Whether you’re starting a new ecommerce business from scratch or you’re expanding an existing retail operation to the web, you must be able to process credit card payments online.

Internet merchant accounts make this possible.

While this may seem straightforward, not every internet merchant account is the same. This guide will break down everything you need to know about internet merchant accounts and what they offer.

What is an Internet Merchant Account?

An internet merchant account is a special type of bank account that allows online sellers to accept credit and debit card transactions. Similar to a traditional merchant account, an internet merchant account is a place where money gets deposited after consumers use a credit or debit card to purchase something online.

Think of an internet merchant account like a middleman.

The money doesn’t go straight from the consumer to the merchant. Before the money lands in a business bank account, it’s placed in a merchant account until the funds have been verified.

As a merchant, you don’t have any control over the internet merchant account. You can’t make deposits or withdrawals here. It’s simply a place where the money goes before it’s deposited into your account.

The role of an internet merchant account is the same as a traditional merchant account. But an internet merchant account has tools and services that cater more towards online businesses.

What Does an Internet Merchant Account Do?

Aside from handling funds as the goes from the buyer to the seller, internet merchant accounts offer other tools and features to help online businesses. Some of these features are must-haves and needs, while others are just nice to have.

Read on learn more about what internet merchant accounts can do for your business.

Provide Payment Gateways

Having a payment gateway included with your merchant account is great. If you’re using a third-party processor like Stripe or Square, it’s common for gateways to come included with the service.

Direct internet merchant accounts tend to offer multiple gateway options. The best option for you depends on the features you’re looking for.

Some internet merchant providers offer a payment gateway as part of the standard service. Others add it to your statement as a separate line item. In some cases, there’s only a fee if you’re using a payment gateway that isn’t offered by the provider.

Authorize.net is one of the most popular payment gateways out there due to its compatibility. But some internet merchant accounts offer a proprietary payment gateway to ensure a smooth experience with the service.

Allow Merchants to Accept Variety of Payment Methods

Every internet merchant account should accept all major credit cards—that goes without saying. But in addition to debit and credit cards, you may want to consider alternative payments as well.

Mobile wallets like Apple Pay and Google Pay are growing in popularity. So you should offer these on your site to accommodate the needs of your consumers.

Some internet merchant accounts also support ACH transfers and click-to-pay transactions. Generally speaking, the more payment options you have on your site, the better it is for your conversion rate.

Facilitate Global Payments

This feature is only important if you’re selling in other countries. Not every internet merchant account can accept payments in currencies other than USD.

But if you want to accept international payments, this feature should be a top priority.

Look for a multi-currency ecommerce merchant account. There will be a conversion fee, but you could always pass that along to the customer if need be.

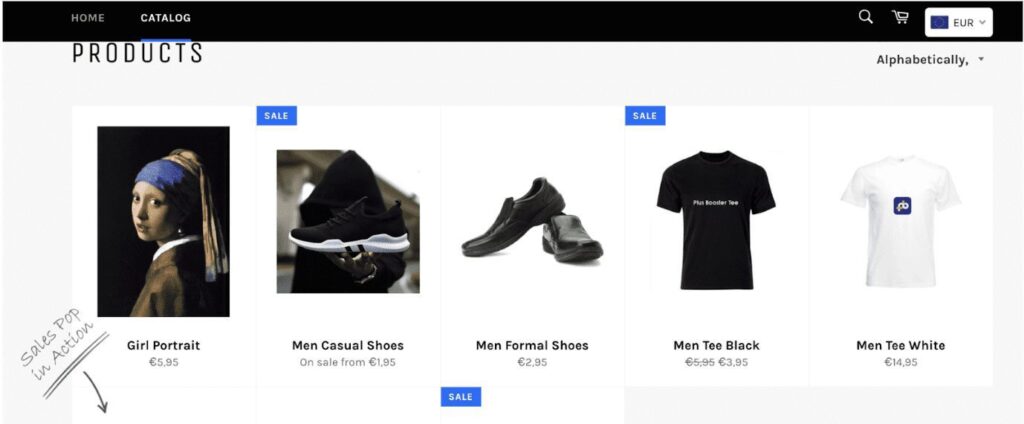

Ideally, you should look for a processor that has dynamic currency conversions. This means that the site will automatically show the price of items in the local currency of the consumer’s location.

So if someone is browsing your site from Italy or France, they’ll automatically see prices in Euros:

This will really improve the buying experience for international customers, which will likely increase your conversion rates.

Provide Shopping Cart Software

You need an online shopping cart that integrates with your site. The cart makes it possible for customers to search through products, add items to their order, select a quantity, choose a color, choose a size, and more.

The vast majority of internet merchant accounts will integrate with major shopping cart tools. But some have a built-in cart that you can take advantage of. Built-in carts are easy and will likely be cheaper than going to a third-party provider for one.

