Credit card processing is not a one-size-fits-all solution.

There are many factors at play, including industry, business type, credit card processing plan, sales volume, and more. Depending on the scenario, business size can also play a large role in your credit card processing plan. The size of your company could even impact your credit card processing fees.

But there’s lots of confusion about what exactly “business size” means and when it actually matters for credit card processing.

This guide will cover different scenarios and business size factors that may or may not affect your credit card processing.

Time in Business

Regardless of your business size, your time in operation could impact credit card processing. There are some processors on the market that are more startup-friendly than others.

If you’re launching a new business and accepting credit cards for the first time, you might get rejected from some credit card processing companies that only work with more established businesses.

Certain startups could experience rolling reserves or funds on hold—neither is something you want.

So you’ll want to find a credit card processor that can accommodate the needs of a smaller startup without putting a stranglehold on your contract terms. You might ultimately outgrow this processor as your business matures, but it’s better than the alternative.

Credit Card Processing Volume

In terms of business size, credit card processing volume arguably has the most significant impact on your payment processing terms. There are several different reasons for this, but we’ll dive into the most important ones.

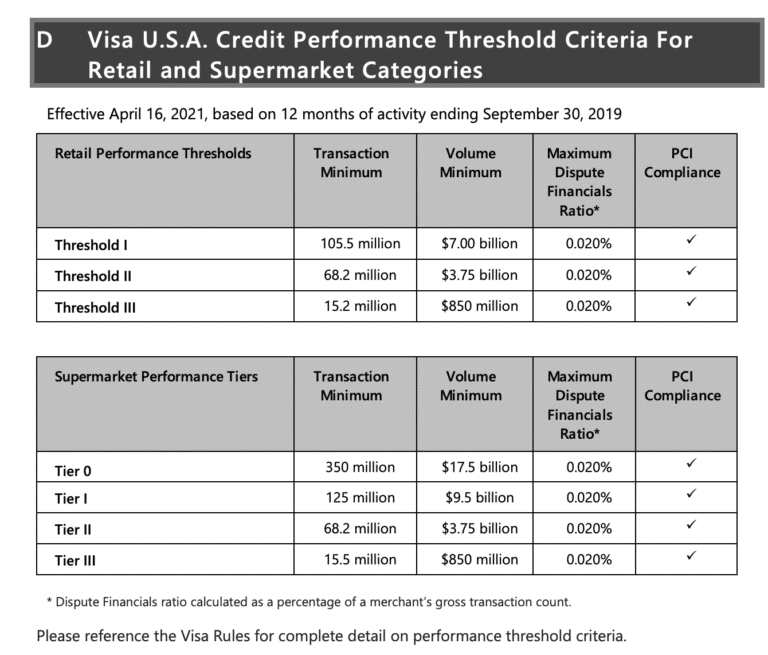

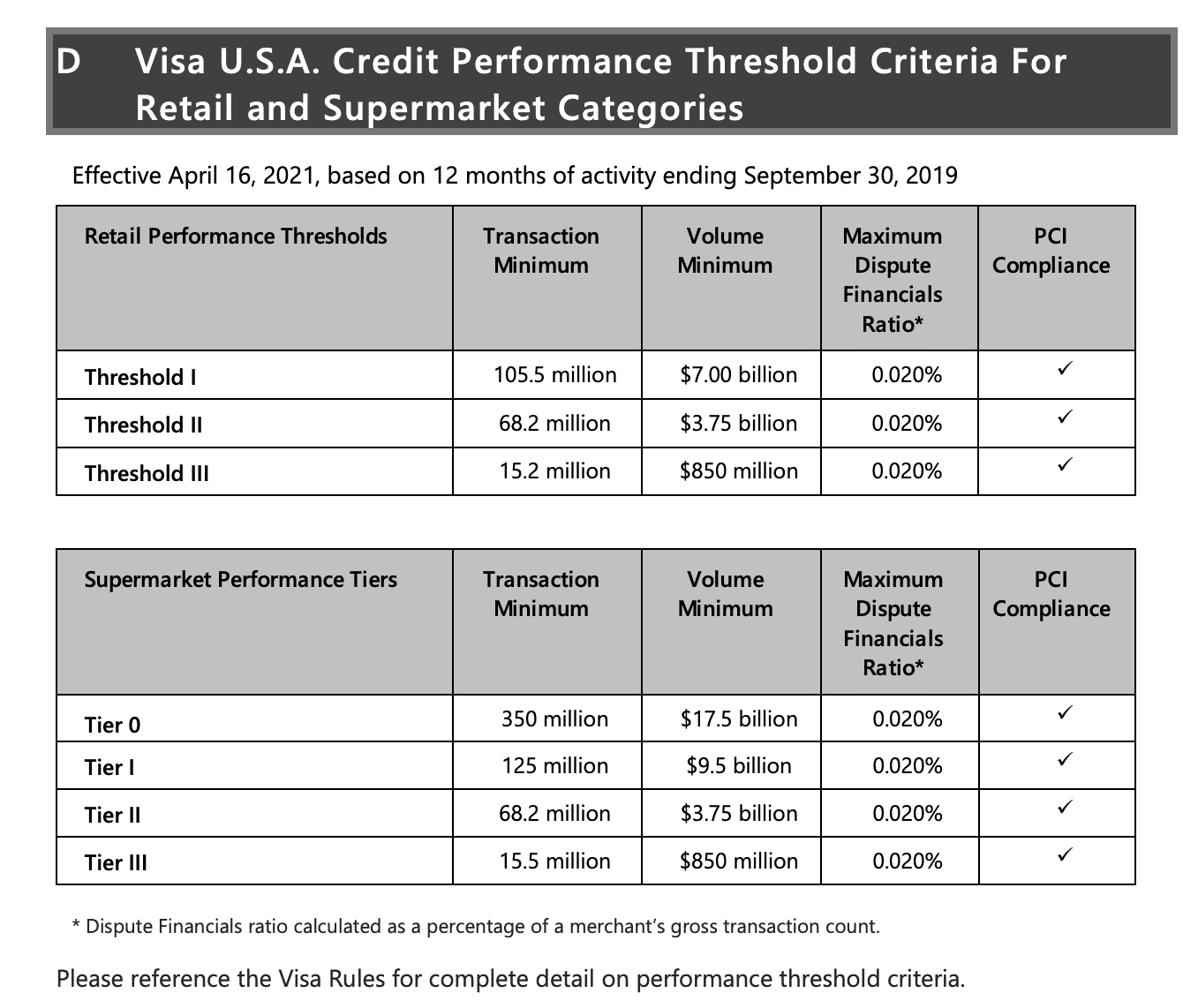

Credit Card processing volume begins at the interchange level—imposed by the credit card networks. For example, let’s take a look at some snippets of Visa’s Interchange Reimbursement Fees:

This section of the table is just for supermarkets and retail credit cards. As you can see from the free program column on the far left, these businesses are segmented into different tiers and thresholds (0, I, II, and III). The rates are different at each level.

Where are these tiers and thresholds coming from? It’s based on transaction volume.

Tier 0 supermarkets must have a $17.5 billion volume minimum and at least 350 million transactions. Only huge businesses will qualify for this and meet the criteria in 12 months.

But as a result, this tier has access to lower credit card processing rates than tier I, tier II, and tier III merchants. In this scenario, business size definitely matters for credit card processing.

Credit card processing volume also matters when you’re selecting a processor and plan type.

For example, let’s say you want to work with a credit card processing company like Payment Depot. This credit card processing company offers “wholesale” rates to merchants for a monthly membership fee. The higher the membership cost, the lower the transaction fees. Here’s what the cost structure and plans look like:

- $79 per month — $0.15 + interchange per transaction (up to $50,000 per month)

- $99 per month — $0.10 + interchange per transaction (up to $150,000 per month)

- $199 per month — $0.07 + interchange per transaction ($300,000+ per month)

As you can see from this breakdown, this is another instance where volume plays a role in your credit card processing.

