Whether you’re thinking about using Fullsteam for payment processing or you’re a current Fullsteam customer who’s looking for more information, you’ve come to the right place.

We have several clients using Fullsteam, so we’ve spent years auditing these statements, and we’re very familiar with their services and pricing.

Read on for our insider take on Fullsteam, including its pros, cons, pricing, and an in-depth look at how to understand your statements.

MCC Quick Take on Fullsteam

Fullsteam brands itself as an integrated payment processor. But based on the statements we see, they are ultimately a PayFac leveraging Fiserv’s acquiring services.

Most of our clients using Fullsteam are in the home appliances space or the pool and spa industries, but there are some other industry-specific solutions that this processor caters to.

Pros

- Interchange-plus pricing is available.

- Sales reps are open to negotiations.

- Pricing is average at best, but not bad for an integration.

Cons

- Terrible reporting (among the worst we’ve ever seen).

- Frequent rate hikes—as often as twice per year.

- The “quotes” they send to new customers are incredibly difficult to understand, especially to the untrained eye.

Ultimately, it’s safe to say the negatives outweigh the good stuff by far. The reporting alone is reason enough to stay away, and we’ll take a closer look at exactly what I mean later on.

Fullsteam Pricing and Credit Card Processing Rates

Fullsteam offers custom pricing to each account, and it varies significantly based on your business type and processing volume.

Fullsteam’s average markup tends to fall right around 0.40% (40 bps).

But we’ve seen it as low as 0.10% (10 bps) above interchange and as high as 1.05% (105 bps) over interchange.

Getting a 0.40% markup definitely isn’t the cheapest option on the market, but it’s far from the most expensive and it’s not awful if you’re getting a truly integrated processing solution.

Other Fullsteam Fees to Look Out For

In addition to transaction markups, Fullsteam will potentially charge a range of other fees. Examples that we see include:

- PCI Breach Protection Fee — $14.95 to $19.95 per month

- PCI Non-Compliance Fee — $34.95 to $39.95 per month

- Account Updater Fee — $1 per update

- Monthly Service Fee — Varies (sometimes $0)

- Accelerated Funding Fee — $20 per month (for next business day deposits)

- Monthly Billing — 0.05% of total volume

- Partner of Processing Cost Fee — 0.02% + $0.02 (on monthly volume on RB Smart Pay Accounts)

Some of these are optional services (like the Accelerated Funding Fee). Others don’t necessarily apply to every account type (like the Partner of Processing Cost Fee).

But if Fullsteam is charging you a monthly service fee, then you should call and ask for it to be removed.

I can’t stand PCI fees. It should be your processor’s responsibility to provide you with PCI-compliant solutions. So it’s bogus when they could charge you for non-compliance if they offer a paid service to help keep you compliant.

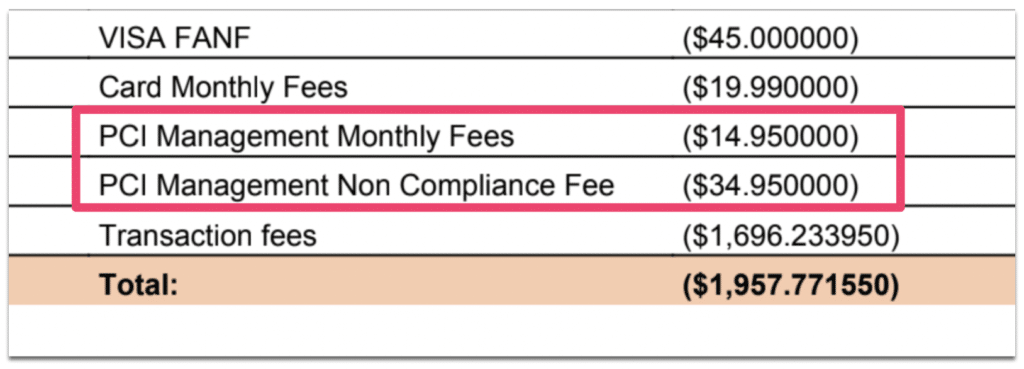

Here’s an example from a Fullsteam statement so you can see what I mean:

Why should a merchant be charged a PCI management fee if they’re also being charged for non-compliance? It doesn’t make sense.

In-Depth Breakdown of Fullsteam’s Merchant Statements (With Real Examples)

My reviews are honest, but I try to stay as neutral as possible and I don’t like to bash any businesses. That said, I can’t hold my tongue with Fullsteam’s reporting.

At Merchant Cost Consulting, we literally review and audit thousands of statements from virtually every processor in existence—and Fullsteam’s statements are truly some of the worst on the market.

Here’s the problem with these reports.

