a sole proprietor, LLC, Partnership, C-Corp, or S Corp, they are a nonetheless a merchant.

Acquirer: The acquiring bank is YOUR bank. Your bank will collect the data from the credit card transaction when you buy a good or service.

Credit Card Processor/ISO/Merchant Account Provider: These are the guys, or ladies, who make this industry oh so colorful to the say the least.

They get the most recognition, and they are the cause of all those phone calls your business receives on a daily basis telling you they can save you money.

They are the Third Party, the middleman, which process the credit card transactions a business performs on any given day.

From here, there are also Direct Processors and then there are ISO’s (Independent Sales Organizations).

There is one major difference between both and that is an ISO can essentially sell credit card processing for as many Direct Processors as it wants.

There then comes into play Registered ISO’s and then there are Unregistered ISO’s.

The major difference between those two is that an Unregistered ISO is just a sales agent. You know, one of the guys, or ladies, who walk into a business and try to sell you credit card processing.

A Registered ISO is an actual independent company.

Some examples of Direct Processors are:

- First Data, now Fiserv

- Worldpay, now FIS

- TSYS

- Global Payments

- Paya

- Paysafe

- ChasePaymentTech

- Elavon

- American Express

- Heartland, now Global

Some examples of ISO’s are:

- CardConnect

- Vantiv

- Bank of America

- Wells Fargo

- Citibank

- Suntrust Bank

- BB&T

- Santander

- Moneris

- Cayan, now TSYS

- Merchant E Solutions

- IPayment

- North American Bancard

- Leaders Merchant Services

- Merchant Lynx

- Intgreity

- EvO

- Sterling Payment Technologies

- BlueSnap

- Fatt Merchant

- Payment Depot

- Host Merchant Services

- Payment Cloud

Gateways: These are strictly for online businesses only.

They allow your customers to “Pay Now” on your website, collect the credit card processing information, encrypt the data, and sends an authorization request to the card issuing bank through the Direct Processor or ISO.

Some examples of credit card merchant gateways:

- Authorize.net

- Braintree

- PayPal – PayFlow

- Stripe

- CardPointe

- USAePay

- PayEazy

- WePay

- BlueSnap

- PaySimple

- PayTrace

Payment Facilitator (PayFacs): PayFacs are the Square, Stripe, PayPal, and Braintree’s of the world. These guys, or ladies, offer credit card processing on a sub – merchant platform.

The main difference between a PayFac and a Direct Credit Card Processor is they are a bit more efficient when offering their services.

The underwriting is performed on an ongoing basis as opposed to right upfront like you see with a Direct Credit Card Processor.

Types of Credit Card Processing Fees

On a very high level, there are 3 components to credit card processing pricing that your business needs to understand.

- Interchange fees

- Visa Interchange Fees

- MasterCard Interchange Fees

- Discover Interchange Fees

- American Express Interchange Fees

- Assessments

- Visa Assessment Fees

- MasterCard Assessment Fees

- Discover Assessment Fees

- Markup Costs

- Discount Rate

- Authorization Fee

- Per Transaction Fee

- Setup Fee

- Cancellation Fee

- Statement Fee

- IRS Reporting Fee

- Monthly Subscription Fee

- PCI Compliance Fee

- PCI Non Compliance Fee

- PCI Regulatory Fee

- Software Fee

- Gateway Fee

- CPU Fee

- AVS Fee

- Terminal Fee

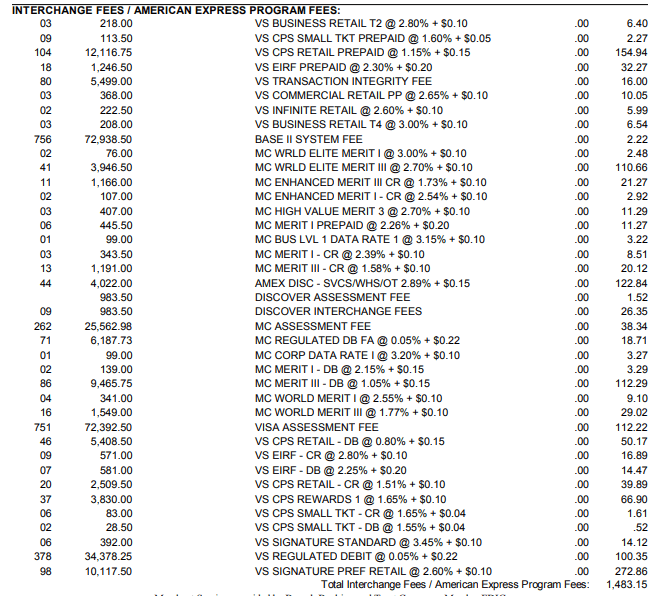

Wells Fargo has created a useful matrix that breaks down credit card processing interchange rates and assessment rates for each individual card.