Annual Revenue

In many cases, annual revenue can matter in credit card processing. We covered a couple of those scenarios in the previous section.

But technically speaking, annual revenue alone could be irrelevant—here’s why.

The only thing that matters is the revenue generated through your credit card processing company. For example, if your company generates $20 million per year but $15 million comes from checks and cash, that portion of the revenue won’t impact your payment processing. Only the remaining $5 million (assuming it comes from credit cards, debit cards, or ACH transfers going through your processor) would affect your rates.

Number of Employees

The number of people employed by an organization is often directly associated with business size—more employees, larger business.

But in terms of credit card processing, this does not matter. Smaller businesses with fewer employees could have a higher processing volume than a mid-size organization with 400 people on the staff.

PCI Compliance

Payment Card Industry Data Security Standards compliance, better known as PCI DSS or simply PCI compliance, is something every organization that accepts credit cards needs to prioritize.

But there are actually four different levels of PCI compliance, based on business size:

- PCI Compliance Level 1 — 6+ million transactions per year, or any merchant that has previously had a data breach

- PCI Compliance Level 2 — 1 – 6 million transactions per year

- PCI Compliance Level 3 — 20,000 – 1 million online transactions per year

- PCI Compliance Level 4 — Up to 1 million transactions per year or fewer than 20,000 online transactions per year

As you can see, your minimum compliance standards can be impacted by business size.

Business Locations

The number of locations matters for credit card processing. This is especially true for brick-and-mortar operations with customer-facing storefronts.

Whether you’re a retailer, restaurant, service-based organization, or anything with a physical presence, size matters in this scenario.

The reason why it matters has to do with your processing hardware. There’s a big difference between a merchant that needs one or two credit card processing terminals at a single location compared to a merchant that needs dozens across several locations.

Depending on your industry, your POS stations and credit card terminals might need to double as solutions for inventory management and more. From an accounting and back-office perspective, certain processors are better than others for things like data integration automation.

If your business operates on the go, like with a food truck, at a farmers market, or with field service technicians, the type of processing hardware you use will vary as well.

Final Thoughts

“Business size” is somewhat of a broad term in the credit card processing space. But in many cases, your size will have an impact on your processing terms, process, fees, and more.

Some things like employee size and overall revenue don’t really matter. Credit card volume and transaction volume typically have the most significant impact.

Regardless of your business size, our team here at Merchant Cost Consulting can help keep your credit card processing fees low. Reach out for a free consultation, and we’ll help you save money without switching processors.