Many terms in the credit card processing industry are fairly obvious. Others aren’t so clear.

“Merchant ID” tends to fall somewhere in the middle. It’s clearly an identifier, but many businesses aren’t sure what it identifies or why it matters.

For those of you who process credit card payments, it’s important to understand the basics of merchant IDs. That’s because your merchant ID plays a key role in how money gets transferred from your customers to your bank account.

Do you have a merchant ID? Do you need a merchant ID? Continue below to find out.

Merchant Identification Number (MID) Defined

A merchant ID, also known as “MID” or simply “merchant number,” is a unique number that identifies a business for credit card processing.

The easiest way to think of a merchant ID is like an account number. It’s shared with several different service providers and is ultimately used to transfer payments from a consumer account to your merchant account.

Not every business has a merchant ID. Merchant IDs are only assigned to businesses with merchant accounts.

For those of you using third-party processors or PayFacs like Square, PayPal, or Stripe to accept card payments, you won’t have a merchant ID number.

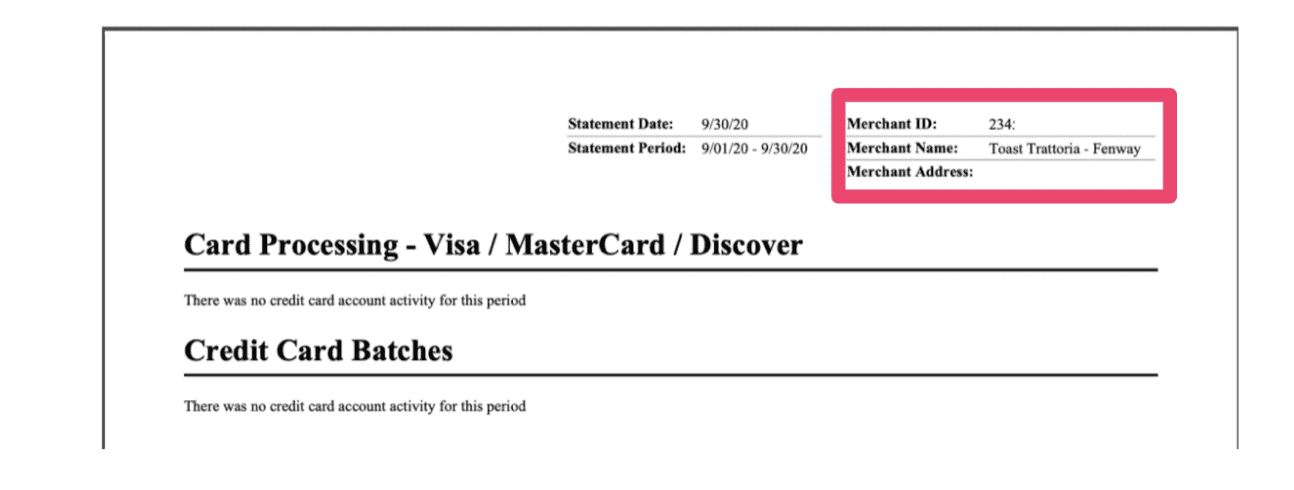

How to Find Your Merchant ID Number

To find your existing merchant ID start by reviewing your monthly statements. It’s typically located in the upper right corner:

Additionally, you should be able to find this number from an online dashboard associated with your credit card processing account (assuming you have online access from your credit card processing company).

Just navigate to your account information page from the home menu, and the MID should be there.

For those of you who process mobile payments from an app, the merchant ID can typically be found within your admin account information here as well.

Finally, your merchant ID might be somewhere in your merchant agreement. Check the application forms and attachments, as it’s more likely to be here as opposed to in the contract itself.

As previously stated, you won’t have a merchant ID if you’re using a third-party processor or PayFac to process credit cards.

Companies like Stripe and Square might have another account number used to identify you. But don’t confuse this with a true merchant ID number—it doesn’t serve the same purpose.

Speaking of confusion, make sure you don’t mistakenly assume that another identification number is your merchant ID.

