Assessment fees are just part of accepting credit credits. They’re imposed by the card networks and passed through to merchants on monthly statements.

Unfortunately, some payment processors inflate or “pad” these assessment fees. This is an unethical billing practice because those charges are presented as non-negotiable and coming straight from the card network—but in reality, the processor is profiting from the difference.

Padded assessments could be costing you thousands of dollars. But most merchants have no idea this is happening right under their noses.

I’ve found countless instances of padded assessments over the years auditing statements for our clients—and I’m here to pass along my knowledge to you.

What is Interchange Padding?

Interchange padding and assessment padding occur when payment processors hide additional markup fees disguised as non-negotiable charges from the card network.

Instead of increasing rates according to the terms of your contract, some processors just add to the interchange rate or assessments without telling you. When you get your statement, it looks like those charges are legitimate and coming from the card brands.

But if your assessments are “padded” then your processor is charging extra on top of their normal markup fee—and trying to hide it from you!

Why It’s So Hard to Spot Padded or Inflated Assessment Fees

To the untrained eye, it’s nearly impossible to spot padded assessments because you would need to know the actual assessment fee for each card network and transaction category.

Payment processing statements are several pages long and have dozens of different line items. If you run a multi-location business, we could be talking upwards of 30 pages and hundreds of line items sent to you each month.

Once you identify the assessment fees on your statement, it’s never going to be glaringly obvious if the rate is inflated. That’s because assessment rates are often fractions of a percentage.

For example, your processor could be charging you 0.29% instead of 0.13% on just one line item. But this is mixed in with dozens of other assessments, interchange charges, and miscellaneous fees. You’d have to go through each one, line-by-line, and then verify the charges with another source for accuracy.

Here’s an analogy.

Let’s say you’re at the grocery store in a state that charges $0.10 per plastic bag at checkout (a non-negotiable state law). You purchase ten items and need two bags. So the cashier adds an extra $0.20 to your receipt. But what if in addition to that $0.20, they also added another $0.10 to your eggs and $0.10 to your milk.

Would you be able to catch that on your receipt?

You’d have to remember exactly what the price listed was for each. And if it’s just $0.10 more, you probably won’t think twice about it.

This is similar to how challenging it can be to spot padded assessments. But instead of looking through a ten-item receipt with prices you know, you’re looking at potentially hundreds of line items with rates you’re unsure of.

The Biggest Problem With Padded Assessments

The biggest problem with padded assessments is that it means your payment processor is taking advantage of you.

Not only is it unethical, but it’s most likely an outright breach of contract. It’s a predatory action because the processor knows that you’ll have an extremely hard time catching them.

If your payment processor is willing to pad your assessments, it’s a sign that they’re likely doing other things to inflate your overall costs.

There’s a good chance that you’re paying a higher-than-necessary markup to them—and I can almost guarantee that you’ll find other bogus fees listed on statements every month.

Examples of Padded Assessments on Real Merchant Processing Statements

Here are a couple of recent examples of padded assessments that my team found when auditing statements for our clients.