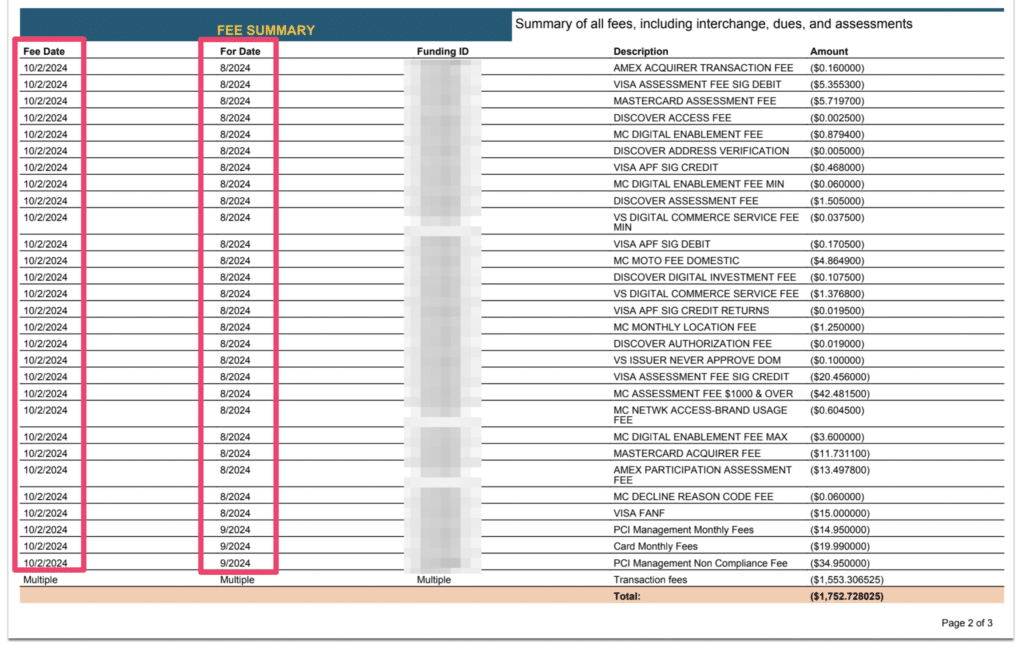

First, you need to have three consecutive months of statements to even calculate your total fees—which is outrageous. That’s because the fees on your current monthly statement are for the fees two months prior.

The screenshot below is from an October statement from one of our clients. As you can see, the fees were charged in October, but they’re August’s fees.

Fullsteam also includes a fee summary at the top of every monthly report.

But this doesn’t provide the information you need either—as it’s not the summary of the entire statement, but just a recap of the day-by-day transactions.