For example, “terminal IDs” are used to identify different registers at physical store locations. There are also “gateway IDs” for online payment processing. Neither of these is a merchant ID. Instead, these numbers are typically used to troubleshoot software or hardware problems. But they have nothing to do with the way money gets transferred to your merchant account.

What is a Merchant ID Used For?

A merchant ID is used to identify a specific merchant account as the destination for funds in a credit card transaction. Without a merchant ID number, the funds would never reach a merchant’s bank account.

The MID is used when the merchant account provider sends the info to the acquirer and then when the final payment gets sent to the business bank account..

MID numbers are ultimately used to ensure all money is sent and received correctly in credit card processing. If you accept credit card payments, you need to have a merchant ID.

How Do Merchant ID Numbers Work?

There are lots of moving parts in the credit card processing world. When a transaction gets processed, the merchant ID travels through the payment infrastructure, along with the cardholder details, so each party can communicate with each other about the transaction.

Let’s go through a simple credit card payment process scenario to explain how merchant ID numbers work:

- A consumer pays for goods or services using a credit card.

- That transaction data is sent directly to your merchant account provider.

- The merchant account provider passes the info to the acquiring bank.

- The acquiring bank sends the transaction data to the issuer.

- The issuing bank verifies that the cardholder has sufficient funds, approves the transaction, and sends the approval message back to the acquiring bank.

- The acquiring bank pays your merchant account provider.

- Your merchant account provider deposits funds into your bank account.

Each time payment data is transferred during this process, the merchant ID is used as the final payment destination.

It’s common for these companies to subcontract roles to different providers, creating several layers of business. So as the transaction info passes from one party to another, the MID identities your unique business as the payment requester.

You cannot get paid without a merchant ID number.

Additional Reading: Acquiring Banks vs. Issuing Banks in Credit Card Processing

Can Businesses Have Multiple Merchant IDs?

When you’re going through the merchant account setup process, card issuers require all businesses to be identified through a merchant category code (MCC).

MCCs are used to identify your industry and they impact your credit card processing rates. For example, some industries fall into high-risk processing categories. So the merchant category code in these industries would result in higher processing rates.

Each business can only have one merchant category code. However, some businesses will have multiple merchant IDs.

For example, look at a business like IKEA. IKEA is a furniture store, but they also have a restaurant business. In this scenario, they could have two merchant IDs for each merchant account—one for the furniture business and another for the restaurant business.

A hotel is another good example. The hotel might also have a bar on-site with a different merchant ID. Maybe the hotel is on the water and has a separate business for watersport rentals (boats, kayaks, paddleboards, jet skis, etc.). To get the lowest possible credit card processing rates, these types of businesses might be set up with multiple merchant IDs.

But generally speaking, having more than one merchant ID for the same business is rare. Most businesses don’t fall into scenarios that require multiple merchant numbers.

So if you see several IDs on your bank statement, don’t assume they’re all MIDs. You can always contact your merchant services provider to verify if you’re confused.

It’s also worth noting that if you switch merchant account providers, you’ll get a new merchant ID. That’s because this number is tied directly to your merchant bank account.

Be advised; we typically don’t recommend switching your payment processor. If you think you’re overpaying on credit card processing, we can help you lower those rates by negotiating terms with your existing provider. So there’s no need to switch—just reach out to our team for a consultation.

How Do You Get a Merchant ID?

Getting a merchant ID is simple. You’ll automatically be issued a merchant ID from your payment processing provider when you open a new merchant account.

You don’t get to choose your merchant ID, and you may not even be notified when your merchant ID gets issued.

If you still have questions, you can always the processor you’re using to accept card payments about your merchant ID. They can tell you the status of your merchant ID number, if it’s been issued, and if you need to do anything else with your bank accounts to get paid.

Final Thoughts on Merchant Identification Numbers

Merchant ID numbers play a significant role in the credit card processing world. If you have a merchant account to accept credit and debit card payments, you can’t get paid without a merchant ID.

With that said, there’s not much you need to do with your MID. You just need to know what it is on your merchant statement in case a problem arises, and you need to contact someone in the processing chain for assistance.

Without your merchant ID ready, these entities likely won’t be able to help you or access the information related to your question.