What is EMV Fallback? Fees Explained

EMV fallback occurs when an EMV chip card is used on a chip-capable terminal, but the transaction doesn’t process with the chip. Instead, it “falls back” to an alternative processing method.

As of right now, EMV cards and chip readers are the most secure way to process transactions in person. So if this method isn’t working correctly, your business is exposed to greater liabilities.

The occasional fallback transaction is normal. There are a number of reasons why this could happen. But too much EMV fallback can lead to fines, penalties, and other problems with your merchant account.

EMV Fallback Explained

Even if you didn’t know the proper name for it, I’m sure you’ve experienced EMV fallback either as a consumer, merchant, or both.

Just the other day, this happened to me when I was buying groceries at my neighborhood corner store. I inserted my card into the chip reader—error. I tried again—error. After the third failed attempt, the cashier instructed me to swipe my card instead, and it went through without any problems.

“It happens all of the time,” he said. I’m sure it does. These are some of the most common reasons why EMV fallback happens:

- Damaged chip

- Dirty card

- Problems with the chip reader

- Untrained staff

- Fraud

In most cases, EMV fallback is nothing to be concerned about. But the potential of fraud is definitely one of the reasons why you need to understand how it works and why it happens.

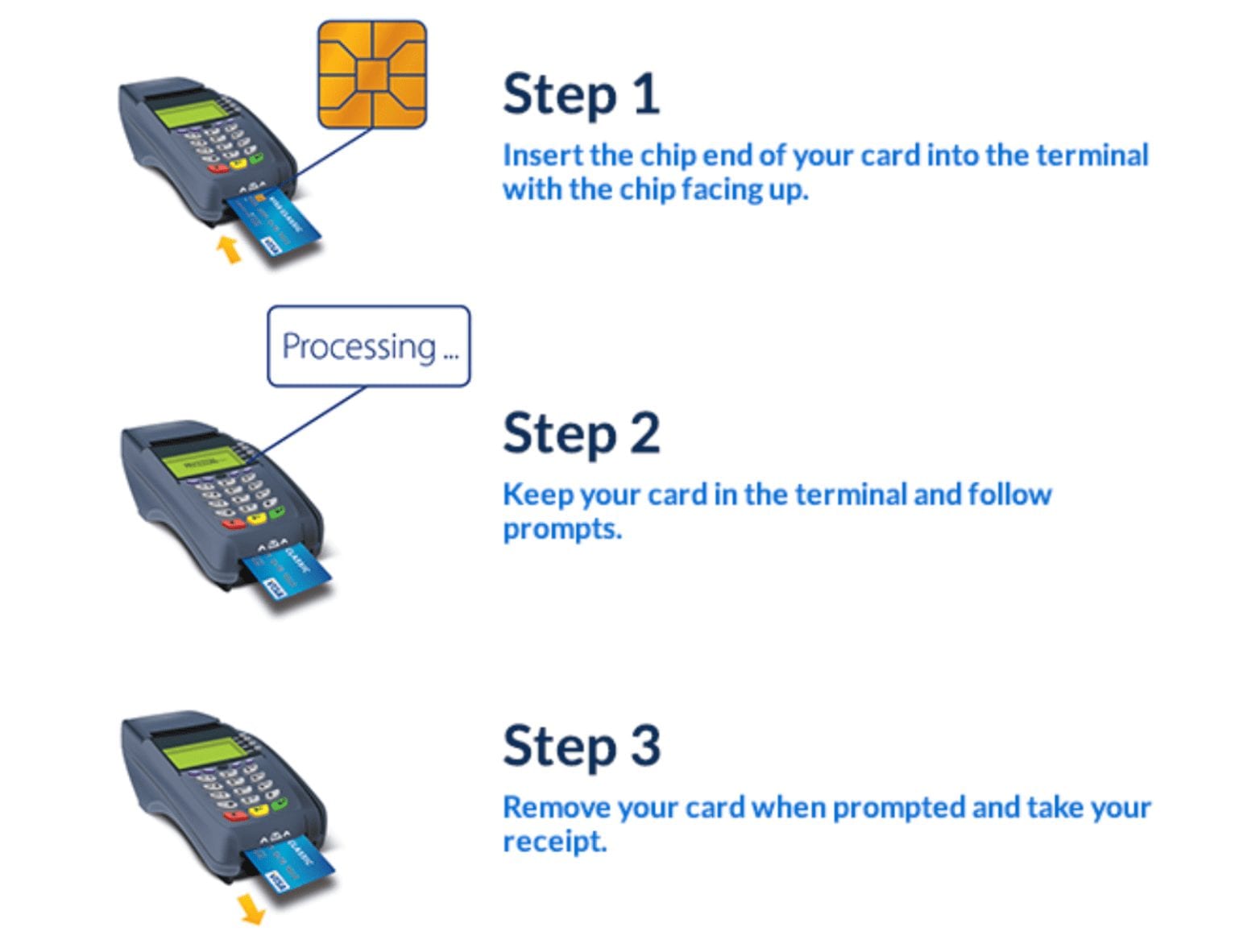

EMV fallback can only happen during a “card-present” transaction. As you probably know, this is how a chip-activated terminal is supposed to work when it’s functioning properly.