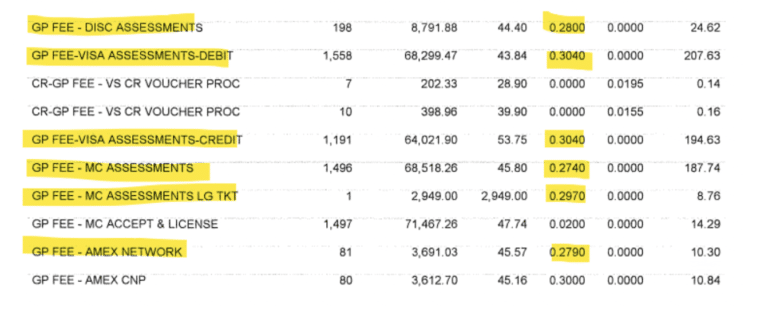

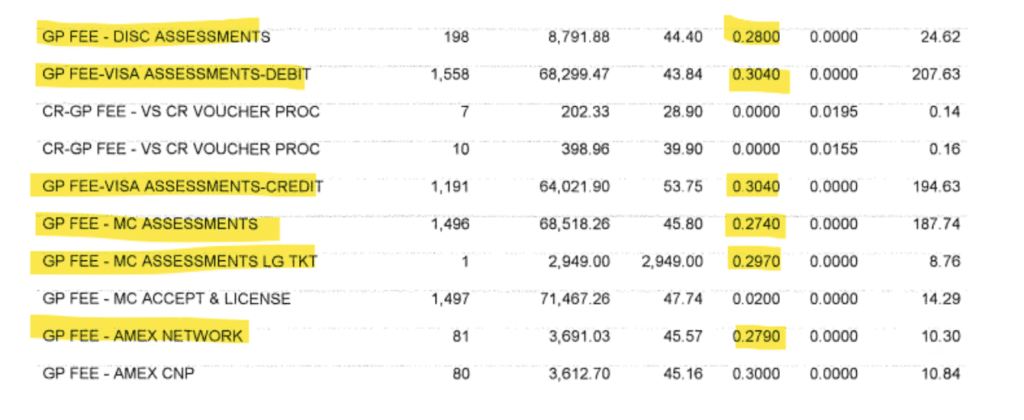

The screenshot below is a page from a Global Payments statement audit, and I’ve highlighted the assessments in yellow:

There are five different assessments listed on this page—one from Discover, two from Visa, and two from Mastercard.

At first glance to the untrained eye, these all look legitimate. But upon closer inspection, we can see that this merchant is getting ripped off.

The Discover assessment is supposed to be 0.13%. Global Payments is charging them 0.28% (more than double).

Both Visa assessments are being charged 0.3040%. But in reality, Visa only charges 0.13% for debit card volume and 0.14% for credit card volume. Global Payments more than doubled these rates, too.

Mastercard’s assessment rate is 0.1275% and 0.1475% for large ticket transactions. But Global charged 0.274% and 0.32% for these—again, more than double the actual cost.

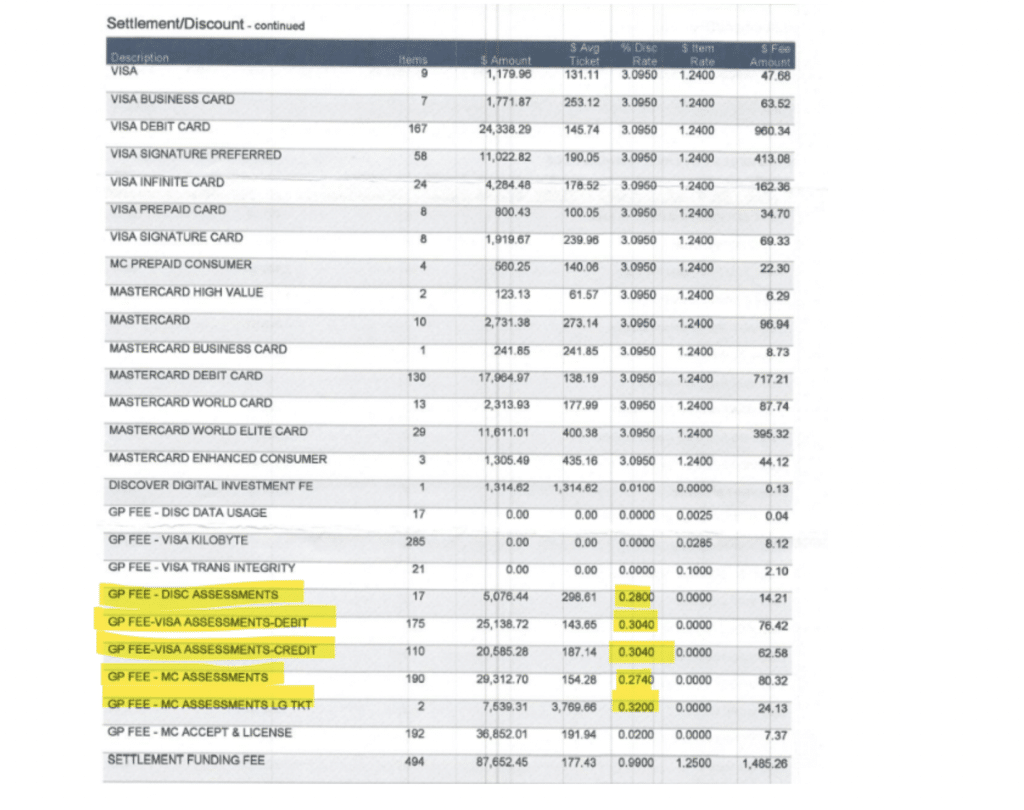

With all of those rates in mind, let’s look at another statement. This time the merchant is using OpenEdge for payment processing (which also happens to be a Global Payments company).

You can compare these rates to the actual rates shown above, and you’ll quickly see that OpenEdge is also roughly doubling all of these assessment rates.