It also showcases the increases or decreases that has occurred on each card, and what to expect from said card moving forward.

These include all Visa, MasterCard, Discover, and American Express.

The new changes occurred at the beginning of April 2019 and will be impacted until another change occurs in October 2019.

American Express has also increased their pricing as of July 1, 2019, so be aware of those changes.

Interchange Fees: These are rates that are established by the card networks, i.e. Visa, MasterCard, Discover, and American Express.

These fees are NON negotiable, however, there are different levels of Interchange rates that can significantly reduce your costs (this is for another time.)

The Interchange fees are passed along from the card networks to your credit card processing provider, who then passes these fees along to you, the merchant.

The fees make up roughly 90-95% of the fees you are charged on a monthly basis, which is unfortunate and just the service costs for accepting credit and debit cards.

Credit Card Processing companies can pad these interchange rates to increase their profit, which is something you need to be careful of.

They will blame the increase on the interchange rate and that there is nothing they can do.

However, little to your knowledge they have added a higher percentage rate on top of the Interchange fees. Be aware of this!

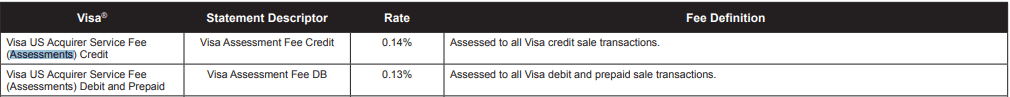

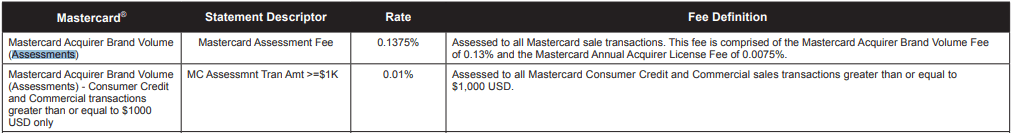

Assessments: These fees are NON negotiable and are passed along by the card networks, similar to interchange fees.

Like Interchange, there is a set rate for each network, that a business will be charged, and there are no if, and, or buts about it.

Be careful with these as it is uncommon, but still possible, to see credit card processing companies pad the assessment fees to gain more profit.

- Visa Assessments:

- MasterCard Assessments:

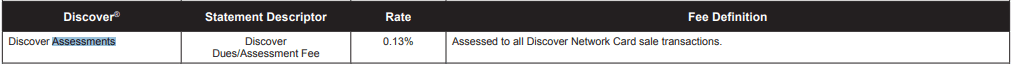

- Discover Assessments:

Markup Costs: Here is where the party gets going and the reasoning why credit card processing get such a bad reputation.

Markup costs are the profit the credit card processing company makes over the interchange cost that is passed along to your business

There are numerous deceptive sales tactics that credit card processing companies will use.

Most say they will lower your credit card processing rates, but it does not take long to figure out this is not the case.

They simply change a few rates around, lower some and raise others, to where there is little to no savings when all is said and done.

The markup costs can include, but are not limited to, discount percentage, per transaction, per authorization, monthly fees, PCI fee, PCI non regulatory fee, software monthly fees, gateway fees, CPU fees, AVS fees, equipment costs, etc..

All these fees ARE NEGOTIABLE and should be reviewed prior to any engagement with a credit card processor..

Different Credit Card Processing Pricing Structures

Most businesses have no idea that there are different pricing structures within credit card processing.

They hear the lowest credit card processing rate come out of a sales reps mouth, and that is the provider they are going with.

WRONG! With Interchange rates constantly changing, different credit card processing pricing structures have been created to account for this ever moving industry.

See what is best for your business below:

- Tiered/Bundled

- Flat Rate

- BackBill/ERR

- Subscription/Membership

- Interchange Plus Pricing

Tiered/Bundled Pricing:The WORST pricing structure in credit card processing. Stay as far away as possible from this one.

A high level overview of how it works is a credit card processor gives you 3 different rates for Qualified (1.75%), Mid-Qualified (2.45%), and Non-Qualified transactions (3.25%).

Depending on the card you take, dictates which bucket that card will fall under. Depending on the bucket, depends on the rate you are charged. Fairly simple.

The PROBLEM with this structure is that:

1. The processor dictates the bucket each card falls under and the rate of said bucket.

2. The actual Interchange rate of said card is more often than not significantly lower than what the bucket is tagged at.

What this means? Your provider is making money hand over fist.

Example: A Tiered/Bundled pricing model would look like this: Qualified Rate: 1.75% Mid Qualified Rate: 2.25% Non-Qualified Rate: 3.40%.

The Interchange rate for a debit card is often 0.05% + $0.22/transaction.

