We see it on a daily business—most merchants are overpaying for credit card processing.

Interchange optimization is a complex subject within the credit card processing industry. But it’s a topic every business that accepts credit cards needs to consider. This is especially true for organizations that process B2B (business to business) credit card transactions.

The cost savings on B2B credit card processing transactions can be significant. In some cases, optimized business rates can save you over 1% per commercial transaction.

We created this guide to help shed some light on why your business might not be getting optimized level 2 and level 3 credit card processing rates. You can follow the advice outlined below and ultimately save money on your B2B credit card processing rates.

B2C vs. B2B Credit Card Processing Payments: What’s the Difference?

First, let’s talk about how B2B transactions differ from traditional B2C transactions. There are a few significant differences between the two that impact pricing for merchants.

B2B payments have a higher average transaction value compared to B2C. Research shows that the average B2B ACH debit transaction is $31,118, and the average ACH credit transaction is $9,349. On the flip side, the average consumer debit card transaction is $44, and the average consumer credit card transaction is $57.

For those of you who process B2C and B2B transactions, I’m sure it’s clear that your average B2B ticket price is significantly higher than a general consumer purchase.

B2B purchases also have a higher quantity of goods sold and a higher ordering frequency compared to B2C transactions.

Price aside, the purchase terms of a B2B transaction are often very different from a B2C transaction. While B2C purchasing typically happens immediately at the point of sale or through an online terminal, B2Bs might have a bit more flexibility in when payments are due. In many cases, invoices are required, and payments are not taken in advance. Payments aren’t required until the business receives the goods or services, and they usually have 30 days or so to settle the invoice.

Level 2 and Level 3 Interchange Fees

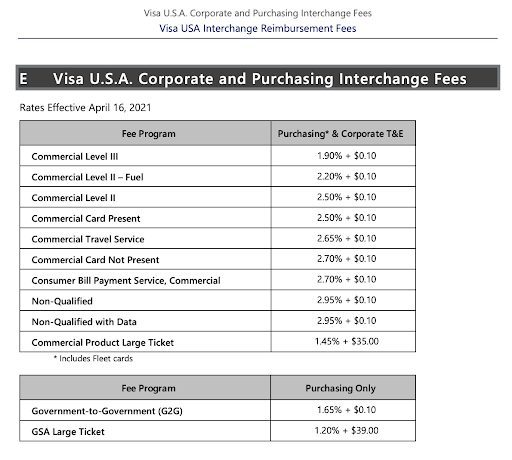

At the interchange level (imposed by the credit card companies), B2B transactions generally have lower credit card processing fees than B2C credit cards. For example, if you look at Visa’s Interchange Reimbursement Fees, you’ll see different sections for business cards.

You can refer to that full PDF from Visa to see more examples of business credit card processing fees, commercial card credit card processing fees, government credit card processing fees, and more.

However, B2B card transactions don’t automatically qualify for the lowest possible interchange rates. In fact, some business transactions appear to have higher interchange fees at first glance.

If you look at the screenshot above, you’ll see a significant difference between non-qualified transactions (2.95% + $0.10 per transaction) compared to Commercial Level 3 (1.90% + $0.10 per transaction).

Let’s say a business processes $10 million per year in commercial card transactions. This 1.5% difference results in an extra $150,000 in credit card processing fees. That’s a huge number!

Level 2 and Level 3 Credit Card Processing Fees

To lower the cost of B2B payment processing fees, you need to cut down the interchange rates imposed by the card brands. One way to do this is by adding extra data to the transaction.

The more data you pass through the transaction, the more secure it is in the eyes of the card network. This makes the transaction less risky and reduces the chance of a chargeback (including costs associated with the chargeback).

Level 1 Data

For traditional consumer card transactions, only Level 1 data is processed. This includes basic information like:

- Credit card number

- Expiration date

- Card verification value (CVV2)

- Zip code

- Total transaction amount

- Transaction date

- Merchant category code

- Business name

But for B2B transactions, you can process additional data.

Level 2 Data

All Level 2 and Level 3 data includes everything listed in a Level 1 transaction. Level 2 data also includes:

- Sales tax amount

- Merchant TIN (tax ID number)

- Sales outlet zip code

- Customer accounting code

Level 3 Data

Level 3 credit card processing takes this one step further with information like:

- Ticket number

- Product quantities

- Product codes

- Product descriptions

- Shipping zip code

- Freight amount

- Duty amount

- Units of measure

- Discount indicators

- Discount amounts

- Net indicator

- Gross indicator

- Tax rate associated with transaction

- Tax type associated with transaction

To process Level 2 and Level 3 credit card processing transactions, your processor must support these data entries. Rather than manually entering all of this into the credit card terminal for each B2B transaction, most processors have automated solutions that will collect and process this data for you—ultimately reducing the costs associated with B2B transactions.

So, Why Aren’t You Getting Level 2 and Level 3 Business Rates on Credit Card Transactions?

Let’s get back to the initial question—why aren’t you getting discounted level 2 and level 3 credit card processing rates?

There’s no single answer to this question. It’s possible your credit card processing company doesn’t support Level 2 and Level 3 card data. Or maybe you just haven’t been set up to process Level 2 and Level 3 data just yet.

Your contract and pricing model can also impact whether or not you’re getting optimized B2B rates.

For example, let’s say you’re on a fixed or flat-rate pricing contract. Even if a credit card company is charging lower credit card processing fees at the interchange level, you won’t see those savings. You’ll need to be on an “interchange plus” pricing model to truly get the lowest possible rates on B2B transactions.

The equipment provided by your merchant services provider can also play a role here. You either need a standalone credit card terminal or updated gateway that’s equipped to process enhanced data programs.

Final Thoughts

As mentioned earlier, countless businesses are overpaying on credit card processing. But merchants operating in the B2B space have an opportunity to save a ton of money.

In some instances, your transactions might qualify for lower rates at the interchange level, but your processor isn’t passing those savings to you based on your pricing model.

Here at Merchant Cost Consulting, we negotiate with credit card processors on behalf of our clients every day. So reach out to us for a free consultation to see how much we can save you on B2B transactions—helping ensure that you’re getting optimized business rates. Best of all, you won’t need to switch processors.