The only instance where the assessment wasn’t double (or more) was for the Amex Network Fee. OpenEdge charged 0.2790% for this, when in reality, it’s supposed to be 0.15% (so almost double, but not quite).

If you read my OpenEdge review, I included a complete breakdown of these padded assessments with a table that compares the actual card network rate against OpenEdge’s padded rate. It’s really quite eye-opening, particularly for any merchants currently using OpenEdge.

How to Spot Padded Assessments and Inflated Interchange Rates

Now that you have more background information on padded assessments and what they look like, let me show you how to spot these on your statements.

Educate Yourself

You can’t spot padded assessments if you don’t know where your fees are coming from. Here’s a quick breakdown to help you understand.

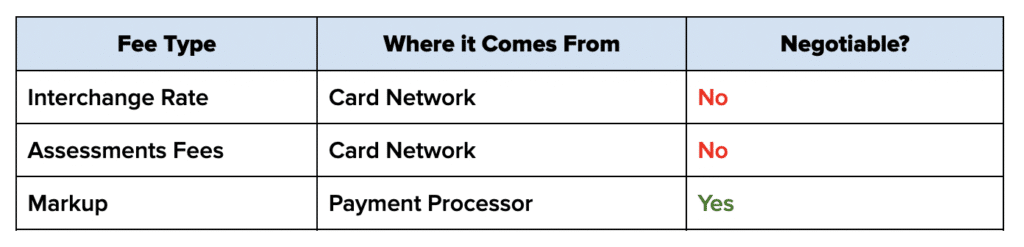

There are three main costs associated with every credit card transaction:

Interchange and assessments are set in stone. But the markup is your fee paid to the processor for handling your merchant account.

While the processor is still entitled to some compensation for their role in the transaction process, you have complete control over that rate. It’s a rate that you agreed to when you initially signed your contract.

Your processor doesn’t get to charge you a markup and inflate your assessments. That’s double-dipping, and now how payment processing is supposed to work.

If your assessment fees contain additional costs from anyone other than the card network, it’s been padded by your processor.

Know Where to Find the Actual Card Network Fees

To find a padded assessment, you need a go-to source where you can find the actual assessment rates imposed at the card network level. You can get these directly from the card networks, but they’re not always easy to find.

Instead, you can just bookmark or refer to our page on assessment fees by card network.

It’s a quick and easy way to compare the rates on your statement to the rates you’re supposed to be charged (and it’s the same source I used for the examples shown earlier).

Audit Your Statements Every Month

You need to review your processing statements every month. I know it’s time-consuming and tedious, but if your processor is padding your rates, that’s how you’ll catch them.

The craziest part about this is that by the time your statement comes, your processor has already deducted your fees. So you’re already playing catch-up.

That’s why it’s important to review these statements as soon as they become available—whether it’s online or mailed to your business.

Keep an Eye Out For Other Bogus Charges and Hidden Fees

If you have a long list of miscellaneous fees on your statement, it could be a sign that they’re unethical and also padding assessments.

This definitely doesn’t apply to every payment processor. We’ve found instances of processors that add bogus fees to statements but don’t necessarily pad assessments.

However, we almost always find that processors padding assessments also charge bogus fees. So a long list of bogus charges could be the first red flag that causes you to scrutinize your assessments a bit closer.

We have a list of the most common hidden fees in credit card processing that you can use as a reference.

Work With a Merchant Consultant

Working with a merchant consultant is the shortcut to finding padded assessments and inflated interchange rates. Rather than having to spend countless hours each month doing this stuff on your own, a merchant consultant can handle it all on your behalf.

Here at Merchant Cost Consulting, we’ll give you a free audit to see if we identify any padded assessments, bogus fees, and any other cost savings opportunities.

From there, we’ll work directly with your payment processor to get those bogus fees removed and potentially refunded. Once those adjustments have been made, we’ll continue to monitor your statements each month in case your processor tries to raise your rates or pad assessments moving forward.

Ok, You’ve Found Padded Assessments on Your Statement—Now What?

Don’t panic.

Believe it or not, we actually don’t recommend canceling your merchant account or finding a new processor if you find padded assessments on your statements. You have tons of leverage right now, and it’s the perfect opportunity to negotiate a better deal with your processor.

Fees you’ve already paid in padded assessments can be recovered, especially if your processor violated the terms of your agreement.

You can try to contact your processor on your own, but it’s much easier with the help of a merchant consultant. Contact our team here at MCC, and we’ll help navigate you through this path and let you know exactly what steps to take next.