If you are on tiered/bundled pricing, the processor will categorize this card in a Qualified bucket, charging you the Qualified rate (1.75%). 1.75% is a significantly more than 0.05% + $0.22/transaction.

Flat Rate Pricing: The SECOND WORST pricing structure in credit card processing. The name of the pricing structure is pretty self-explanatory.

Your business is charge a set rate for every transaction you accept, regardless of the type of card or how you process the transaction.

Similar to the example of Tiered/Bundled pricing, you are not charged the true cost of the card you accept from your customer.

Instead, you are charged the flat rate, and your credit card processing company makes all the profit over the true interchange cost of your customer’s card. STAY AWAY from this structure as well.

Although it seems transparent and simple, like what the Stripe’s or PayPal’s of the world want you to think, it is not cost effective for your business.

Example: The Interchange rate for a debit card is often 0.05% + $0.22/transaction. If you are on Flat Rate pricing, the processor will charge you a flat fee of 2.75%.

That means credit card processor makes in profit the difference of 2.75% and the cost of the interchange rate of the card your business accepted.

This can be an extremely lucrative pricing model for credit card processing companies. Stay away at all costs.

BackBill/ERR Pricing: The TIED FOR SECOND WORST non cost effective pricing structure, although this one is more out dated than the others.

Your credit card processing provider will set your ERR rate during the application process.

An added headache to this pricing model is the reporting. The true fees you were charged do not show up on your statements until the following month, hence the “BackBill” name.

For this example, let’s stick with the 1.75% mentioned in the Tiered Pricing model above.

Example: As a business, any credit or debit card you accept from your customers that has an interchange rate LOWER than 1.75%, your business is charged the 1.75%.

Your credit card processing provider makes the difference of the two in profit.

Any credit or debit card you accept from your customers that has an interchange rate HIGHER than 1.75%, you are charged 1.75% PLUS an additional surcharge that was determined by your credit card processing provider.

Subscription/Membership Pricing: This is a relatively new pricing structure within the credit card processing industry.

It can be cost effective depending on your monthly volume of sales and the subscription cost your credit card processing provider sets you up with.

How it works is your merchant provider charges a flat monthly fee (subscription), a per transaction cost ($0.05 – $0.30), and passes along the true interchange cost of the card you accept from your customers.

At times, it can be cost effective for your business because you know what the processor is making every month as far as their profit.

The issue and disadvantage of this model is that based on your sales volume, the merchant make increase the fixed membership fee, which can hurt your business.

They may also increase the markup per transaction cost as well.

Although a transparent pricing model, it will depend on your needs and monthly sales volume.

Example: A subscription pricing model would be as follows: Interchange Rates + 0.00% + $0.15/transaction + $199.00/month Fee.

Interchange Plus Pricing: You always save the BEST for last. Interchange Plus Pricing is by far the most transparent and cost effective pricing structure within the payment industry.

High level, you are charged the true interchange rates set by the card networks, in addition to the true mark up costs the credit card processing provider charges you.

If you are looking to save the most amount of money and have fair and transparent pricing, this is the route you need to go!

Example: An Interchange Plus Pricing model would be as follows: Interchange Rates + 0.50% + $0.10/transaction.

To use the debit card example mentioned above, the interchange costs for a debit card is 0.05% + $0.22/transaction.

On Interchange Plus Pricing, you are charged the debit card interchange PLUS whatever the mark up costs of the credit card processing company. In this example, it is 0.50% + $0.10/transaction.

The key takeaway here, and something we cannot stress enough, always ensure you are on Interchange Plus Pricing if you want to lower your credit card processing fees.

This pricing structure is by far the most transparent and cost effective pricing model within the credit card processing industry.

Get a free audit here to see your current credit card pricing structure and potential savings.

How To Lower Credit Card Processing Fees

Credit card processing fees are daunting, confusing, and obnoxious to say the least.

Identifying which credit card processing fees are mandatory vs. a markup cost can be difficult.

Finding the correct ways to lower your credit card processing fees without having to switch processors is a task every business should look into.

Other than a technical circumstance with equipment, software, or your business’ gateway, you should always look to lower your credit card processing fees before making change to your credit card merchant provider.

When you switch credit card merchant service companies, you have to look at the costs to making a change.

There are equipment fees, gateways fees, the costs to teach your employees on how to work the new systems, and the risk involved that comes with making a change.

Most credit card processing companies can use deceptive sales tactics to make it seem you are getting a good deal by switching.

But if you are a novice to credit card processing, review these tips below to help you navigate the credit card merchant industry.

Tips To Lower Credit Card Processing Fees

Step One: Ensure a credit card processing rate increase has not occurred

If you know how to already read a credit card processing statement, you are a step ahead of the curve.

Audit your last 3 credit card processing statements and compare the discount, per trans, auth, and monthly fees you were charged.

