Key Takeaways:

- Your discount rate is the markup your payment processor charges you per transaction.

- The effective rate represents all of your merchant fees as a percentage of your total card sales.

- Discount rate, interchange fees, assessments, and other processor fees are all included in the effective rate.

- Using only the discount rate to track your processing costs can be very misleading.

One of the most crucial components to your credit card processing costs isn’t found anywhere on your monthly statement: your effective rate.

Instead, most processors tend to emphasize your discount rate in monthly reporting. And while this is important to know, it’s deceptive if that’s the only thing you’re using to gauge your costs.

Where to Find Your Merchant Discount Rate

Your discount rate can be found in the merchant agreement that you signed with your processor. There’s a high probability that your rates have increased since that initial contract was penned, so you can also use your monthly merchant statement to find your most up-to-date discount rate.

- Discount rates are charged per transaction as a percentage of the sale amount.

- They’re paid directly to your processor, marked up on top of interchange.

- Unlike interchange, your discount rate is 100% negotiable.

The formatting on your statement can vary widely by processor. Some statements are more transparent and straightforward to understand, which makes it easier to find your discount rate. Other times you need to dig a bit harder.

Here are some examples so you can see what I mean:

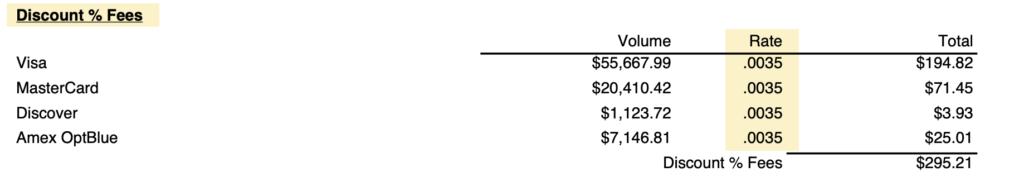

Easy to Find: 0.35% Discount Rate (35 Basis Points)

This is as straightforward as it gets. Each card type is charged the same amount, and the discount rate is clearly applied to the total volume of each card.

The rate is 0.0035, which converts to 35 basis points or 0.35%.

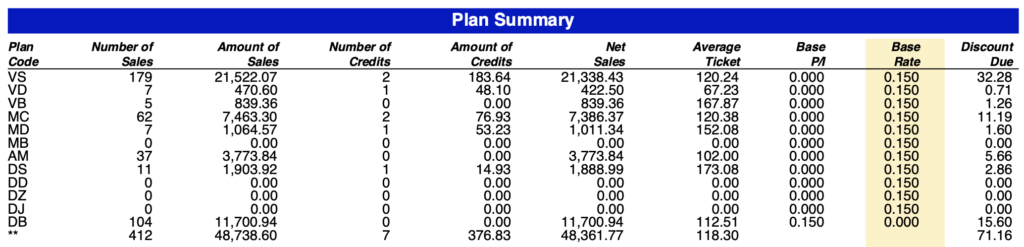

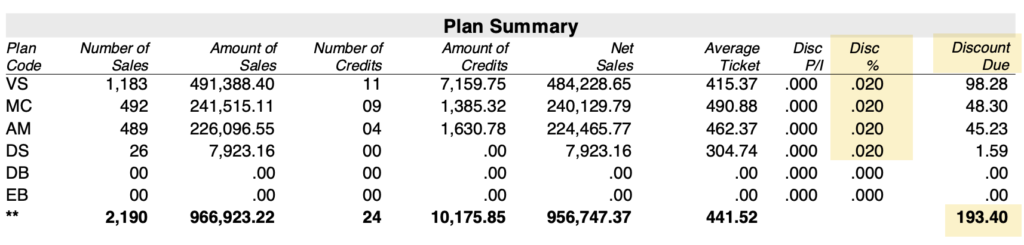

Semi-Easy to Find: 0.15% Discount Rate (15 Basis Points)

Here we can see the discount column is actually called the “Base Rate.”

But if we do the math, multiplying the base rate by the net sales for each row, we can see that the numbers match the “Discount Due” column to the far right.

