Huntington Bank is a regional financial institution with a primary presence across the Midwest. They provide all of the typical banking services you’d expect from your local bank, plus a wide range of business solutions—including credit card processing.

So whether you’re considering Huntington Bank as your payment processor or you’re currently using Huntington Bank to accept credit cards and want to know if you’re getting a good deal, this review is for you.

I’ll cover Huntington Bank’s pros, cons, prices, and provide industry expertise based on our personal experience auditing Huntington Bank statements on behalf of our clients.

MCC Quick Take on Huntington Bank

Like many banks offering credit card processing, Huntington Bank is just a reseller. They leverage existing business banking relationships to get clients that need payment processing, then rely on Fiserv to handle everything on the backend.

This means Huntington Bank has complete access to all the products and services that Fiserv offers (including Clover systems).

However, it’s at Huntington Bank’s discretion as to what they want to charge clients. Sometimes these rates are competitive, but other times they aren’t.

What We Like About Huntington Bank

- Great customer service.

- Interchange-plus pricing is available.

- Rates can be fairly competitive.

- Willing to negotiate and offer good merchant terms.

- We don’t typically see any price gouging or tiered plans.

Where Huntington Bank Falls Short

- Some bogus fees that should be removed from statements

- As a reseller, they slightly inflate rates to earn higher margins.

- Limited presence nationwide.

- Complex statements and reporting.

Huntington Bank’s Pricing and Credit Card Processing Rates

Huntington Bank’s rates are customized for each business. Factors like your industry, business type, and processing volume will all play a role in what you’re being charged.

But your rate also depends on the sales rep you’re working with. As previously mentioned, Huntington Bank has a lot of control over what they decide to charge you, and some sales reps are greedier than others.

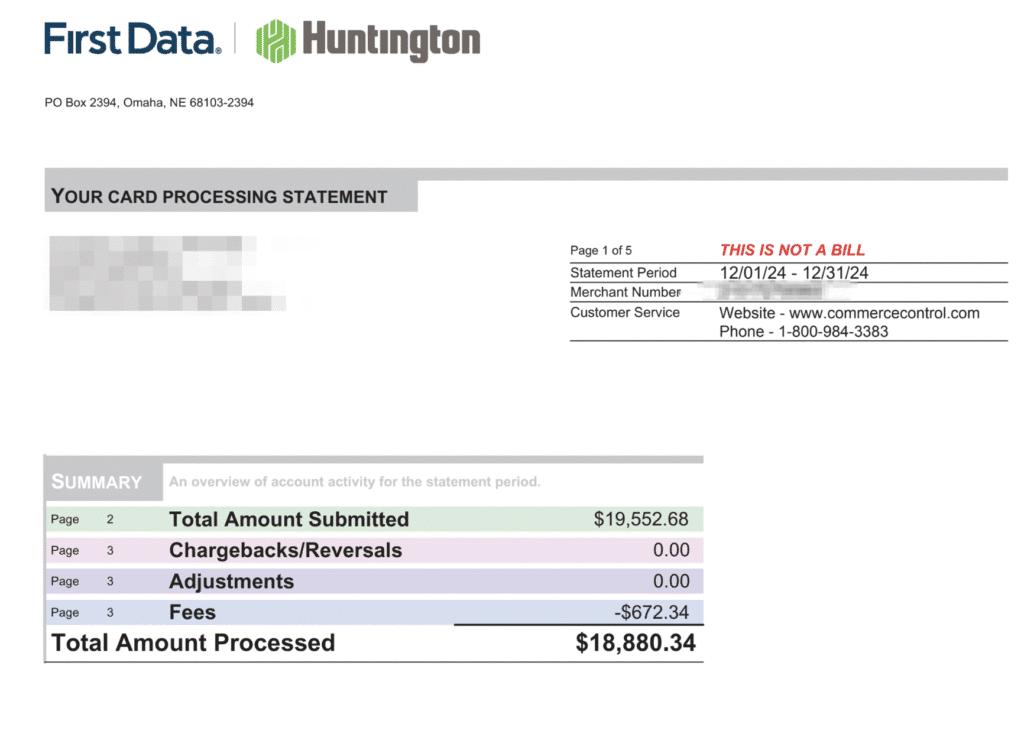

That said, we don’t typically see anything too egregious when we’re auditing statements from Huntington Bank. Here’s a look at a real statement from a fairly low-volume merchant, with an effective rate around 3.44%. This is higher than we’d prefer, but not terrible for the volume.

As you can see, these statements still have First Data branding on them—which is funny, considering that Fiserv acquired First Data back in 2019.

