Flat-rate credit card processing is awful for businesses. Despite its perceived simplicity, this processing model is incredibly expensive.

The truth is, payment processors are not your friends. They’re for-profit businesses looking to squeeze every possible dollar they can from you.

So if you’re currently on a flat-rate pricing plan, I’ve got bad news for you—you’re overpaying.

Read on to find out why and what steps you can take to save money. And if you’re considering a flat-rate contract, you can use this guide to determine if it’s actually right for you (assuming you’re ok with paying more than you need to).

The Expensive Illusion of Simplicity

Flat-rate pricing is designed to sound simple because payment processors assume you’re too busy running a business to actually crunch the numbers and understand your true processing costs.

But it’s all a marketing ploy.

Thousands of businesses are overpaying by 25-50% or more on every sale because they think 2.9% + $0.30 per transaction is easier to understand than interchange tables.

In reality, a debit card transaction may only cost 0.05% + $0.21 or 1.15%+ $0.15 per transaction at the interchange level. The interchange rate for credit card transactions may start around 1.65% + $0.05 per transaction.

If you’re on a flat-rate model, you’re still paying upwards of 3% on those sales. The difference goes straight to your processor as a pure profit.

Is it easier to know that all of your transactions will cost 2.9% + $0.30 per transaction? Maybe.

But wouldn’t you rather have it be slightly more complex instead of overpaying by tens of thousands of dollars every year?

Breaking Down the Actual Costs of Flat-Rate Processing

The math doesn’t lie.

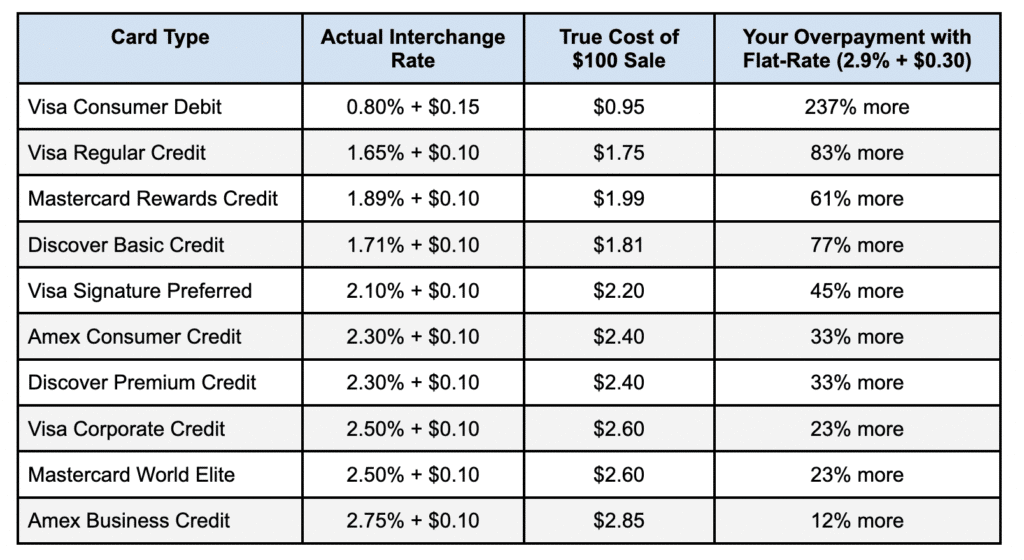

Let’s take a closer look at some real interchange categories from different card networks so you can see exactly how much flat-rate processing is costing you.

There are thousands of different interchange categories that depend on factors like the card network, transaction environment, card type, MCC code, and more. But this is a fairly average mix that works as a good illustration for most businesses (I didn’t just cherry-pick the lowest possible rates).

As you can see, you’re overpaying on every single transaction—by a lot.

If we do some rough math here, we can assume that a business processing $75,000 per month will have a mix of these cards and rates. We’ll say 30% are debit cards ($700 overpayment), 40% are standard credit cards ($550 overpayment), and the remaining 30% are premium rewards and corporate cards ($400 overpayment).