But when the transaction doesn’t go through, it doesn’t necessarily mean that the card has declined. More often than not, it’s due to one of the innocent reasons that I mentioned above (excluding fraud from innocent, of course).

EMV Fallback Hierarchy

There are three hierarchy levels for EMV chip transactions. Starting with the most secure, this is the order:

- Chip cards

- Magstripe

- Keyed

For EMV fallback to occur, the first level (EMV chip cards) have failed. By default, swiping the card is the next logical step, because it’s the most secure of the remaining options. Manually keying the card transaction is the third level of the hierarchy; it’s the least secure of the three.

If an EMV chip card doesn’t work, don’t jump steps and key the transaction manually.

This is a problem that I see with lots of merchants. They assume the card has an issue, and they automatically enter the card details manually into the terminal, which is when a fallback transaction occurs. This should only be done as a last result. Always try to process a magstripe transaction if the EMV method fails.

Benefits of EMV Fallback Transactions

The main advantage of EMV fallback is customer service. If the chip isn’t working, regardless of the reason, it gives the customer the option to pay using that card through an alternative credit card processing method.

It’s also easier for the cashier, customer, and anyone else waiting in line if the card can just be swiped, as opposed to paying cash or using a different card.

In some cases, the customer might not even have a backup payment method. So without EMV fallback, the entire purchase would be dead in the water for those instances.

EMV Fallback Fees

How much are EMV fallback fees?

Unfortunately, this answer varies depending on the card and payment processor. In many cases, a card that was dipped (chip) or swiped (magstripe) are charged the same credit card processing fees. So if this doesn’t happen too often, and the swipe processes the transaction, you may not get charged differently.

However, keyed transactions are usually processed with higher fees. Furthermore, too many EMV fallback transactions and keyed entries will increase your chances of becoming a high-risk merchant.

Some credit card processing companies charge non-compliance fees to processors for providing services to merchants with an “excessive” amount of EMV fallback.

What counts as excessive and how much those fees are have not been confirmed. However, you can be sure that your processor will pass any fines or extra fees along to you if they are being penalized by the card companies. They might even impose their own penalties in addition to those fees. The only way to get this answer with certainty is by contacting your processing company directly.

EMV Fallback Fraud

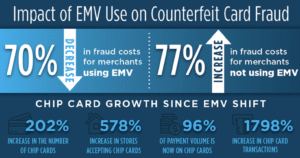

Enhanced security is the whole purpose behind EMV cards and chip readers. This chip card technology has helped reduce in-store fraud for card-present transactions.

EMV cards and terminals aren’t immune to lost or stolen credit cards. So if a thief uses a stolen card on an EMV-compliant terminal, the card will process as it should.

However, it’s more challenging to duplicate a fake credit card with a working chip. That’s why chip card transactions are so much safer than magnetic stripe transactions.

So a fraudulent card might not work in the chip reader, but could ultimately be processed through one of the fallback methods (magstripe or keyed).

While EMV fallback benefits the customer, it does put the merchant at a higher risk for processing a fraudulent transaction.

How to Prevent EMV Fallback Transactions

As a merchant, it’s crucial that you understand the importance of EMV transactions and EMV technology. Educating yourself on proper processing is arguably the best way secure payments and avoid unnecessary fees.

Here are some quick tips to keep in mind:

- Make sure you’re using EMV enabled technology (upgrade if you haven’t)

- Always attempt a chip transaction before swiping a card

- Only consider a magnetic stripe transaction as a last result

- Reach out to your processor and see if they can block fallback transactions

- Adopt EMV for debit cards, credit cards, ATMs, and all POS sales

- Take steps to prevent fraud resulting in added fees and chargebacks

Final Thoughts

EMV fallback happens every day. In most cases, it’s the result of a faulty chip, dirty card, or problem with the terminal.

While EMV fallback might seem harmless, it could come with fees, fines, penalties, and other repercussions from your credit card processing company.

As a merchant, you need to avoid EMV fallback whenever possible. Make sure the fallback isn’t occurring because of a problem with your machines or untrained staff. If it does happen, make sure your staff understands the fallback hierarchy.

Always attempt to swipe the card before you enter the details manually. This will save you processing fees and help reduce the risk of fraud.

Is your payment processor charging you extra fees? If you think you’re paying too much for credit card processing, let us negotiate your rates, as opposed to switching providers.