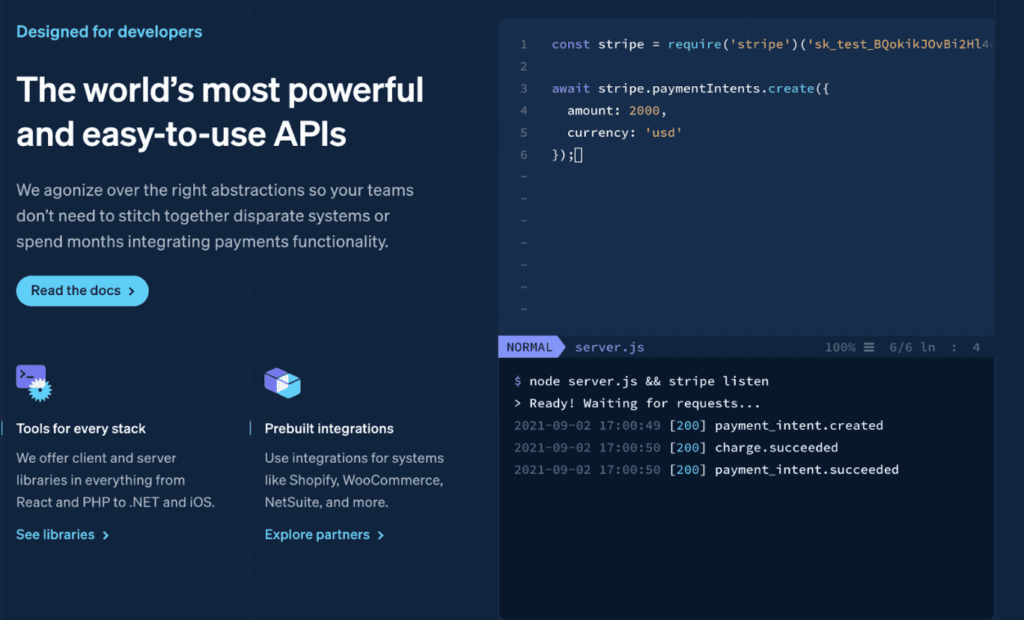

Offer Developer Tools

If your organization has in-house developers and you’d like to customize every aspect of your ecommerce site, this will be a top tool to consider.

Third-party processors like Stripe are known for being developer-friendly.

Developer tools are only important if you want to use APIs to build custom ecommerce solutions.

In addition to the mainstream third-party processors like Stripe, many direct internet merchant account providers offer solutions for developers.

Provide Customer Support

Great customer support is an often overlooked feature of internet merchant accounts. Unfortunately, most people don’t realize they’re getting terrible support until a problem occurs. But by then, it’s usually too late.

So make sure you do some research and read plenty of customer reviews before you settle on a merchant account.

If you have questions or run into any issues, you’ll want an internet merchant account that will help resolve things ASAP.

Do You Need a Merchant Account to Sell Online?

In most cases, need a merchant account to sell online if you’re accepting credit card and debit card payments.

However, it’s still possible to sell online without a merchant account. Online payment services, like PayPal for business, aggregate multiple merchants into a single merchant account—meaning each merchant doesn’t have its own internet merchant account or merchant ID.

What’s the Difference Between a Payment Gateway and Internet Merchant Account?

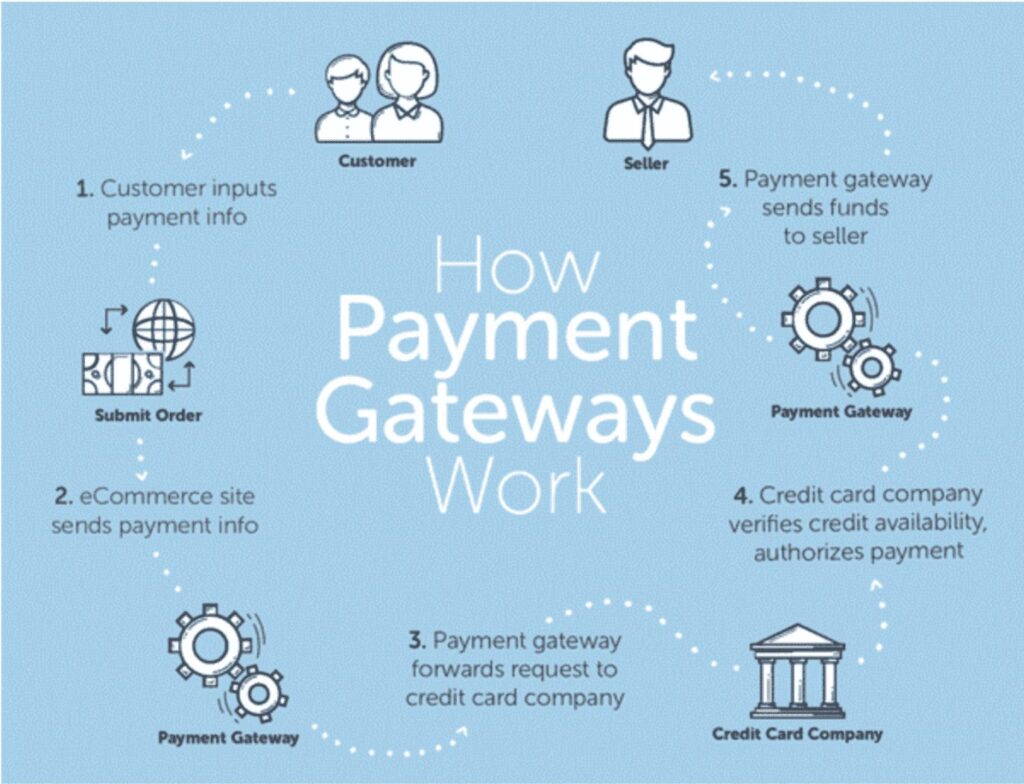

Payment gateways and merchant accounts serve two different functions. A payment gateway is an online tool that allows businesses to process online transactions, and a merchant account is where those funds go before being routed to a traditional bank account.

You can think of a payment gateway like a bridge that connects the customer’s bank to the merchant.

Both payment gateways and internet merchant accounts are required to accept credit card payments online. In many cases, you can get a payment gateway directly from your merchant account provider.

Final Thoughts on Internet Merchant Accounts

In summary, internet merchant accounts perform the same core functions as traditional merchant accounts. The only difference is that internet merchant accounts are geared specifically toward online sellers.

I hope you found this guide useful and informative about internet merchant accounts.

Having an internet merchant account is important for ecommerce websites. It’s something you’ll need to accept your first payment online, and it will also be there as your business scales.