While this is quick napkin math, it still results in $1,650 in overpayments per month, translating to $19,800 in excessive fees per year.If your business processes $150,000 per month, that’s nearly $40,000 in overpayments per year and about $200,000 in unnecessary processing fees over the course of five years on a flat-rate plan.

Hidden Fees Beyond the “Flat Rate”

Your processor might tell you that you’re paying a flat rate. But in reality, it always ends up being more.

You’ll likely end up paying other hidden fees that can raise your effective rate by over 100 basis points (or more).

- Setup fees

- Monthly statement fees

- PCI compliance fees

- PCI non-compliance fees

- POS fees

- Terminal fees

The list is never-ending.

Stripe is a popular example of a modern processor offering flat-rate pricing. But if you look at my Stripe review, you can see that they charge tons of other usage-based fees that will end up increasing your rate.

So if your flat-rate processor claims that you’re only 2.90% + $0.30 per transaction, I bet your actual costs are higher than 4% on your total statement volume. That’s far too high.

Real Flat-Rate Processing Statement Examples

Let’s take this a step further now and look at real merchant statements, comparing flat-rate costs to interchange-plus pricing.

Example 1

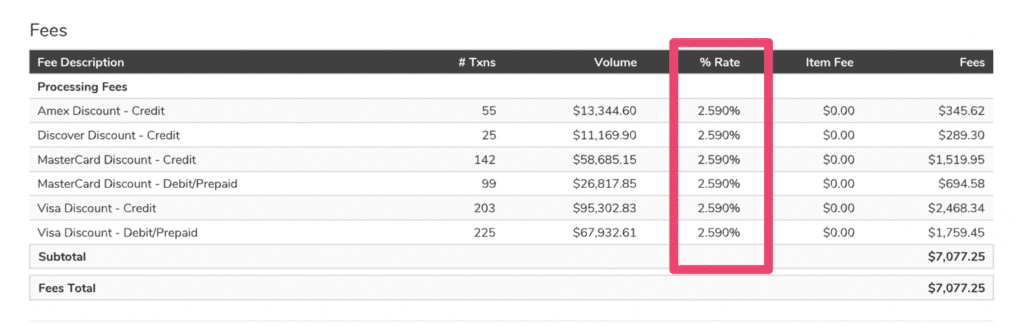

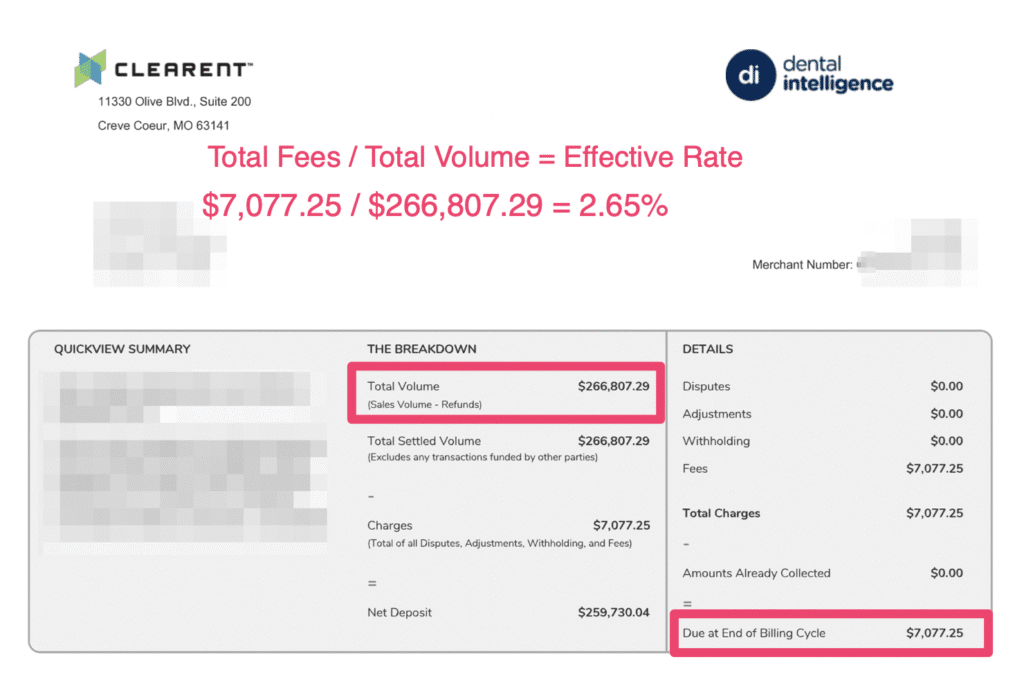

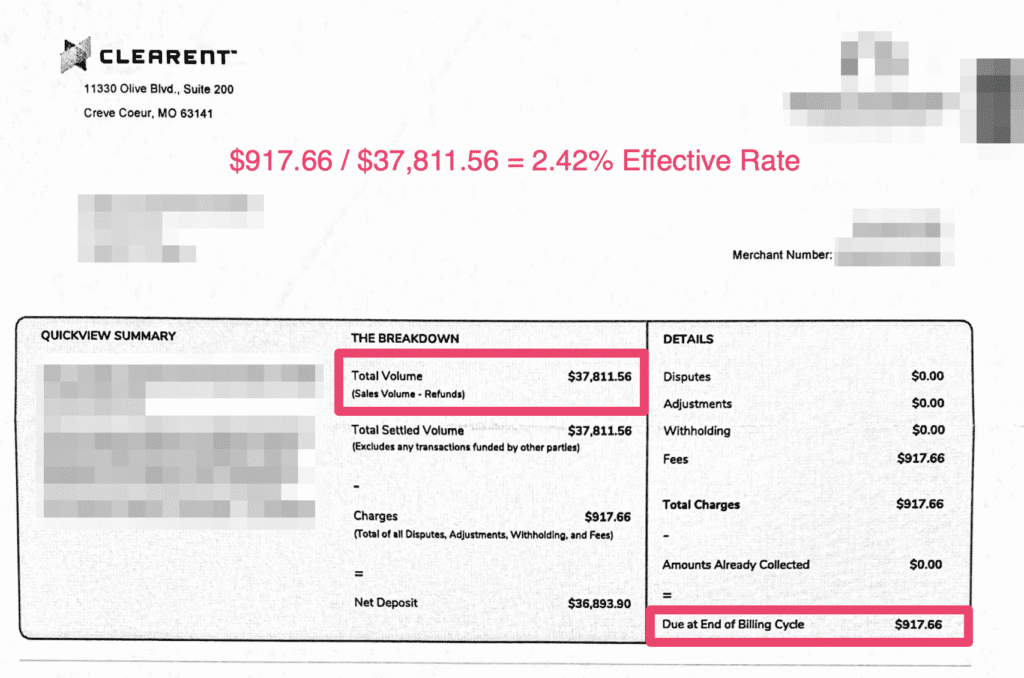

This merchant is on a flat-rate pricing structure with Clearent, paying 2.59% per transaction:

In the world of flat-rate plans, this one actually isn’t terrible. But it’s still so much more than they’d pay if they were on an interchange-plus structure.

Fortunately, Clearent doesn’t have too many extra hidden fees (at least for this merchant. So we can calculate the effective rate at 2.65% for this statement period.

Now let’s look at another Clearent statement—this time from a merchant on an interchange-plus pricing plan.

