Illinois allows merchants to legally surcharge credit card transactions. For the most part these laws are pretty similar compared to the other states where it’s legal to surcharge.

Here’s a quick summary of what you need to know:

- Surcharging is legal in Illinois.

- Sellers in Illinois must provide notice to consumers if a surcharge fee is imposed on credit card payments.

- Debit card surcharging is prohibited in Illinois (and also illegal in all 50 states).

- Illinois passed a landmark bill that prohibits card networks, banks, and processors from charging interchange fees on tax and gratuity—which goes into effect on July 1, 2026.

These are the key highlights, but there’s a lot more to unpack about credit card surcharging in Illinois.

So whether you’re running a business in Illinois and need to stay compliant or you’re a consumer who’s concerned about being charged extra fees, read on to learn more.

Disclaimer: This information is for reference only, and it does not constitute legal advice. Consult with an attorney with any legal-specific questions.

Surcharging Credit Card Transactions is Currently Legal in Illinois

Currently, there are no state-specific laws in Illinois prohibiting credit card surcharges. This means that merchants in Illinois can default to the 4% maximum allowable surcharge imposed at the federal level.

That said, card networks have their own rules when it comes to surcharging credit cards, which will effectively cap your surcharge rate at 3% per transaction. While violating these rules aren’t technically illegal, you could be subject to other penalties at the card network level.

For example, Visa limits surcharges to 3% per transaction. Visa’s surcharging rules also prohibit merchants from applying different surcharge rates to other card brands (meaning you couldn’t add a 3% fee to Visa transactions but charge 4% on Discover cards).

It’s worth noting that Illinois Rep. Jonathan Carroll sponsored House Bill 3128 back in 2021, attempting to limit surcharging in Illinois to 1% or the cost of processing the transaction, whichever is lower. However, this bill never made it out of the House. So it’s possible that we could see some tighter restrictions in the future if the Illinois General Assembly decides to take a closer look or a similar bill gets introduced.

Surcharge Laws in Illinois Apply to All Transactions, and Notice Must be Provided to the Consumer

This is another big part of the Illinois surcharging law that’s often overlooked—it applies to all transactions.

- In-Person Transactions

- Online Payments

- Payments Made Over the Phone

Online sellers and businesses charging cards on file aren’t exempt from these laws. Even though the cost of accepting a payment online or over the phone is likely higher.

Businesses aren’t allowed to surprise customers with surcharge fees either, as governed by the Illinois Consumer Fraud and Deceptive Business Practices Act. To remain compliant, businesses must clearly post and notify customers if they’re applying a surcharge to credit card transactions and how much that surcharge is.

A Closer Look at the Illinois Interchange Fee Prohibition Act Effective July 2026

On June 7, 2024, Illinois passed a first-of-its-kind bill regulating how interchange fees are applied to tax and tips. Passed by a 5-0 vote, Illinois House Bill 4951 includes the Interchange Fee Prohibition Act.

The new law says that interchange fees cannot be charged tax or gratuity as long as the merchant informs the acquiring bank (or its designee) of the taxes or gratuity at the time of authorization or settlement.

Originally, the law was set to go into effect on July 1, 2025. But it’s been pushed back a full year to July 2026 due to legal battles.

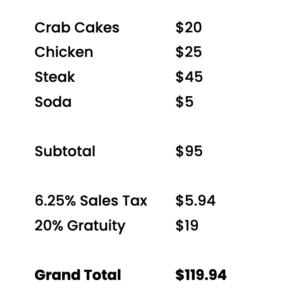

Let’s look at a sample transaction to see how this would impact a merchant’s processing cost:

Currently, a business in Illinois would pay processing fees based on the grand total amount of $119.94. So if the interchange rate is 2.70% for this particular transaction, the merchant would pay $3.24.

But beginning July 2026, the 2.70% interchange rate would be imposed on the $95 subtotal—not including the tax and gratuity. This would lower the interchange fee to $2.57.

This ultimately reduces the merchant’s interchange cost by more than 20%.

New Illinois Interchange Law Faces Delays and Legal Obstacles

The implementation of Illinois’s new Interchange Fee Prohibition Act has been delayed by one year following legislative action in June 2025.

Governor J.B. Pritzker signed the delay on June 16, 2025, pushing the effective date from July 1, 2025 to July 1, 2026.

Why the delay?

There’s been ongoing federal court challenges to the law, specifically coming from banking industry groups. The American Bankers Association and Illinois Bankers Association (among others) successfully obtained a partial injunction that blocked the law. However, the injunction doesn’t cover federal credit unions, banks chartered in Illinois, or card networks (like Visa and Mastercard).

The banks argue that the technology needed to separate tax and tips from interchange fees doesn’t exist and would be expensive to implement. These legal challenges are ongoing, and the courts will ultimately decide if and when the new law takes effect at all.

Final Thoughts on Illinois Surcharge Laws

If you’re an Illinois-based merchant and frustrated about your processing costs, you need to understand that there are other ways to save money on credit card processing.

While surcharging is often a quick and easy path, it’s far from your only option. Here at Merchant Cost Consulting, our team can negotiate your rates directly with your provider—helping you reduce costs without having to change processors. Get a free audit to find out how much you can save today.