No business wants to issue a refund. This event means that something went wrong with a customer. Unfortunately, refunds are just part of doing business. They’re usually inevitable and nearly impossible to avoid altogether.

But refunds can actually be more expensive than you realize. Not only will you lose the cost of the sale, but in most instances, you’ll pay extra credit card processing fees.

Yes—you heard that correctly. Refunds, even for a simple return, have a direct impact on your credit card processing costs.

How is this possible? Continue reading below to learn more.

Who Pays a Credit Card Refund Fee?

The cost associated with credit card refunds always falls on the merchant.

Unless you’re one of the few businesses out there with a “no returns, no exceptions” policy (we don’t recommend this), then you’ve already been paying credit card refund fees, whether you realize it or not.

The tricky thing about credit card refund fees is that they don’t present themselves the same way as other line items on your processing statement. Depending on your processor and contract structure, the fee won’t be clearly displayed on each statement—but it’s in there.

In many cases, the credit card refund fee is equal to the cost of the interchange fees. You aren’t charged twice for the interchange; you just won’t be reimbursed those costs when the refund gets processed. Other processors might reimburse you for the interchange, but charge a fixed fee for each credit card refund. Either way, some fees are going to come out of your pocket.

Understanding the Steps Involved With Credit Card Processing (and Returns)

To fully understand how refunds impact your processing fees, we need to start with the basics—the steps associated with credit card processing.

Once you have a firm grasp of this process, you’ll understand how credit card refunds work. Then the concept behind why you’re paying for refunds will make a little bit more sense (even though it won’t change anything).

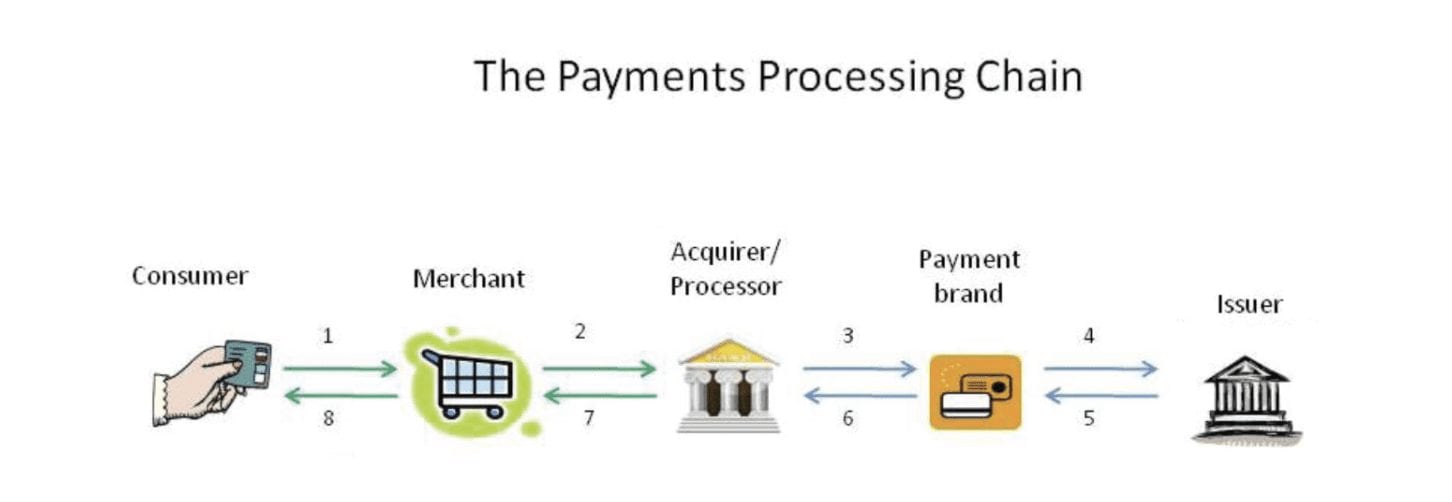

There are lots of different parties associated with a credit card transaction.

- Customer

- Merchant

- Issuing bank

- Acquiring bank

- Card associations

- Payment Processors

In some instances, you might even have a payment gateway or terminal issued by another third-party provider. For those situations, you need to add those companies to the list as well.

As you can see, each credit card transaction isn’t as simple as the customer paying the merchant directly. Even though a credit card transaction seems like an instantaneous occurrence, all of these players are involved in some capacity—and everyone wants to be compensated for their role in the transaction.

Here’s a simple visual representation that shows the different steps that take place between various parties.

This is essentially the life cycle of the transaction. I could spend a full day explaining the intricacies of what goes on behind the scenes of a simple card swipe, but I’ll spare you those details and summarize the process in a few quick lines.