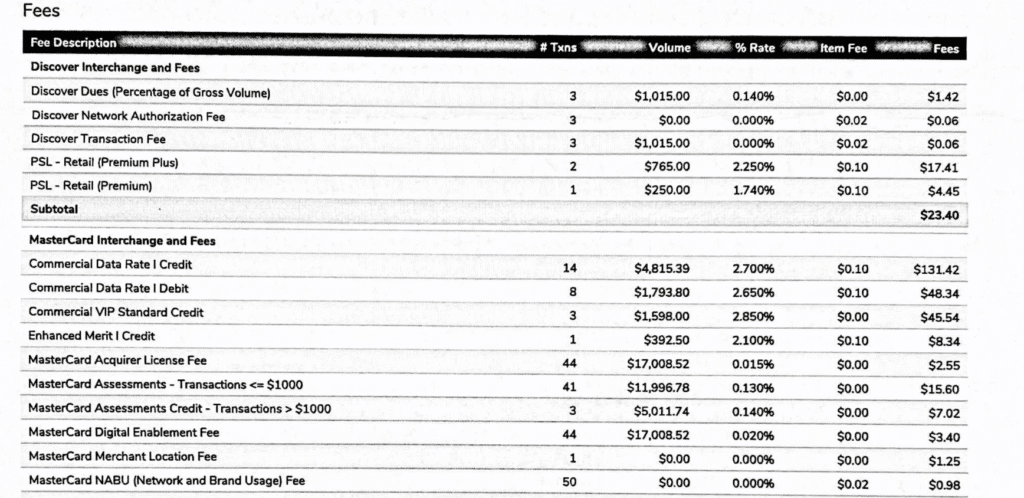

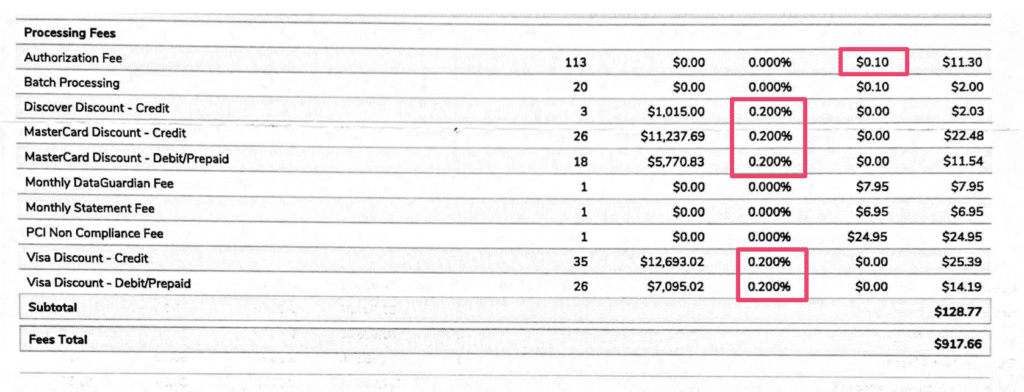

On this statement, you can see the actual costs being passed through by the card networks.

This is just a snippet, but there are several pages of these fees covering all of the transactions by card network and interchange category.

Now if we look at Clearent’s markup, we can see it’s 0.20% (20 basis points) over the interchange rate.

There’s also a $0.10 fee per authorization.

In total, this merchant paid a 2.42% effective rate for the statement period:

That’s 23 basis points less than the first merchant on a flat-rate plan.

Had the first merchant paid 23 basis points less on $266,807 in processing, they would have saved $613 this month alone—roughly $7,365 for the year. Just by moving from a flat-rate to interchange-plus plan.

Here’s the crazier part.

Clearent offered a 0.20% + $0.10 markup to that second merchant that’s only processing $37k per month. So for the business processing over $266k per month, I bet that markup could be cut in half (or at least close).

So we can conservatively estimate that the first merchant could save over $10,500 annually just by moving away from a flat-rate plan—and they wouldn’t even have to switch providers.