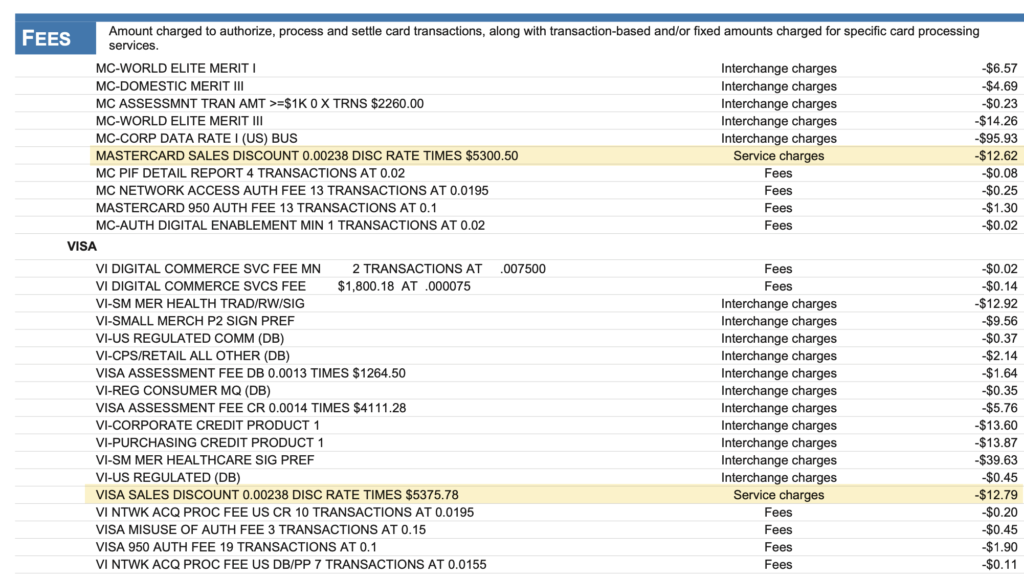

Harder to Spot: 0.238% Discount Rate (23.8 Basis Points)

This processor makes you work a little bit harder to find your discount rate.

The discount is itemized alongside interchange charges, network assessments, and other processor fees. All of the information is on there, but you can clearly see that it’s more challenging to spot compared to the first two examples.

How to Calculate Your Effective Rate

Processors typically do not include your effective rate on statements. So you’ll need to do some math to get this number.

Effective Rate = (Total Merchant Fees) / (Total Net Card Sales Volume)

I find it interesting that not all statements include these two numbers on the same page. So in addition to NOT calculating your effective rate for you, some processors make you take an extra step to calculate it.

Your total sales are usually on the first or second page of the statement under the activity summary, whereas total fees are toward the last page.

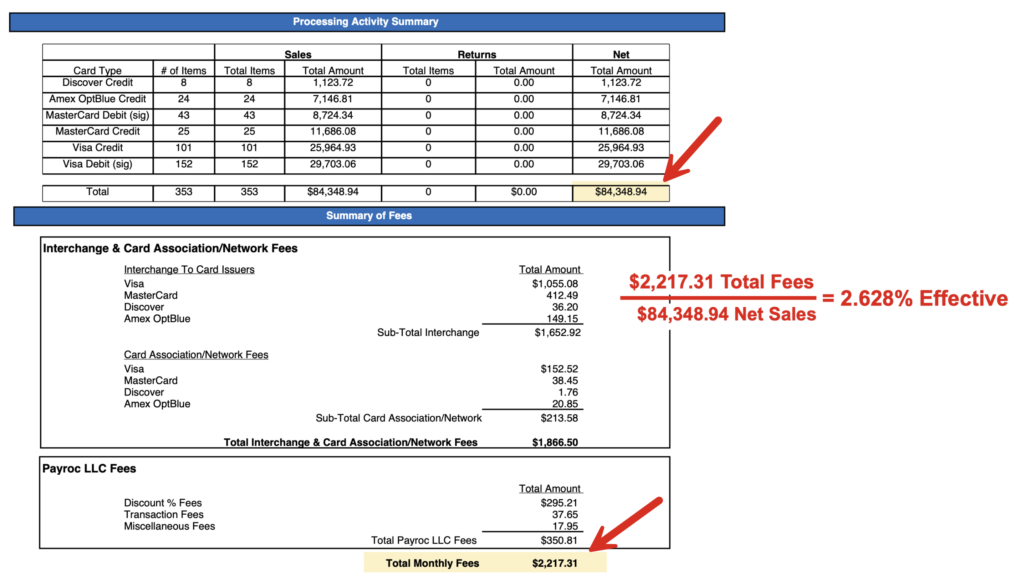

Here’s a good example of transparency, where everything you need to calculate your effective rate is in one place:

This business had $2,217.31 in total merchant fees for the month and $84,348.94 in net sales.

