Credit card authorization rates are essential for organizations of all shapes, sizes, and industries. This is especially true for ecommerce businesses, where customers may not have another payment option to fall back on.

Unfortunately, credit card authorization rates are often overlooked by merchants and processors alike. It’s just not discussed as much as other aspects of credit card processing.

But without authorizations, you wouldn’t be able to process credit or debit card payments—it’s that simple.

That’s why I created this guide. For those of you with low or inadequate authorization rates, I’ll explain the steps you must take to boost this crucial metric.

What is a Credit Card Authorization Rate?

Let’s start with the basics.

Credit card authorization is used to determine if the card being used has sufficient funds to process the transaction. Without authorization, the sale will not be approved.

So in simple terms, the credit card authorization rate is the number of successful transactions divided by the total number of attempted transactions. Let’s say you have an 80% transaction rate. That means eight of ten transactions were approved. An 80% authorization rate implies a 20% failure rate (two of ten transactions failed).

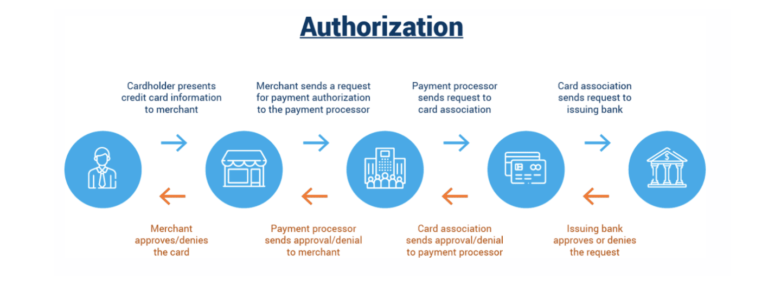

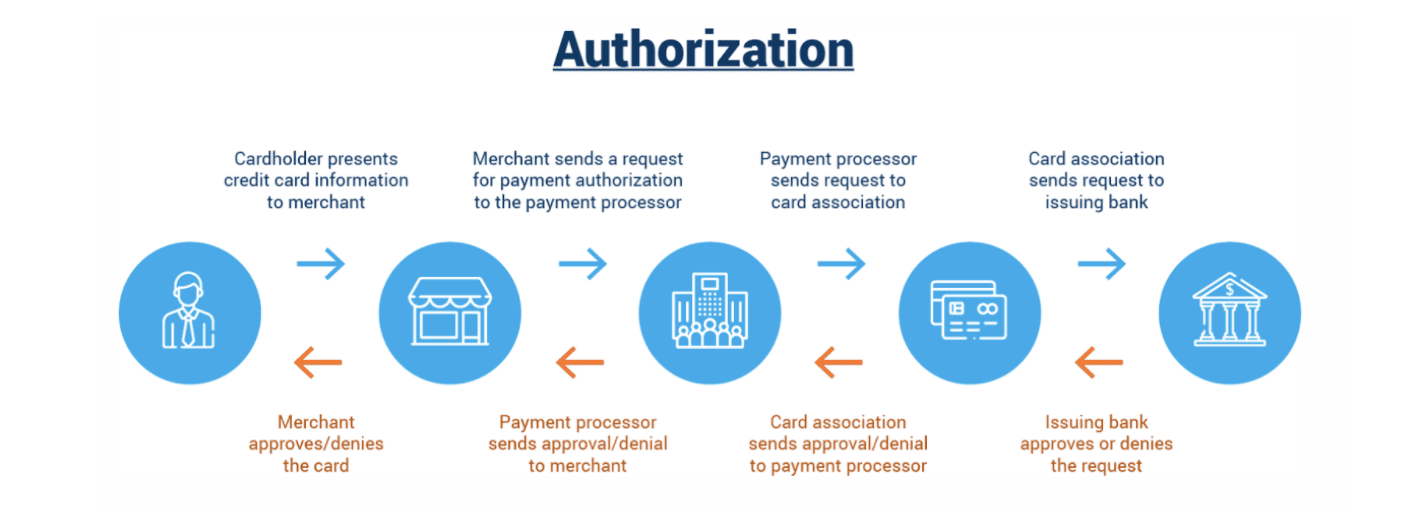

Here’s a visual representation of what the authorization process looks like:

There are several different ways that the issuing bank can respond to an authorization request. Here are some authorization code codes and explanations:

- Approved — The card has sufficient funds, and the account is in good standing.