If we dig a little bit closer into this statement, we’ll find that the majority of this merchant’s effective rate is coming from Huntington Bank’s markup.

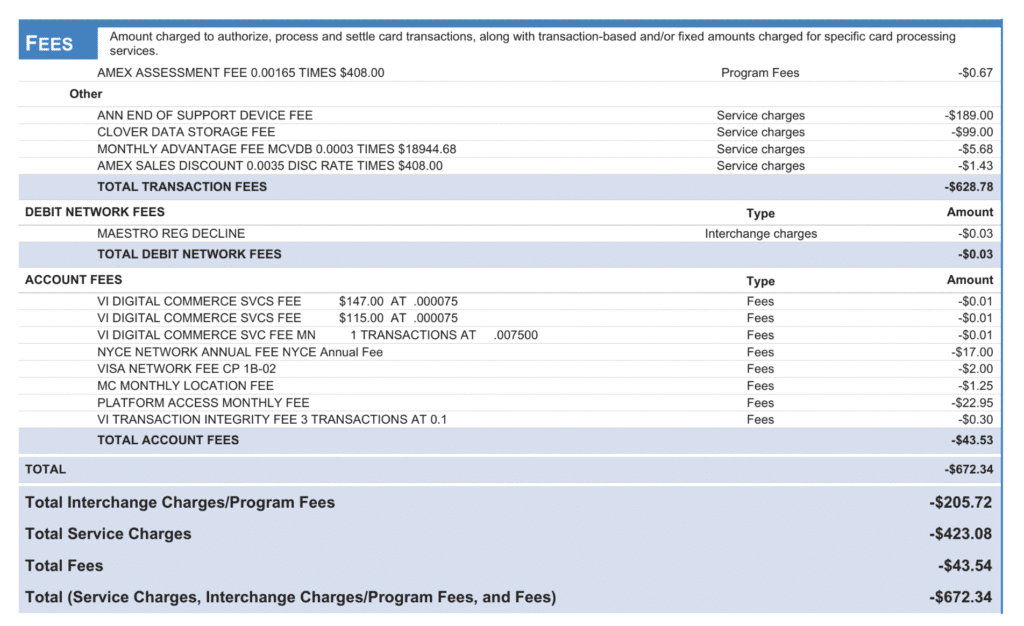

Of the $672.34 in total fees, over half ($423.08) are going straight to Huntington Bank. As a dollar amount, it’s not a ton. But percentage-wise, it’s quite high.

Other Huntington Bank Fees to Look Out For

Merchants using Huntington Bank need to keep a close eye on statements for bogus fees.

The ANN END OF SUPPORT DEVICE FEE on the statement above is one example of this. It’s a nothing fee that’s just made up to try and squeeze an extra $189 out of an account.

As a Fiserv reseller, it’s also common for us to find some of Fiserv’s fees on Huntington’s statements. Examples include:

- Annual Fees

- PCI Compliance Fees

- Inactivity Fees

- Batch Fees

- Clover Fees

- Clover Data Storage Fees

- Cloer Security Fees

I recommend reading our Fiserv review for more information on these. You should also make sure you know how to read your merchant statement so it’s easy to identify hidden fees.

Should You Switch to Huntington Bank?

If you’re currently accepting credit cards from another payment processor, I wouldn’t switch to Huntington Bank. There’s really nothing exciting about what Huntington Bank offers that warrants a switch.

Some businesses are tempted to use Huntington Bank for credit card processing because they have other accounts at that bank (like a traditional business checking or business savings account).

They like the idea of keeping everything simple and centralized from one provider.

That said, even if you do use Huntington Bank for other banking solutions, you can likely get a better rate elsewhere. They’re just reselling what Fiserv already offers and charging a higher markup on it.

Should You Terminate Your Huntington Bank Contract?

No, don’t cancel your Huntington Bank merchant agreement.

While Huntington isn’t the best payment processor on the market, they’re far from the worst. And switching providers rarely works in your favor.

Instead, you can save money by negotiating your existing rate directly with Huntington. This way, you can pay less without having to change processors or any of your operations.

It’s also worth noting that as a Fiserv reseller, there’s a chance you have early termination fees or even liquidated damages in your Huntington Bank contract. These terms are unique and different for every merchant, but they’re never worth paying to cancel an agreement.

Our Final Thoughts on Huntington Bank

Huntington Bank is a middle-of-the-road payment processor. They’re a regional bank that just resells Fiserv products and Clover systems.

This can be good for small, local businesses that are already using Huntington for other banking services. Rates can be pretty competitive if you get a good sales rep and have a decent processing volume.

But otherwise, there’s really no reason to choose Huntington Bank over other providers on the market.