The coronavirus global pandemic has forced businesses across all industries to change the way they operate. This is especially true for retailers, restaurants, and organizations with a physical presence.

Adding marks on the floor to enforce social distancing, increasing sanitation routines, and restricting store capacities are just a few of many measures that businesses are taking in our “new normal” era of COVID-19.

But as businesses implement policies to protect their staff and employees, there’s one segment that hasn’t quite reached its full potential just yet—contactless payments.

The Future of Contactless Payments (by the Numbers)

Before we talk about the future, let’s take a quick second to rewind and reflect on contactless payment trends prior to the COVID-19 outbreak.

According to a 2019 study published by Forbes, 73% of Millennials say that they would be interested in using tap-to-pay with a contactless card. The study also revealed that over 75% of the top 100 merchants in the United States offer contactless payments during checkout. Furthermore, over 60% of all Visa transactions in the US occur at contactless-enabled merchants.

However, the US lags behind other countries that have adopted contactless payments. For example, more than 90% of POS sales with Visa-branded cards in Australia are contactless.

As for mobile wallets, interest was modest for US consumers. 60% of consumers said they don’t use mobile wallets because they “don’t have a need” for them, or they “prefer traditional payment methods.”

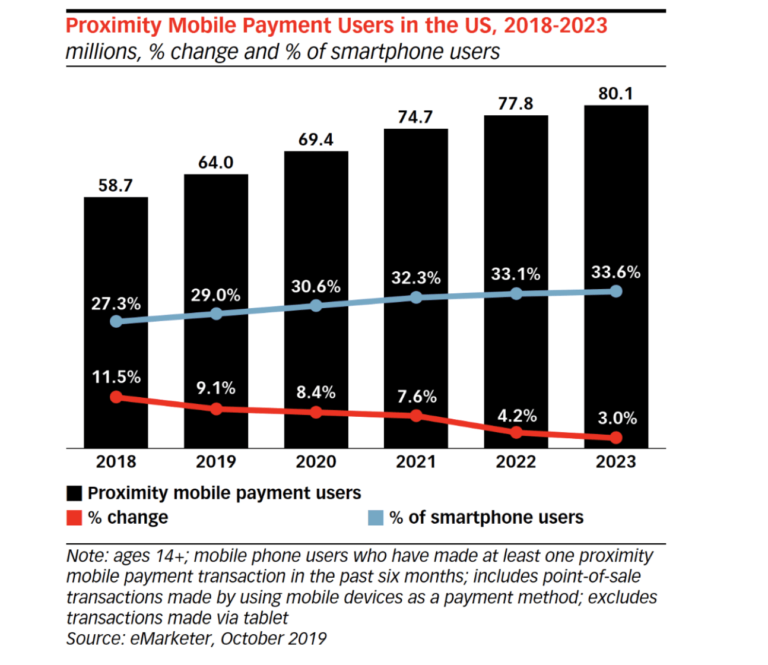

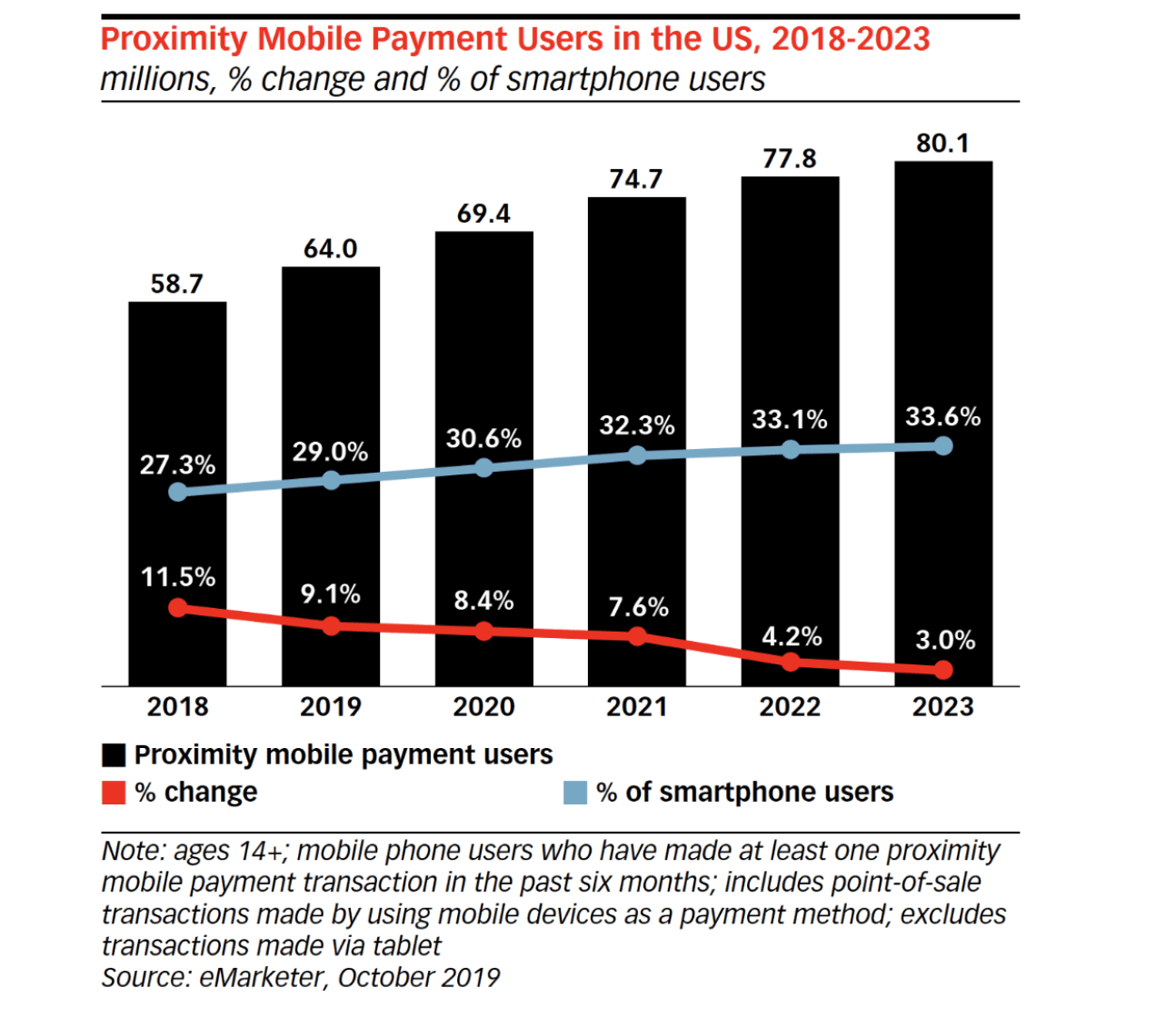

With that said, a 2019 chart from eMarketer showed the slow but steady growth of mobile proximity transactions in the US.

While the predicted growth wasn’t substantial, it was still on the rise.

COVID-19 Contactless Payment Trends

Now let’s fast forward to the present time. How have these contactless payment statistics changed in the first half of 2020? While it’s still early, recent reports suggest contactless payments are trending upward.

In May 2020, 50% of US consumers say they used contactless payments at least four times during the month. 69% of people said that using a contactless payment method was more convenient than paying with cash.

60% of consumers in the United States agree that making contactless payment purchases during COVID-19 makes them feel more comfortable about using that method in the future.

We’ve seen this trend on a global scale as well. A recent study shows that 49 countries worldwide have seen an increase in contactless payments. The percent increase ranges from 25% to 400%, with a total average increase of 113%.

Contactless Payment Adoption For Brick-and-Mortar Merchants

As you can see from the trends and statistics mentioned above, making the move to contactless payment adoption seems like a logical move for merchants. So for those of you who aren’t currently accepting these payment methods, consider updating your equipment and technology to accommodate the changing landscape of payment processing.