Example 2

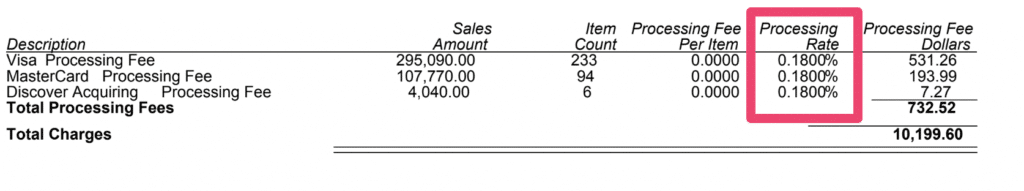

Here’s another example—this time using US Bank as the processor.

If you go to US Bank’s website, you can see that flat-rate processing starts at 2.60% + $0.10 per transaction (and goes as high as 3.50% + $0.15 per transaction).

But if we look at an interchange-plus statement from a merchant using US Bank, we can see here that the markup is 0.18% (18 basis points) over the interchange rate.

Look at the total sales amounts for each card type (column 1). If we add those up, we can see the merchant processed $406,900 on 332 transactions for Visa, Mastercard, and Discover.

If they were on a flat-rate pricing plan from US Bank (we’ll say paying an average of 3.05% + $0.125 per transaction), they would have paid $12,451.95 on this volume.

So the interchange-plus plan ended up saving them about $2,250 per month compared to the flat-rate model.

Transparency Results in Higher Savings

The biggest problem with flat-rate processing is its lack of transparency. You don’t actually see the true cost of each transaction. Instead, you just see what your processor charges you all-in to handle it.

But if you’re on an interchange-plus pricing plan, you can see exactly what’s being charged by the card networks and passed through to you.

This makes it much harder for your processor to charge sky-rates because the markup is in plain sight. All you need to do now is negotiate that markup fee.

Depending on your processor, business type, and volume, you can negotiate markups as low as 0.05% + $0.05 per transaction.

But anything under 20 basis points is likely going to yield significant savings compared to flat-rate plans.

Is Flat-Rate Processing Good For Anyone?

Flat-rate processing really only makes sense for brand new businesses and low-volume merchants.

Some new businesses struggle to get a good interchange-plus deal because the processor’s underwriting team views them as a high risk.

In this case, you may have to temporarily get on a flat rate plan until you can prove that you’re not a high-risk merchant.

Small startups processing less than $20,000 per month can potentially start on a flat-rate plan if they just want to start getting paid as quickly as possible without getting a merchant account.

That’s when you can turn to a company like Stripe, PayPal, or Square to handle your payment acceptance. But it’s going to be expensive and I don’t recommend this as a long-term solution.

If you accept payments in-person, flat-rate processing is costing you even more money because those tend to be the cheapest interchange rates.

How to Get Out of a Flat-Rate Processing Contract

For those of you currently on a flat-rate processing contract, you can still save money without switching providers or changing your operations.

Start by contacting your provider and asking them to put you on an interchange-plus plan. This will most likely be met with some resistance, so be prepared to negotiate.

If you need some assistance, our team at Merchant Cost Consulting can help you out. We’ll audit your statements for free and let you know much you can save by moving away from the flat-rate model (while still keeping your current provider).

The great part about working with us is that since we’ve audited statements from virtually every processor, we know what they can offer you (because we’ve seen it firsthand).

While they might tell you that an interchange-plus rate isn’t an option or that the rate you’re asking for is too low, they can’t say that to us because we have real statements to back up our claims.

Final Thoughts

While flat-rate processing might sound simple, it’s one of the worst pricing models for credit card processing.

Simply put:

- The “flat rate” never ends up reflecting your true costs

- It’s not transparent

- It’s expensive

As a result, you’re likely overpaying by hundreds, if not thousands, of dollars every month.

So if you’re still in talks with a new provider and they’re trying to get you on a flat-rate deal, do not accept it. And if you’re already on a flat-rate deal, you can likely get out of it without having to change providers.

Stop letting flat-rate pricing eat into your profit margins. Switching to interchange-plus might make your statements a bit tougher to understand, but the thousands of dollars in savings are well worth it.