When a customer pays using a credit card, the merchant’s processor must verify the transaction with the issuing bank (the customer’s bank). Sometimes, the card network and issuing bank are one in the same (American Express and Discover). They do this to make sure the card is valid, check to see if the customer has sufficient credit, and more.

Once the issuing bank gives the green light, the transaction can be processed. Then the merchant has to settle the transaction with their processor, and the money moves between the issuing bank and acquiring bank (facilitated by the processor).

Every entity involved with the transaction gets a piece for their troubles.

Now, what happens when a credit card refund occurs? This entire process gets reversed. Now the processor must move the money from the acquiring bank back to the issuing bank, so the customer can be credited.

Again, these parties aren’t going to do this for free. Everyone who plays a role in the credit card refund process needs to be compensated, so that’s where the credit card refund fee comes into play.

Debit Card Transaction Refunds

Like credit cards, there’s also a debit transaction fee when customers use debit cards to pay.

The interchange rates here depends on the card issuer and financial institution. Thanks to the Durbin Amendment, large banks are capped with how much they can charge for debit transactions.

So you’ll likely be paying lower fees on debit cards, regardless of the transaction amount, card present, CNP, or the credit card processor that you’re using.

But just like a credit card, there are still multiple parties involved with a debit card transaction and refund. Since the process of returning the money from your business back to the customer has to go through multiple parties, a fee is charged for this service.

Void vs. Refund: What’s the Difference?

Refunds and voids are commonly confused with each other. While the two both may have the same end result, they are far from the same thing.

A voided credit card transaction occurs before any funds are transferred. If a charge is voided before the merchant batches and settles their transactions (usually occurring at the end of each business day), then it can be voided at no cost.

Here’s an example. Let’s say a customer buys something worth $15 at a physical business location. The employee working the register mistakenly enters $150 into the credit card terminal (an honest mistake).

They quickly realize the error, but the transaction already went through. That charge can easily be voided without any penalty since the funds haven’t moved yet.

But let’s say the error wasn’t discovered until the following day after the credit card transactions were batched and settled the previous night. To rectify this situation, a refund would need to take place—and the merchant will be charged accordingly.

But let’s say the error wasn’t discovered until the following day after the credit card transactions were batched and settled the previous night. To rectify this situation, a refund would need to take place—and the merchant will be charged accordingly. The only way to avoid these additional fees would be to issue store credit instead of their money back. But it’s highly unlikely that the customer would agree to something like that—as they’re entitled to their money back.

Chargeback vs. Refund: What’s the Difference?

Refunds are issued by the merchant. But chargebacks are issued by the bank.

If a cardholder disputes a charge on their credit or debit card, the bank refunds them the money through a chargeback. From the merchant side, this is a forced payments reversal, meaning you don’t have any control over the money being sent back to the cardholder.

In addition to the funds reversal, you’ll also be imposed chargeback fees and penalties. These fees aren’t imposed as harshly for refunds.

With a refund, you’re typically getting back the goods that sold to the customer. If someone buys a shirt and they return it, they’ll get their money back and you’ll get the shirt back. That’s not the case with a chargeback.

We have a complete guide that covers the differences between refunds and chargebacks. You can refer to this resource for more information.

How Your Contract Structure and Processor Affects Credit Card Refund Fees

Not every merchant is charged the same amount for credit card refunds (just like not every merchant is charged the same for transactions).

This isn’t a definitive guide, but in most cases, here’s how different plan types will impact how you pay for credit card refunds:

- Flat-rate or tiered pricing — No reimbursement for processing fees.

- Interchange-plus pricing — You are entitled to a refund of the interchange fee (assuming the card network refunds the interchange). The processor markup may or may not be refunded.

Some credit card processors are unethical; there’s really no other way to say it. On interchange-plus pricing plans, we’ve encountered processors that pocket the refunded interchange fees (even though the card network refunded them). By right, those fees paid should be going back to you. But most merchants don’t realize that they’re entitled to this.

Final Thoughts on Credit Card Refunds

Refunded transactions can be a pain for merchants. But they’re just part of doing business.

Since credit card refund fees aren’t clearly displayed on processing statements, many merchants don’t even realize how much they’re paying to process refunds.

Depending on your processing structure, you might be overpaying for credit card refunds.

So what’s the solution? No, it’s not to stop issuing refunds altogether. If you do that, customers can just file chargebacks, which will be even worse and more expensive for your business.

Instead, contact our team here at Merchant Cost Consulting. We’ll review your contract structure and speak to your processor on your behalf. We’ll see how they’re handling refund fees and even negotiate your other processing fees.