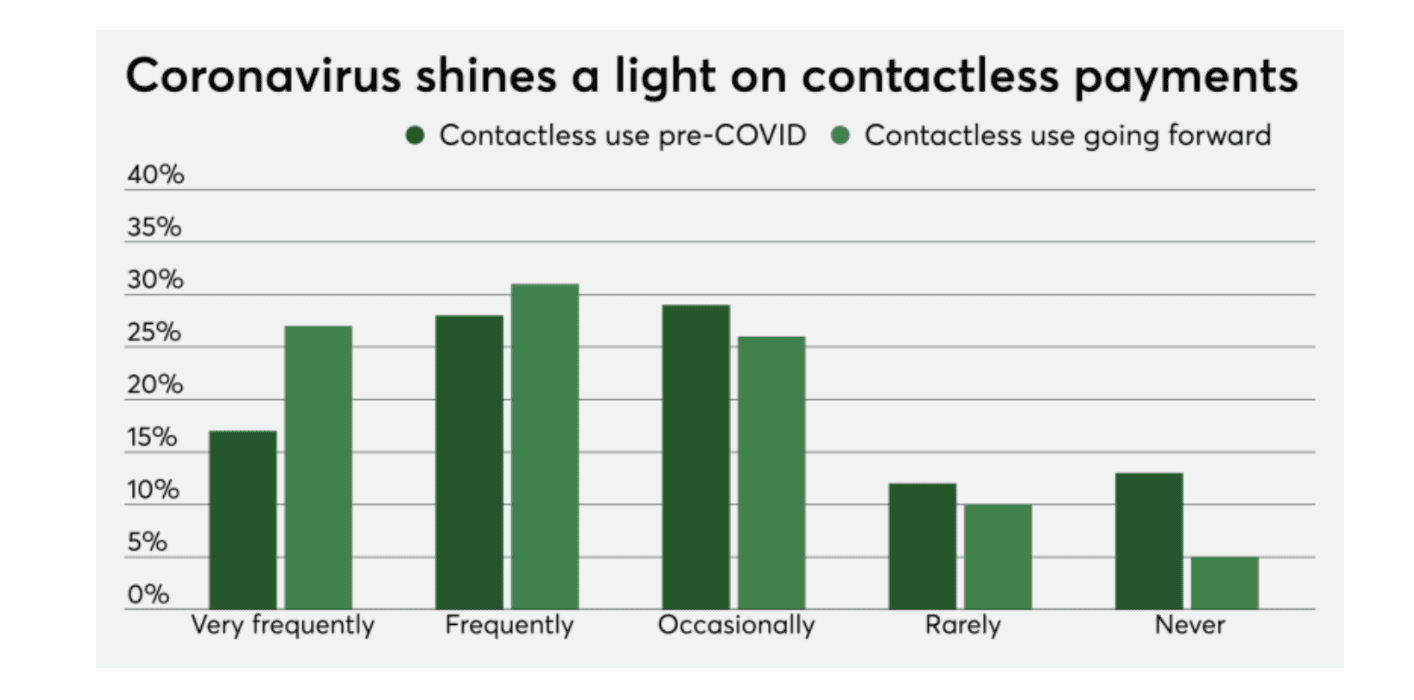

Consumers currently using contactless payments feel safe about doing so. Even those who weren’t on board the contactless train last year have changed their mindset due to the coronavirus pandemic.

Moving forward, we’re definitely going to see a change in how people feel about contactless payments.

Failure to adapt could have severe consequences. While we haven’t reached this point quite yet, consumers may eventually feel that contactless payment methods are the only safe way to shop in-person. The last thing you want is to make your customers feel uncomfortable or unsafe.

While it’s unlikely that governments will force contactless payments as a mandate, this is something that you should also be thinking about.

Challenges with Contactless Payments

With all of this in mind, it’s important to understand that contactless payment adoption isn’t perfect. There are still some hurdles and barriers to entry that merchants need to be aware of as they make this transition.

Internet Stability

An unstable internet connection can prevent you from processing contactless payments. It could take multiple attempts and potentially even fail altogether.

Making sure your locations have reliable and high-speed internet connections is crucial for accepting contactless payments. The future rollout of 5G technology could benefit you here, but don’t wait. Do whatever it takes to make sure you have a stable connection immediately.

Cost

Smaller organizations don’t get the same credit card processing rates as organizations with high transaction volumes. Most of our readers here at Merchant Cost Consulting are bigger businesses, so this shouldn’t be a major concern for you.

Consumer Preferences

Remember when you rolled out EMV acceptance? I’m guessing it wasn’t the smoothest transition.

As a consumer, I personally remember it being a pain. Out of habit, I would always swipe my card. Then I’d be told that it’s supposed to be inserted with the chip instead. Once I finally got used to inserting my card, not every merchant had the right equipment. The ones that were EMV compliant seemed to process the transactions slowly. Overall, it wasn’t great.

The same analogy can be applied here. In general, we are all creatures of habit. So don’t be surprised if your customers are resistant to change. Plus, not everyone will have a contactless card or mobile wallet (at least not right away). It could take some time before this becomes the new normal.

With that said, the trends indicate that consumers are more willing to adapt due to COVID-19. But only time will tell if that’s actually the case.

Employee Training

Any time you’re using new technology or adding a different process to your business, you need to make sure that your staff knows how it works.

Remember, this is a time when you’re already asking employees to do things differently. They are already worried about sanitizing work stations, wearing protective gear, and trying to enforce social distancing rules in the checkout line.

Adding contactless payment technology to the mix could be a lot for them to take on at once. So just make sure that everyone is properly trained.

Final Thoughts

So, will coronavirus push contactless payments into the mainstream?

It’s still too early to make a definitive statement. But based on all of the statistics, trends, and research, all signs seem to be pointing in that direction.

If you’re worried about the costs associated with contactless payment adoption, reach out to our team here at Merchant Cost Consulting. Find out how much money you can save on credit card processing without switching processors.