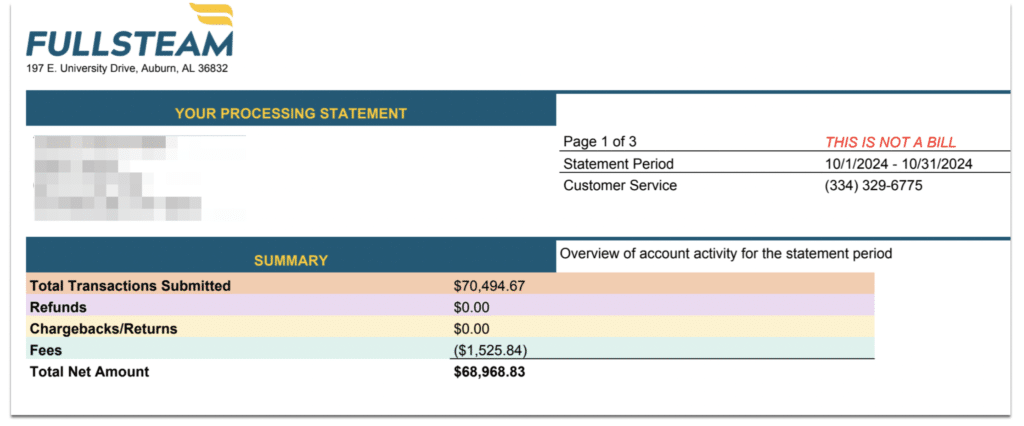

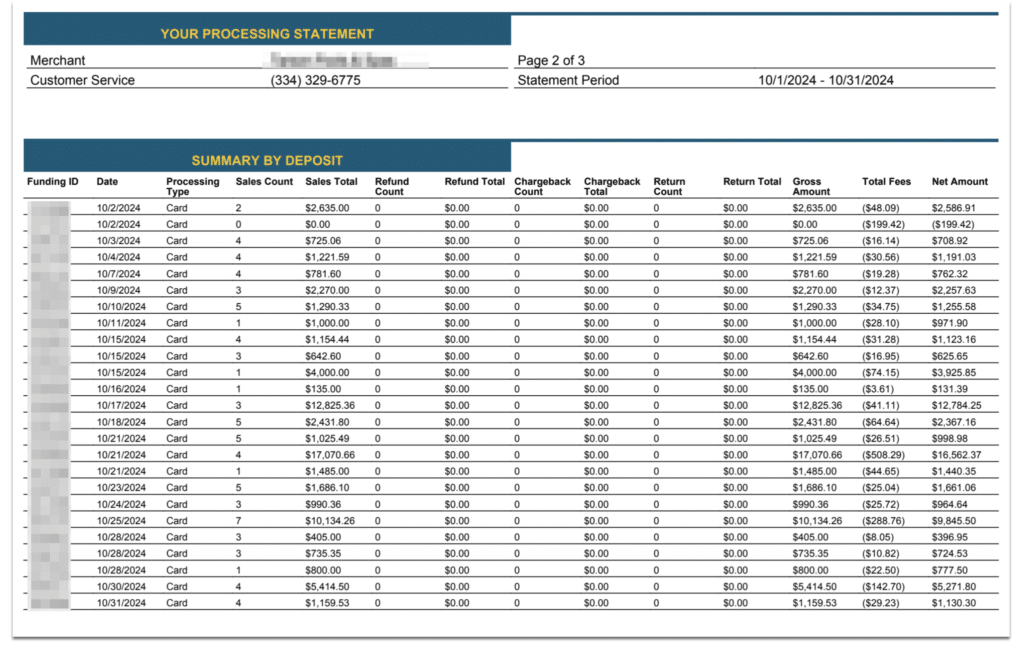

Here’s an example of what that looks like:

Remember, Fullsteam doesn’t charge you all of the card brand fees until two months later. So the fees in your summary snippet aren’t telling you what you actually paid for the statement period.

It’s also worth noting that Fullsteam might be the only processor on the planet that doesn’t show markups on their statements.

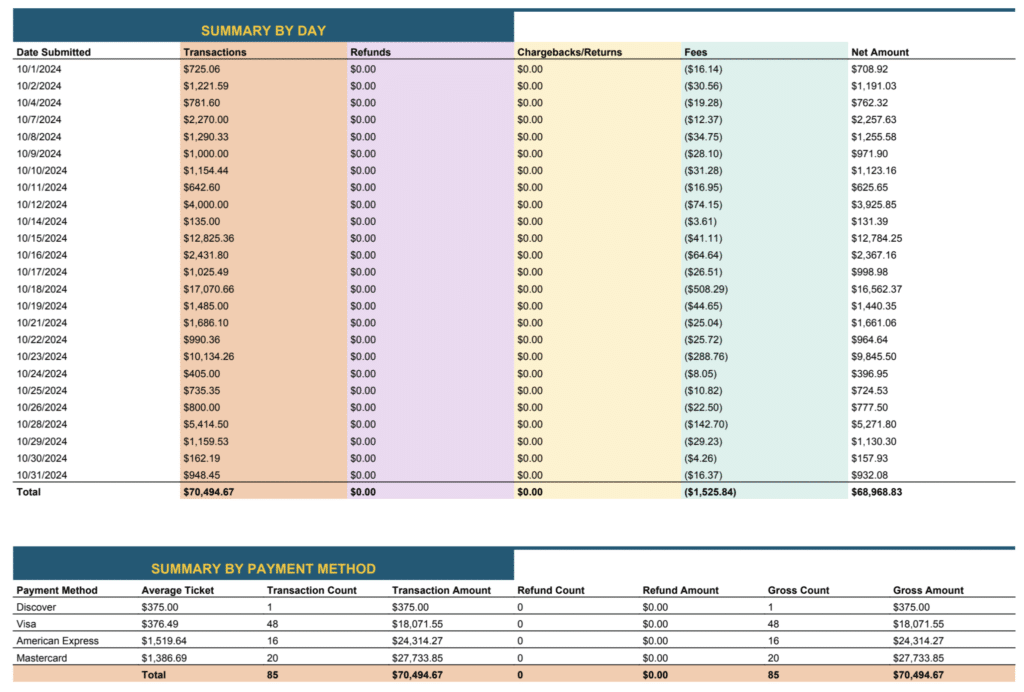

First, here’s an expanded look at the monthly summary by day and payment method:

So, where is Fullsteam’s rate markup? It’s definitely not here.

It must be somewhere else on the statement, right? Let’s check on the summary of daily deposits:

Nope.

The actual rate that merchants pay to Fullsteam isn’t displayed anywhere on the monthly statement.