If we divide the fees by the sales, we get an effective rate of 2.628%, which is solid.

Which One is More Important?

Your effective rate is far more important than your discount rate because the discount rate alone doesn’t give you full context into your processing costs.

Here’s why.

The Discount Rate Doesn’t Tell the Full Story

Lots of merchants make the mistake of looking solely at their discount rate when assessing merchant fees. But this can be very misleading.

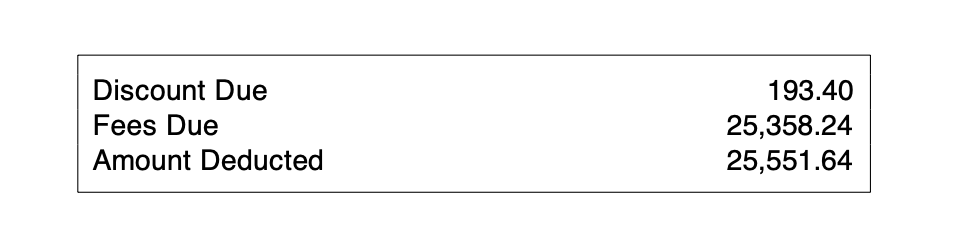

To put this into perspective, let me show you a merchant that’s being charged a super low discount rate: just 2 basis points (0.02%).

They paid $193.40 in discount fees on over $956k in net sales for the month.

But when we look at the total merchant fees, it’s significantly higher: $25,551.64.

The effective rate is 2.67%, which isn’t bad at all.

But this shows that the discount rate is only a small portion of what you’re paying. And there are additional processor markups buried in the other fees that you’re being charged.

Your Effective Rate Includes All Processing Costs

Processors love to show discount rate totals on statements because it makes it look like you’re paying less than you really are.

Sticking with the example from above, it’s easy for a merchant to quickly glance at this statement and assume their processor is only charging $193.40, and the rest of the fees are non-negotiable interchange rates. This isn’t true.

And that’s why you need to calculate your effective rate.

Effective rates factor in:

- Discount rates

- Per-item and per-transaction fees

- Other fees charged by your processor

- Interchange

- Assessments

- Network fees

The problem with most statements is that everything except the discount rate gets bundled into some form of an “other fees” total. This is where processors bury additional markup that’s harder for you to find.

If your effective rate is increasing but your discount rate remains unchanged, it’s a sign that:

- Your processor is adding other fees to pad their markups OR

- Your transactions are being downgraded at the interchange level

More often than not, it’s processor-imposed markups outside of the discount rate that’s increasing your effective rate.

What’s a Good Effective Rate?

A good effective rate is close to 2% of your sales volume. You typically can’t get much lower than that. Effective rates above 3% deserve closer scrutiny, as you’re likely overpaying somewhere.

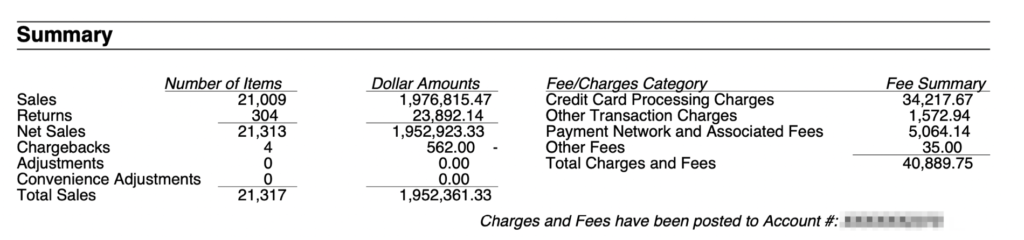

Here’s an example of a 2.09% effective rate that we negotiated for one of our clients:

They’re processing nearly $2 million per month, and that volume definitely plays a factor in them getting a good deal.

Their discount rate is 0.06% (6 basis points), and they barely have any other processor markups or service fees.

