I’ve recently encountered many business owners facing the same problem—they don’t know how to accept credit card payments over the phone.

Some of these organizations improperly take phone payments, leading to higher credit card processing fees, more chargebacks, and increased risks for the business.

Companies in nearly every industry have a need for credit card processing phone payments. From restaurants to ecommerce, retail to field service, you want to give your customers as many credit card processing payment options as possible.

The proper way to accept credit card phone payments is with a virtual terminal—and this guide will teach you how.

What You Need to Take Payments Over the Phone

Before you can accept over the phone payments, there are a few prerequisites to get started—mainly, a merchant account provider and a virtual terminal.

Merchant Services Provider

Every business needs payment provider to accept any credit or debit card. This holds true whether you’re accepting payments over the phone, in-person through a credit card terminal, and even if you’re taking mobile payments using a credit card reader.

MSPs provide the support, technology, and services required for taking credit card payments.

Virtual Terminal

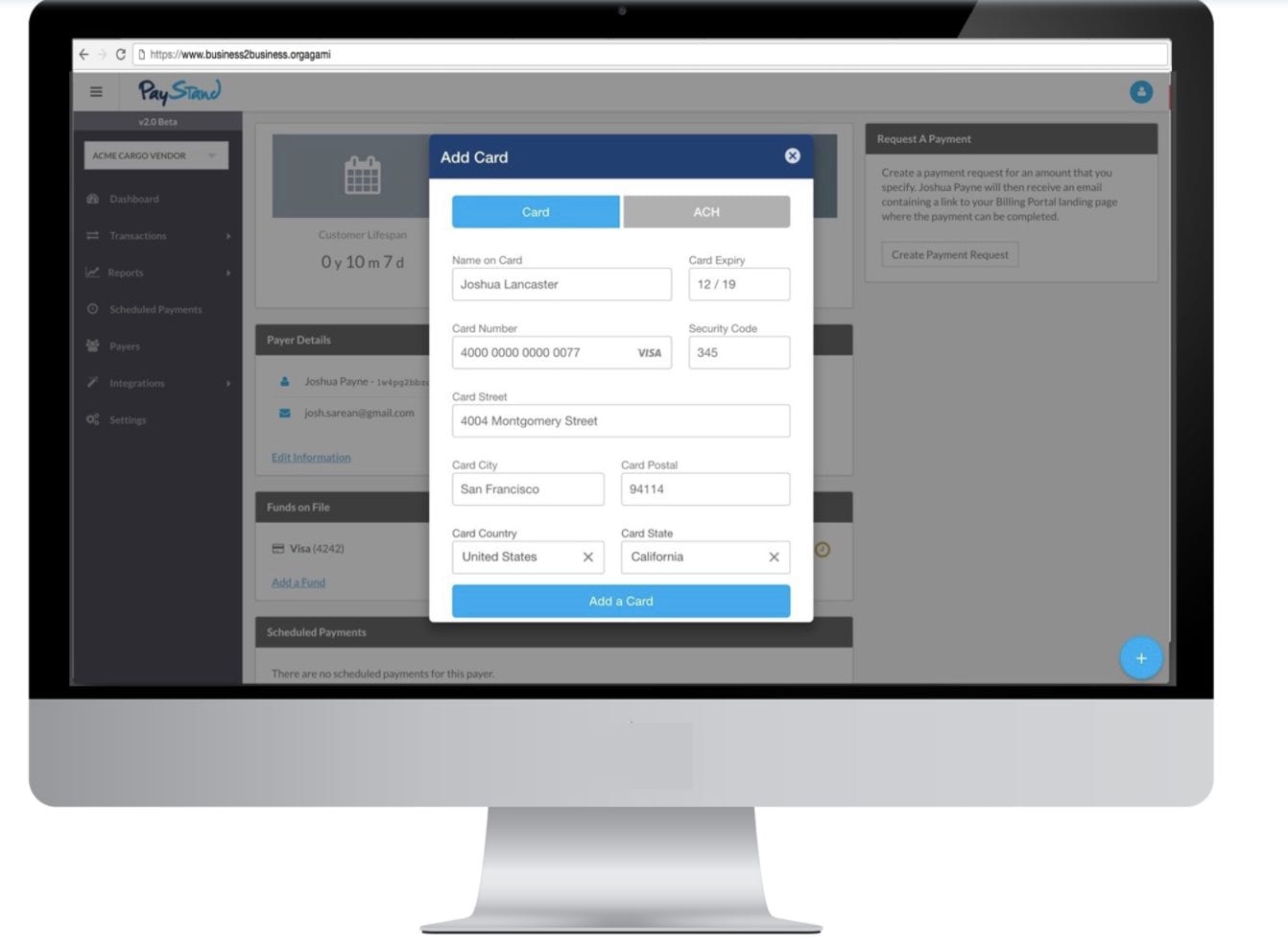

Most virtual terminals can be provided by your payment processor. A virtual terminal is a web-based version of your POS system for processing credit cards. You can connect to the terminal by going to a specific web page that’s provided by your credit card processing payment gateway.