Latest Processor Rate Increases, Updates, and Noteworthy News

As previously mentioned, Fullsteam increases its rates on a regular basis. You can see our complete history of Fullsteam’s rate increases and updates here, and these are the most recent rate hikes that we’ve seen:

- April 2025 — 0.072% + $0.01 per transaction rate increase

- April 2024 — 0.09% + $0.09 per transaction rate increase

- October 2023 — 0.14% + $0.14 per transaction rate increase

- May 2023 — 0.14% + $0.14 per transaction rate increase

Not every account is affected by these increases.

So it’s important to keep a close eye on any emails you receive because, unlike other processors, Fullsteam doesn’t add rate increase notes to their statements. Otherwise, you have to call and ask them if you’ve been affected.

And as shown above, you can’t just compare one month’s statement to the next to see if your rate has gone up because Fullsteam doesn’t include its markup rate on statements.

Should You Switch to Fullsteam?

I wouldn’t. There’s really nothing special offered from Fullsteam that you can’t get from another processor.

We have some clients using them, and they’ve been with Fullsteam for a long time.

But in today’s day and age, where you have other processors using cutting edge-technology and then you see a provider like Fullsteam that doesn’t even have readable statements, it’s tough to recommend them.

I’d consider them in the future if they cleaned up their reporting—which they honestly might have to if state-specific laws start cracking down and force more transparency.

It’s also worth noting that the main reason why merchants even consider switching payment processors is for cost savings. I always say to take these quotes with a grain of salt, because any processor you ask for a quote will undercut your current provider.

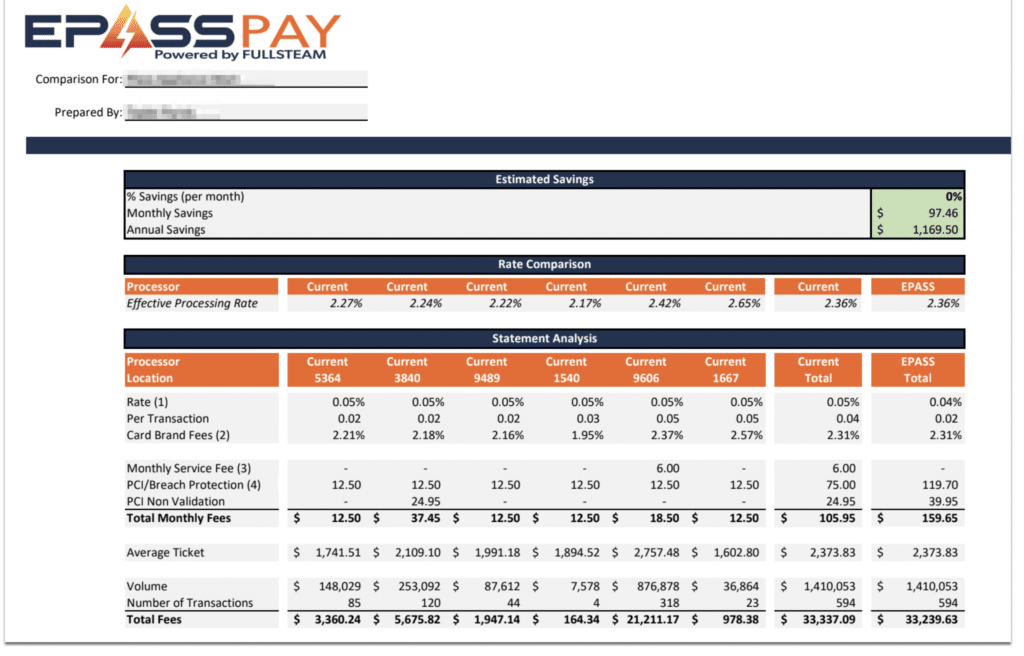

But check out this quote that Fullsteam sent to a client who asked for a pricing comparison:

First of all, the quote is incredibly difficult to read and understand.

We see these all of the time, and it’s common for sales reps to do side-by-side comparisons to illustrate cost savings. But similar to Fullsteam’s actual monthly statements, the quotes aren’t very good either.

But the craziest part about this quote is that it’s to save just $97 per month.

At MCC, we save clients tens of thousands per month without switching processors. I can’t think of a situation where it makes sense to actually switch your processor to save such a small amount of money.

Our Final Thoughts on Fullsteam

Despite anything that Fullsteam actually does well, their monthly reporting and lack of transparency just can’t be overlooked.

So if you’re thinking about using Fullsteam, I’d say you’ll have better luck using another provider.

That said, this doesn’t mean that you should cancel your contract if you’re currently using Fullsteam to process your card payments.

Contact our team here at MCC before you switch. We can negotiate your rates directly with Fullsteam on your behalf, and we’ll even handle the monthly auditing of your statements so you won’t have to worry about trying to calculate your fees.