- Approved Partial — The account is in good standing, but there may not be sufficient funds to cover the cost of the transaction.

- Declined — The card is reported lost or stolen, the account isn’t in good standing, or there are insufficient funds.

- Referral — There is a problem with the credit card number.

- Expired Card — Card is expired. The customer can try again with the correct expiration date.

- Incorrect PIN — Transaction declined because the customer entered wrong PIN. Re-attempt using the correct PIN.

- Pick Up Card — The issuing bank requests that the merchant physically retains the credit card. This is typical in scenarios when the card gets reported lost or stolen by the cardholder.

As you can see, there are several different reasons why the authorization could be denied.

What Causes Low Credit Card Authorization Rates?

Now that you have a better understanding of authorization and authorization codes as a whole, let’s take a deeper look at the root causes of those declines.

- Outdated Technology — If your merchant services provider or bank uses outdated technology, you’ll suffer from lower authorization rates. Old technology gateways likely won’t have the best fraud screen methods, data updates, local routing systems, or retry systems.

- High Risk Processing — It’s common for merchants that fall into a high-risk processing category to have lower authorization rates. That’s because these industries have an increased risk of fraud. Some credit card companies might automatically decline transactions that seem suspicious. In other cases, the transaction attempts will actually be fraudulent.

- Inadequate Fraud Prevention — In theory, authorization declines are in place to reduce the risk of fraud. So merchants with poor fraud prevention practices will see lower authorization rates.

- Account Changes — As technology changes, thousands of new cards are issued on a daily basis to accommodate new features, such as contactless payments. Cardholder information changes with these updates. For those of you who collect recurring payments, you’ll see authorization rates drop as new cards get issued to your customers.

- Changing Regulations — There are always new laws being enacted worldwide, especially when it comes to data protection. For example, regulations like PSD2 (Revised Payment Services Directive) calls for enhanced authorization stipulations in the EU. Some transactions will require two-factor authentication.

- Cross-Border Payments — It’s common for transactions to be declined if the payments originate from a different region than the processing bank. For example, if an Italian-issued credit card gets processed by a regional bank that’s only in the US, it has a higher chance of being declined. Currency mismatches are another leading cause of declined authorizations.

If you’re a global ecommerce shop, check out our guide to increasing margins on cross-border sales.

How to Boost Credit Card Authorization Rates

Fortunately, there are ways that you can prevent low credit card authorization. If you’re currently getting more declines that you’d like, use the tips and best practices below to increase credit card authorization.

Understand Your Customers

Are you selling in multiple countries or regions? Make sure your equipment and software are optimized to accommodate international sales.

The authorization process will be routed to multiple countries. If your international sales are being denied, consider working with a payment processor in those specific regions.

Properly Classify Transactions

Processors might decline transactions because the network tags weren’t properly labeled.

For example, let’s say you run a subscription business. A customer signs up for your services online. If you classify that sale as an ecommerce transaction as opposed to a recurring transaction, future payments could be declined.

Stay Current With Equipment and Regulations

Make sure you’re informed about the last data laws and compliance updates locally, regionally, and even internationally.

Furthermore, it’s crucial that you and your processor are using new software and hardware to process transactions. Even if your technology isn’t necessarily broken, it should still be replaced every five years or so.

Communicate With Your Processor

We rarely recommend switching processors. So rather than blaming your processor for your problems, simply consult with them about what can be done to improve your low authorization rates. What is causing transactions to be declined? What can we do to fix this problem?

A good processor should be willing to work with you in order to resolve these types of problems.

Final Thoughts

Low authorization can be a major problem for merchants. If authorizations are declining, then you’re missing out on potential sales.

Plus, this can be a big headache for your customers who are trying to buy your products or services.

Follow the tips that I’ve explained in this guide to increase your authorization rates. You can always reach out to our team here at Merchant Cost Consulting if you have additional questions or need assistance lowering your credit card processing fees.