Once you’re on that page, you can safely and securely input customer credit card payment information to accept credit cards or ACH payments online.

You don’t even need a business website to use a virtual terminal. That’s because the web page is not customer-facing. It’s designed for internal use, like accepting credit cards over the phone.

How to Accept Credit Cards Through Phone Payments

Processing cards through phone payments can be completed in just a three simple steps:

Step 1 – Determine What Information You Need to Collect

Every processor will require slightly different payment information to complete a phone transaction. Examples include:

- Credit card number

- Expiration date

- CSV code

- Customer’s name

- Billing address

The customer’s payment information is obviously required. But you won’t always need to add certain details, like a shipping address (especially if you’re not shipping anything to them).

It’s also useful for products or services that require a bit more sales assistance. Phone payments are really common in the restaurant industry for takeout and delivery orders.

Step 2 – Take the Customer’s Order

This process will vary based on your business type and order workflow, but you can’t charge a customer without taking their order.

So when a customer calls, make sure you’re ready to take their order.

It could be for food, clothes, services—whatever. In some cases, a customer might call to pay for something that you’ve already provided. This is common for medical practices. In this case, just bring up the invoice due or whatever else you have on file so you can appropriately charge the customer.

Step 3 – Enter the Customer’s Credit Card Information into the Virtual Terminal

Now it’s just a matter of asking the caller for their preferred payment method.

Simply enter what’s required (which you’ve already determined back in Step 1), and manually key the card details into the virtual terminal.

From the business end, the screen of a virtual terminal looks something like this:

That’s it! Your payment processor will take over from there, and the card details will get processed.

Types of Businesses and Industries That Typically Take Payments Over the Phone

Phone payments work well for subscription services since you can add a card to a customer’s profile for recurring payment cycles.

It’s also useful for products or services that require a bit more sales assistance. Phone payments are really common in the restaurant industry for takeout and delivery orders.

We also see virtual terminals in the field service industry, where customers pay invoices over the phone instead of mailing a check.

A Note About Card Not Present Transactions & Why It Matters

Virtual terminals are considered to be a card-not-present (CNP) transaction in the eyes of the credit card companies and your credit card processor.

This terminology is fairly straightforward—it means the credit card used is not physically present at the time of the sale.

Card not present transactions typically have higher credit card processing fees. Ecommerce transactions, phone transactions, and even manually keyed transactions all fall into this category.

Depending on your credit card processing company, the difference between inputting a credit card into a virtual terminal and manually keying the entry into a physical terminal can be very different. But they can both put you at a higher risk for chargebacks, fraud, and potential compliance issues. This is something that you should be avoiding at all costs.

Something simple, like asking for the customer’s billing address and running it through an address verification system can help you reduce the risk of credit card fraud.

Advantages of Accepting Credit Card Payments Over the Phone

Now that you have a better understanding of how virtual terminals work for phone payments, we’ll take a closer look at the benefits of using them for credit card payment acceptance.

- Customer Convenience — Phone payments make things much easier for your customers. It gives them more flexibility with how and when they pay for goods or services and eliminates bottlenecks in your transaction process.

- Faster Payments — The ability to get paid over the phone often means faster payment collection for many businesses. This is especially true for field service industries and B2B services. It’s much easier for someone to call and give you credit card information over the phone instead of mailing a check.

- Fraud Protection — Lots of modern virtual terminals offer more than just the ability to accept payments. These solutions can come with fraud scoring methods and other tools to ensure the transaction is legitimate.

- Lower Costs — Compared to a manually keyed transaction on a physical terminal, virtual terminals are usually cheaper. This will obviously depend on your processor, but it’s common throughout the industry.

- Safe Storage — All payment data will be saved in the virtual terminal, so you won’t have to worry about handling this on your own. This is crucial for different data security and standards and PCI compliance.

Final Thoughts

The vast majority of businesses need the ability to accept credit card payments over the phone.

Even if your industry or business doesn’t have a high frequency of phone payments, it’s still a good idea to have a virtual terminal for those one-off occurrences.

Once you have a virtual terminal set up, you can accept payments over the phone from anywhere, even if you’re out of the office. As long as you can connect to that virtual gateway, you’ll have the ability to facilitate one-time transactions and recurring payments from your customers over the phone.

If your credit card processing company is charging you extra credit card processing fees and high costs for credit card payments over the phone, contact our team here at Merchant Cost Consulting. We’ll help negotiate those rates on your behalf to save your business money on credit card processing fees—without switching credit card processing companies.