If you know how to identify surcharges, do the same exercise to ensure the credit card processing rates are consistent.

If you do not know how to read your credit card processing rates, get a free audit or analysis to have someone point them out to you.

Knowing your baseline costs and what you currently pay is crucial to knowing how much wiggle room you have in negotiations.

Step Two: Evaluate if you are under contract and for what length of time is remaining

Being under contract has no effect on a rate reduction. The term remaining on the contract however, will affect to what extent you are able to reduce your existing credit card processing fees.

If you have less than 6 months remaining, you will reduce costs significantly.

If you have 24 months or more remaining, you can still achieve savings, they just may not be as prominent as you may have liked.

Step Three: Do your homework

Do not go into a negotiation blind without any ammunition of how the rates and fees work.

You need an understanding of your current pricing structure, the other pricing structures in the industry, the service markup you are charged, and the industry standard of what your competitors pay.

Do no ask for a reduction, tell them you want a reduction and give examples of pricing that you want to obtain. Do NOT let the credit card processing company dictate the negotiation.

Step Four: Push Back

Credit card processing companies will tell you that they cannot go any further in lowering their credit card processing rates after the initial negotiation.

This is not the case, but simply a tactic used to get you off the phone. Of course they do not want to lower your credit card processing fees because it ultimately loses them money.

However, it may 2 or 3 times to further reduce your credit card processing fees.

Step Five: Monitor your credit card processing fees monthly

Monitor your credit card merchant statements monthly. Most processors spike their rates quarterly, some even do it as often as a monthly rate increase.

You need to be aware of this because lower your credit card processing fees is only half the battle.

You need to ensure that your pricing always stays low, and never increases once you negotiate.

It requires a monthly audit in order to make sure that credit card processing fees aren’t being increased.

If a business is looking at a merchant processing statement with an untrained eye, rate increases are going to be impossible to detect.

How To Lower Credit Card Processing Fees (American Express)

When it comes to the credit card processing world American Express tends to be their own monster.

American Express has long been viewed as the outsider of the large four card brands when it comes to acceptance.

Higher rates have been the primary reason that a lot of merchants are hesitant to accept American Express.

An average credit card processing fee for Visa/MasterCard is 2.17% while AMEX is 2.33% per transaction.

Recently, Amex has been making a push to boost spending on its network. There have been some new rate cuts through a program for certain merchants call Amex OptBlue.

What is AMEX OptBlue?

OptBlue is a processing option released by Amex five years back.

Prior to the OptBlue program Amex cards were solely processed through a separate merchant account managed by Amex. This would result in higher, non-negotiable rates.

With the OptBlue pricing structure Amex opened up the processing of Amex through a separate merchant account. This is very similar to how a business accepts Visa, MasterCard and Discover.

Due to the fact merchants can now process Amex through a standard merchant service provider they can obtain lower rates than previously.

Prior to this, Amex would only offer a flat rate nonnegotiable structure. Now, on the OptBlue pricing program merchants can negotiate with the processing company to decrease costs.

What is Amex Direct?

Amex Direct adheres to the original flat-rate structure that Amex used prior to the OptBlue program.

Amex direct has to be used by businesses processing $1M and up per year in Amex transactions.

Believe it or not these businesses typically have to pay more than the businesses processing less than $1M a year in Amex transactions.

Going to Amex direct entails Amex’s standard rates which tend to be much higher than the processors rates.

How Can I Negotiate Amex OptBlue?

Negotiating OptBlue pricing is actually very similar to negotiating pricing for the other card brands. The biggest thing is to first ensure you have secured an interchange plus pricing for all cards.

If one processing company insists they can only offer a tiered pricing structure for Amex then we suggest to go elsewhere. This would be similar if not higher than going to Amex Direct.

Once the interchange plus pricing for all cards has been secured it is important to get the same markup for all four cards brands.

To give you an example, if a processing company offers an interchange plus pricing of 0.30% + $.10 per transaction it should be that for all four card brands.

A lot of processing companies will offer a much higher markup for Amex transactions which is just another profitable category for them.

About Merchant Cost Consulting

If you made it this far in our blog, we assume your head is spinning, but hopefully in a good way.

The key take way to note in all of this is that your credit card merchant provider makes money by having your rates be as high as possible, as the higher the rate, the more money that goes into their pocket.

Here are Merchant Cost Consulting, it is our job to educate, inform, and assist our audience about the murky waters of the credit card processing industry and help our clients lower credit card processing fees without making a change to their current processor, bank, equipment, or gateway provider. D

Don’t like reading long blog posts? Check out our 1 minute video explainer here!

Merchant Cost Consulting is made up of industry experts with over 25 years of knowledge and expertise. When MCC becomes part of our client’s team, there is no upfront costs or fixed monthly fee. MCC is a performance based consulting firm that is only compensated on the savings this is obtained for our clients.