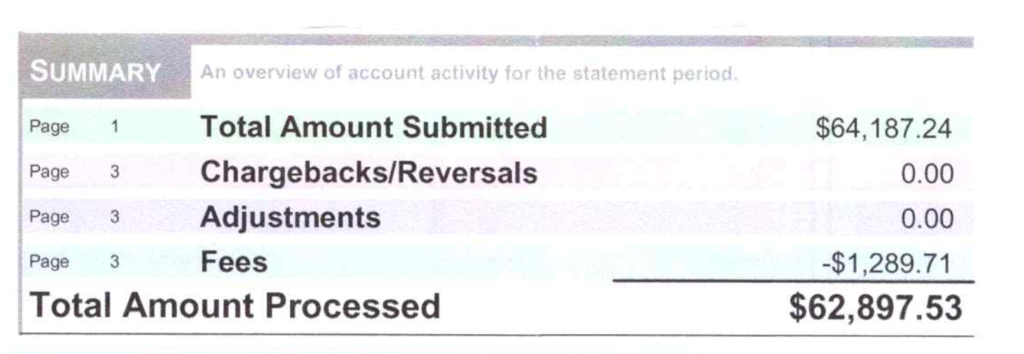

But you don’t always need to be a high-volume business to get a good deal. Here’s another client of ours that has a 2% effective rate on ~$63k in monthly sales:

So these deals are definitely out there and achievable for businesses of all sizes.

Don’t let your processor tell you that “you’re already getting the best deal.” And if you need help negotiating this stuff, just contact our team here at MCC and we’ll help you out.

What’s a Good Discount Rate?

The best discount rates are less than 0.05% per transaction. But anything below 0.10% or 10 basis points is solid.

If you have a complex setup or integration, it’s typically going to be higher.

For example, discounts of 0.20% are decent for integrated processing.

Just don’t be fooled by a low discount percentage. Most processors also charge a fixed dollar amount per transaction, and these per-item fees can add up quickly, especially for merchants processing a high volume of lower-ticket transactions.

Say you’re paying 0.05% + $0.50 per transaction.

That $0.50 component isn’t technically included in your discount total. But it’s still a markup being paid to your processor on each transaction.

And if you process 15,000 transactions in a month, that’s $7,500 in per-transaction fees, whereas your discount rate may only total a couple hundred dollars.

Other Tips to Keep in Mind

As you’re looking at your discount rate and calculating your effective rate over time, there are a couple of other things that I urge you to do.

Double-Check the Math on Your Discount Rate

When auditing your statements, you should always do the math manually to double-check you’re being charged the correct discount rate.

Just because the discount percentage is correct in the column or row, it doesn’t always mean that the amount deducted from your account is correct.

Here’s an example we found when auditing a statement for one of our clients:

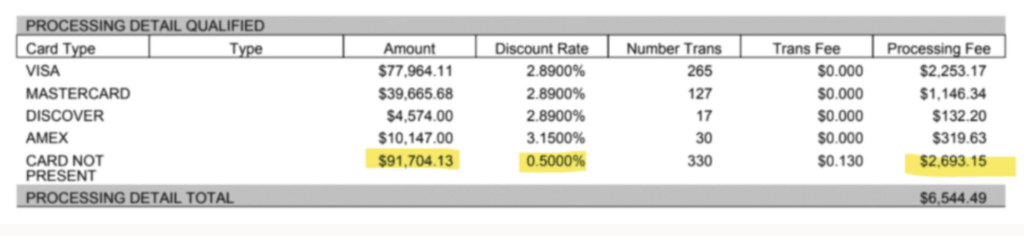

The discount rate here is 0.50% for CNP transactions.

On $91,704.13 in volume, this should result in $458.52. But instead, more than 5x that amount was charged ($2,693.15).

This doesn’t happen often. But when it does, it’s very easy to overlook if you’re just doing a quick glance at your numbers.

Remove E-Checks and ACH From Your Effective Rate Calculation

If your merchant services provider also handles e-checks and/or ACH processing for your business, you’ll need to subtract those totals from your volume and fees when you’re determining your effective rate.

Here’s why.

ACH transfers are cheap. They can be as low as $0.50 to $1 per transaction.

So if your business has a lot of these transactions, it artificially makes your effective rate look lower than it is.

This is particularly important for high-volume B2Bs.

A $20,000 ACH transfer may only cost you $15 flat. But if that same amount was charged on a credit card, you could be looking at hundreds of dollars in merchant fees.

Final Thoughts

Your merchant discount rate is important. But it’s only one small component of your processing costs.

Despite how your statement is presented to you, I can guarantee that your processor is marking up your transactions beyond the discount rate.

The key is finding those additional markups, knowing what’s negotiable, and making sure those costs don’t get out of control. And monitoring your effective rate is the best way to do that.